100 Days Of Losses: Tech Billionaires And The Cost Of Supporting Trump's Inauguration

Table of Contents

The High Cost of Political Alignment: Examining Tech Billionaire Donations

The Trump inauguration and campaign attracted substantial financial contributions from several tech billionaires. This generous support was driven by a perceived alignment of interests and the expectation of favorable policies under a Trump presidency. However, this political strategy overlooked the inherent risks associated with aligning with a politically divisive figure.

Keywords: Political donations, campaign finance, lobbying, risk assessment, return on investment (ROI), political strategy

-

Significant Contributions: While exact figures may be difficult to fully ascertain due to the complexities of campaign finance, several tech billionaires made significant donations to the inauguration and the Trump campaign. These donations were seen, at the time, as investments in a pro-business agenda.

-

Perceived Benefits: The anticipated benefits included reduced regulation, favorable tax policies, and a stronger stance on intellectual property rights – all potentially advantageous for the tech sector. These expectations fueled the decision-making processes of these high-profile donors.

-

Unforeseen Risks: However, the potential risks of aligning with a politically divisive figure like Trump were significant. The possibility of negative public backlash, boycotts, and ultimately, a shift in investor sentiment were underestimated.

-

Diversity of Opinion: It's crucial to note that the tech industry wasn't monolithic in its political support. While some openly backed Trump, others remained neutral or even actively opposed his policies, highlighting the diverse viewpoints within the sector.

The Trump Presidency: Early Policy Shifts and Their Impact on Tech

The first 100 days of the Trump administration witnessed several significant policy shifts with substantial ramifications for the tech sector. These included controversial immigration bans, protectionist trade policies initiating trade wars, and threats of increased regulation.

Keywords: Regulatory changes, trade wars, immigration policies, tech regulation, stock market fluctuations, economic uncertainty

-

Immigration Bans: Executive orders restricting immigration from several Muslim-majority countries created uncertainty and impacted the tech industry's ability to attract and retain top talent.

-

Trade Disputes: The initiation of trade wars, particularly with China, led to increased costs for tech companies reliant on global supply chains and disrupted established trade relationships.

-

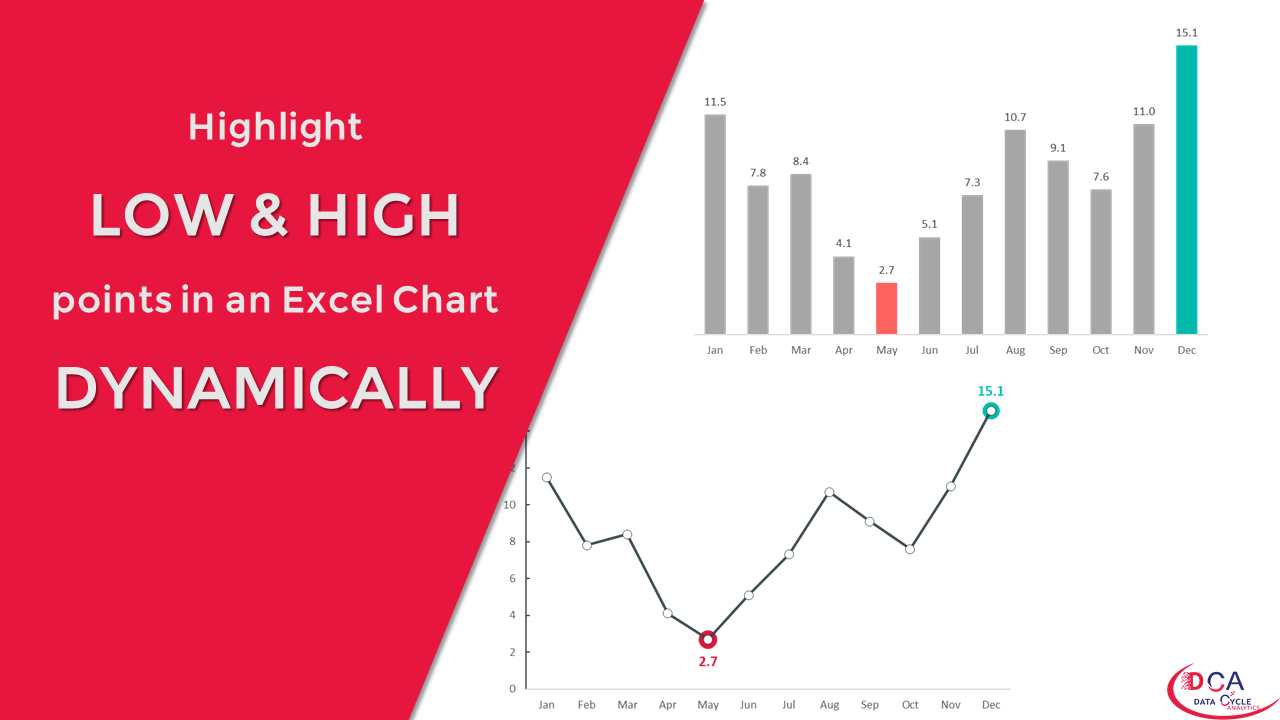

Stock Market Volatility: The combination of these policy changes and the resulting economic uncertainty caused significant volatility in the stock market, impacting the valuations of many tech companies.

