2% Drop In Amsterdam Stock Exchange Following Trump's Latest Tariffs

Table of Contents

Impact on Key Sectors of the Amsterdam Stock Exchange

The impact of Trump's new tariffs wasn't evenly distributed across the Amsterdam Stock Exchange. Certain sectors proved far more vulnerable than others, experiencing sharper declines. Export-oriented industries, in particular, bore the brunt of the negative market reaction.

- Technology: Companies within the technology sector, heavily reliant on global supply chains and international trade, suffered significant losses. For example, ASML Holding, a leading semiconductor equipment manufacturer, saw its share price fall by 3.5%, reflecting concerns about reduced demand from affected markets. This vulnerability stems from their reliance on international trade for both components and sales.

- Financials: The financial sector also experienced a downturn, with banks and insurance companies feeling the pressure of increased market uncertainty. ING Groep, a major Dutch bank, saw a 2.8% decrease in its share price. This sensitivity can be attributed to the overall economic slowdown risk associated with trade wars.

- Export-Oriented Industries: Companies heavily reliant on exports to the US and other affected markets experienced the most dramatic drops. This includes various manufacturing and agricultural businesses, facing increased costs and reduced competitiveness. Specific examples and percentage drops would need to be added based on real-time market data. The government announced preliminary plans for aid but details are yet to emerge.

Investor Sentiment and Market Reaction

The prevailing investor sentiment following the tariff announcement was one of significant risk aversion. Market uncertainty soared, leading to a "flight to safety," as investors sought refuge in less volatile assets like government bonds.

- Trading Volume: Trading volume on the Amsterdam Stock Exchange increased dramatically, indicating a surge in trading activity fueled by the uncertainty. This suggests heightened anxiety and a rush to adjust portfolios.

- Investment Strategy Shifts: Many investors shifted their strategies towards more conservative investments, reducing exposure to riskier assets and increasing their holdings in safe haven assets.

- Expert Opinions: Analysts have expressed concern, with several predicting further volatility in the short term. One leading economist commented, "The impact of these tariffs on the Amsterdam Stock Exchange, and indeed the broader European economy, could be significant and long-lasting."

Global Implications and the Wider European Market

The ripple effects of Trump's tariffs extended far beyond the Amsterdam Stock Exchange. Other European stock exchanges also experienced declines, though the impact varied.

- Comparison with Other Indices: The AEX's 2% drop was comparable to, or even slightly more pronounced than, the declines seen in other major European indices like the FTSE 100 and the DAX. This indicates a widespread response to the trade war news.

- Spillover Effects: The impact wasn't limited to the financial markets. Spillover effects are expected across various industries and economies, impacting supply chains and consumer prices.

- Global Economic Outlook: The overall global economic outlook has darkened following the tariff announcement, raising concerns about a potential slowdown or even recession. This uncertainty is affecting both investor confidence and long-term economic projections.

Long-Term Outlook and Potential Recovery for the Amsterdam Stock Exchange

Predicting the long-term impact on the AEX and the timeline for a potential recovery is challenging, but several factors will play a crucial role.

- Government Intervention: The Dutch government may implement measures to mitigate the negative impacts on businesses and the economy, such as providing financial support or adjusting trade policies.

- Dutch Economic Resilience: The resilience of the Dutch economy and its capacity to adapt to trade shocks will be vital in determining the speed and extent of any recovery.

- Cautious Outlook: While the immediate outlook is bleak, the long-term picture will depend on several factors, including the duration of the trade war and the responses from both the US and the EU. A cautiously optimistic prediction for recovery depends on successful negotiation and mitigation strategies.

Conclusion: Navigating the Uncertainty Following the Amsterdam Stock Exchange Drop

The 2% drop in the Amsterdam Stock Exchange following President Trump's new tariffs represents a significant blow, impacting key sectors like technology, financials, and export-oriented industries. The resulting market volatility, heightened risk aversion, and global implications underscore the serious challenges posed by escalating trade tensions. Investors witnessed a flight to safety and significant shifts in investment strategies. The long-term outlook remains uncertain, depending on government responses and the broader global economic climate. To stay updated on AEX performance and monitor the impact of Trump's tariffs on the Amsterdam Stock Exchange, follow reputable financial news sources and consider subscribing to market analysis newsletters. Stay informed to navigate this evolving situation.

