47% Spike In India Real Estate Investments: Q1 2024 Report

Table of Contents

Key Drivers Behind the 47% Investment Surge

Several interconnected factors contributed to this impressive 47% surge in India real estate investment during Q1 2024. Analyzing these drivers provides crucial context for understanding the current market dynamics and predicting future trends in the India property market.

-

Robust Economic Growth and Increased Disposable Incomes: India's consistent economic growth has led to a rise in disposable incomes, empowering more individuals to invest in property. This increased purchasing power fuels demand across various property segments, from affordable housing to luxury apartments.

-

Government Initiatives and Supportive Policies Boosting the Sector: The government's commitment to infrastructure development and affordable housing schemes, such as the Pradhan Mantri Awas Yojana (PMAY), has significantly boosted investor confidence. These initiatives not only increase the availability of housing but also stimulate related industries, further driving investment growth in India real estate.

-

Lower Interest Rates Making Home Loans More Accessible: Lower interest rates on home loans have made property ownership more affordable, encouraging both first-time buyers and investors to enter the market. This accessibility has broadened the pool of potential buyers, further propelling demand.

-

Increased Demand for Residential and Commercial Properties in Major Cities: Rapid urbanization and population growth in major metropolitan areas have created a surge in demand for both residential and commercial spaces. This high demand, especially in cities like Mumbai, Delhi, and Bengaluru, has driven up property prices and investment levels.

-

Rising Foreign Direct Investment (FDI) in the Indian Real Estate Market: Increased FDI inflows signify growing global confidence in the Indian economy and its real estate sector. This influx of foreign capital further fuels investment growth, contributing to the overall 47% surge. Data from the Reserve Bank of India (RBI) shows a significant year-on-year increase in FDI specifically targeting real estate development.

Geographical Distribution of Investments: Where the Money is Flowing

The 47% investment surge wasn't evenly distributed across India. Certain regions experienced more significant growth than others, reflecting varying levels of economic activity, infrastructure development, and market dynamics.

-

Investment Concentration in Major Metropolitan Areas: Tier-1 cities like Mumbai, Delhi-NCR, Bengaluru, Chennai, and Hyderabad continue to dominate real estate investment, attracting the lion's share of capital. These cities boast robust job markets, superior infrastructure, and established social amenities, making them attractive investment destinations.

-

Emerging Investment Hotspots in Tier 2 and 3 Cities: While Tier-1 cities remain dominant, investment is increasingly flowing into Tier 2 and 3 cities. These areas offer relatively lower property prices, attracting investors seeking higher returns and untapped potential. Cities like Pune, Jaipur, and Coimbatore are emerging as notable examples.

(Insert Map/Chart Here showing investment distribution across India)

The factors driving investment in specific regions include improved infrastructure (new metro lines, highways, and airports), increasing employment opportunities in diverse sectors, and improving connectivity, making these areas increasingly attractive to both residents and investors. Large-scale infrastructural projects significantly influence property prices and investment decisions.

Property Types Driving Investment Growth

The 47% investment spike wasn't limited to a single property type; it reflects a broad-based growth across various segments of the India property market.

-

Residential Real Estate: Apartments and villas continue to be the major drivers of investment, reflecting the persistent demand for housing in urban areas. The growth in the affordable housing segment is particularly noteworthy, driven by government initiatives and growing middle-class aspirations.

-

Commercial Real Estate: Office spaces and retail spaces also saw significant investment growth, mirroring the expansion of businesses and the increasing demand for commercial properties in prime locations. The rise of e-commerce and related logistics has further fueled this segment.

-

Luxury Properties: The luxury property market also experienced considerable growth, albeit at a slower pace than other segments. High-net-worth individuals continue to invest in premium properties as a means of wealth preservation and appreciation.

The growth in specific property types reflects shifts in demographics, evolving investor preferences (such as a growing preference for sustainable and green buildings), and the overall economic climate.

