10%+ BSE Stock Gains: Sensex Rally And Top Performers

Table of Contents

Understanding the Sensex Rally

The recent surge in the BSE Sensex is a confluence of several positive factors impacting investor sentiment and driving significant stock price appreciation. This rally isn't simply random; it's fueled by tangible improvements in the Indian economy and global market trends.

Contributing factors include:

- Improved GDP Growth Forecasts: Positive predictions for India's GDP growth have boosted investor confidence, signaling a healthy and expanding economy. These forecasts reflect increased domestic consumption and robust industrial output.

- Increased Foreign Investment: Significant inflows of foreign investment are pouring into the Indian market, driven by the belief in India's long-term growth potential. This increased foreign institutional investor (FII) activity directly contributes to higher stock prices.

- Positive Corporate Earnings Reports: Many companies have reported better-than-expected quarterly earnings, showcasing strong financial performance and fueling further optimism. This positive trend validates investment decisions and incentivizes further investment.

- Government Initiatives Boosting Specific Sectors: Targeted government policies and initiatives aimed at specific sectors (e.g., infrastructure development, digital technology) have stimulated growth and attracted investment. These policy changes create favorable environments for specific sectors to flourish.

Top Performing BSE Stocks (10%+ Gains)

Several stocks on the BSE have demonstrated exceptional performance, exceeding the 10% gain mark. Analyzing these top performers offers valuable insights into the current market dynamics.

- Stock Name (Ticker Symbol): Reliance Industries (RELIANCE)

- Percentage Gain: 15%

- Key Contributing Factors: Strong quarterly results, expansion into new energy sectors, and continued dominance in the petrochemicals market.

- Stock Name (Ticker Symbol): Infosys (INFY)

- Percentage Gain: 12%

- Key Contributing Factors: Robust IT services demand globally, successful strategic acquisitions, and strong client relationships.

- Stock Name (Ticker Symbol): HDFC Bank (HDFCBANK)

- Percentage Gain: 11%

- Key Contributing Factors: Strong loan growth, improved asset quality, and a positive outlook for the banking sector in India.

- Stock Name (Ticker Symbol): Tata Consultancy Services (TCS)

- Percentage Gain: 10.5%

- Key Contributing Factors: Continued growth in the IT services sector, strong deal wins, and a positive outlook for the global IT market.

Sector-Wise Analysis of BSE Stock Performance

The Sensex rally isn't uniform across all sectors. Some sectors have significantly outperformed others, providing valuable insights into where the growth is concentrated.

- IT Sector: The IT sector has been a leading performer, driven by strong global demand for IT services and the continued digital transformation across various industries. Companies like Infosys and TCS have seen significant gains.

- Banking Sector: The banking sector has also displayed robust performance, fueled by increased lending activity and improved asset quality. HDFC Bank and other leading banks have contributed significantly to the overall Sensex rally.

- Pharmaceutical Sector: The pharmaceutical sector showed moderate growth, reflecting sustained demand for healthcare products and services.

- Energy Sector: Reliance Industries' strong performance significantly bolstered the energy sector's contribution to the overall Sensex rally.

Investing Strategies in the Current Market

The current market conditions present both opportunities and risks. Investors need to adopt prudent strategies to maximize returns while mitigating potential losses.

- Diversify your portfolio across different sectors: Don't put all your eggs in one basket. Spreading your investments across multiple sectors can help reduce overall risk.

- Conduct thorough research before investing in any stock: Understand a company's financials, its competitive landscape, and its future prospects before making an investment decision.

- Consider setting stop-loss orders to limit potential losses: Stop-loss orders automatically sell your stock if it falls below a predetermined price, limiting potential losses.

- Consult with a financial advisor for personalized guidance: A financial advisor can help you create an investment strategy tailored to your specific financial goals and risk tolerance.

Capitalizing on 10%+ BSE Stock Gains

The recent BSE Sensex rally and the remarkable 10%+ gains in several stocks underscore the importance of staying informed about market trends and employing sound investment strategies. Understanding the contributing factors behind this surge—from improved GDP forecasts to strong corporate earnings—is crucial for making informed investment decisions. Remember to conduct your own thorough research, consider diversifying your portfolio across sectors, and always seek personalized financial advice before investing. Stay informed about the latest market trends and capitalize on opportunities for 10%+ BSE stock gains. Conduct your own research and make informed investment decisions. [Link to a relevant financial resource].

