$6.1 Billion Celtics Sale: What It Means For The Future Of The Franchise

Table of Contents

The Impact of the Record-Breaking Sale Price

The sheer magnitude of the $6.1 billion sale price is staggering, signifying a new era for the Boston Celtics. This substantial investment has profound implications for the franchise's future, both financially and structurally.

Financial Implications and Potential Investments

This influx of capital unlocks unprecedented opportunities for the Celtics. The possibilities are vast and exciting for fans and players alike.

- Increased resources for player recruitment and development: The Celtics can now aggressively pursue top-tier free agents and invest heavily in player development programs, fostering a pipeline of young talent.

- Potential upgrades to infrastructure (arena, training facilities): Modernizing TD Garden and improving training facilities could enhance the player experience and attract even more fans.

- Enhanced marketing and fan engagement initiatives: Increased investment in marketing and fan engagement could create a more immersive and rewarding experience for the loyal Celtics fanbase.

- Exploration of new revenue streams (e.g., merchandise, digital platforms): The new owners can explore innovative ways to increase revenue, leveraging the team's brand and global appeal.

This injection of capital could revolutionize the Celtics' operations, enabling them to compete at the highest level consistently. The ability to attract and retain top talent, coupled with improved infrastructure, sets the stage for sustained success.

Ownership Changes and Management Structure

The change in ownership inevitably brings changes to the management structure. Understanding the new ownership group's background and experience is crucial.

- Analyze the background and experience of the new ownership group: A thorough examination of their previous business ventures and sporting investments will reveal their strategic vision for the Celtics.

- Discuss any potential changes to the team's management structure: The new owners may implement changes in the front office, coaching staff, or other managerial roles.

- Assess the potential impact of new leadership on team strategy and player relationships: This change in leadership could influence the team's long-term vision, impacting player acquisition strategies and fostering a new team culture.

The transition in leadership may bring about a shift in the team's long-term vision, potentially leading to new strategies for player recruitment and team building. The impact on player relationships and overall team morale is a critical factor to observe in the coming years.

Future of Player Acquisitions and Roster Management

The $6.1 billion sale significantly alters the Celtics' approach to player acquisitions and roster management. The increased financial flexibility opens doors to previously unattainable opportunities.

Potential for Star Player Signings

The substantial increase in financial resources allows the Celtics to aggressively pursue high-profile free agents and make significant moves during the trade deadline.

- Discuss the Celtics' potential to attract high-profile free agents: The team can now offer lucrative contracts to attract some of the NBA's biggest names.

- Analyze the team's draft strategy and potential for acquiring promising young talent: The Celtics can invest in the draft, acquiring promising young players to build a strong foundation for the future.

- Evaluate the impact of the sale on the team's salary cap flexibility: The sale significantly increases the team's salary cap flexibility, allowing them to make ambitious moves in free agency.

Speculation is rife on which players the Celtics might target, but their ability to compete with other teams for top talent has undoubtedly increased.

Impact on Current Players and Contract Negotiations

Existing player contracts and future negotiations will also be affected by this significant change in ownership.

- Discuss the potential effects on existing player contracts and negotiations: Current players may see their contract situations impacted, leading to renegotiations or extensions.

- Analyze the potential for retaining key players or making difficult roster decisions: The new owners may prioritize retaining core players or make difficult decisions regarding players not fitting their long-term vision.

How the new ownership approaches contract negotiations with current players will be closely watched, potentially influencing the team's overall chemistry and future performance.

The Broader Impact on the NBA Landscape

The $6.1 billion Celtics sale sends shockwaves throughout the NBA, altering the league's competitive dynamics and potentially setting a new standard for franchise valuations.

Increased Competition and League Dynamics

The Celtics' increased financial strength significantly impacts the competitive balance within the NBA.

- Discuss the implications of the Celtics' increased financial strength on the competitive balance within the NBA: This sale could exacerbate the existing imbalance between wealthy and less-wealthy franchises.

- Analyze the potential impact on other franchises' strategies and player acquisitions: Other teams may respond by adjusting their own strategies for player recruitment and retention.

This sale might trigger a ripple effect across the league, prompting other teams to reassess their financial strategies and potentially driving up player salaries further.

Conclusion

The $6.1 billion Celtics sale represents a transformative moment for the franchise. The influx of capital opens up unprecedented opportunities for player recruitment, infrastructure upgrades, and enhanced fan engagement. While uncertainties remain regarding specific strategic moves, this sale undeniably positions the Boston Celtics for a bright future. The impact will undoubtedly be felt throughout the NBA, altering the competitive landscape and potentially setting a new benchmark for franchise valuations. Stay tuned to see how this record-breaking deal unfolds and shapes the future of the Boston Celtics and the NBA. Keep an eye on future developments related to the $6.1 billion Celtics sale to see how this significant investment impacts the team's success.

