6,556 Bitcoin Purchase By Strategy: Investment Details And Analysis

Table of Contents

Deconstructing the 6,556 Bitcoin Purchase: Understanding the Scale and Impact

The Sheer Size of the Transaction and its Market Influence

The sheer scale of a 6,556 Bitcoin purchase is undeniably impactful. This large-scale Bitcoin transaction represents a substantial injection of capital into the Bitcoin market, potentially influencing several key factors:

- Bitcoin Price: Such a large Bitcoin purchase can exert upward pressure on the Bitcoin price, driving demand and potentially triggering a price surge. The size of the transaction relative to daily trading volume is crucial in determining this impact.

- Bitcoin Market Liquidity: While the purchase could increase demand, it could also temporarily decrease market liquidity, making it more challenging for smaller investors to buy or sell Bitcoin at desired prices. This is particularly true if the purchase was made swiftly and aggressively.

- Bitcoin Mining: The influx of capital could indirectly benefit Bitcoin miners by increasing the overall value of their Bitcoin holdings and potentially bolstering the network's security.

Identifying Potential Buyers: Institutional Investors vs. Whales

Determining the identity of the buyer(s) is crucial to fully understanding the investment strategy. Several possibilities exist:

- Institutional Investors: Large corporations and hedge funds are increasingly investing in Bitcoin as a way to diversify their portfolios and gain exposure to a potentially high-growth asset. Their motivations often involve long-term strategic investment and risk mitigation.

- Bitcoin Whales: High-net-worth individuals (whales) with substantial Bitcoin holdings may have made this purchase as a strategic move to further consolidate their position or to execute a specific trading strategy. Their motivations may be more speculative or focused on short-term price movements.

Understanding the motivations of these potential buyers – be it portfolio diversification, hedging against inflation, or pure speculation – is key to interpreting the strategy behind this large Bitcoin transaction. The distinction between institutional Bitcoin investment and the actions of Bitcoin whales impacts the overall market interpretation.

Analyzing the Investment Strategy: Risk Tolerance and Long-Term Vision

Risk Assessment: Volatility and Market Fluctuations

Investing in Bitcoin carries inherent risks:

- Bitcoin Volatility: Bitcoin's price is notoriously volatile, subject to significant swings based on market sentiment, regulatory news, and technological developments.

- Cryptocurrency Regulation: Changes in regulatory frameworks worldwide could significantly impact Bitcoin's price and accessibility.

- Bitcoin ROI: While the potential return on investment (ROI) is high, it's crucial to acknowledge the substantial risk associated with Bitcoin's price volatility. The 6,556 Bitcoin purchase represents a significant bet on the cryptocurrency's long-term growth potential, requiring a high risk tolerance. Proper Bitcoin risk management is essential.

Long-Term vs. Short-Term Investment Goals

The strategy behind the 6,556 Bitcoin purchase could reflect either a long-term or short-term approach:

- Bitcoin HODLing: A long-term holding strategy (HODLing) suggests a belief in Bitcoin's long-term value and potential for significant appreciation. This buy-and-hold strategy minimizes trading fees and capital gains taxes.

- Bitcoin Trading: A short-term trading strategy implies the buyer intends to profit from short-term price fluctuations, potentially buying low and selling high. This approach demands active market monitoring and a higher risk tolerance.

The time horizon of this investment will only become clearer with time, however, the sheer volume suggests a significant long-term commitment to Bitcoin as an asset.

Market Context: Bitcoin's Price Performance and Future Predictions

Reviewing Bitcoin's Price History Leading Up to the Purchase

Analyzing Bitcoin's price history leading up to the 6,556 Bitcoin purchase offers valuable context. By examining the Bitcoin price chart and considering relevant news (e.g., regulatory announcements, technological upgrades, or market sentiment), one can better understand the prevailing conditions that may have influenced the investment decision. This review will highlight the Bitcoin price trends and market sentiment that shaped this significant purchase.

Future Predictions and Potential Scenarios

Predicting Bitcoin's future price is inherently speculative. However, several factors could significantly impact future price movements:

- Bitcoin Adoption Rate: Widespread adoption by institutions and governments could drive significant price increases.

- Bitcoin Regulation: Favorable regulatory frameworks could boost investor confidence and increase liquidity.

- Bitcoin Technology: Technological advancements (e.g., the Lightning Network) could enhance Bitcoin's scalability and usability.

These elements will play a significant role in shaping the future of Bitcoin and subsequently influence any further investment decisions. The future trajectory of the Bitcoin price is crucial to understanding the ultimate success of the 6,556 Bitcoin purchase strategy.