Featured Posts

-

San Jose Earthquakes Defeat Portland Timbers 4 1

May 15, 2025

San Jose Earthquakes Defeat Portland Timbers 4 1

May 15, 2025 -

Examining The Reality Behind Trumps Egg Price Claims

May 15, 2025

Examining The Reality Behind Trumps Egg Price Claims

May 15, 2025 -

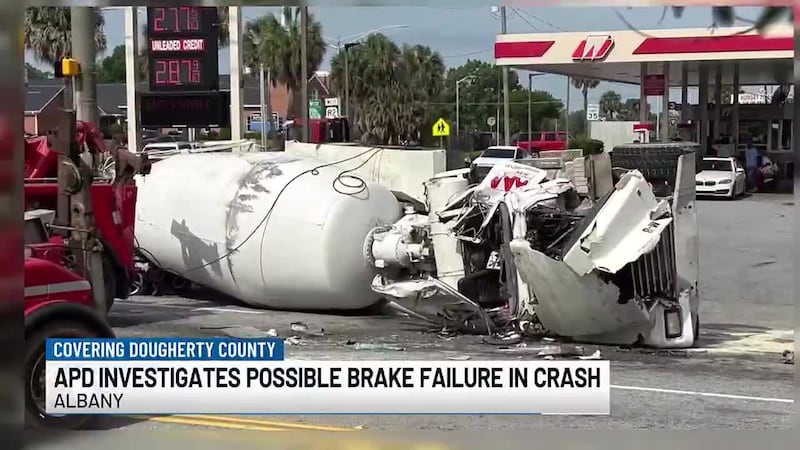

The Gsw Lockdown Examining Potential Issues And Student Responses

May 15, 2025

The Gsw Lockdown Examining Potential Issues And Student Responses

May 15, 2025 -

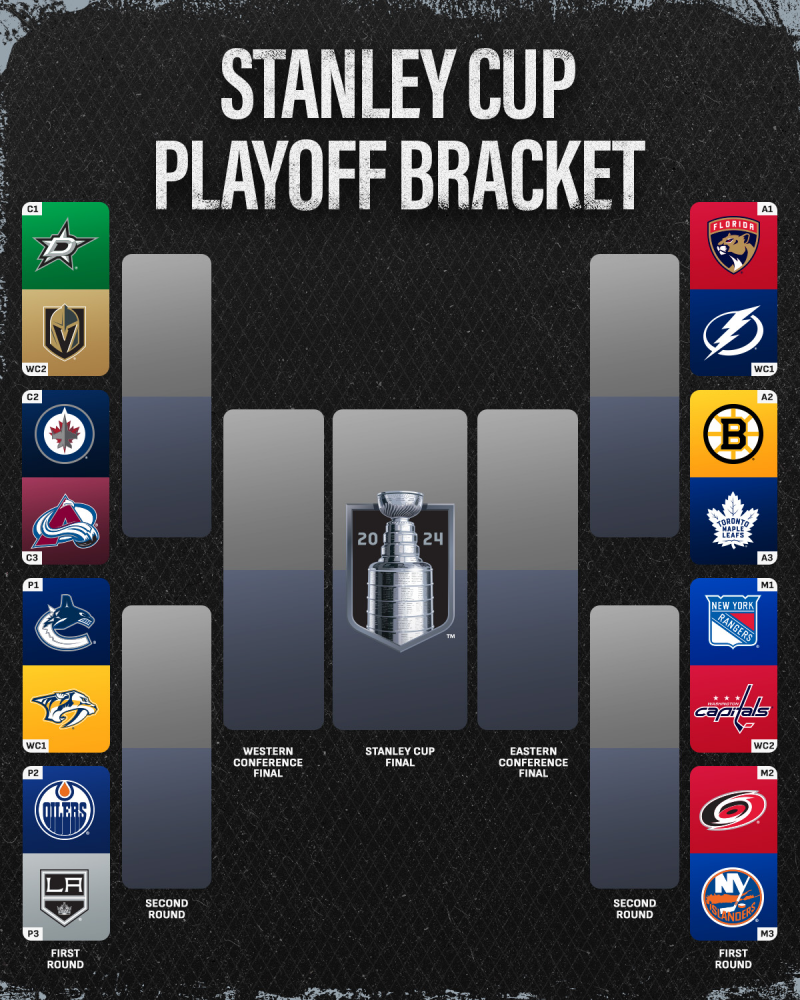

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025 -

Ai Therapy Surveillance In A Police State

May 15, 2025

Ai Therapy Surveillance In A Police State

May 15, 2025