5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Understand Your Risk Tolerance and Investment Goals in the Private Credit Market

Before diving into the private credit market, a thorough self-assessment is paramount. Understanding your risk appetite and defining clear investment objectives are crucial for making informed decisions and achieving your financial goals.

Assess your risk appetite: Conservative, moderate, or aggressive?

The private credit market offers a spectrum of risk levels. Your comfort level with risk will dictate your investment strategy.

- Conservative: Focus on senior secured debt, which generally offers lower returns but higher priority in repayment.

- Moderate: Consider a mix of senior secured debt and mezzanine financing, balancing risk and reward.

- Aggressive: Explore subordinated debt or equity investments, which carry higher risk but potentially higher returns.

The correlation between risk and return is fundamental in private debt investment. Higher-risk investments typically offer the potential for higher returns but also a greater chance of loss. Careful risk assessment is crucial for aligning your investment choices with your tolerance for potential downsides.

Define clear investment objectives: Short-term or long-term goals?

Your investment timeline significantly impacts your private credit strategy.

- Short-term goals (e.g., 1-3 years): Prioritize investments with shorter maturities and higher liquidity, although these might offer lower returns.

- Long-term goals (e.g., 5+ years): Consider investments with longer maturities, potentially offering higher returns but reduced liquidity.

Aligning your investment strategy with your specific timeline and financial goals is critical for success in private lending. Understanding the potential liquidity challenges of certain private credit instruments is essential for long-term planning.

Do: Thoroughly Undertake Due Diligence Before Investing in the Private Credit Market

Due diligence is the cornerstone of successful private debt investment. Thorough investigation is essential to mitigate risks and maximize your chances of positive returns.

Credit analysis and risk evaluation:

Rigorous credit analysis is non-negotiable. This involves:

- Analyzing financial statements to assess the borrower's creditworthiness.

- Developing cash flow projections to evaluate repayment capacity.

- Conducting industry research to understand market conditions and competitive pressures.

Independent verification of information is crucial. Don't rely solely on the information provided by the borrower. Engage independent professionals to validate key data points and ensure accuracy. A comprehensive due diligence checklist can help you ensure no crucial steps are missed.

Legal and regulatory compliance:

Navigating the legal and regulatory landscape of private credit is complex.

- Ensure that all investment documentation is reviewed by competent legal counsel.

- Understand the relevant regulatory framework governing private credit transactions.

Ignoring legal and regulatory compliance can result in significant financial penalties and legal repercussions. A thorough understanding of the regulatory framework is crucial for mitigating legal risks and ensuring smooth transactions.

Do: Diversify Your Private Credit Portfolio

Diversification is key to mitigating risk in any investment portfolio, and the private credit market is no exception.

Portfolio diversification strategies:

Diversify your portfolio across multiple dimensions:

- Sectors: Invest in various industries to reduce exposure to sector-specific risks.

- Geographies: Spread investments across different regions to lessen the impact of localized economic downturns.

- Credit ratings: Include a mix of investment-grade and high-yield private debt instruments.

Strategic asset allocation is essential for building a resilient portfolio.

