A Practical Guide To Investing In XRP (Ripple)

Table of Contents

Understanding XRP and Ripple

XRP is a cryptocurrency designed to facilitate fast and low-cost transactions on RippleNet, Ripple's payment network. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, XRP uses a unique consensus mechanism allowing for significantly faster transaction speeds. Ripple's technology aims to streamline international payments by connecting banks and financial institutions globally. This has led to numerous partnerships with major banks and financial institutions, signifying increasing institutional adoption. However, it's crucial to acknowledge the ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC). This legal uncertainty adds a layer of complexity to XRP investment.

- XRP's role in RippleNet: XRP acts as a bridge currency, enabling faster and cheaper conversions between different fiat currencies.

- Key features of XRP: Speed, low transaction fees, and scalability are key advantages.

- SEC lawsuit: The SEC alleges that XRP is an unregistered security. The outcome of this case remains uncertain and could significantly impact XRP's price and future. It is vital to stay updated on legal developments.

Analyzing XRP's Market Performance & Price Prediction

XRP's price is influenced by a variety of factors, including overall market sentiment, regulatory news, and the rate of adoption by financial institutions. Analyzing XRP charts using technical analysis tools can help identify potential buying and selling opportunities. However, it's crucial to avoid relying solely on price predictions, as the cryptocurrency market is notoriously volatile. Fundamental analysis, considering Ripple's partnerships and technological advancements, is equally important.

- Resources for checking XRP price: CoinMarketCap, CoinGecko, and other reputable cryptocurrency data providers offer real-time price charts and historical data.

- Fundamental Analysis for XRP: Focus on Ripple's partnerships, technological developments, and regulatory developments.

- Risks of volatile assets: Investing in XRP carries significant risk due to its price volatility.

Strategies for Investing in XRP

Several strategies can be used for XRP investment. Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, mitigating the risk of investing a lump sum at a market high. Lump-sum investing, on the other hand, involves investing a significant amount of money at once, potentially maximizing profits if the price rises significantly. Risk management and diversification across various asset classes are crucial. Choosing a secure and reputable cryptocurrency exchange is also paramount.

- DCA vs. Lump-Sum: DCA reduces risk but may miss out on potential gains from a rising market. Lump-sum investing carries higher risk but offers the potential for higher returns.

- Reputable exchanges: Research thoroughly before choosing an exchange; prioritize security features and a positive user experience. Remember that this article does not endorse any specific exchange.

- Security measures: Always use strong passwords and enable two-factor authentication. Only invest what you can afford to lose.

Risks and Considerations of XRP Investment

The cryptocurrency market is inherently volatile, and XRP is no exception. Regulatory uncertainty, particularly the ongoing SEC lawsuit, presents a significant risk. Scams and hacks are also prevalent threats in the cryptocurrency space. Understanding these risks is crucial for responsible XRP investment.

- Market manipulation: The price of XRP, like other cryptocurrencies, can be susceptible to manipulation.

- Private key security: Keeping your private keys secure is paramount to protect your XRP holdings.

- Beware of hype: Don't make investment decisions based solely on social media trends or hype.

Storing Your XRP Safely

Secure storage of your XRP is critical. Hardware wallets offer the highest level of security, storing your private keys offline. Software wallets, while convenient, require careful attention to security practices. Storing XRP directly on exchanges exposes your assets to potential hacking risks.

- Hardware vs. Software Wallets: Hardware wallets are more secure but less convenient than software wallets.

- Backing up your seed phrase: Always back up your wallet's seed phrase; losing it means losing access to your XRP.

- Wallet security: Research and choose reputable wallet providers, prioritizing security features.

Conclusion

Investing in XRP presents both significant opportunities and substantial risks. Understanding Ripple's technology, analyzing market trends, and implementing sound risk management strategies are crucial for navigating this volatile market. The ongoing regulatory uncertainty surrounding XRP adds another layer of complexity. Thorough research and due diligence are paramount before making any XRP investment decisions. Ready to learn more about making informed XRP investment decisions? Start your research today!