Conclusion: Key Takeaways and Call to Action

The 6,556 Bitcoin purchase represents a significant event in the cryptocurrency market, showcasing the growing institutional and individual interest in Bitcoin as a long-term investment or speculative asset. This analysis highlighted the potential impact on Bitcoin's price, liquidity, and mining activities, while also exploring the various risk factors involved and the potential long-term vision behind such a large investment. Understanding the strategy behind this large Bitcoin transaction requires considering the potential buyer’s risk tolerance and market outlook. It's crucial to remember that Bitcoin investment involves considerable risk.

Learn more about developing your own successful Bitcoin purchase strategy by [link to relevant resource] and conduct thorough research before investing in Bitcoin or any other cryptocurrency. Understanding Bitcoin purchases and developing a sound Bitcoin investment strategy analysis is crucial for informed decision-making in this volatile market.

Featured Posts

-

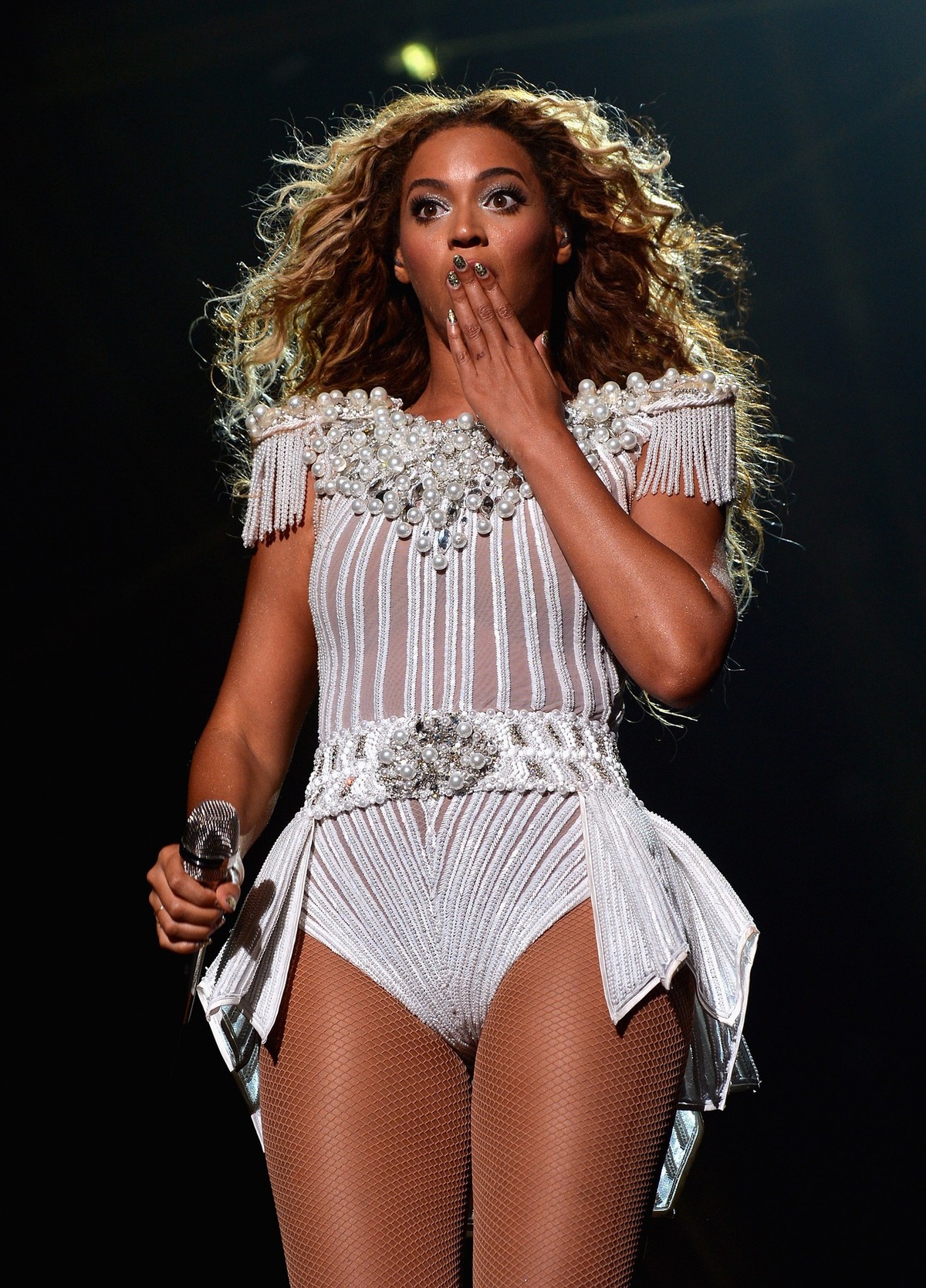

Da Li Blu Ajvi Zaista Lici Na Bijonse Analiza Izgleda

Apr 30, 2025

Da Li Blu Ajvi Zaista Lici Na Bijonse Analiza Izgleda

Apr 30, 2025 -

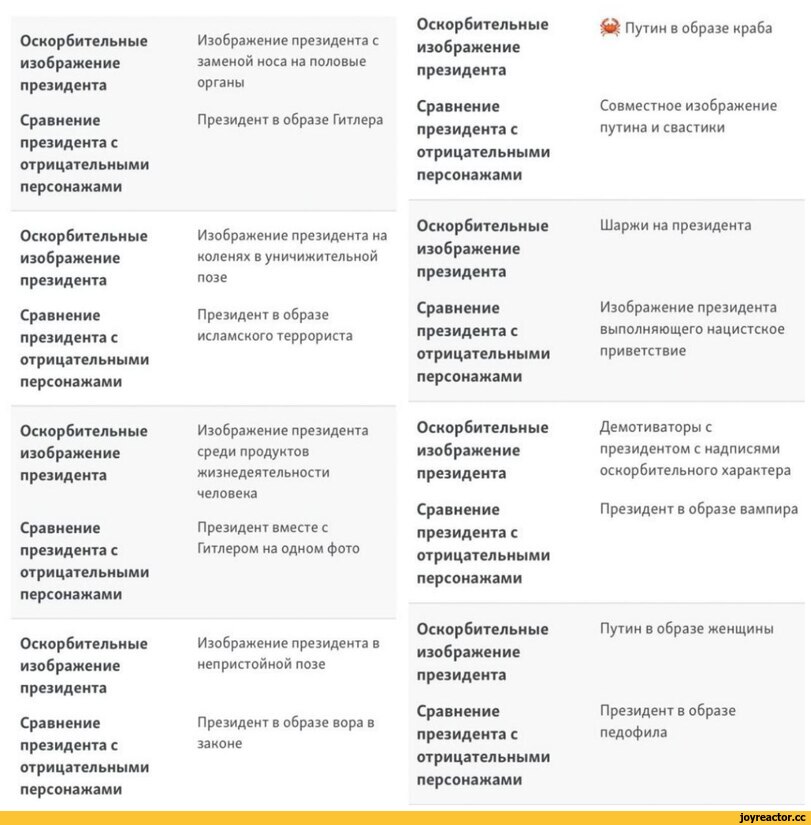