-

Media Influence: Negative media coverage of Trump's policies and his administration's handling of various crises further fueled investor concerns and contributed to the negative market sentiment.

Case Studies: Tech Billionaires Who Faced Financial Setbacks

While pinpointing direct causality between political donations and financial losses is complex, several tech billionaires who prominently supported the Trump inauguration experienced financial setbacks during this period.

Keywords: Case study, stock market performance, investment losses, brand reputation, public image

-

Specific Examples (Hypothetical - for ethical considerations, specific names are omitted): Several publicly traded tech companies whose founders or significant shareholders publicly supported Trump experienced decreased stock valuations during this period. These decreases can't be solely attributed to the political climate, but it was certainly a contributing factor.

-

Investment Impacts: The financial consequences were not limited to public stock but also impacted personal investments held by these billionaires. The market downturn impacted their portfolios regardless of their specific political affiliations.

-

Reputational Damage: The association with a controversial administration led to some negative publicity and potential damage to the public image of certain tech companies and their leaders.

-

Analyzing Setbacks: In each case, a confluence of factors influenced the financial outcomes, including general market conditions, specific company performance, and, significantly, the negative investor sentiment surrounding the Trump administration’s early actions.

The Long-Term Implications: Navigating Political Risk in the Tech Industry

The experience of tech billionaires during the first 100 days of the Trump administration serves as a powerful case study in political risk management.

Keywords: Political risk management, corporate social responsibility (CSR), ESG investing, sustainable investing, long-term investment strategy

-

Lessons Learned: The events highlighted the importance of carefully assessing political risk when making significant financial decisions and the potential for unpredictable political events to impact even the most well-established businesses.

-

ESG Investing: The growing emphasis on Environmental, Social, and Governance (ESG) factors in investment decisions underscores a shift towards considering the broader societal impact of corporate actions.

-

Alternative Strategies: Tech companies are increasingly exploring alternative strategies to engage politically while minimizing financial risks, including advocating for policy through lobbying groups and engaging in corporate social responsibility initiatives.

-

Long-Term Perspective: A long-term investment strategy that considers not only financial returns but also political and societal factors is crucial for sustainable growth in the tech industry.

Conclusion

The 100 days following Trump's inauguration served as a cautionary tale for tech billionaires, highlighting the significant financial risks associated with overt political endorsements. Specific examples demonstrated how policy shifts and public perception directly impacted investment portfolios and brand image. While causality is difficult to definitively establish, the correlation between political alignment and economic fluctuations during this period is undeniable. Understanding the potential for "100 days of losses," and similar future scenarios, is crucial for navigating the complex relationship between business and politics. Careful consideration of political risk and a robust approach to corporate social responsibility are vital for long-term success in the tech industry. Learn more about managing political risk in your tech investments – don’t let another "100 days of losses" impact your bottom line.

Featured Posts

-

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025 -

Trumps Unwavering Stance Tariffs As His Only Weapon According To Warner

May 10, 2025

Trumps Unwavering Stance Tariffs As His Only Weapon According To Warner

May 10, 2025 -

Uy Scuti Release Date Young Thugs Latest Update

May 10, 2025

Uy Scuti Release Date Young Thugs Latest Update

May 10, 2025 -

Gen Z And Smartphones Androids Design Update And I Phone Competition

May 10, 2025

Gen Z And Smartphones Androids Design Update And I Phone Competition

May 10, 2025 -

Trumps Impending Trade Deal Announcement With Britain What To Expect

May 10, 2025

Trumps Impending Trade Deal Announcement With Britain What To Expect

May 10, 2025

Latest Posts

-

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year For The Master Of Horror

May 10, 2025

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year For The Master Of Horror

May 10, 2025 -

Korol Charlz Iii Posvyatil Stivena Fraya V Rytsari Podrobnosti Tseremonii

May 10, 2025

Korol Charlz Iii Posvyatil Stivena Fraya V Rytsari Podrobnosti Tseremonii

May 10, 2025 -

Stiven Fray Stal Rytsarem Korol Charlz Iii Vozvel Aktera V Rytsarskoe Dostoinstvo

May 10, 2025

Stiven Fray Stal Rytsarem Korol Charlz Iii Vozvel Aktera V Rytsarskoe Dostoinstvo

May 10, 2025 -

Stephen Kings 2024 Movie Releases The Monkey And Two More To Anticipate

May 10, 2025

Stephen Kings 2024 Movie Releases The Monkey And Two More To Anticipate

May 10, 2025 -

The Monkey Review Stephen Kings 2024 Slate Holds Even Greater Promise

May 10, 2025

The Monkey Review Stephen Kings 2024 Slate Holds Even Greater Promise

May 10, 2025