1,500% Bitcoin Growth: Analyzing The Prediction And Its Implications

Table of Contents

Factors Supporting a Potential Bitcoin Price Surge

Several key factors could potentially fuel a significant Bitcoin price increase, although reaching 1500% would require an unprecedented surge.

Technological Advancements

Bitcoin's underlying technology is constantly evolving. Advancements like the Lightning Network, which significantly improves transaction speed and scalability, and Taproot, which enhances privacy and efficiency, are crucial. These upgrades address some of Bitcoin's historical limitations, making it a more attractive investment and a more functional currency.

- Improved scalability: The Lightning Network allows for faster and cheaper transactions, making Bitcoin more suitable for everyday use.

- Increased transaction speed: Reduced transaction times make Bitcoin more competitive with traditional payment systems.

- Lower fees: Lower transaction fees make Bitcoin more accessible to a wider range of users.

- Enhanced security: Upgrades like Taproot improve the security and privacy of Bitcoin transactions.

Institutional adoption is another powerful driver. Companies like MicroStrategy and Tesla have made significant Bitcoin investments, signaling a shift in how major corporations view cryptocurrency. This institutional buying pressure significantly impacts market dynamics and price action.

Growing Institutional and Mainstream Interest

Beyond specific companies, broader institutional interest in Bitcoin is growing rapidly. Pension funds, hedge funds, and other large financial institutions are increasingly adding Bitcoin to their portfolios as a means of diversification and exposure to a potentially high-growth asset.

- Increased buying pressure: Large-scale institutional purchases create significant upward pressure on Bitcoin's price.

- Diversification strategies: Bitcoin is viewed by many as a non-correlated asset, offering diversification benefits in investment portfolios.

- Reduced risk perception: Increased institutional adoption lends credibility to Bitcoin, reducing the perceived risk for some investors.

Data on institutional Bitcoin holdings shows a steady increase, demonstrating the growing confidence of large financial players in the cryptocurrency's long-term potential.

Macroeconomic Factors and Inflation

Macroeconomic conditions play a crucial role in Bitcoin's price. High inflation and uncertainty in traditional financial markets can drive investors towards Bitcoin as a hedge against inflation and a store of value.

- Inflation hedging: Bitcoin's fixed supply of 21 million coins makes it an attractive hedge against inflation, as its value may rise while fiat currencies depreciate.

- Decreased trust in fiat currencies: Economic instability can erode faith in traditional currencies, pushing investors towards alternative assets like Bitcoin.

- Safe-haven asset: Some view Bitcoin as a digital gold, offering a safe haven during times of economic turmoil.

The correlation between Bitcoin's price and macroeconomic indicators like inflation rates and the performance of traditional markets is a subject of ongoing research and analysis.

Factors Hindering a 1,500% Bitcoin Growth

While the potential for Bitcoin price increases is significant, several factors could hinder a 1500% growth scenario.

Regulatory Uncertainty and Government Intervention

Government regulations and potential bans pose significant risks. Varying regulatory approaches across different countries create uncertainty and can impact Bitcoin's price negatively.

- Regulatory hurdles in different countries: Different countries have different regulatory frameworks for cryptocurrencies, creating uncertainty for investors.

- Potential for price manipulation: Regulatory gaps can create opportunities for price manipulation and market instability.

Examples of regulatory actions impacting crypto markets include the recent crackdowns in China and ongoing discussions about regulation in the United States. These actions highlight the inherent regulatory risk associated with Bitcoin.

Market Volatility and Price Corrections

Bitcoin's price is notoriously volatile. Sharp price corrections are common, and a 1500% increase would almost certainly involve significant swings.

- Risk of large price swings: Investors need to be prepared for significant price fluctuations, both upward and downward.

- Need for risk management strategies: Proper risk management is crucial for navigating the volatile nature of the Bitcoin market.

- Potential for bear markets: Extended periods of price declines ("bear markets") are a characteristic feature of the cryptocurrency landscape.

