12% Subscriber Jump For Spotify: Earnings Report Analysis (SPOT)

Table of Contents

Key Highlights of Spotify's Earnings Report

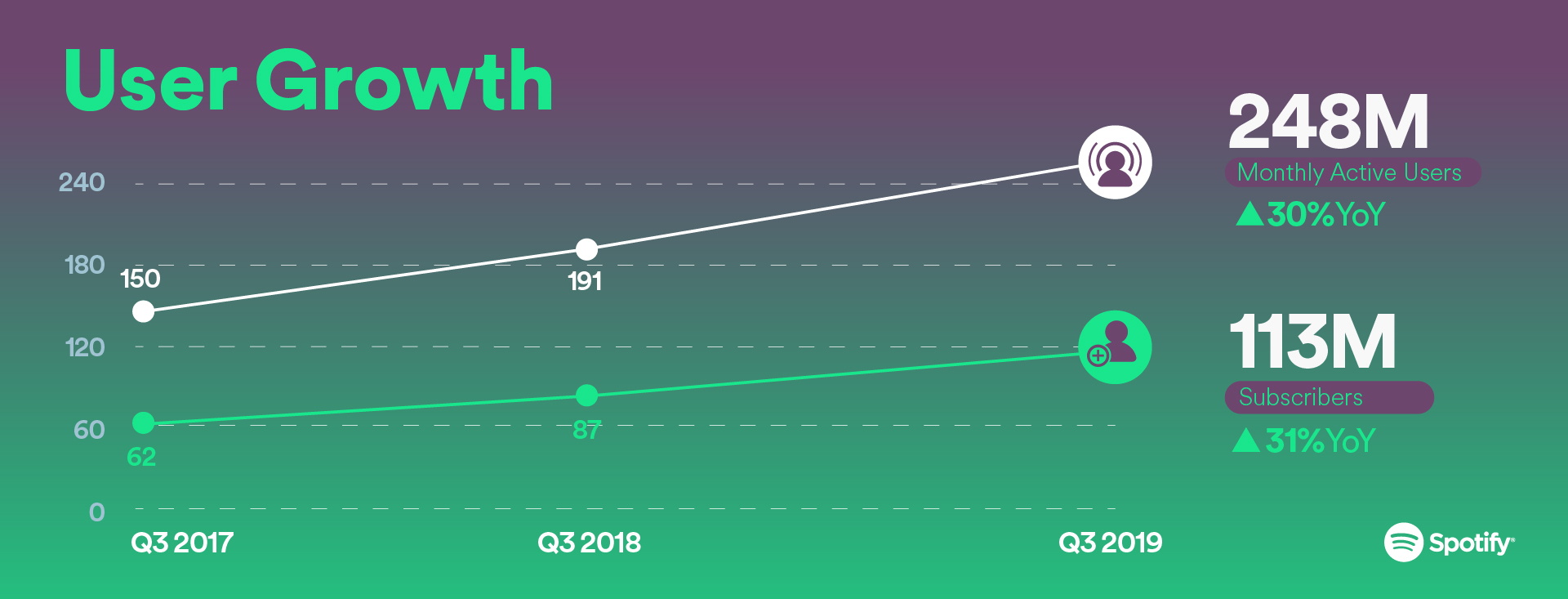

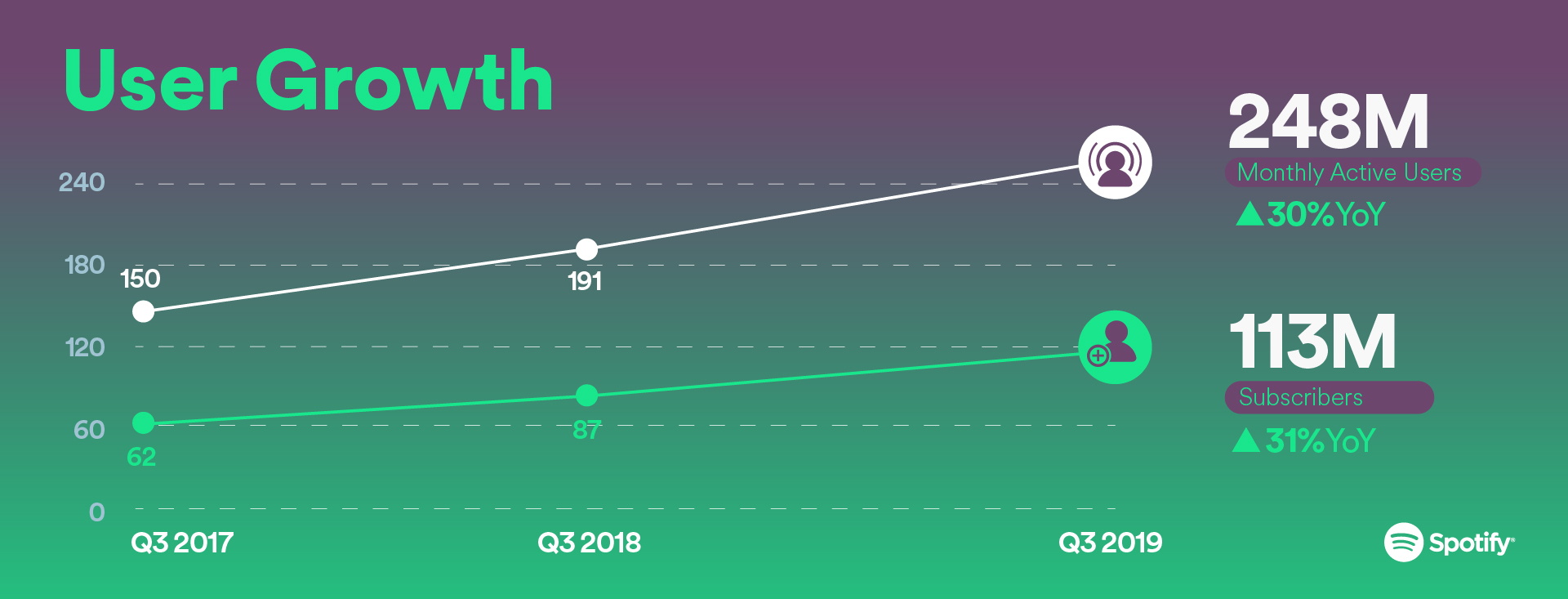

The overall financial performance reported by Spotify showcased robust growth, exceeding many analysts' expectations. While specific numbers vary depending on the quarter reported, the key metrics consistently painted a positive picture. Beyond the headline-grabbing 12% subscriber increase, other key performance indicators provided a comprehensive view of Spotify's financial health.

- Total revenue increase/decrease percentage: [Insert percentage from the actual report, e.g., a 15% increase]. This significant increase demonstrates strong revenue generation and market penetration.

- Premium subscriber count and percentage change: [Insert numbers from report, e.g., X million premium subscribers, representing a 12% increase year-over-year]. This substantial growth in premium subscribers is a key driver of Spotify's overall success.

- Ad-supported user count and percentage change: [Insert numbers from report, e.g., Y million ad-supported users, representing a 5% increase]. While premium subscribers are more lucrative, growth in the ad-supported user base also contributes to revenue diversification.

- ARPU (Average Revenue Per User) changes and reasons for fluctuations: [Insert data and explanation from the report. For example: ARPU increased by X%, primarily driven by higher premium subscription prices and increased engagement with premium features.]

- Overall profit or loss and comparison to previous quarters/years: [Insert data and comparison. For example: The company reported a net profit of Z dollars, a significant improvement compared to a net loss in the same quarter last year, indicating increased operational efficiency and improved profitability.]

Factors Driving the 12% Subscriber Growth

The 12% surge in Spotify subscribers wasn't accidental. Several factors contributed to this impressive growth, highlighting the company's strategic successes and the evolving music streaming landscape.

- Impact of new podcast acquisitions and exclusive content: Spotify's aggressive investment in podcasts, including exclusive deals with high-profile creators, has significantly broadened its appeal, attracting new users and enhancing user retention. Exclusive content acts as a powerful differentiator from competitors.

- Effectiveness of marketing campaigns and user acquisition strategies: Targeted marketing campaigns, leveraging social media and other digital platforms, successfully reached new audiences and drove subscriber sign-ups. Efficient user acquisition strategies optimized cost-effectiveness.

- Price changes or promotions influencing subscription rates: Strategic pricing adjustments and limited-time promotions may have played a role in boosting subscription rates, making Spotify more accessible to price-sensitive consumers.

