30 Jobs Cut At TVA Group Amidst Streaming Competition And Regulatory Pressure

Table of Contents

The Impact of Streaming Services on TVA Group

The proliferation of global streaming giants like Netflix, Disney+, and Amazon Prime Video has fundamentally altered the media consumption landscape. This "cord-cutting" phenomenon, where viewers abandon traditional cable television in favor of on-demand streaming, has led to significant audience erosion for broadcasters like TVA Group. This directly impacts advertising revenue, a key source of income for traditional television networks.

- Increased Competition: The influx of high-quality, readily available streaming content presents a formidable challenge to TVA Group's ability to attract and retain viewers.

- Declining Viewership: Traditional television viewership continues to decline, impacting the effectiveness of advertising campaigns and reducing revenue streams.

- Content Investment: To compete, TVA Group needs to invest heavily in creating original streaming content, a costly endeavor that puts further pressure on profitability.

- Strategic Response: TVA Group must adapt its strategy to counter the streaming threat. This could involve increased investment in high-quality original programming for its own streaming platform, exploring strategic partnerships with international streaming services, or focusing on niche programming to cater to specific audiences. The success of other media companies in navigating this transition, such as the BBC's iPlayer strategy, offers valuable lessons.

Regulatory Pressure and its Influence on TVA Group's Restructuring

The Canadian Radio-television and Telecommunications Commission (CRTC) plays a significant role in shaping the Canadian media landscape through broadcasting regulations, media ownership policies, and content quotas. These regulations, while intended to foster Canadian content and protect cultural diversity, can also present significant challenges for companies like TVA Group.

- Licensing and Content Quotas: Changes in licensing requirements and content quotas can impact TVA Group's programming strategies and operational costs.

- Financial Stability: Compliance with evolving regulations necessitates significant investment and can strain the company's financial stability, particularly when coupled with the challenges posed by streaming competition.

- Non-Compliance Risks: Failure to comply with CRTC regulations can lead to substantial penalties and reputational damage, further compounding the company's difficulties.

- Broader Impact: Regulatory changes significantly influence the overall Canadian media landscape, affecting not only TVA Group but other broadcasters and media companies as well.

Analyzing the 30 Job Cuts: Which Departments Were Affected?

The 30 job cuts represent a significant restructuring effort by TVA Group, aimed at streamlining operations and reducing costs in the face of mounting challenges. While the exact breakdown of affected departments hasn't been publicly released in full detail, it's likely that areas such as marketing, production, or even administrative roles were impacted.

- Departmental Impact: The specific departments affected likely reflect TVA Group's attempts to optimize resources and focus on core competencies.

- Cost-Cutting Measures: These layoffs are undoubtedly part of a broader cost-cutting strategy designed to improve the company's financial health.

- Official Statement: TVA Group’s official statement on the layoffs should be examined for further insight into the reasoning behind the specific cuts.

The Future of TVA Group in a Changing Media Landscape

The future of TVA Group hinges on its ability to adapt to the changing media landscape and effectively address the challenges of streaming competition and regulatory pressures. Survival requires innovation, diversification, and strategic initiatives.

- Strategic Initiatives: Investing in its own streaming platform, forging strategic partnerships, and exploring new revenue streams (e.g., through digital content, merchandise, or events) are crucial.

- Long-Term Viability: TVA Group’s long-term viability depends on its capacity to transform its business model and adapt to the evolving consumer preferences and technological advancements.

- Diversification: Expanding into new areas, such as digital media or content creation for international markets, could offer diversification opportunities and new revenue streams.

- Mergers and Acquisitions: Potential mergers or acquisitions could provide access to new technologies, content libraries, or distribution channels.

Conclusion

The 30 job cuts at TVA Group highlight the significant challenges facing the Canadian media industry, stemming from the dual pressures of aggressive streaming competition and evolving regulatory landscapes. These layoffs represent a necessary, albeit painful, step for the company to navigate this turbulent period. Understanding the dynamics of streaming competition and regulatory pressure is crucial for navigating the evolving media landscape. Stay informed about further developments at TVA Group and the impact on the Canadian media industry by following [link to relevant news source or TVA Group website]. Learn more about the impact of streaming services on the Canadian media industry and other related topics by exploring related articles on [link to relevant resources].

