$2.5 Trillion Wipeout: The Stunning Losses Of The Magnificent Seven Stocks

Table of Contents

The Magnificent Seven: A Closer Look at the Losses

The combined market cap loss of the Magnificent Seven represents a significant market correction, impacting investor confidence and highlighting the inherent risks in tech stock investments. Let's examine the individual performance:

-

Microsoft (MSFT): Experienced a [Insert Percentage]% loss, translating to a dollar loss of [Insert Dollar Amount]. This represents a significant downturn compared to its previous performance. [Include a chart/graph showing MSFT's stock performance]

-

Apple (AAPL): Suffered a [Insert Percentage]% decline, resulting in a loss of [Insert Dollar Amount]. This is [comparatively higher/lower] than its losses during previous market downturns. [Include a chart/graph showing AAPL's stock performance]

-

Amazon (AMZN): Saw a [Insert Percentage]% drop, amounting to a loss of [Insert Dollar Amount]. The impact on Amazon's cloud computing division (AWS) is particularly notable. [Include a chart/graph showing AMZN's stock performance]

-

Alphabet (GOOG): Experienced a [Insert Percentage]% decrease, equating to a loss of [Insert Dollar Amount]. Advertising revenue decline contributed significantly to this drop. [Include a chart/graph showing GOOG's stock performance]

-

Tesla (TSLA): Underwent a [Insert Percentage]% decline, resulting in a loss of [Insert Dollar Amount]. This reflects broader concerns regarding the electric vehicle market and Tesla's valuation. [Include a chart/graph showing TSLA's stock performance]

-

Meta (META): Faced a [Insert Percentage]% plummet, losing [Insert Dollar Amount]. The decline reflects challenges in the advertising sector and increased competition. [Include a chart/graph showing META's stock performance]

-

Nvidia (NVDA): Experienced a [Insert Percentage]% reduction, with a dollar loss of [Insert Dollar Amount]. The semiconductor industry's sensitivity to economic downturns played a role. [Include a chart/graph showing NVDA's stock performance]

Factors Contributing to the $2.5 Trillion Wipeout

Several interconnected factors contributed to the significant losses experienced by the Magnificent Seven stocks.

Rising Interest Rates and Inflation

Rising interest rates significantly impact tech valuations.

-

Higher rates reduce investor appetite for growth stocks: Growth stocks, like those of the Magnificent Seven, are particularly sensitive to interest rate hikes because their valuations are heavily reliant on future growth projections. Higher rates increase the discount rate applied to these future earnings, reducing their present value.

-

Increased borrowing costs for tech companies: Higher rates make borrowing more expensive for tech companies, impacting their ability to invest in research and development, expansion, and acquisitions.

-

Inflation's effect on consumer spending and tech demand: Inflation erodes consumer purchasing power, impacting demand for discretionary tech products and services.

Geopolitical Uncertainty and Supply Chain Disruptions

Global instability and ongoing supply chain issues further exacerbated the challenges faced by tech companies.

-

The impact of the war in Ukraine: The war disrupted global supply chains, impacting the availability of key components for tech manufacturing.

-

Ongoing supply chain bottlenecks: Bottlenecks continue to constrain production and increase costs for tech companies.

-

Increased energy prices and their influence on operating costs: Higher energy prices significantly increased operating costs across the board, impacting profitability.

Overvaluation and Market Correction

The significant losses could also be attributed to a period of overvaluation in the tech sector preceding the downturn.

-

Price-to-Earnings ratios before and after the downturn: Analyzing P/E ratios reveals a potential overvaluation in the lead-up to the current market correction.

-

Investor sentiment and market speculation: Market speculation and exuberant investor sentiment might have contributed to inflated valuations before the correction.

-

Potential bubbles and their bursting: Some analysts suggest that a speculative bubble in certain tech sectors might have burst, contributing to the sharp decline.

Impact on Investors and the Broader Economy

The $2.5 trillion wipeout in the Magnificent Seven stocks has had far-reaching consequences.

Investor Sentiment and Portfolio Diversification

The downturn significantly impacted investor confidence.

-

Analysis of investor behavior in response to the losses: Investors reacted with fear and uncertainty, leading to significant market volatility.

-

The importance of risk management and diversification strategies: The event highlights the crucial role of risk management and diversification in mitigating portfolio losses.

-

Recommendations for adjusting investment portfolios: Investors are urged to re-evaluate their portfolios and consider adjusting their asset allocation strategies.