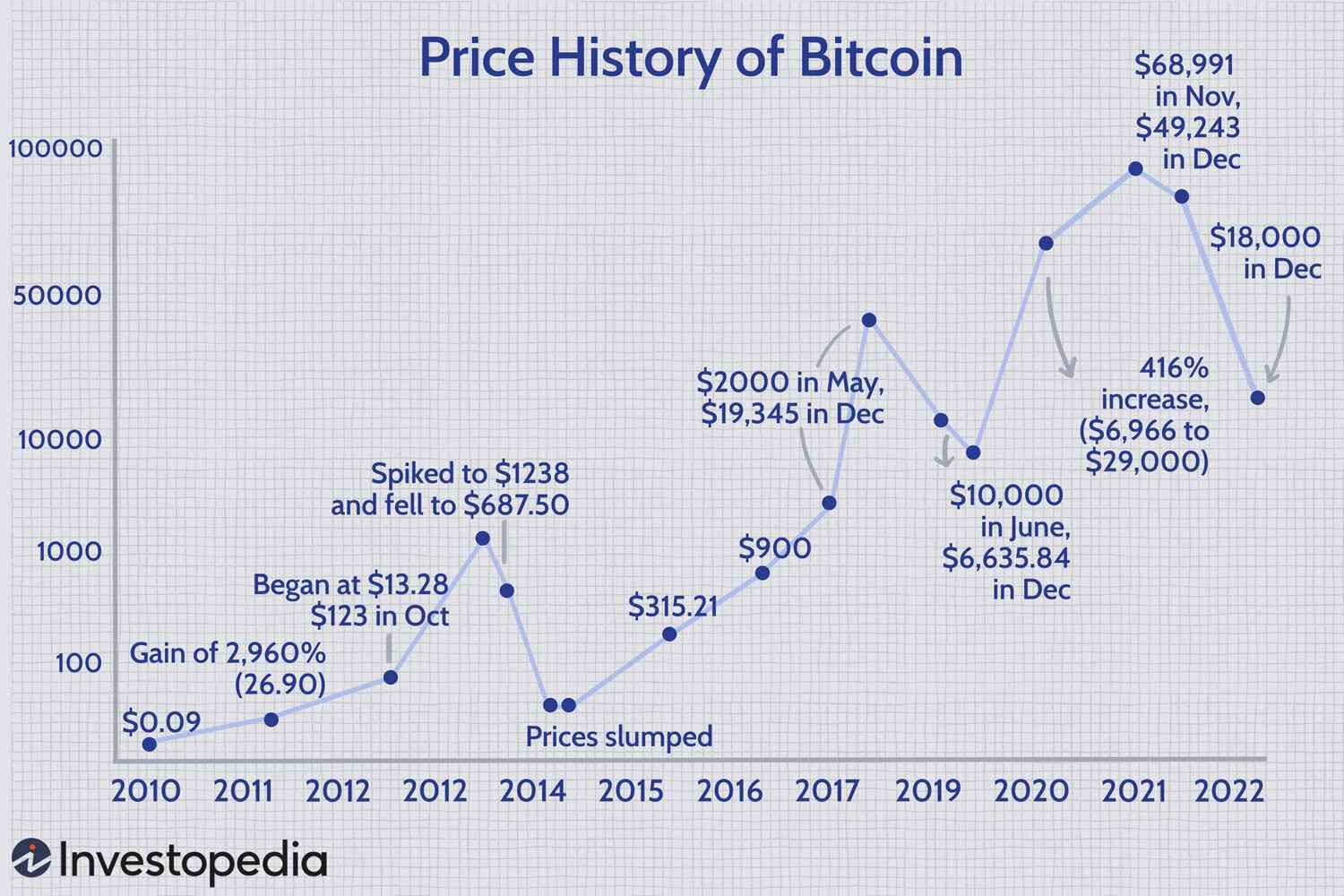

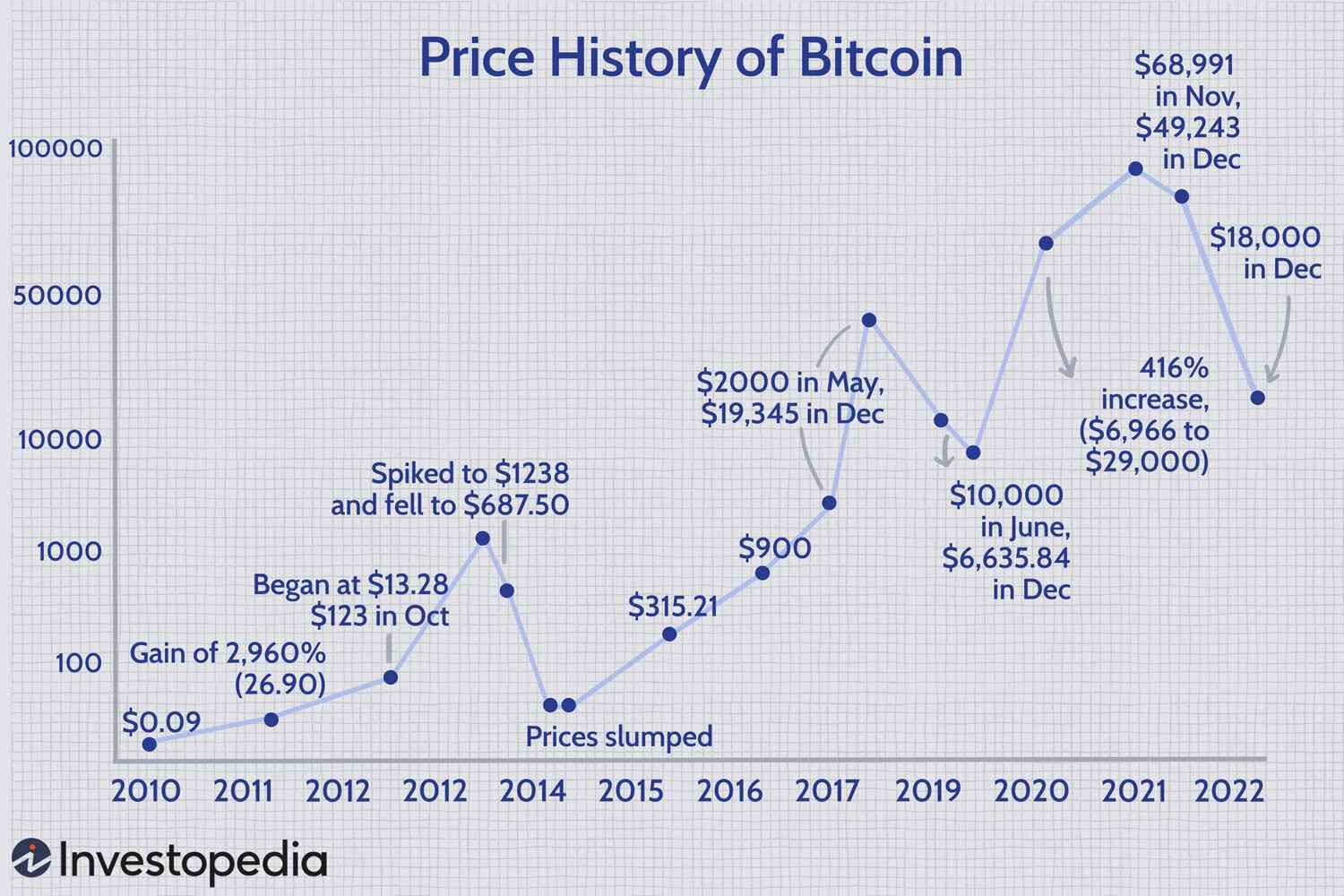

Historical data clearly shows the considerable volatility of Bitcoin, reminding investors of the inherent risks.

Competition from Other Cryptocurrencies

Bitcoin faces competition from other cryptocurrencies ("altcoins"). These altcoins offer alternative features and functionalities, potentially attracting investment capital away from Bitcoin.

- Competition for investment capital: Altcoins compete with Bitcoin for investor attention and funds.

- Potential for market share erosion: The emergence of successful altcoins could potentially reduce Bitcoin's market dominance.

Prominent altcoins, such as Ethereum, Solana, and Cardano, have substantial market capitalizations and active communities, demonstrating the competitive landscape within the cryptocurrency space.

Conclusion: Evaluating the 1,500% Bitcoin Growth Prediction – A Realistic Outlook?

A 1500% Bitcoin price increase represents a highly ambitious prediction. While factors like technological advancements, growing institutional adoption, and macroeconomic conditions could drive substantial growth, regulatory uncertainty, market volatility, and competition from altcoins pose significant challenges. The inherent unpredictability of the cryptocurrency market makes precise price predictions extremely difficult, if not impossible.

