31% Decrease In BP Chief Executive's Salary: Analysis And Implications

Table of Contents

H2: The Context of the 31% BP CEO Salary Reduction

H3: Bernard Looney's Departure and its Impact: Bernard Looney's departure from BP, preceding the announced salary reduction, was shrouded in controversy. While initially presented as a resignation, investigations into potential breaches of company policy surrounding his relationship with an executive from another energy company led to his abrupt exit.

- Date of Departure: [Insert Date]

- Reason for Departure: Alleged violation of company policy regarding relationships with executives from other companies. Further investigation is ongoing.

- Controversies: The exact nature of the policy violation remains unclear, and the investigation may reveal further details impacting public perception of both Mr. Looney and BP’s internal controls.

- Severance Package: While specifics haven't been publicly disclosed, it's anticipated that Mr. Looney likely received a significant severance package alongside his reduced salary for the period he served. This needs further clarification from official BP statements.

H3: BP's Financial Performance and the Rationale: BP's financial performance in recent years has been a mixed bag. While the company has experienced periods of significant profit, driven partly by volatile oil prices, it has also faced challenges related to energy transition and regulatory pressures. The board's decision to reduce the BP CEO salary might be interpreted as a response to these fluctuating market conditions and a need to demonstrate fiscal responsibility to shareholders.

- Profitability: [Insert relevant statistics on BP's profits and losses in recent years].

- Shareholder Returns: [Insert data regarding shareholder returns and stock performance].

- Rationale for Salary Reduction: While BP hasn't explicitly linked the salary reduction solely to financial performance, the move suggests a focus on aligning executive compensation with broader company performance and shareholder expectations. Further clarity is needed on the official reasoning.

H2: Implications for Executive Compensation in the Energy Sector

H3: Setting a Precedent for Corporate Governance: The BP CEO salary cut could set a significant precedent for corporate governance within the energy sector and beyond. It highlights a growing awareness of the need for executive compensation to reflect company performance and societal expectations. This might encourage greater scrutiny of executive pay packages and a move towards greater transparency.

- CSR and Executive Pay: The increasing importance of Corporate Social Responsibility (CSR) is influencing executive compensation decisions, pushing companies to consider ethical and social factors alongside financial performance.

- Similar Cases: While a 31% cut is substantial, there have been other instances of significant salary reductions for executives following controversies or poor performance, but rarely at this scale within a top energy company. Further research would need to analyze similar cases across various sectors.

- Shareholder Activism: The growing power of shareholder activism and the pressure for responsible executive compensation are key drivers in this trend towards greater accountability.

H3: The Broader Debate on Fair Pay and Inequality: The debate surrounding executive compensation often centers on the vast disparity between executive salaries and the average employee's earnings. The BP CEO salary cut, while significant, does not fully address these wider concerns about inequality, but it fuels the ongoing conversation.

- Executive Pay vs. Average Employee Salaries: The ratio between executive pay and average worker salaries remains a contentious issue. The BP decision might indirectly influence the debate, encouraging further discussion on fair pay practices.

- Legislation and Regulation: Legislation and regulations concerning executive compensation are evolving, with a growing push for greater transparency and accountability.

- Stakeholder Viewpoints: Employees, shareholders, and the wider public hold diverse perspectives on executive pay, highlighting the complexities of this issue.

H2: Future Outlook and Predictions for BP's Leadership

H3: The Search for a New CEO and Compensation Expectations: The search for a new BP CEO is underway. The compensation package offered to the successor will likely influence future discussions around executive pay within the company and the broader industry.

- Selection Criteria: BP will likely emphasize experience in the energy sector, a strong understanding of the energy transition, and a commitment to sustainable business practices.

- Salary Range: The salary for the next CEO may fall below Mr. Looney's previous compensation, signaling a continuing trend towards moderation in executive pay. However, the exact figure remains to be seen.

- Potential Candidates: Speculation is likely to focus on experienced executives from within BP or other major energy companies with demonstrated success in navigating the challenges of the evolving energy landscape.

H3: Long-Term Impact on BP's Strategy and Culture: The BP CEO salary cut could have lasting implications for the company's strategy and culture. It might lead to a greater focus on risk management and ethical conduct.

- Risk Management: The company may implement stricter protocols to mitigate future controversies and maintain a strong reputation.

- Employee Morale: The salary cut's impact on employee morale will depend on how the company communicates the decision and addresses broader concerns about fair compensation.

- Reputation and Stakeholder Relations: The move could improve BP's reputation and enhance its relationships with shareholders and other stakeholders who prioritize responsible corporate governance.

3. Conclusion:

The 31% reduction in the BP CEO salary is a significant event with broad implications for executive compensation, corporate governance, and the energy sector as a whole. The circumstances surrounding Bernard Looney's departure and the subsequent salary cut highlight the increasing scrutiny of executive pay practices and the importance of aligning executive compensation with company performance and broader societal expectations. The future direction of BP, both in terms of its leadership and its approach to executive compensation, remains to be seen. However, this event marks a turning point in the ongoing dialogue surrounding fair pay, responsible corporate governance, and the evolving landscape of the energy industry.

