$40 Million Series B Investment Fuels Pliant's B2B Payment Solutions Growth

Table of Contents

The Significance of the $40 Million Series B Investment for Pliant's Growth

This significant investment represents a strong vote of confidence in Pliant's vision and its innovative approach to B2B payment processing. The $40 million will be instrumental in accelerating Pliant's overall growth strategy across multiple key areas. This funding allows Pliant to significantly expand its operations and solidify its leadership in the competitive B2B payment solutions market.

-

Accelerated product development for B2B payment solutions: The investment will fuel the development of new features and functionalities within Pliant's existing platform, enhancing its efficiency, security, and user experience. This includes improvements to API integrations and the development of more sophisticated analytics dashboards for better financial oversight.

-

Expansion into new markets and customer segments: Pliant plans to leverage this funding to expand its reach into new geographic markets and target specific underserved customer segments with tailored B2B payment solutions. This strategic expansion will broaden their customer base and increase market share.

-

Strategic acquisitions to enhance its B2B payment platform capabilities: The capital will enable Pliant to pursue strategic acquisitions of complementary technologies or companies, further bolstering its platform and expanding its service offerings within the B2B payment ecosystem.

-

Increased hiring across engineering, sales, and marketing teams focusing on B2B payments: Pliant will significantly expand its workforce, bringing in top talent to accelerate product development, expand sales and marketing efforts, and enhance customer support for its B2B payment solutions.

-

Strengthened market position against competitors in the B2B payments industry: The investment provides Pliant with the resources needed to invest heavily in marketing and sales, strengthening its brand presence and market share against its competitors in the fiercely competitive B2B payment solutions market.

How Pliant's B2B Payment Solutions are Revolutionizing the Industry

Pliant's B2B payment solutions stand out by addressing the key pain points businesses face with traditional methods. Their innovative approach offers a streamlined, secure, and transparent experience, unlike many legacy systems.

-

Focus on specific pain points in traditional B2B payment methods: Pliant directly tackles issues such as slow processing times, high fees, lack of transparency, and complex reconciliation processes common in traditional B2B payment methods. This focus on solving real-world problems is a key differentiator.

-

Highlight key features of Pliant's solutions: Pliant's platform boasts automation features that significantly reduce manual processing, robust integration capabilities for seamless connection with existing ERP and accounting systems, and advanced security measures to protect sensitive financial data. These features are critical for businesses looking to improve efficiency and security.

-

Mention specific types of B2B payments supported: Pliant supports a wide range of B2B payment types, including automated invoice payments, purchase order processing, virtual card payments, and other solutions tailored to the specific needs of various industries. This comprehensive approach caters to a broad spectrum of business needs.

-

Showcase success stories and case studies: Numerous case studies demonstrate how Pliant's B2B payment solutions have helped businesses improve their cash flow, reduce administrative overhead, and enhance their relationships with suppliers and customers. These real-world examples highlight the tangible benefits of Pliant's platform.

Future Outlook and Market Implications of Pliant's B2B Payment Solutions

With this significant investment, Pliant is poised for substantial growth and innovation. Their future plans will further solidify their leadership position in the B2B payment solutions market.

-

Expansion into international markets: Pliant plans to expand its operations into new international markets, bringing its innovative B2B payment solutions to a global audience.

-

Development of new B2B payment solutions tailored to specific industries: The company aims to develop specialized B2B payment solutions catering to the unique needs of specific industries, such as healthcare, manufacturing, and retail.

-

Strategic partnerships with other companies in the fintech ecosystem: Pliant will actively seek strategic partnerships with other fintech companies to expand its ecosystem and provide even more comprehensive B2B payment solutions.

-

Potential impact on the overall B2B payments market: Pliant's continued growth and innovation will undoubtedly impact the broader B2B payments market, driving further adoption of efficient and secure payment technologies.

-

Predictions regarding future trends in B2B payment solutions: Pliant anticipates continued growth in the demand for automated, secure, and transparent B2B payment solutions, driven by increasing digitalization and the need for improved efficiency in business operations.

Conclusion

The $40 million Series B investment represents a significant turning point for Pliant, empowering the company to accelerate its growth and innovation in the competitive B2B payment solutions market. The investment will drive product development, market expansion, and strategic partnerships, ultimately shaping a more efficient and secure B2B payment landscape.