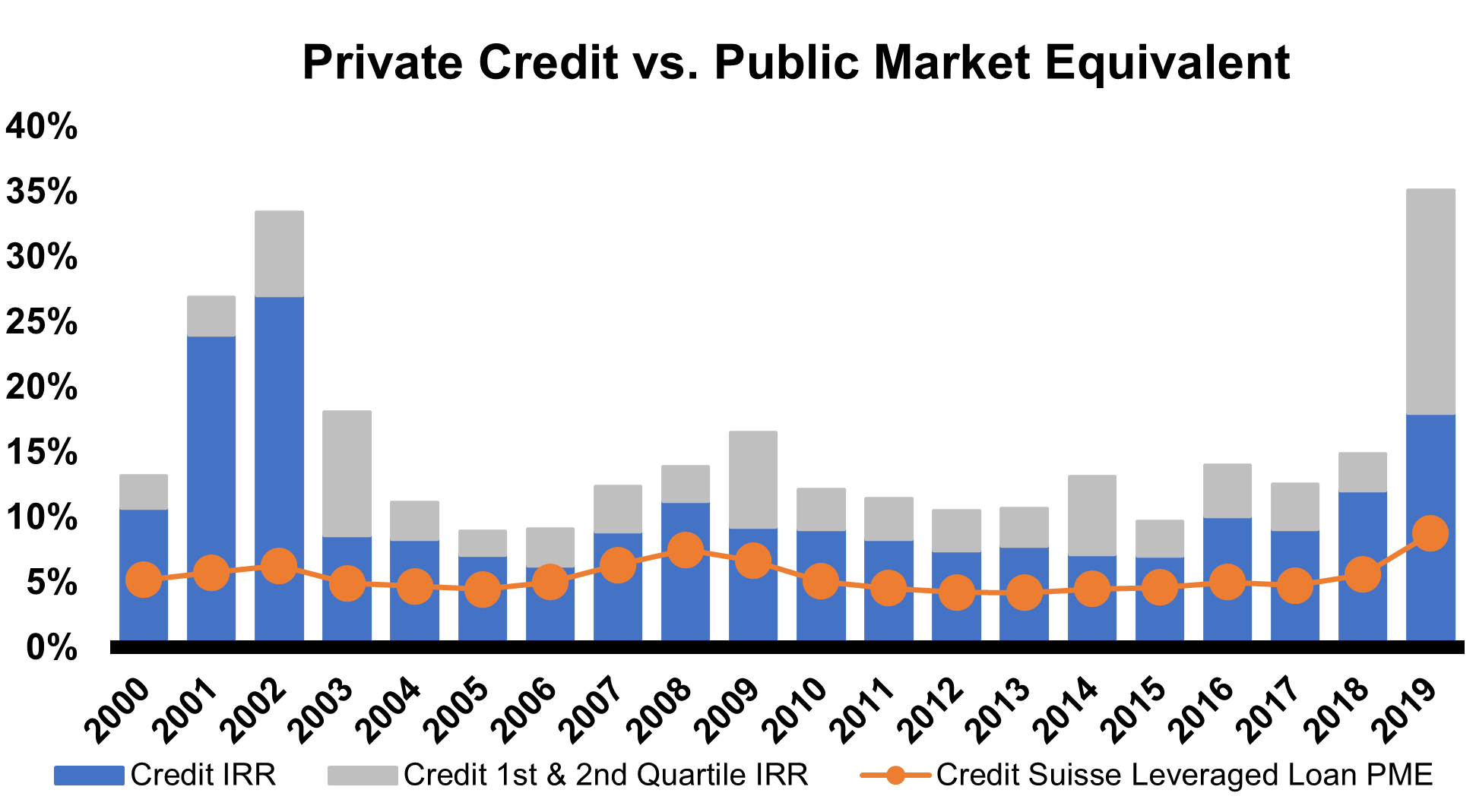

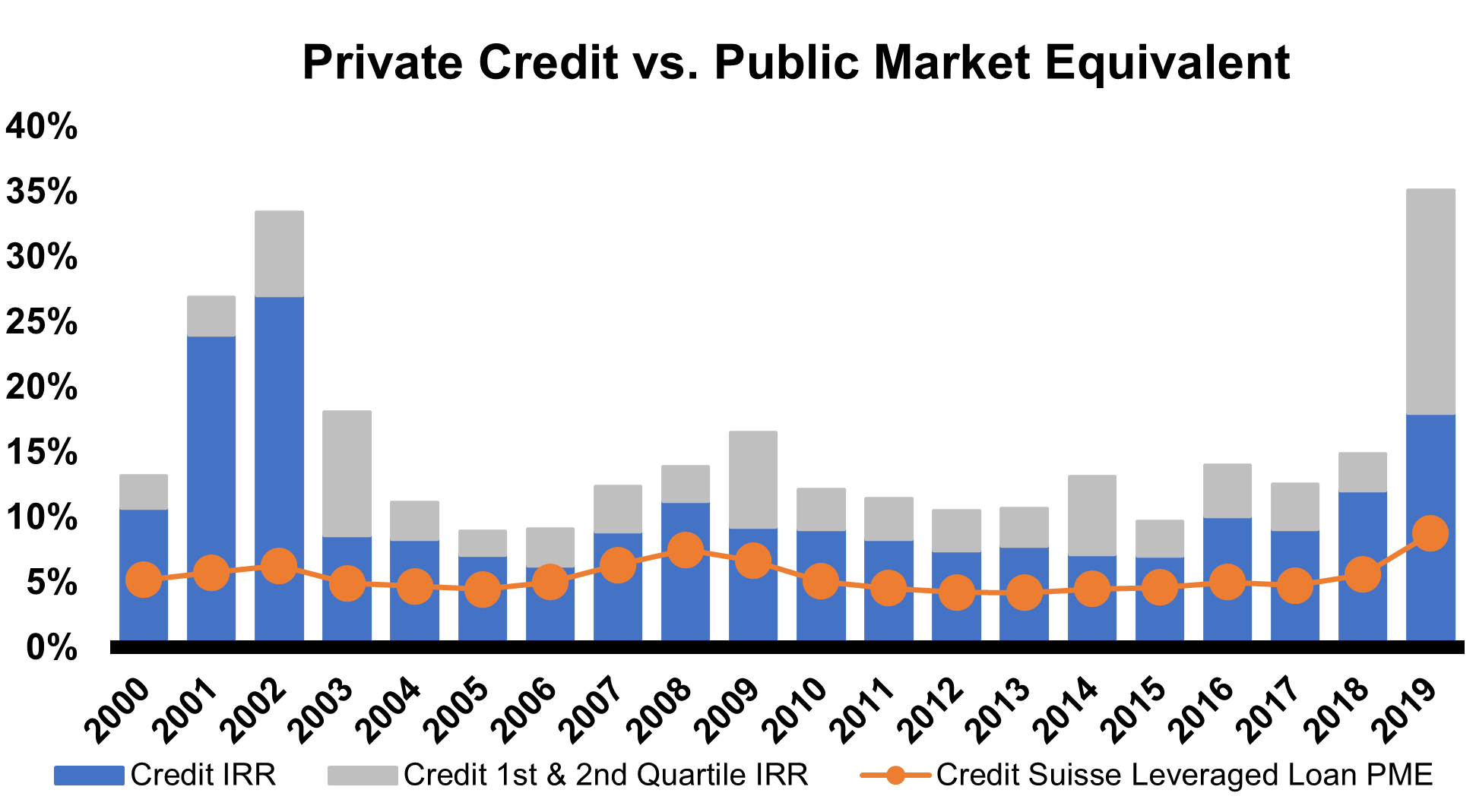

Balancing risk and return:

Achieving the optimal balance between risk and return is a constant process.

- High-yield private debt instruments offer potentially higher returns but come with increased risk.

- Investment-grade private debt offers lower returns but reduced risk.

Carefully assessing the risk-adjusted return of each investment is crucial for achieving optimal portfolio performance. Different private debt strategies offer varying risk-return profiles; carefully selecting which strategies best align with your risk tolerance is essential.

Don't: Neglect Professional Advice

Investing in the private credit market without professional guidance can be highly risky.

The importance of expert guidance:

Seek expertise across different disciplines:

- Legal counsel: Ensure compliance with all relevant regulations and protect your legal interests.

- Financial advisors: Develop a tailored investment strategy that aligns with your financial goals and risk tolerance.

- Tax advisors: Optimize your tax strategy to minimize your tax liability.

