110% Growth Potential? Analyzing The Billionaire-Backed BlackRock ETF For 2025

Table of Contents

Understanding the BlackRock ETF

For the purpose of this analysis, we'll focus on the iShares Global Clean Energy ETF (ICLN), a popular choice often cited in discussions about high-growth potential ETFs. While it's not explicitly stated to be "billionaire-backed" in the same way some private equity funds are, its holdings align with investment strategies favored by many high-net-worth individuals and institutional investors interested in sustainability and renewable energy. ICLN's investment strategy targets companies involved in the global clean energy sector. This includes companies focused on solar, wind, biofuels, and other renewable energy technologies. Its target market includes investors seeking exposure to the growing clean energy industry.

- Expense Ratio: The ICLN ETF has a relatively competitive expense ratio (check the current expense ratio on the fact sheet). Lower expense ratios mean more of your investment returns stay in your pocket.

- Billionaire Investors (Indirect): While not directly named as backers, the underlying companies within ICLN attract investment from numerous large institutional investors, many of which are managed on behalf of high-net-worth individuals and billionaires with portfolios aligned with ESG (Environmental, Social, and Governance) principles.

- Fact Sheet: You can find the official fact sheet and further details on the ICLN ETF on the BlackRock website: [Insert Link Here].

Analyzing Past Performance and Future Projections

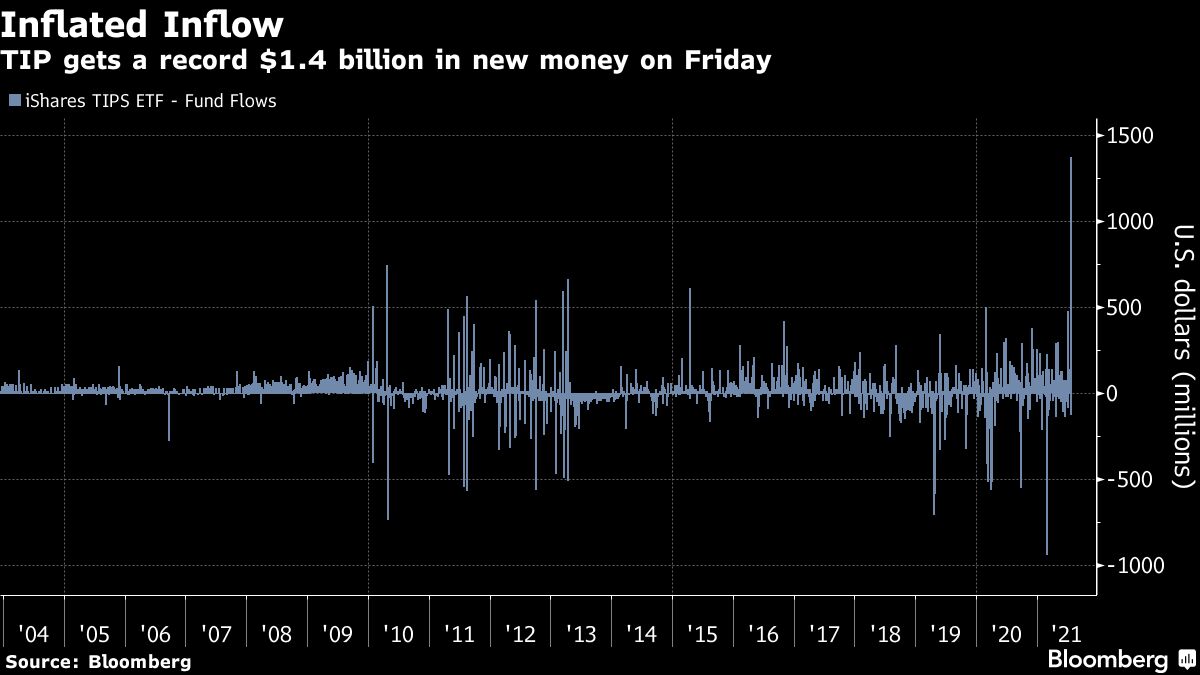

Analyzing the ICLN ETF's historical performance requires looking at several factors. While past performance is not indicative of future results, it provides valuable insights. [Insert Chart/Graph showing ICLN's historical performance]. The ETF's performance has been influenced by factors such as fluctuating oil prices, government policies supporting renewable energy, and technological advancements in the sector.

Market trends point to continued growth in the clean energy sector. Governments worldwide are increasingly investing in renewable energy infrastructure, driven by climate change concerns and energy security needs. Technological advancements continue to drive down the cost of renewable energy technologies, making them more competitive with fossil fuels.

- Key Performance Indicators (KPIs): Analyze the Sharpe ratio, alpha, and beta to understand the ICLN ETF's risk-adjusted return and its volatility compared to the overall market. [Include data or interpretative analysis here].

- Comparison with Similar ETFs: Compare ICLN's performance with other clean energy ETFs, such as the Invesco Solar ETF (TAN), to assess its relative strengths and weaknesses.

- Expert Opinions: Many financial analysts predict significant growth in the clean energy sector over the next decade, suggesting potential for strong returns on ETFs like ICLN. [Cite relevant sources].

Assessing the Risks Involved

Investing in ICLN, or any ETF focused on a specific sector, carries inherent risks. Market volatility, particularly within the rapidly evolving clean energy sector, is a major concern. Geopolitical events, changes in government regulations, and technological disruptions can significantly impact the performance of individual companies and the ETF as a whole.