Ripple Effects on Related Industries

The tech sector downturn has broader economic implications.

-

Effect on the advertising industry: The decline in Meta's stock price highlights the challenges faced by the advertising industry.

-

Impact on the semiconductor industry: Nvidia's performance reflects the broader challenges faced by the semiconductor sector.

-

Wider macroeconomic implications: The downturn has wider macroeconomic implications, impacting consumer confidence and economic growth.

Conclusion

The $2.5 trillion wipeout in the Magnificent Seven stocks represents a significant market event driven by a confluence of factors, including rising interest rates, inflation, geopolitical uncertainty, supply chain disruptions, and potential overvaluation. This event serves as a stark reminder of the inherent risks involved in investing in growth stocks and the importance of portfolio diversification. Understanding the dynamics behind these substantial losses is crucial for navigating the current market volatility.

Call to Action: Understanding the dynamics behind the $2.5 trillion loss in the Magnificent Seven is crucial for navigating the current market volatility. Stay informed about market trends and consider diversifying your investment portfolio to mitigate risk. Learn more about effective investment strategies to manage your investments in light of these significant losses in the Magnificent Seven stocks and consult with a financial advisor.

Featured Posts

-

The Russian Militarys Actions A Growing Threat To Europe

Apr 29, 2025

The Russian Militarys Actions A Growing Threat To Europe

Apr 29, 2025 -

Porsche 911 Za 1 33 Mln Zl Najpopularniejszy Model W Polsce

Apr 29, 2025

Porsche 911 Za 1 33 Mln Zl Najpopularniejszy Model W Polsce

Apr 29, 2025 -

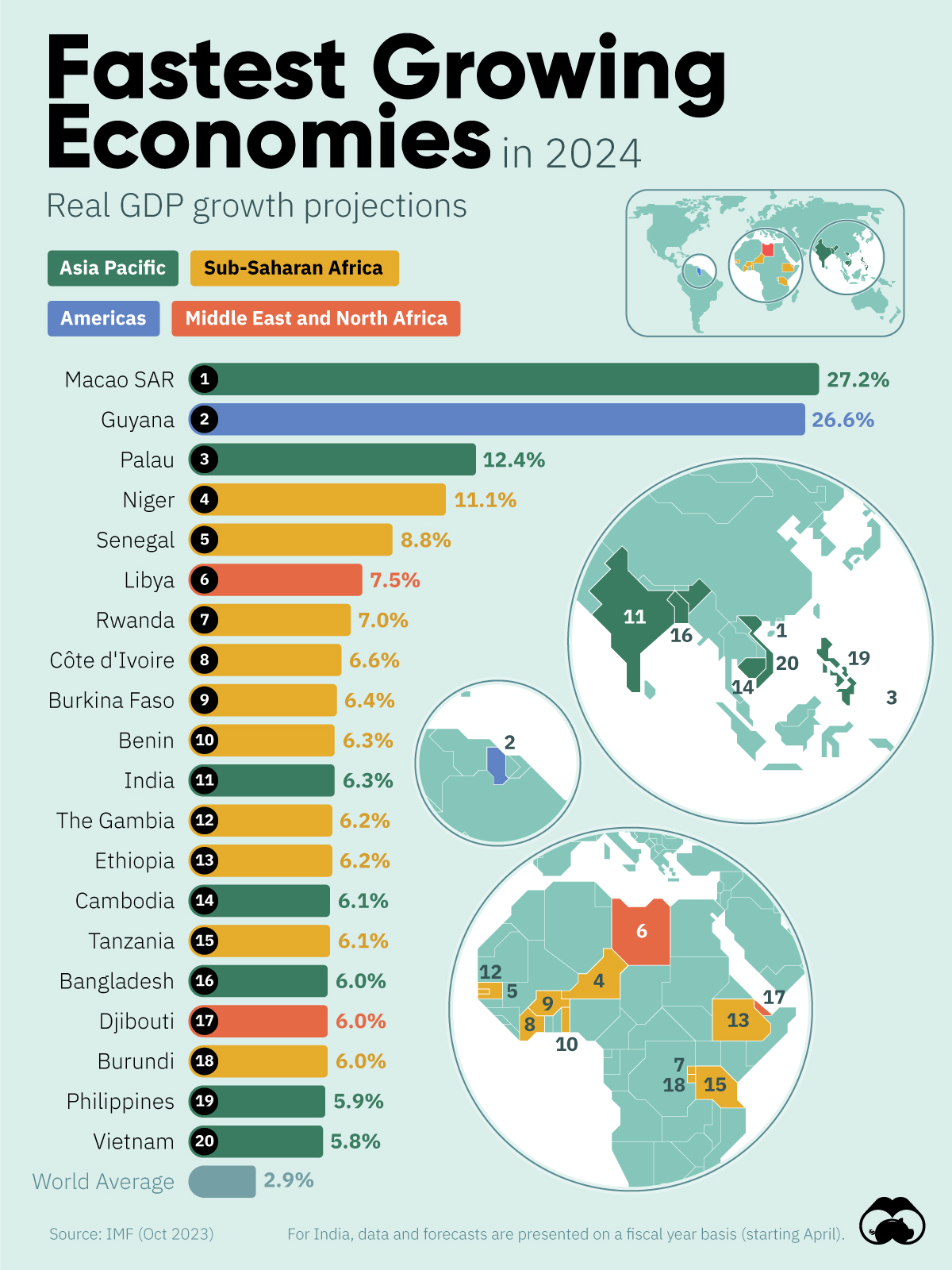

The Countrys Fastest Growing Business Regions A Comprehensive Guide

Apr 29, 2025

The Countrys Fastest Growing Business Regions A Comprehensive Guide

Apr 29, 2025 -

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025 -

Minnesota Twins Beat New York Mets 6 3

Apr 29, 2025

Minnesota Twins Beat New York Mets 6 3

Apr 29, 2025

Latest Posts

-

Lgbt Rights A Look At The Key Legal Players And Their Impact

Apr 29, 2025

Lgbt Rights A Look At The Key Legal Players And Their Impact

Apr 29, 2025 -

The Supreme Courts Ruling On Gender Impact On Trans Rights And Gender Critical Movements

Apr 29, 2025

The Supreme Courts Ruling On Gender Impact On Trans Rights And Gender Critical Movements

Apr 29, 2025 -

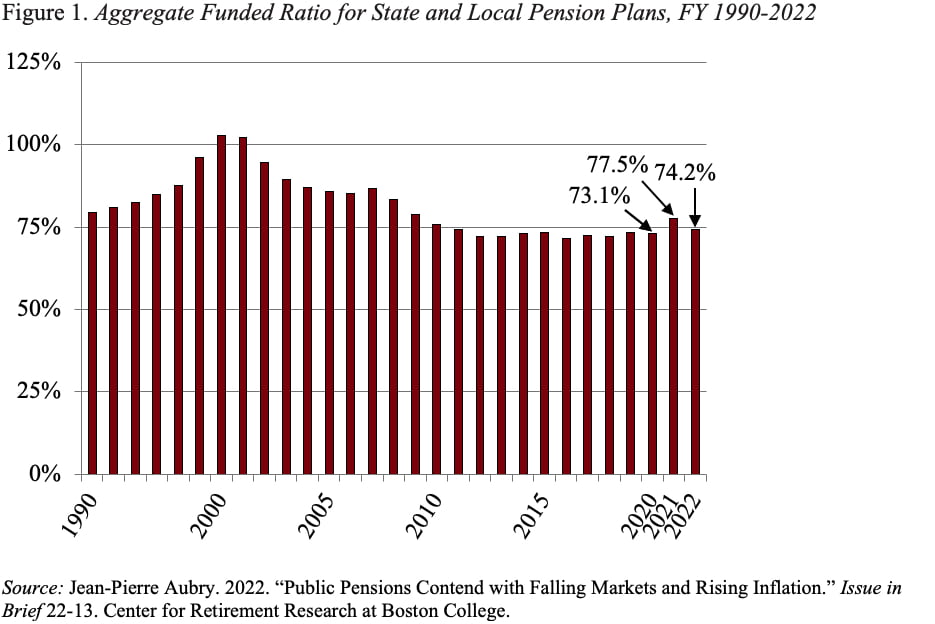

The Growing Financial Strain Of Public Sector Pensions On Taxpayers

Apr 29, 2025

The Growing Financial Strain Of Public Sector Pensions On Taxpayers

Apr 29, 2025 -

Exploring The Contributions Of Lgbt Figures To Legal Reform

Apr 29, 2025

Exploring The Contributions Of Lgbt Figures To Legal Reform

Apr 29, 2025 -

Supreme Court Decision On Gender A Clash Of Activist Views

Apr 29, 2025

Supreme Court Decision On Gender A Clash Of Activist Views

Apr 29, 2025