5 Key Actions To Secure A Private Credit Role

Table of Contents

Master the Fundamentals of Private Credit

Before you even begin crafting your resume, you need a solid understanding of the private credit industry. This goes beyond just knowing the basics; it requires a deep dive into the intricacies of the market.

Understand the Investment Landscape

The private credit world encompasses various strategies, each with its own nuances. A thorough understanding is crucial.

- Direct Lending: Learn about the different types of direct loans, their structures, and the risks involved. Research the due diligence processes required for underwriting direct loans.

- Mezzanine Financing: Grasp the complexities of mezzanine debt, its position in the capital structure, and its associated risks and returns. Understand how it differs from senior debt.

- Distressed Debt: Familiarize yourself with distressed debt investing, including identifying undervalued assets, restructuring strategies, and the challenges involved in working with financially troubled companies.

- Private Credit Funds: Research the different types of private credit funds (e.g., fund of funds, single-strategy funds), their investment mandates, and their target returns. Analyze their performance benchmarks and understand their typical investor base.

- Market Trends: Stay informed about current market trends by following industry publications, attending webinars, and networking with experienced professionals. Understand the impact of interest rate changes, economic cycles, and regulatory shifts on the private credit market.

Develop Strong Financial Modeling Skills

Proficiency in financial modeling is paramount in private credit. You'll be building complex models to analyze potential investments.

- Excel Mastery: Go beyond basic spreadsheet skills. Master advanced functions, macros, and data analysis techniques. Practice creating clear and efficient models.

- Software Proficiency: Familiarize yourself with industry-standard financial modeling software such as Argus, Bloomberg Terminal, and others relevant to your target firms.

- Practical Application: Don't just learn the theory. Practice building models for leveraged buyouts (LBOs), debt financings, and restructurings. Use real-world examples or create hypothetical case studies.

- Showcase your Skills: Include examples of your financial modeling work in your portfolio, highlighting your ability to analyze complex financial data and make sound investment recommendations.

Sharpen Your Valuation and Due Diligence Expertise

Accurate valuation and thorough due diligence are cornerstones of successful private credit investing.

- Valuation Methodologies: Master discounted cash flow (DCF) analysis, comparable company analysis, precedent transactions, and other valuation techniques relevant to private credit investments.

- Due Diligence Process: Develop expertise in financial statement analysis, credit risk assessment, and legal due diligence. Understand how to identify potential red flags and assess the overall creditworthiness of borrowers.

- Industry-Specific Knowledge: Familiarize yourself with the legal and regulatory frameworks that govern the private credit industry, including compliance requirements and relevant legislation. This knowledge will be crucial in your due diligence process and your overall professional practice.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression; make it count.

Highlight Relevant Experience

Tailor your resume to showcase your skills and experience relevant to private credit roles.

- Quantifiable Achievements: Use metrics to quantify your accomplishments, demonstrating the impact you made in previous roles. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in $X cost savings."

- Keywords: Incorporate relevant keywords throughout your resume and cover letter, including terms like "debt financing," "leveraged buyouts," "credit analysis," "underwriting," "due diligence," and "financial modeling."

- Action Verbs: Use strong action verbs to describe your responsibilities and accomplishments.

Showcase Your Skills and Knowledge

Your cover letter should demonstrate your understanding of private credit and your enthusiasm for the role.

- Targeted Approach: Research the specific firm and role thoroughly and tailor your cover letter to highlight how your skills and experience align with their needs and investment strategy.

- Passion and Enthusiasm: Let your passion for private credit shine through. Demonstrate your genuine interest in the field and the specific firm you are applying to.

- Clear and Concise Communication: Your cover letter should be clear, concise, and easy to read. Avoid jargon and focus on highlighting your key skills and accomplishments.

Ace the Interview Process

The interview process is your opportunity to demonstrate your knowledge and personality.

Prepare for Technical Questions

Expect in-depth questions on financial modeling, valuation, and credit analysis.

- Practice Makes Perfect: Practice answering common interview questions related to private credit, focusing on behavioral questions, technical questions, and case studies.

- Case Study Preparation: Prepare to discuss case studies to showcase your analytical and problem-solving skills, as well as your practical experience in the field.

- Company Research: Thoroughly research the firm's investment strategies, portfolio companies, and recent transactions. This will demonstrate your dedication and help you tailor your responses to their specific needs.

Demonstrate Your Soft Skills

Private credit roles require strong interpersonal and communication skills.

- Teamwork and Collaboration: Highlight your ability to work effectively within a team and contribute positively to a collaborative environment.

- Communication Skills: Demonstrate your ability to clearly communicate complex financial information to both technical and non-technical audiences.

- Problem-Solving and Critical Thinking: Show how you approach challenges, analyze situations, and propose solutions.

Network Strategically

Networking is crucial for uncovering hidden opportunities and building valuable relationships.

Attend Industry Events

Connect with professionals in the field.

- Industry Conferences: Attend conferences and networking events to meet potential employers and learn about new developments in the private credit market.

- Professional Organizations: Join relevant professional organizations to expand your network and stay updated on industry trends.

- Online Engagement: Engage actively on LinkedIn and other professional social media platforms; participate in discussions, share insightful articles, and connect with individuals in your target firms.