Future Outlook and Predictions for the Indian Real Estate Market

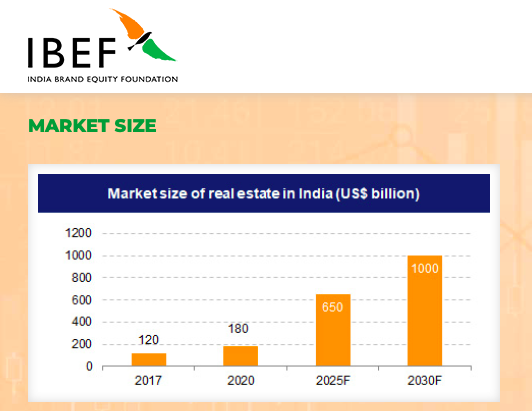

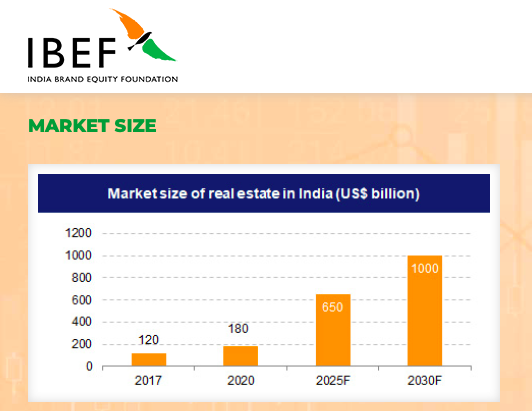

The robust growth witnessed in Q1 2024 paints a positive picture for the future of the Indian real estate market, although certain challenges need consideration.

-

Predictions for Investment Growth in the Coming Quarters: While maintaining the same pace of growth may be challenging, the overall forecast remains positive. Steady economic growth, supportive government policies, and continued urbanization should drive further investment, although perhaps at a slightly moderated rate.

-

Potential Challenges and Risks Facing the Sector: Potential challenges include inflation, interest rate fluctuations, and potential regulatory changes. Careful risk assessment is crucial for investors.

-

Expected Changes in Property Prices and Demand: Property prices are expected to continue their upward trajectory, albeit at a more controlled pace. Demand remains strong, particularly in key urban centers.

-

Opportunities for Investors and Homebuyers in the Future: The Indian real estate market continues to offer substantial opportunities for both investors and homebuyers. Strategic investment decisions, coupled with careful market research, can yield significant returns.

The long-term outlook for the Indian real estate market remains positive, offering significant potential for growth and profitability.

Conclusion

The 47% spike in India real estate investments in Q1 2024 is a testament to the sector's dynamism and resilience. Driven by robust economic growth, supportive government policies, and a surge in demand across various property types, the market displays a strong and promising trajectory. The geographical distribution reflects both the continued dominance of major metropolitan areas and the emergence of exciting opportunities in Tier 2 and 3 cities. While challenges exist, the long-term outlook remains optimistic, suggesting continued growth in the coming years. The booming Indian real estate market presents unprecedented opportunities for investors. Don't miss out on this surge in India real estate investment; explore the various investment options available and capitalize on this dynamic market today! Contact us for expert advice on India property investment.

Featured Posts

-

Anchor Brewing Companys 127 Year Run Comes To An End

May 17, 2025

Anchor Brewing Companys 127 Year Run Comes To An End

May 17, 2025 -

Venezia Vs Napoles En Vivo Y Online

May 17, 2025

Venezia Vs Napoles En Vivo Y Online

May 17, 2025 -

Coquimbo Unido Everton Vina Reporte Del Partido 0 0

May 17, 2025

Coquimbo Unido Everton Vina Reporte Del Partido 0 0

May 17, 2025 -

Office365 Data Breach Millions Lost Criminal Charged

May 17, 2025

Office365 Data Breach Millions Lost Criminal Charged

May 17, 2025 -

Kino Pavasaris 2024 Virs 70 Tukst Ziurovu Populiariausi Filmai

May 17, 2025

Kino Pavasaris 2024 Virs 70 Tukst Ziurovu Populiariausi Filmai

May 17, 2025