Call to Action: Learn more about Pliant's cutting-edge B2B payment solutions and how they can streamline your business operations. Visit [Pliant's website] today to explore the future of B2B payments.

Featured Posts

-

Fords Brazilian Decline Byds Electric Vehicle Rise

May 13, 2025

Fords Brazilian Decline Byds Electric Vehicle Rise

May 13, 2025 -

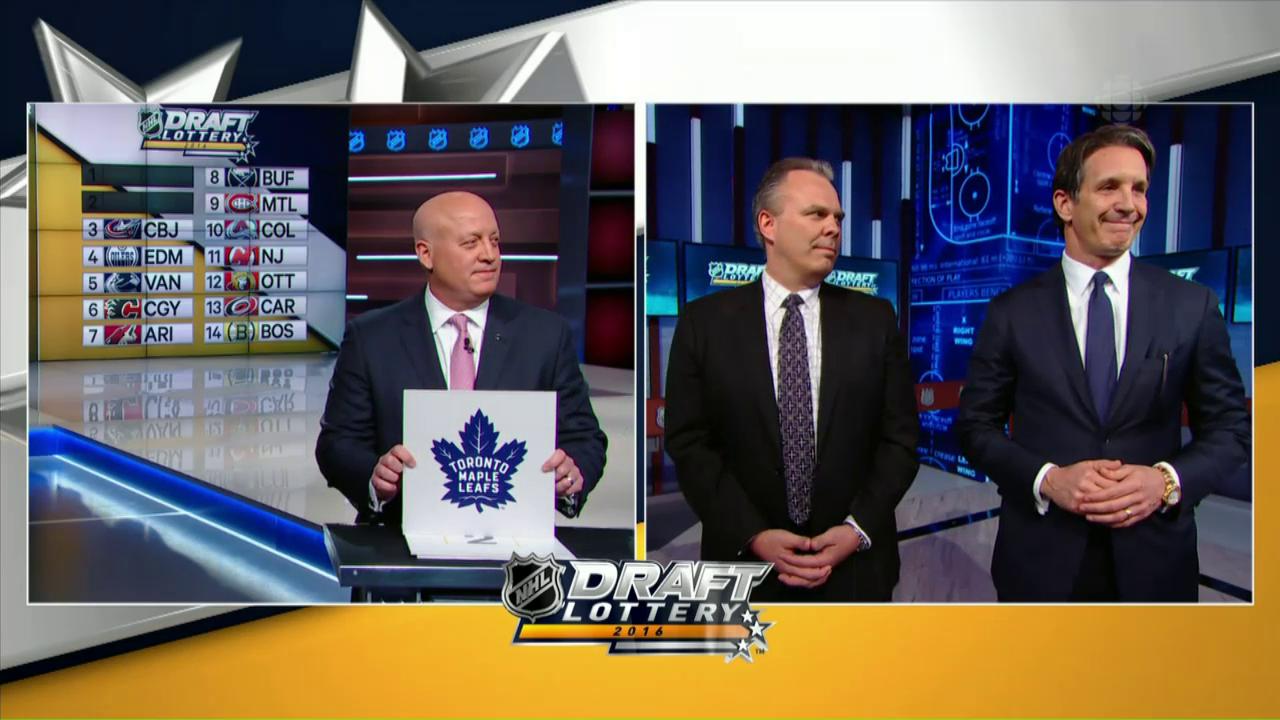

Nhl Draft Lottery Islanders Win Top Selection Sharks Second

May 13, 2025

Nhl Draft Lottery Islanders Win Top Selection Sharks Second

May 13, 2025 -

The R2 Crore Failure How One Salman Khan Film Ended Careers

May 13, 2025

The R2 Crore Failure How One Salman Khan Film Ended Careers

May 13, 2025 -

Deja Kelly From Oregon Ducks Star To Aces Hero

May 13, 2025

Deja Kelly From Oregon Ducks Star To Aces Hero

May 13, 2025 -

Tucows Announces 2024 Director Nominations And Honors Retiring Board Members

May 13, 2025

Tucows Announces 2024 Director Nominations And Honors Retiring Board Members

May 13, 2025