$2,000 Ethereum Price Target: Resistance Successfully Broken

Table of Contents

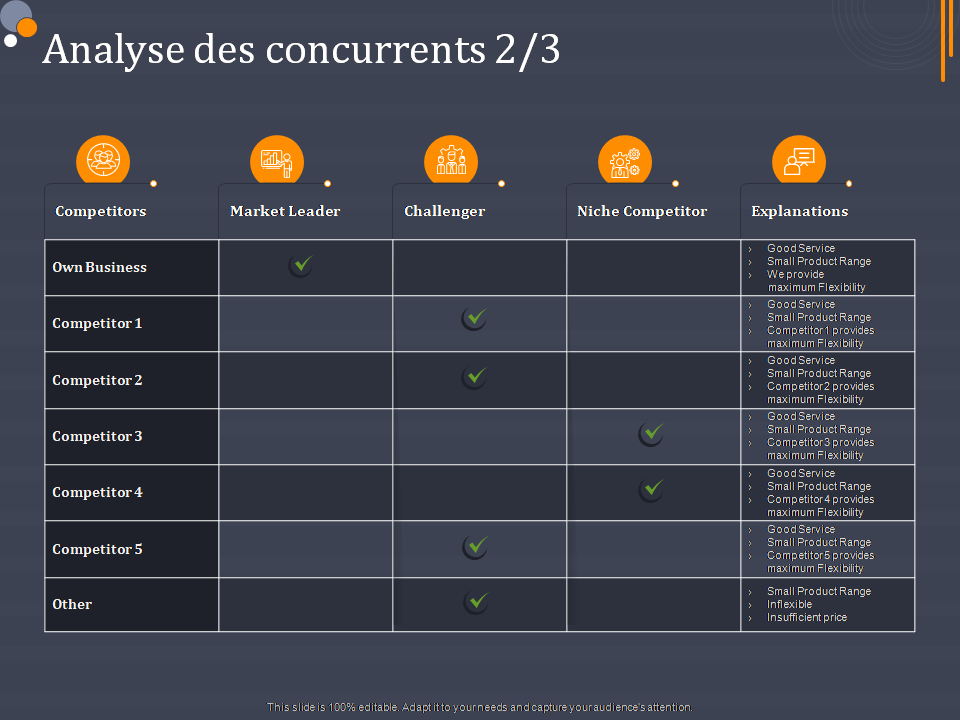

Technical Analysis: Deconstructing the Breakout

The recent surge in the ETH price isn't just random fluctuation; it's supported by robust technical analysis.

Chart Patterns and Indicators:

Several key chart patterns pointed towards a potential breakout. We observed a clear ascending triangle pattern forming on the ETH/USD chart over the past few weeks. This pattern, characterized by higher highs and consistently rising support levels, often precedes a significant price increase. Furthermore, indicators like the Relative Strength Index (RSI) showed an oversold condition before the breakout, signaling potential upward momentum. The Moving Average Convergence Divergence (MACD) also provided a bullish signal, crossing above its signal line just before the price surge. (Include relevant chart images here with descriptive alt text like "ETH/USD chart showing ascending triangle pattern and RSI indicator".)

Volume Confirmation:

The breakout wasn't just a price movement; it was accompanied by substantial volume. High trading volume during the breakout confirms strong buying pressure and suggests the move is likely sustainable. This high volume indicates a significant number of investors are confident in Ethereum's future price.

Support and Resistance Levels:

Previously acting as resistance, the price levels around $1,800-$1,900 are now likely to function as support. This means that if the price experiences a temporary pullback, these levels are expected to prevent a significant decline. This strengthens the bullish outlook and supports further upward price movement towards the $2,000 Ethereum price target.

Fundamental Factors Fueling the Ethereum Rally

Beyond the technical indicators, several fundamental factors are underpinning this Ethereum rally.

Ethereum 2.0 and Upgrades:

The ongoing development and implementation of Ethereum 2.0 are major drivers of investor confidence. Upgrades like sharding significantly improve scalability, reducing transaction fees and processing times. The transition to a proof-of-stake consensus mechanism enhances the network's security and energy efficiency. These improvements are essential for Ethereum to remain a leading platform for decentralized applications (dApps).

