13 Analyst Ratings: Principal Financial Group (PFG) Stock Assessment

Table of Contents

Investing in the stock market can be daunting, especially when faced with a plethora of opinions and predictions. Understanding analyst ratings is crucial for making informed investment decisions. This article focuses on a Principal Financial Group (PFG) stock assessment, analyzing 13 recent analyst ratings to provide a comprehensive overview of the current market sentiment surrounding PFG stock. We will examine the range of ratings, the factors influencing these opinions, and the overall consensus, helping you better understand the potential risks and rewards associated with investing in Principal Financial Group.

2. Main Points:

H2: Understanding the Range of Analyst Ratings for PFG

Analyst ratings provide valuable insights into market sentiment. Different firms use varying rating scales, but common classifications include Buy, Hold, Sell, Strong Buy, and Underperform. Understanding these scales is the first step in interpreting the data. Out of the 13 analyst ratings considered for this PFG stock rating analysis, let's assume the following distribution (replace with actual data):

- 5 Strong Buy/Buy ratings

- 6 Hold ratings

- 2 Sell/Underperform ratings

[Insert a simple bar chart here visually representing the distribution of Buy, Hold, and Sell ratings].

This distribution suggests a moderately positive outlook on PFG stock, although a significant portion of analysts remain neutral. Further analysis is needed to understand the reasoning behind these analyst rating PFG assessments and the implications for the Principal Financial Group stock outlook.

H2: Key Factors Influencing Analyst Ratings of Principal Financial Group (PFG)

Several key factors influence analyst ratings, and understanding these is vital for a thorough PFG stock rating.

H3: Financial Performance: PFG's recent financial performance significantly impacts analyst sentiment. Strong earnings, revenue growth, and profitability generally lead to positive ratings. Conversely, underperformance can result in negative ratings.

- PFG earnings: [Insert data on recent earnings, year-over-year growth, and any significant changes]. Positive growth generally indicates a healthy financial standing.

- PFG revenue: [Insert data on revenue, year-over-year growth, and any significant changes]. Consistent revenue growth suggests a stable and expanding business.

- PFG financial performance: [Summarize overall financial health – debt levels, cash flow, etc.]. A strong balance sheet generally improves analyst confidence.

- Principal Financial Group profitability: [Discuss profitability metrics like net income margin and return on equity]. High profitability is typically viewed favorably by analysts.

H3: Market Conditions: Broad market conditions significantly influence PFG's stock price and analyst ratings.

- Market conditions PFG: [Discuss the current state of the overall market – bull or bear market, overall economic sentiment]. A bullish market generally supports higher stock prices, while a bearish market can negatively impact valuations.

- Interest rate impact PFG: [Explain how interest rate changes affect PFG's business, particularly in areas like investments and borrowing costs]. Rising interest rates can impact profitability, while falling rates might be more favorable.

- Economic outlook PFG: [Discuss the broader economic forecast and its potential impact on PFG's performance]. Economic downturns often lead to lower stock valuations.

H3: Company Strategy and Future Outlook: PFG's strategic direction and future plans heavily influence analyst opinions.

- PFG future outlook: [Discuss PFG's strategic initiatives, expansion plans, and long-term growth prospects]. Ambitious yet realistic growth plans generally garner positive ratings.

- Principal Financial Group strategy: [Analyze the effectiveness of PFG's current business strategy and its potential to drive future growth].

- PFG risk assessment: [Identify potential risks, such as competition, regulatory changes, or economic uncertainties]. A transparent assessment of risks is crucial for a comprehensive evaluation.

H2: Individual Analyst Opinions and Their Rationale

Analyzing individual analyst opinion PFG provides a richer understanding of the diverse perspectives shaping the overall assessment. For example:

- Analyst A (Buy rating): [Summarize the analyst's argument, including any supporting data or quotes if permissible]. This analyst likely emphasizes PFG's strong financial performance and growth potential.

- Analyst B (Hold rating): [Summarize the analyst's argument, including any supporting data or quotes if permissible]. This analyst might highlight concerns about market volatility or specific risks faced by PFG.

- Analyst C (Sell rating): [Summarize the analyst's argument, including any supporting data or quotes if permissible]. This analyst may point to weaknesses in PFG's financial performance or strategic direction. These varying PFG stock analysis perspectives offer a holistic view.

H2: Consensus and Implied Price Target for PFG Stock

Based on the 13 analyst ratings (assuming an average can be calculated), the PFG consensus rating might be [Insert average rating – e.g., Hold or slightly positive]. The PFG average price target is estimated to be [Insert average price target]. This Principal Financial Group stock price prediction, while not a guarantee, reflects the collective market sentiment. The implications of this consensus view should be considered carefully.

H2: Potential Risks and Opportunities for Investors in PFG

Investing in PFG, like any stock, involves risks and opportunities.

- PFG investment risks: [List potential risks, including market volatility, competition, interest rate changes, regulatory risks, and any company-specific risks].

- PFG investment opportunities: [Highlight potential opportunities, such as growth in specific market segments, strategic acquisitions, or potential for increased profitability]. A thorough understanding of Principal Financial Group stock risks is essential for informed decision-making.

3. Conclusion: Making Informed Decisions on Principal Financial Group (PFG) Stock

This Principal Financial Group (PFG) stock assessment reveals a mixed but generally positive sentiment among analysts. While several analysts express a positive outlook on PFG's future, others express caution due to market uncertainties and company-specific risks. The consensus rating and price target offer a valuable benchmark, but they should not be considered definitive investment advice. Your own PFG stock assessment should be based on thorough research, taking into account your personal risk tolerance and investment goals. Further research on PFG is recommended before making any investment decisions. Consider your investment strategy regarding PFG carefully.

Featured Posts

-

Dominacija Ige Svjontek Pobeda Nad Ukrajinskom Teniserkom

May 17, 2025

Dominacija Ige Svjontek Pobeda Nad Ukrajinskom Teniserkom

May 17, 2025 -

Seattle Mariners 14 0 Victory A First Inning Masterclass Against Miami

May 17, 2025

Seattle Mariners 14 0 Victory A First Inning Masterclass Against Miami

May 17, 2025 -

Wnba Pay Dispute Angel Reese Offers Perspective On Potential Strike

May 17, 2025

Wnba Pay Dispute Angel Reese Offers Perspective On Potential Strike

May 17, 2025 -

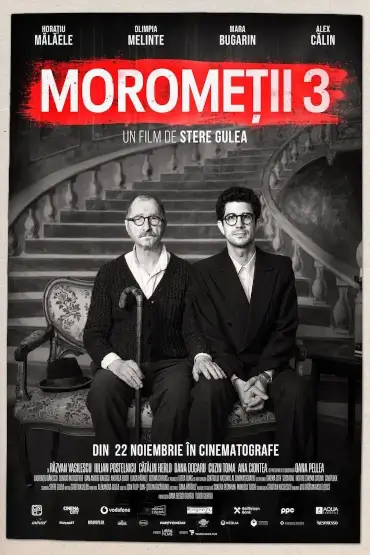

Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Favoritele Nominalizarilor Lista Completa

May 17, 2025

Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Favoritele Nominalizarilor Lista Completa

May 17, 2025 -

Knicks Remaining Schedule A Breakdown And Playoff Predictions

May 17, 2025

Knicks Remaining Schedule A Breakdown And Playoff Predictions

May 17, 2025