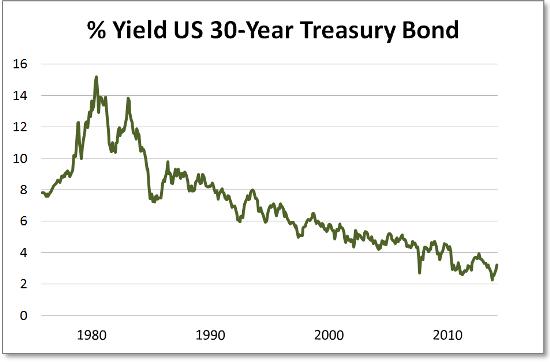

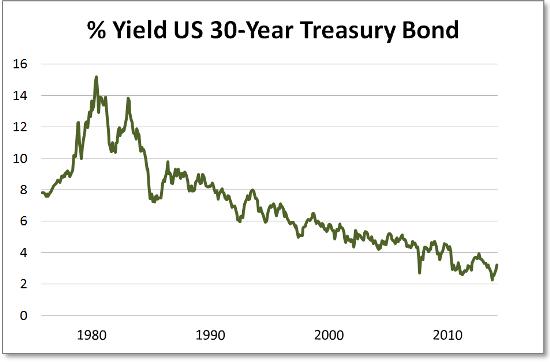

30-Year Treasury Yield Surge To 5%: Implications For The "Sell America" Trade

Table of Contents

Attractiveness of US Treasuries at 5% Yield

The 5% yield on 30-year Treasury bonds presents a compelling proposition for investors worldwide. This high yield, unheard of in recent years, significantly alters the risk-reward equation for several reasons.

Increased Returns for Investors

- Higher yields attract foreign and domestic capital, potentially reversing the "Sell America" trend. The allure of a 5% return on a relatively safe asset like US Treasuries is hard to ignore. This influx of capital could significantly reduce the appeal of the "Sell America" trade, which profits from a weakening US dollar and declining US asset prices.

- A 5% yield offers a considerable comparative advantage against other global bond markets. Many developed economies are grappling with low or even negative interest rates. The US, with its 5% yield, becomes a much more attractive destination for capital seeking stable returns, leading to increased demand for US Treasury bonds.

- The high yield makes US Treasuries an even more attractive safe haven asset for risk-averse investors. During times of economic uncertainty, investors often flock to safe havens like US government bonds. The current yield makes this appeal even stronger, potentially drawing significant investment away from riskier assets and undermining strategies that bet against the US economy.

Implications for the Dollar

The increased demand for US Treasuries, driven by the 5% yield, has significant implications for the US dollar.

- Increased demand for US Treasuries strengthens the US dollar. Foreign investors need to buy dollars to purchase these bonds, thus increasing demand and strengthening the currency's value.

- A stronger dollar impacts currency exchange rates and international trade. A stronger dollar makes US exports more expensive and imports cheaper, potentially impacting the US trade balance and the competitiveness of American businesses.

- A stronger dollar directly undermines the profitability of the "Sell America" trade. This strategy often involves shorting the dollar, anticipating its decline. A strengthening dollar due to high Treasury yields directly contradicts this assumption, leading to potential losses for those employing this strategy.

Impact on Inflation Expectations and Monetary Policy

The 30-year Treasury yield's surge to 5% is a strong signal reflecting market expectations and influencing monetary policy decisions.

The Fed's Response

- The Federal Reserve might adjust its monetary policy in response to the yield surge. The Fed's primary mandate is to control inflation and maintain full employment. A 5% yield on 30-year Treasuries might prompt the Fed to consider further interest rate hikes or maintain a restrictive stance to curb inflation.

- Potential interest rate hikes or pauses depend on the Fed's assessment of inflation and economic growth. The Fed will carefully weigh the risk of further interest rate increases, considering their potential impact on economic growth.

- The relationship between inflation, interest rates, and the bond market is complex and dynamic. High interest rates generally help control inflation but could also slow economic growth. The Fed needs to strike a delicate balance.

Inflationary Pressures

- Higher yields often reflect market expectations about future inflation. Investors demand higher yields to compensate for the erosion of purchasing power caused by inflation.

- Higher interest rates are a tool the Federal Reserve uses to curb inflation. By making borrowing more expensive, higher rates can reduce demand and cool down inflationary pressures.

- Inflation impacts various asset classes and investment strategies differently. For example, inflation can erode the value of fixed-income investments but can be beneficial for certain commodities.

Re-evaluation of the "Sell America" Trade Strategy

The 5% 30-year Treasury yield significantly impacts the viability of the "Sell America" trade.

Risks and Rewards

- Shorting US assets becomes riskier given the higher yields. The attractiveness of US Treasuries diminishes the potential for significant gains from shorting US assets, increasing the risk-reward ratio.

- Increased losses are potential for those betting against the US dollar. A strengthening dollar, driven by the demand for US Treasuries, directly counters the "Sell America" trade's assumption of a weakening dollar.

- Alternative investment strategies might be more appealing now. Investors previously favoring the "Sell America" trade may need to reconsider their approach and explore other investment options with better risk-adjusted returns.

Shifting Market Sentiment

- The yield increase could significantly affect investor sentiment towards US assets. The higher yields could attract a substantial inflow of foreign and domestic investment, bolstering confidence in the US economy.

- Capital flows could reverse, leading to a shift away from the "Sell America" trade. The improved outlook for US assets makes it less appealing to bet against the US economy.

- Market psychology and investor confidence play a crucial role. The shift in sentiment triggered by the 5% yield could accelerate the shift away from the "Sell America" trade.

Conclusion

The 30-year Treasury yield reaching 5% represents a significant turning point in the global financial markets, potentially rendering the "Sell America" trade less attractive. The increased allure of US Treasuries, coupled with potential changes in monetary policy and inflation expectations, suggests that a reassessment of strategies betting against the US economy and dollar is urgently needed. Higher yields on US Treasuries offer a compelling alternative for investors seeking higher returns and relatively safe investments.

Call to Action: Stay informed about fluctuations in the 30-year Treasury yield and their impact on the "Sell America" trade and other investment strategies. Regularly review your portfolio and consider adjusting your allocations based on the evolving economic outlook and interest rate environment. Understanding the dynamics of the 30-year Treasury yield is crucial for navigating the complexities of the current market. Don't hesitate to consult a financial advisor to discuss how these changes might affect your specific investment portfolio and risk tolerance.

Featured Posts

-

Bucharest Tiriac Open Cobolli Secures First Atp Championship

May 21, 2025

Bucharest Tiriac Open Cobolli Secures First Atp Championship

May 21, 2025 -

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025 -

Allentowns Historic Penn Relays 4x100m First Sub 43 Second Run

May 21, 2025

Allentowns Historic Penn Relays 4x100m First Sub 43 Second Run

May 21, 2025 -

Is This The End For The Abc News Show After Layoffs

May 21, 2025

Is This The End For The Abc News Show After Layoffs

May 21, 2025 -

Aston Villa Vs Manchester United Fa Cup Rashfords Goals Secure Victory

May 21, 2025

Aston Villa Vs Manchester United Fa Cup Rashfords Goals Secure Victory

May 21, 2025