- Geographic expansion and market penetration in new regions: Expanding into new markets and improving market penetration in existing territories contributes to the overall subscriber base growth.

- Competitive advantages over other music streaming services (Apple Music, Amazon Music, etc.): Spotify's vast music library, user-friendly interface, personalized recommendations, and strong social features remain key competitive advantages, attracting users away from rival platforms like Apple Music and Amazon Music.

Analysis of Spotify's Financial Performance Beyond Subscriber Growth

While subscriber growth is a significant indicator, a thorough analysis requires a deeper dive into other key financial aspects.

- Gross margin analysis and factors influencing it: [Analyze gross margin data from the report and explain the contributing factors, such as licensing costs and content acquisition expenses.]

- Operating expenses and efficiency improvements: [Examine operating expenses and discuss any cost-saving measures or operational efficiencies that contributed to improved profitability.]

- Debt levels and financial stability of the company: [Assess Spotify's debt levels and discuss its overall financial stability and long-term sustainability.]

- Management's outlook for future quarters and long-term growth: [Summarize management's projections for future performance and their long-term growth strategy.]

- Discussion of any risks or challenges facing Spotify: [Identify potential challenges such as increased competition, licensing costs, and the evolving regulatory landscape.]

Impact on SPOT Stock Price and Investor Sentiment

The strong earnings report, particularly the impressive subscriber growth, had a positive impact on the SPOT stock price and overall investor sentiment.

- Stock price movement following the earnings announcement: [Describe the immediate market reaction to the earnings report, including any significant price fluctuations.]

- Analyst ratings and recommendations for SPOT stock: [Summarize the reactions of financial analysts and their recommendations for the stock.]

- Impact of the subscriber growth on the company's market valuation: [Discuss how the subscriber growth has affected Spotify's overall market valuation.]

- Long-term growth potential for investors in light of the report: [Assess the long-term growth potential for investors based on the earnings report findings.]

- Comparison to competitor stock performance: [Compare Spotify's stock performance to that of its main competitors in the music streaming market.]

Conclusion

Spotify's impressive 12% subscriber jump, as detailed in its recent earnings report, points towards a strong trajectory for the music streaming giant. The analysis revealed key drivers like successful content acquisitions, particularly in the podcasting space, and effective marketing, leading to significant revenue growth and positive investor sentiment. However, ongoing challenges such as intensifying competition and the ever-changing regulatory landscape must be carefully monitored. The company's ability to maintain its momentum and adapt to these challenges will be crucial for its continued success and future growth.

Call to Action: Stay informed on future Spotify (SPOT) earnings reports and the ongoing evolution of the music streaming market. Follow our blog for in-depth analysis and expert commentary on SPOT stock and other key players in the industry. Keep up-to-date with the latest developments in Spotify's subscriber growth and financial performance by subscribing to our newsletter.