Informational Interviews

Reach out to professionals for informational interviews.

- Seek Advice: Use these opportunities to learn about career paths, gain insights, and seek advice from experienced professionals.

- Relationship Building: Build relationships with potential mentors and future colleagues. These informal conversations can lead to valuable connections and potential job opportunities.

- Express Your Interest: Clearly express your interest in a private credit role and show your enthusiasm for the industry.

Leverage Your Online Presence

Your online presence reflects your professional image.

Optimize Your LinkedIn Profile

Your LinkedIn profile is your digital resume.

- Keyword Optimization: Use keywords related to private credit to improve your profile's visibility in searches.

- Professional Summary: Craft a compelling professional summary that highlights your key skills and career goals.

- Recommendations: Solicit recommendations from former supervisors and colleagues to demonstrate your capabilities and build credibility.

Build a Strong Online Portfolio

Showcase your work and skills.

- Financial Models: Include samples of your financial modeling work, showcasing your proficiency and attention to detail.

- Case Studies: Share case studies that illustrate your analytical abilities and decision-making process.

- Publications and Presentations: If applicable, highlight any publications or presentations you've created, demonstrating your expertise and thought leadership.

Conclusion: Securing Your Private Credit Future

Securing a fulfilling private credit role requires a dedicated approach. By mastering the fundamentals, crafting a compelling application, acing the interview process, networking strategically, and optimizing your online presence, you significantly increase your chances of landing your dream job. Start implementing these five key actions today and begin your journey to securing your ideal private credit role. Don't wait – your private credit career awaits!

Featured Posts

-

Oxfordshire Teenager Named After F1 Star To Race At Goodwood

May 26, 2025

Oxfordshire Teenager Named After F1 Star To Race At Goodwood

May 26, 2025 -

Giant Rubber Ducks Myrtle Beach Visit A Message Of Environmental Awareness

May 26, 2025

Giant Rubber Ducks Myrtle Beach Visit A Message Of Environmental Awareness

May 26, 2025 -

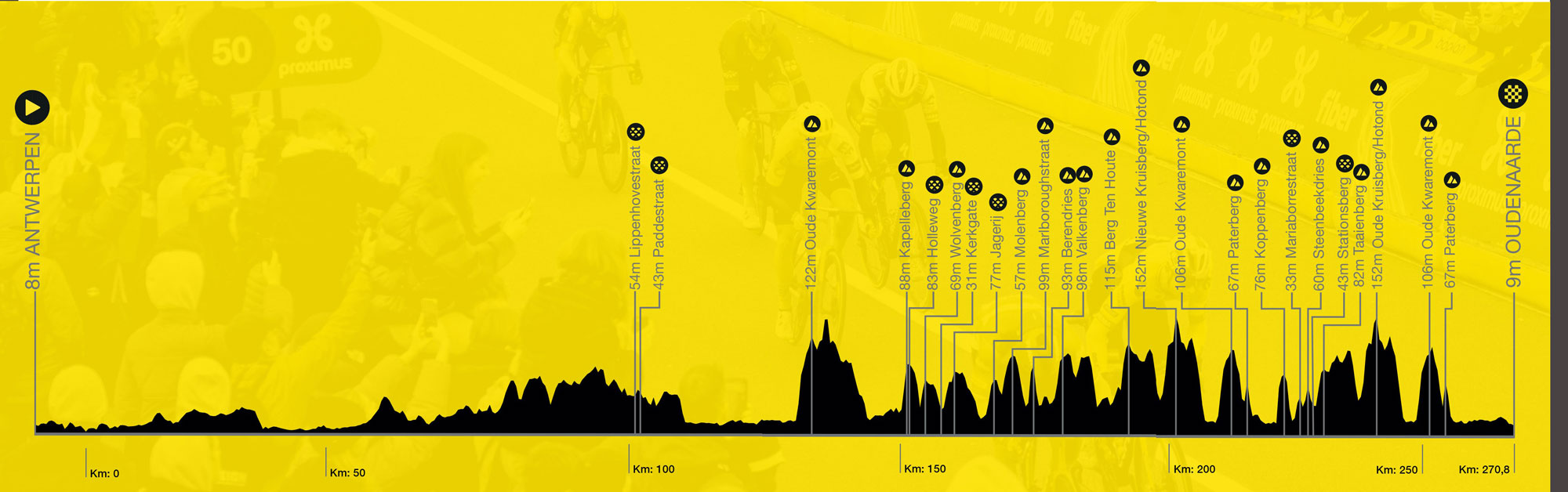

Tour Of Flanders 2024 Pogacars Unstoppable Solo Win

May 26, 2025

Tour Of Flanders 2024 Pogacars Unstoppable Solo Win

May 26, 2025 -

Mathieu Van Der Poel Bottle Attack At Paris Roubaix Demands Legal Action

May 26, 2025

Mathieu Van Der Poel Bottle Attack At Paris Roubaix Demands Legal Action

May 26, 2025 -

Jenson Button Returns To His 2009 Brawn Gp Car

May 26, 2025

Jenson Button Returns To His 2009 Brawn Gp Car

May 26, 2025