What are your thoughts on the BP CEO salary cut? Share your opinions on the future of executive compensation in the comments below!

Featured Posts

-

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025 -

Vybz Kartel Electrifies Brooklyn With Sold Out Performances

May 21, 2025

Vybz Kartel Electrifies Brooklyn With Sold Out Performances

May 21, 2025 -

Stephane La Voix Romande Qui Charme Paris

May 21, 2025

Stephane La Voix Romande Qui Charme Paris

May 21, 2025 -

Premier League 2024 25 Season Champions Picture Special

May 21, 2025

Premier League 2024 25 Season Champions Picture Special

May 21, 2025 -

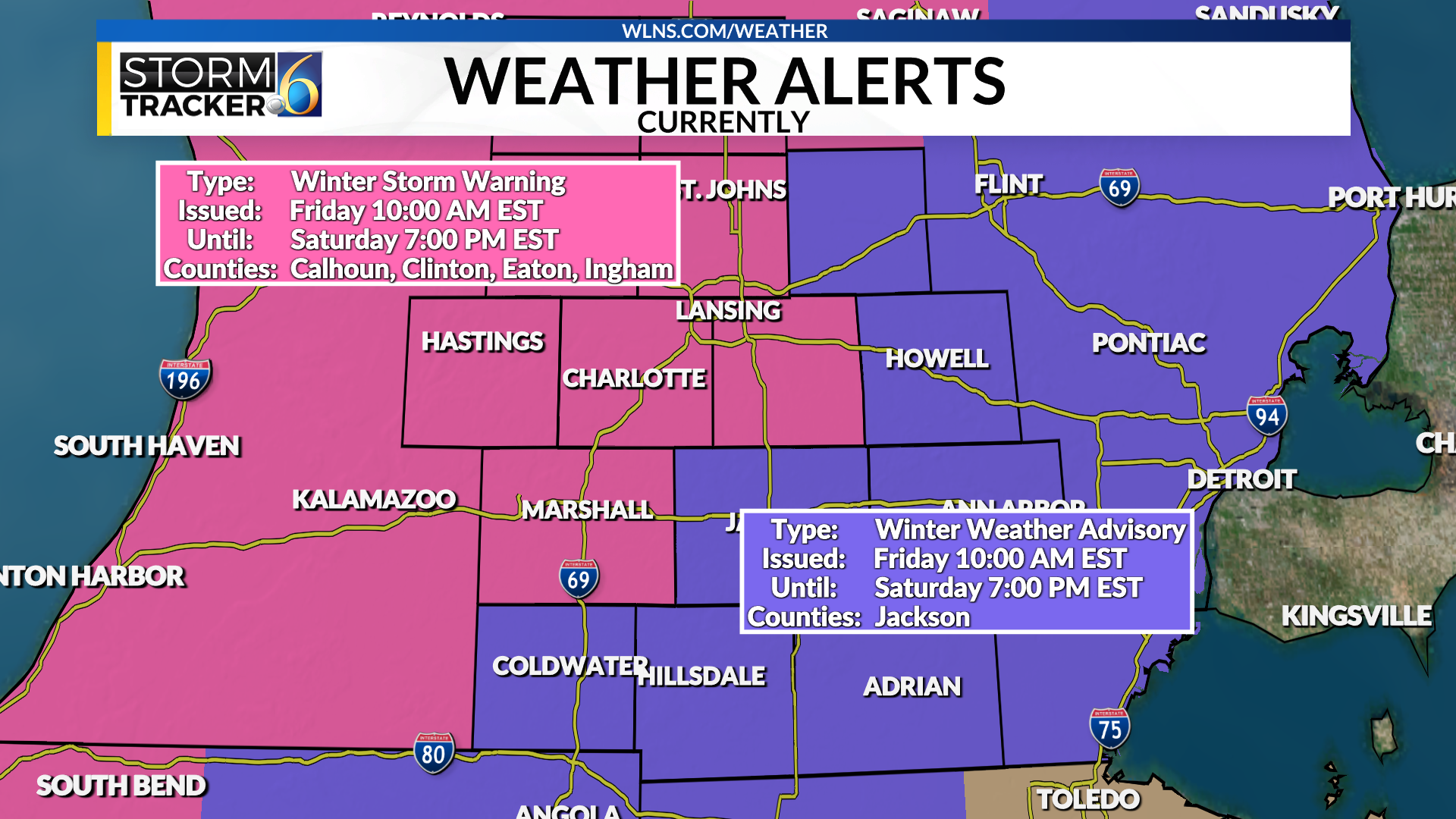

Winter Storm And School Closings What Parents Need To Know

May 21, 2025

Winter Storm And School Closings What Parents Need To Know

May 21, 2025