Featured Posts

-

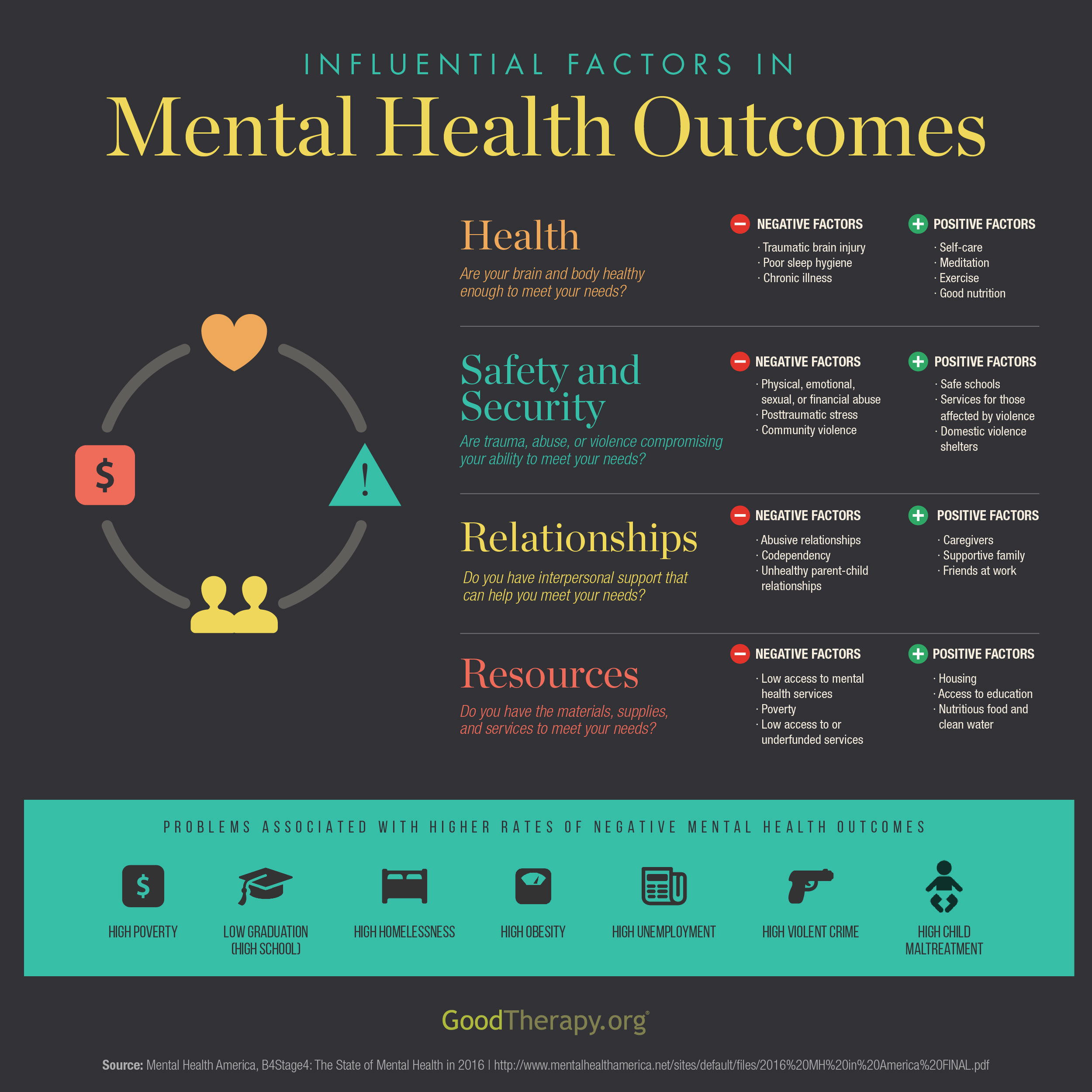

Gender Euphoria Scale A Potential Tool For Better Mental Health Outcomes In Transgender Individuals

May 15, 2025

Gender Euphoria Scale A Potential Tool For Better Mental Health Outcomes In Transgender Individuals

May 15, 2025 -

Star Wars Andor Showrunner Tony Gilroy Shares His Thoughts

May 15, 2025

Star Wars Andor Showrunner Tony Gilroy Shares His Thoughts

May 15, 2025 -

Eau Du Robinet Polluee Comment La Purifier Efficacement

May 15, 2025

Eau Du Robinet Polluee Comment La Purifier Efficacement

May 15, 2025 -

Celtics Vs 76ers Prediction Can Boston Beat Philadelphia

May 15, 2025

Celtics Vs 76ers Prediction Can Boston Beat Philadelphia

May 15, 2025 -

Betting Odds And Predictions Avalanche Vs Maple Leafs March 19th

May 15, 2025

Betting Odds And Predictions Avalanche Vs Maple Leafs March 19th

May 15, 2025