Featured Posts

-

Poznat Izgledot Na Sheshirite Makedoni A Gi Dozna Mozhnite Rivali Vo Ligata Na Natsii

May 23, 2025

Poznat Izgledot Na Sheshirite Makedoni A Gi Dozna Mozhnite Rivali Vo Ligata Na Natsii

May 23, 2025 -

Whats Leaving Hulu This Month Dont Miss These Films

May 23, 2025

Whats Leaving Hulu This Month Dont Miss These Films

May 23, 2025 -

Tik Tokers Viral Pope Leo Video A Resurfaced Connection

May 23, 2025

Tik Tokers Viral Pope Leo Video A Resurfaced Connection

May 23, 2025 -

The Israeli Embassy Attack Identifying Suspect Elias Rodriguez And His Motives

May 23, 2025

The Israeli Embassy Attack Identifying Suspect Elias Rodriguez And His Motives

May 23, 2025 -

2025 Emmy Awards Who Will Win Lead Actress In A Limited Series

May 23, 2025

2025 Emmy Awards Who Will Win Lead Actress In A Limited Series

May 23, 2025

Latest Posts

-

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025 -

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025 -

Essen Uniklinikum Bewegendes Ereignis In Der Naehe Ruehrt Zu Traenen

May 24, 2025

Essen Uniklinikum Bewegendes Ereignis In Der Naehe Ruehrt Zu Traenen

May 24, 2025 -

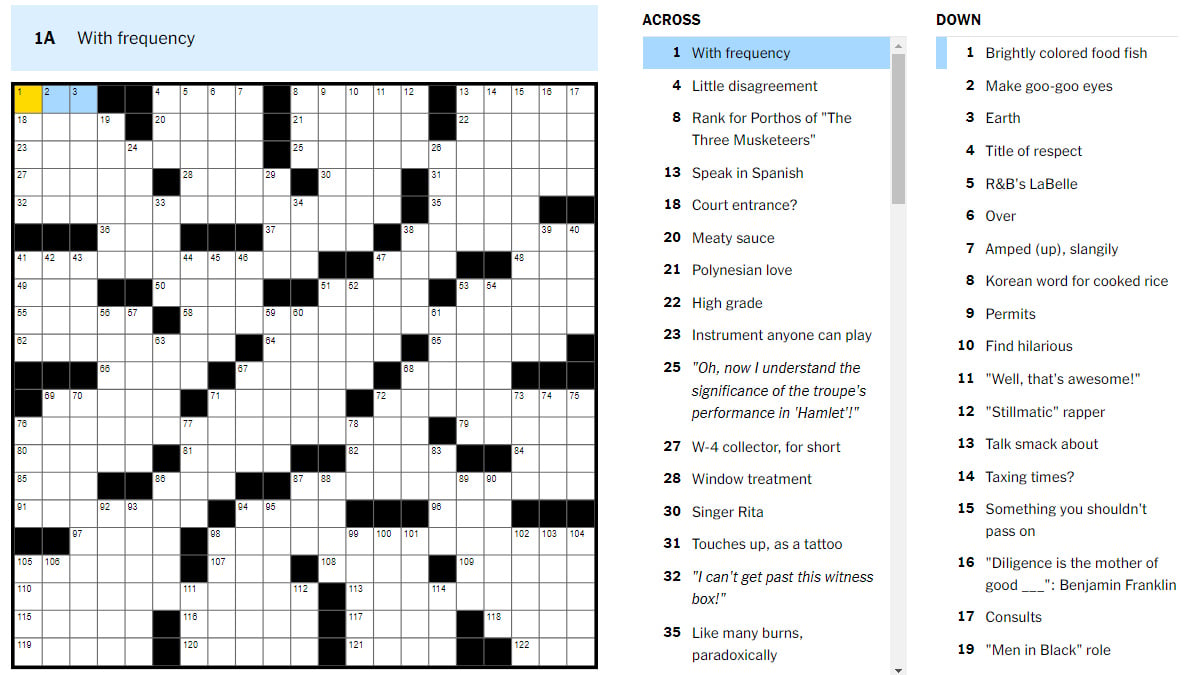

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025 -

Solutions To The Nyt Mini Crossword April 18 2025

May 24, 2025

Solutions To The Nyt Mini Crossword April 18 2025

May 24, 2025