DeFi Growth and Applications:

The thriving Decentralized Finance (DeFi) ecosystem built on Ethereum continues to expand. The total value locked (TVL) in DeFi protocols on Ethereum remains substantial, illustrating the platform's continued relevance and potential for future growth. Popular DeFi applications like Aave, Uniswap, and Compound contribute significantly to the network's activity and attract further investment.

Institutional Adoption:

Growing institutional interest in Ethereum is another key factor. Several large investment firms and corporations are increasingly allocating assets to ETH, signaling a growing acceptance of cryptocurrencies as a legitimate asset class. This institutional adoption provides significant support to the price and reduces volatility in the long term. (Cite examples of institutional investments here)

Potential Challenges and Risks to the $2,000 Ethereum Price Target

While the prospects look bright, it's crucial to acknowledge potential challenges and risks:

Regulatory Uncertainty:

Regulatory uncertainty remains a significant risk factor for the entire cryptocurrency market, including Ethereum. Varying regulatory approaches across different jurisdictions could impact the price and adoption of cryptocurrencies. Clear and consistent regulatory frameworks are needed to foster long-term growth.

Market Volatility:

The cryptocurrency market is inherently volatile. Sharp price corrections or pullbacks are possible, even with strong fundamental and technical indicators. Investors need to be prepared for market fluctuations and manage their risk accordingly.

Competition from Other Cryptocurrencies:

Ethereum faces competition from other cryptocurrencies vying for market share. The emergence of new and improved blockchain technologies could impact Ethereum's dominance in the long run. However, Ethereum's established network effects and strong developer community provide a significant competitive advantage.

Conclusion: Is $2,000 Ethereum a Realistic Goal? Looking Ahead

The recent breakout above significant resistance levels, coupled with strong technical indicators and positive fundamental developments (Ethereum 2.0, DeFi growth, institutional adoption), suggests that a $2,000 Ethereum price target is not entirely unrealistic. However, regulatory uncertainty, market volatility, and competition from other cryptocurrencies pose considerable challenges. It's crucial to remember that investing in cryptocurrencies carries significant risk. Conduct thorough research and only invest what you can afford to lose.

Stay informed on the latest developments in the Ethereum market and track its progress towards the $2,000 Ethereum price target. Keep monitoring the ETH price for further updates and analysis! (Include links to relevant resources here, such as CoinMarketCap, CoinGecko, and reputable Ethereum news sources.)

Featured Posts

-

Le Pouvoir Geometrique Cache Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025

Le Pouvoir Geometrique Cache Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025 -

Xrps 400 Surge Whats Next For The Cryptocurrency

May 08, 2025

Xrps 400 Surge Whats Next For The Cryptocurrency

May 08, 2025 -

Six Month Trend Reverses Bitcoin Buying Outpaces Selling On Binance

May 08, 2025

Six Month Trend Reverses Bitcoin Buying Outpaces Selling On Binance

May 08, 2025 -

Friday April 18 2025 Daily Lotto Winning Numbers

May 08, 2025

Friday April 18 2025 Daily Lotto Winning Numbers

May 08, 2025 -

Nintendo Direct March 2025 Predictions For Play Station Game Announcements

May 08, 2025

Nintendo Direct March 2025 Predictions For Play Station Game Announcements

May 08, 2025

Latest Posts

-

Understanding Xrps Recent Rise The Trump Administrations Influence

May 08, 2025

Understanding Xrps Recent Rise The Trump Administrations Influence

May 08, 2025 -

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025 -

Ripples Xrp Jumps Connecting The Dots To President Trumps Recent Activities

May 08, 2025

Ripples Xrp Jumps Connecting The Dots To President Trumps Recent Activities

May 08, 2025 -

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025 -

Xrp Price Surge Is President Trump The Reason

May 08, 2025

Xrp Price Surge Is President Trump The Reason

May 08, 2025