Featured Posts

-

Analysis Mia Farrows Assessment Of American Democracys Future

May 25, 2025

Analysis Mia Farrows Assessment Of American Democracys Future

May 25, 2025 -

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025 -

Escape To The Country Budgeting For Your Rural Relocation

May 25, 2025

Escape To The Country Budgeting For Your Rural Relocation

May 25, 2025 -

Bolshe 600 Svadeb Na Kharkovschine Za Mesyats Tendentsii I Statistika

May 25, 2025

Bolshe 600 Svadeb Na Kharkovschine Za Mesyats Tendentsii I Statistika

May 25, 2025 -

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

Latest Posts

-

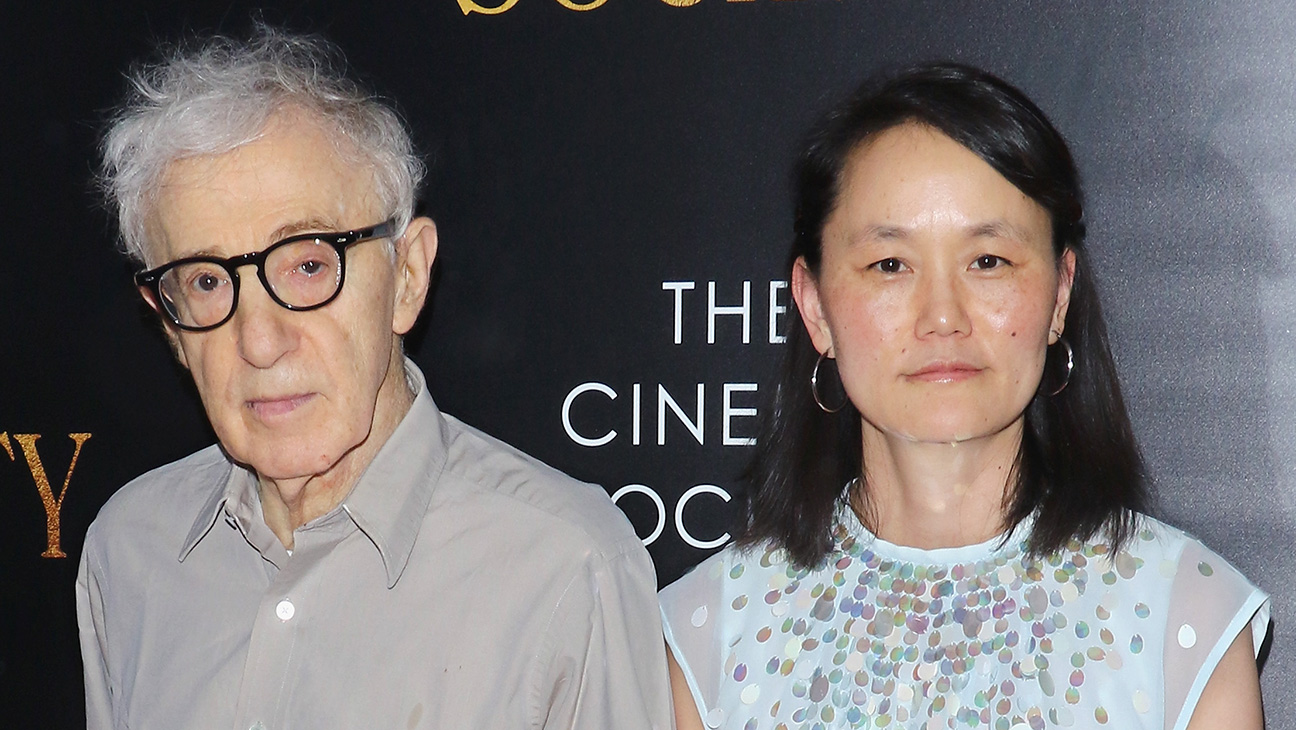

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

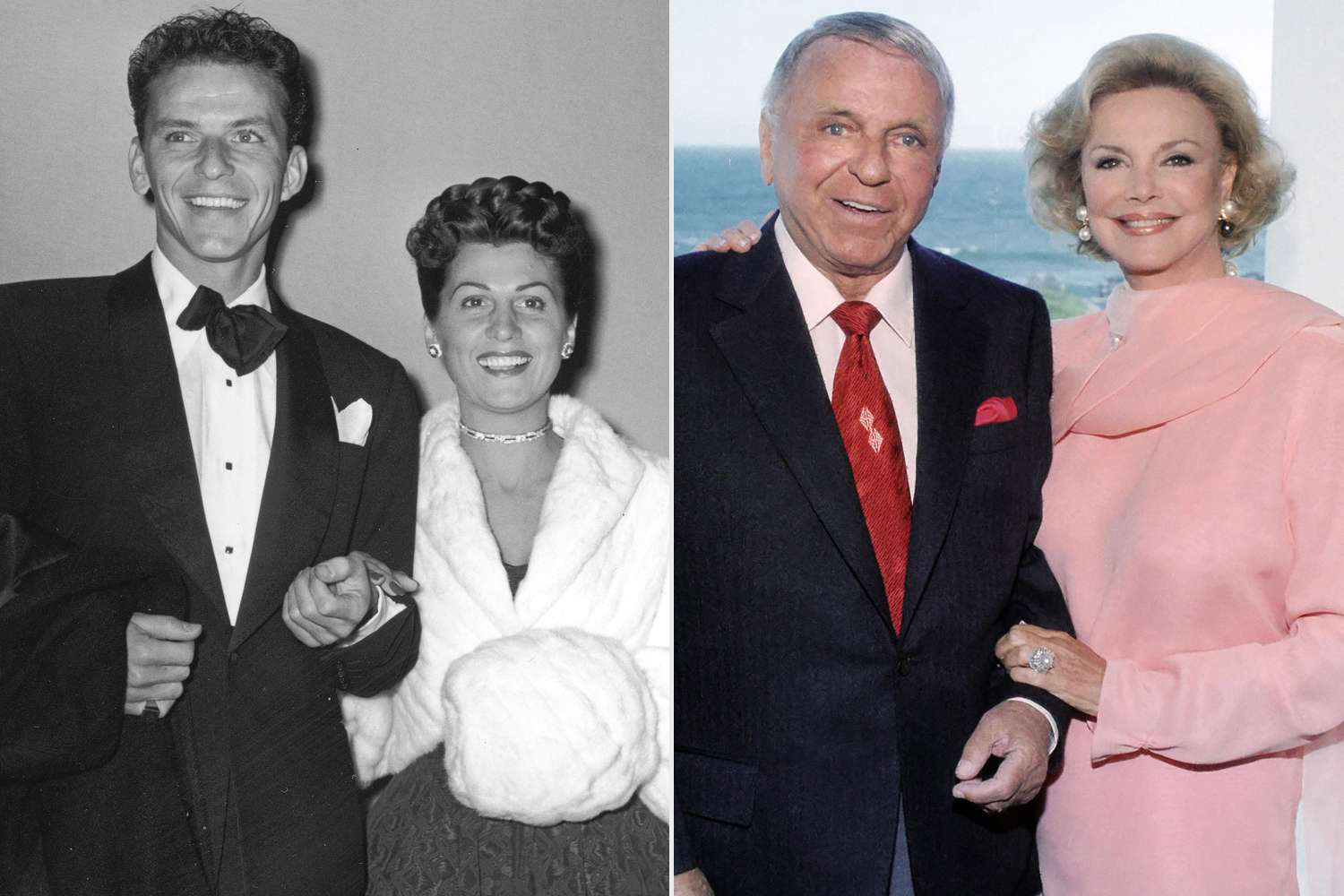

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025