Professional advice can help you avoid costly mistakes and maximize your returns.

Utilizing private credit market specialists:

Consider leveraging the expertise of private credit market specialists:

- Private credit fund managers offer specialized knowledge, access to deal flow, and a robust network.

- Alternative asset management firms offer diversified expertise across multiple asset classes.

Working with experienced professionals enhances your access to opportunities and provides valuable insights you may otherwise miss. Their expert network can unlock opportunities unavailable to independent investors.

Don't: Overlook the Liquidity Aspect of the Private Credit Market

One of the defining characteristics of private credit investments is their relative illiquidity.

Understanding liquidity challenges:

Unlike publicly traded securities, private credit investments are often illiquid:

- It can be challenging to sell private credit investments quickly without incurring significant losses.

- Accessing capital quickly might be difficult, particularly during periods of market stress.

Understanding the limitations on liquidity is crucial for managing your expectations and mitigating liquidity risk.

Long-term investment horizon:

Private credit investments typically have longer maturities:

- Align your investment time horizon with the expected maturity of your private credit instruments.

- Patience is crucial, as realizing returns often requires a long-term perspective.

Adopting a long-term strategy is vital for successfully navigating the illiquid nature of private debt and achieving your investment goals. Having a well-defined exit strategy is vital for optimizing your long-term investment in private debt.

Conclusion: Mastering the Private Credit Market: Key Takeaways and Call to Action

Successfully navigating the private credit market requires a combination of careful planning, thorough due diligence, and professional guidance. Remember these key takeaways: understand your risk tolerance, conduct comprehensive due diligence, diversify your portfolio, seek professional advice, and acknowledge the illiquidity inherent in private credit investments. By following these "do's" and "don'ts," you can significantly improve your chances of achieving your investment goals.

To explore the private credit market further and discover potential investment opportunities, connect with experienced private credit professionals today. Invest wisely in private debt and succeed in the world of private credit!

Featured Posts

-

Italy Vs France Rugby Duponts 11 Point Masterclass

May 01, 2025

Italy Vs France Rugby Duponts 11 Point Masterclass

May 01, 2025 -

Xrps Potential Analyzing The Impact Of Etf Decisions And Sec Actions On Ripple

May 01, 2025

Xrps Potential Analyzing The Impact Of Etf Decisions And Sec Actions On Ripple

May 01, 2025 -

Michael Sheens 1 Million Neighbourly Act In Port Talbot

May 01, 2025

Michael Sheens 1 Million Neighbourly Act In Port Talbot

May 01, 2025 -

Dragons Den Confusion Over Repeat Showing Of Closed Business

May 01, 2025

Dragons Den Confusion Over Repeat Showing Of Closed Business

May 01, 2025 -

Coronation Street Stars Emotional Exit The Truth Behind The Tears

May 01, 2025

Coronation Street Stars Emotional Exit The Truth Behind The Tears

May 01, 2025

Latest Posts

-

Two Disney Cruise Ships Headed To Alaska For Summer 2026

May 01, 2025

Two Disney Cruise Ships Headed To Alaska For Summer 2026

May 01, 2025 -

Carnival Corporation Brands A Complete List Of Cruise Lines

May 01, 2025

Carnival Corporation Brands A Complete List Of Cruise Lines

May 01, 2025 -

Disneys Alaska Expansion Two Ships Sailing In Summer 2026

May 01, 2025

Disneys Alaska Expansion Two Ships Sailing In Summer 2026

May 01, 2025 -

Disney Cruise Line Announces Two Ships For Alaska Summer 2026

May 01, 2025

Disney Cruise Line Announces Two Ships For Alaska Summer 2026

May 01, 2025 -

Nclh Outperforms Expectations Earnings Beat And Raised Guidance Drive Stock Higher

May 01, 2025

Nclh Outperforms Expectations Earnings Beat And Raised Guidance Drive Stock Higher

May 01, 2025