- Sector-Specific Risks: The ICLN ETF's focus on clean energy makes it susceptible to risks specific to this sector, such as competition from fossil fuels, technological failures, and supply chain disruptions.

- Concentration Risk: Investing a significant portion of your portfolio in a single ETF increases your exposure to the risks associated with that sector.

- Underperformance Risk: There is always a risk that the ETF could underperform, or even lose money, due to unforeseen circumstances.

Diversification Strategies with the BlackRock ETF

To mitigate the risks associated with ICLN, it's crucial to incorporate it into a well-diversified portfolio. This might include a mix of asset classes like bonds, real estate, and other ETFs representing different sectors. A balanced portfolio can help reduce overall portfolio volatility and improve risk-adjusted returns.

- Asset Allocation Strategies: Consider a globally diversified portfolio with a specific allocation to renewable energy, aligning with your risk tolerance and long-term financial goals. A financial advisor can help develop a suitable strategy.

- Importance of Consulting a Financial Advisor: It's highly recommended to consult with a qualified financial advisor to create a personalized investment plan that aligns with your individual circumstances, risk tolerance, and financial goals.

The 110% Growth Claim: Realistic or Overblown?

The claim of a 110% return on ICLN by 2025 is highly ambitious and should be treated with caution. Such projections often rely on optimistic assumptions about market growth and technological advancements. While the clean energy sector holds immense potential, predicting such a specific and high return is unrealistic.

- Factors Supporting High Growth: The long-term growth potential of clean energy, supportive government policies, and technological innovation are strong arguments for potential significant gains.

- Factors Hindering 110% Growth: Market volatility, competition, and unforeseen technological or regulatory challenges could significantly impact the ETF's performance.

- Realistic Range of Potential Returns: A more realistic outlook would involve considering a range of potential returns, acknowledging the uncertainties inherent in market predictions.

Conclusion

While the BlackRock ICLN ETF, focusing on the clean energy sector, presents significant long-term growth potential, the claim of 110% growth by 2025 is highly speculative. This analysis highlights the potential for substantial returns but also underscores the associated risks. Thorough research and diversification are key to managing those risks. Remember, past performance is not indicative of future results.

Call to Action: While the prospect of high growth with the Billionaire-Backed BlackRock ETF (represented by ICLN in this analysis) is enticing, thorough research is crucial. Learn more about ICLN's holdings, risk profile, and market outlook before making any investment decisions. Don't chase unrealistic returns – invest wisely. Begin your research on the ICLN ETF today! Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Grbovic Kompromis Je Kljucan Za Formiranje Prelazne Vlade

May 08, 2025

Grbovic Kompromis Je Kljucan Za Formiranje Prelazne Vlade

May 08, 2025 -

Famitsus Most Wanted Games March 9 2025 Dragon Quest I And Ii Hd 2 D Remake Leads

May 08, 2025

Famitsus Most Wanted Games March 9 2025 Dragon Quest I And Ii Hd 2 D Remake Leads

May 08, 2025 -

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025 -

Hong Kongs Monetary Policy Analyzing The Hkd Usd Interest Rate Plunge

May 08, 2025

Hong Kongs Monetary Policy Analyzing The Hkd Usd Interest Rate Plunge

May 08, 2025 -

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025

Latest Posts

-

Batman Returns Dc Comics Announces New 1 Issue And Updated Suit

May 08, 2025

Batman Returns Dc Comics Announces New 1 Issue And Updated Suit

May 08, 2025 -

Dc Comics Batman Relaunches New 1 Issue And Costume Unveiled

May 08, 2025

Dc Comics Batman Relaunches New 1 Issue And Costume Unveiled

May 08, 2025 -

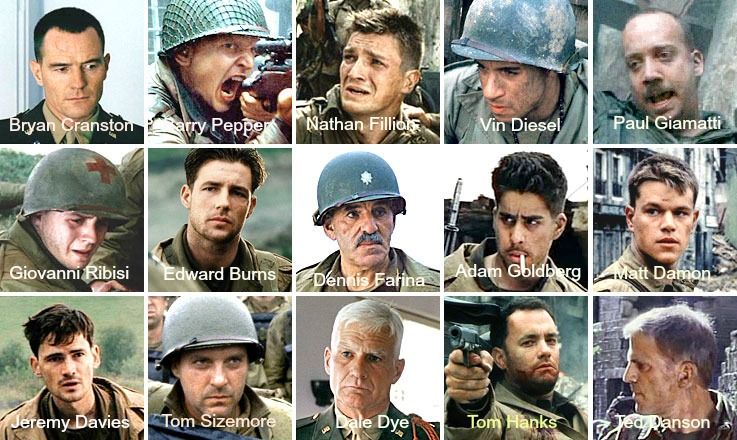

Steven Spielbergs Best War Movies 7 Essential Films Ranked Saving Private Ryan Excluded

May 08, 2025

Steven Spielbergs Best War Movies 7 Essential Films Ranked Saving Private Ryan Excluded

May 08, 2025 -

Longtime Coast Guard Service Recognized Ryan Gentry Honored In Outer Banks

May 08, 2025

Longtime Coast Guard Service Recognized Ryan Gentry Honored In Outer Banks

May 08, 2025 -

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025