Therefore, while significant Bitcoin growth is certainly possible, the likelihood of a 1500% surge remains highly uncertain. Thorough research, a clear understanding of the risks, and a well-defined investment strategy are crucial before investing in Bitcoin or any other cryptocurrency. Learn more about Bitcoin's potential, understand the risks involved in Bitcoin investment, and explore the future of Bitcoin responsibly. Only then can you make informed decisions that align with your risk tolerance and financial goals.

Featured Posts

-

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Performance

May 08, 2025

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Performance

May 08, 2025 -

Arsenal Protiv Ps Zh Analiz Matchey V Evrokubkakh

May 08, 2025

Arsenal Protiv Ps Zh Analiz Matchey V Evrokubkakh

May 08, 2025 -

Gta Vis Latest Trailer The Bonnie And Clyde Inspired Storyline

May 08, 2025

Gta Vis Latest Trailer The Bonnie And Clyde Inspired Storyline

May 08, 2025 -

Sera Que Mick Jagger Trouxe O Pe Frio Para O Oscar Reacoes Brasileiras

May 08, 2025

Sera Que Mick Jagger Trouxe O Pe Frio Para O Oscar Reacoes Brasileiras

May 08, 2025 -

Soaring Taiwan Dollar Demands Economic Policy Changes

May 08, 2025

Soaring Taiwan Dollar Demands Economic Policy Changes

May 08, 2025

Latest Posts

-

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025 -

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025