Featured Posts

-

Days Before Canadian Election Trump Claims Canadas Existence Depends On The Us

Apr 30, 2025

Days Before Canadian Election Trump Claims Canadas Existence Depends On The Us

Apr 30, 2025 -

Manitoba Museum Enriched Hudsons Bay Artifacts Find A Home

Apr 30, 2025

Manitoba Museum Enriched Hudsons Bay Artifacts Find A Home

Apr 30, 2025 -

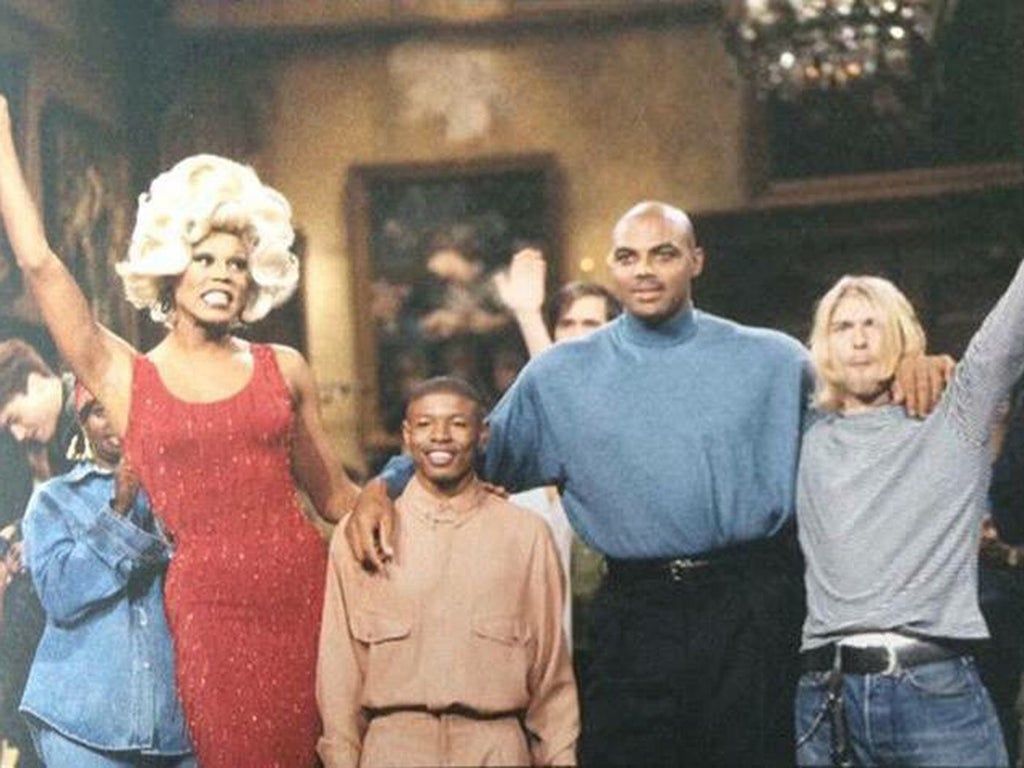

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025 -

Tina Knowles Shares Her Eyebrow Grooming Secret Blue Ivy Approved

Apr 30, 2025

Tina Knowles Shares Her Eyebrow Grooming Secret Blue Ivy Approved

Apr 30, 2025 -

Zoe Kravitz And Noah Centineo Unconfirmed Relationship Sparks Speculation

Apr 30, 2025

Zoe Kravitz And Noah Centineo Unconfirmed Relationship Sparks Speculation

Apr 30, 2025

Latest Posts

-

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025 -

Popular American Cruise Lines Reviews And Comparisons

Apr 30, 2025

Popular American Cruise Lines Reviews And Comparisons

Apr 30, 2025 -

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025 -

Best Cruise Lines In The Usa For 2024

Apr 30, 2025

Best Cruise Lines In The Usa For 2024

Apr 30, 2025 -

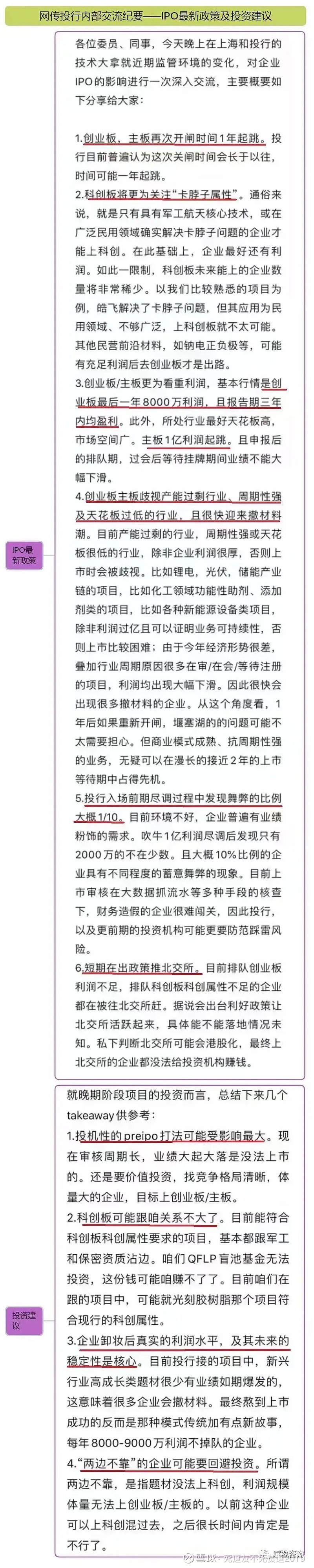

Ipo

Apr 30, 2025

Ipo

Apr 30, 2025