Featured Posts

-

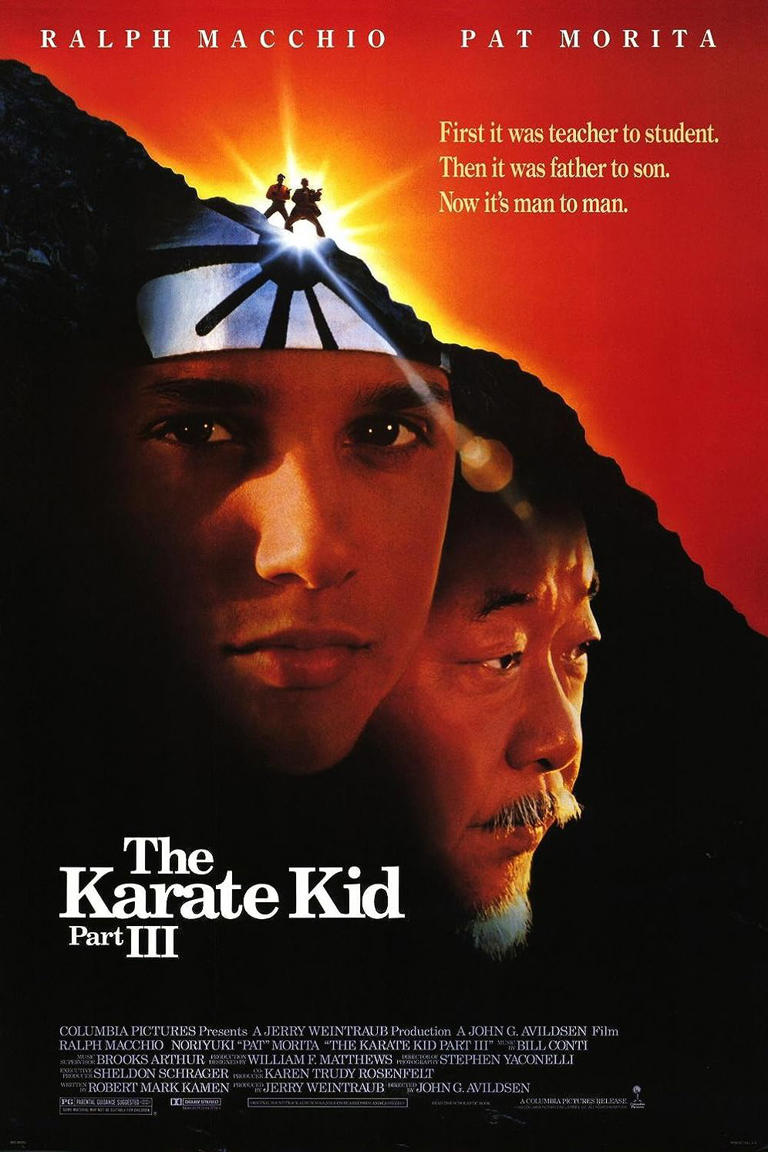

The Karate Kid Movies Ranked From Worst To Best

May 07, 2025

The Karate Kid Movies Ranked From Worst To Best

May 07, 2025 -

Will There Be A John Wick 5 Exploring The Possibilities

May 07, 2025

Will There Be A John Wick 5 Exploring The Possibilities

May 07, 2025 -

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 07, 2025

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 07, 2025 -

Is Xrps 400 3 Month Rally Sustainable A Buyers Guide

May 07, 2025

Is Xrps 400 3 Month Rally Sustainable A Buyers Guide

May 07, 2025 -

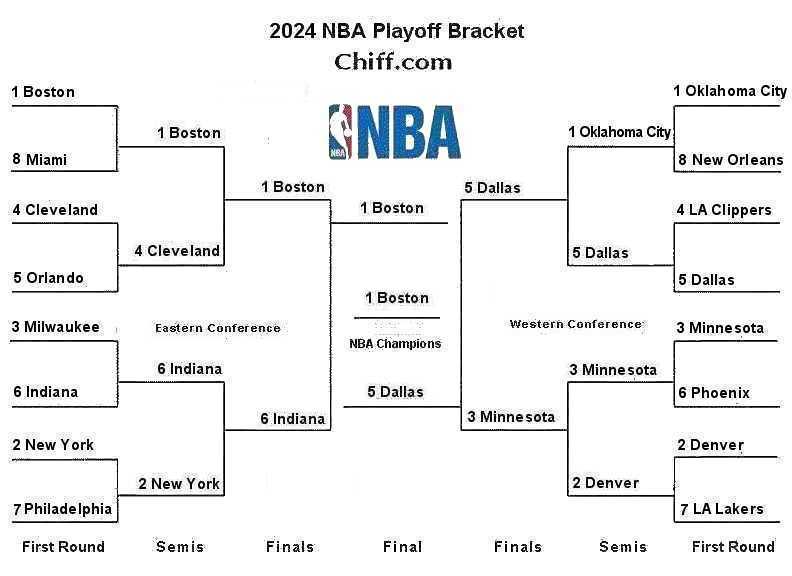

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025

Latest Posts

-

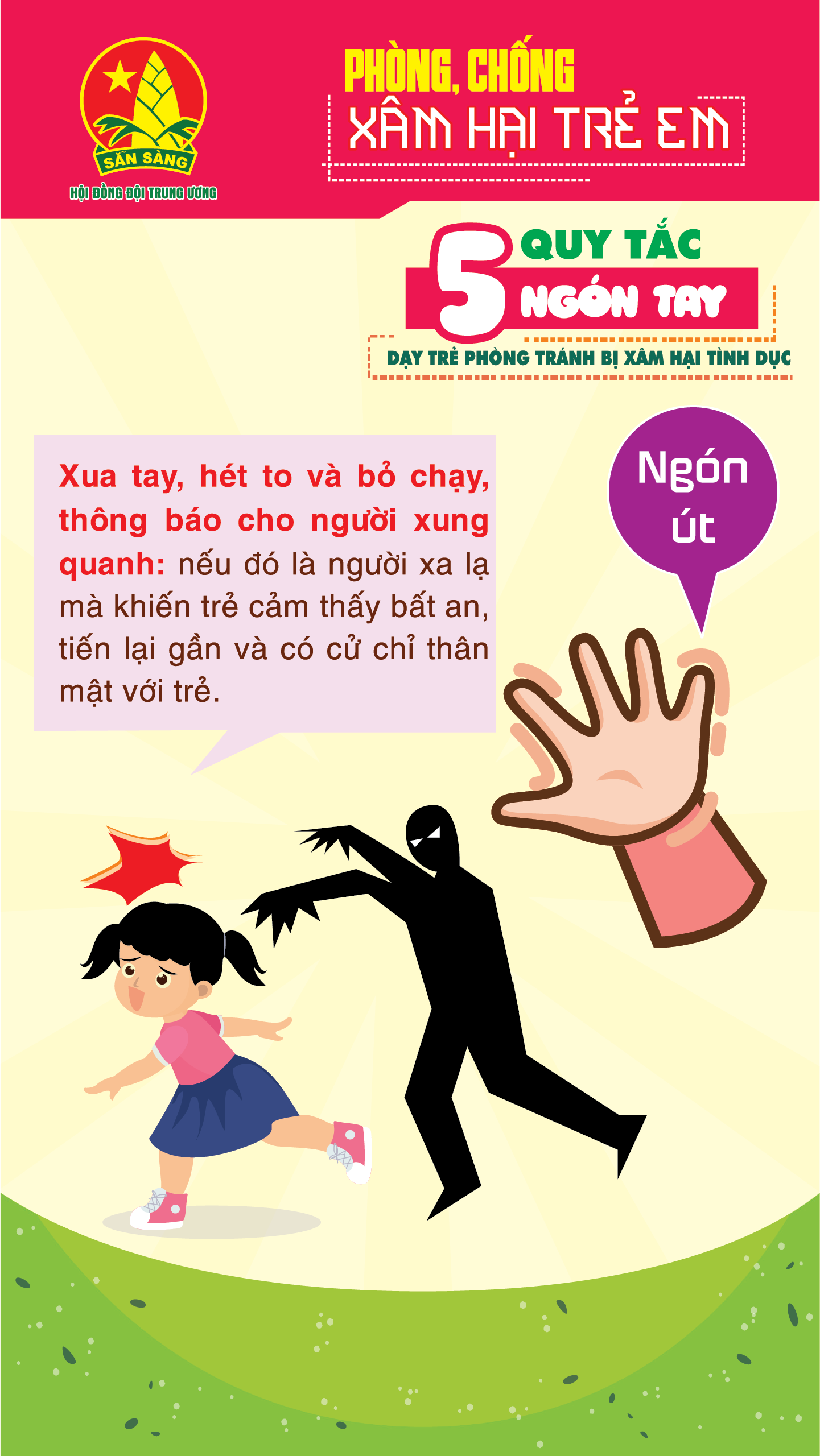