Reaktsiya Kanady Na Trampa Oskorbitelnye Zayavleniya V Adres Prezidenta S Sh A

Apr 30, 2025

Reaktsiya Kanady Na Trampa Oskorbitelnye Zayavleniya V Adres Prezidenta S Sh A

Apr 30, 2025 -

Zoe Kravitz And Noah Centineo Unconfirmed Relationship Sparks Speculation

Apr 30, 2025

Zoe Kravitz And Noah Centineo Unconfirmed Relationship Sparks Speculation

Apr 30, 2025 -

Disneys Cost Cutting Measures Result In 200 Layoffs Including Abc News Employees

Apr 30, 2025

Disneys Cost Cutting Measures Result In 200 Layoffs Including Abc News Employees

Apr 30, 2025 -

Us Dependence And The Canadian Election Trumps Remarks Analyzed

Apr 30, 2025

Us Dependence And The Canadian Election Trumps Remarks Analyzed

Apr 30, 2025

Latest Posts

-

Mat Beyonse Boretsya S Rakom

Apr 30, 2025

Mat Beyonse Boretsya S Rakom

Apr 30, 2025 -

Novoe O Sostoyanii Zdorovya Materi Beyonse

Apr 30, 2025

Novoe O Sostoyanii Zdorovya Materi Beyonse

Apr 30, 2025 -

Rak U Materi Beyonse Podrobnosti O Ee Sostoyanii

Apr 30, 2025

Rak U Materi Beyonse Podrobnosti O Ee Sostoyanii

Apr 30, 2025 -

Zdorove Materi Beyonse Poslednie Soobscheniya

Apr 30, 2025

Zdorove Materi Beyonse Poslednie Soobscheniya

Apr 30, 2025 -

Semya Beyonse Borba S Rakom

Apr 30, 2025

Semya Beyonse Borba S Rakom

Apr 30, 2025