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

Nc Daycare Suspended State Action And What It Means For Parents

May 09, 2025

Nc Daycare Suspended State Action And What It Means For Parents

May 09, 2025 -

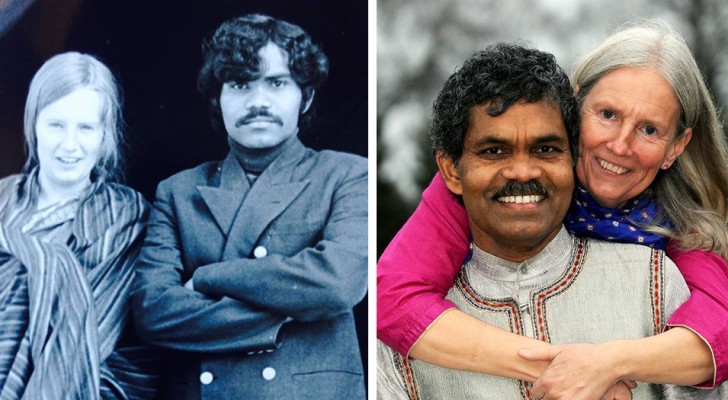

De Inzet Van Brekelmans Om India Als Bondgenoot Te Behouden

May 09, 2025

De Inzet Van Brekelmans Om India Als Bondgenoot Te Behouden

May 09, 2025 -

Bao Ve Tre Em Ra Soat Va Xu Ly Nghiem Cac Vu Bao Hanh Tai Co So Giu Tre Tu Nhan

May 09, 2025

Bao Ve Tre Em Ra Soat Va Xu Ly Nghiem Cac Vu Bao Hanh Tai Co So Giu Tre Tu Nhan

May 09, 2025 -

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Kan Houden

May 09, 2025

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Kan Houden

May 09, 2025