A Practical Guide To Investing In XRP (Ripple) And Managing Risk

Table of Contents

Understanding XRP and its Underlying Technology

What is XRP and how does it work?

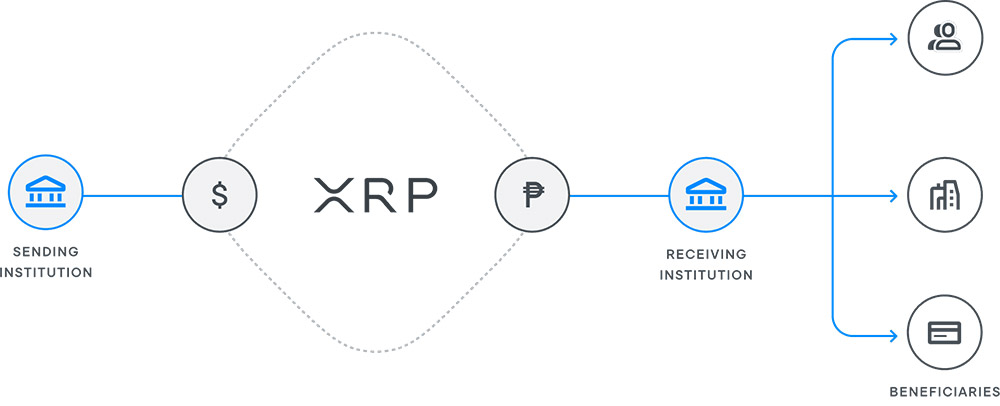

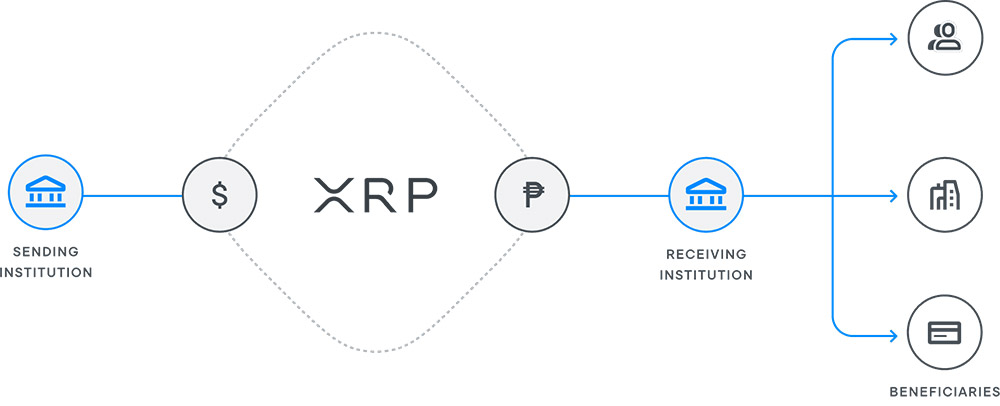

XRP is the native cryptocurrency of the Ripple network, a real-time gross settlement system (RTGS), currency exchange, and remittance network. Unlike Bitcoin which relies on proof-of-work, XRP uses a unique consensus mechanism, allowing for incredibly fast and low-cost transactions. Its speed and efficiency are key differentiators. XRP facilitates cross-border payments, enabling near-instantaneous transfers between different currencies. This makes it attractive for banks and financial institutions looking to streamline their operations.

- Speed: Transactions are processed in a matter of seconds.

- Low Fees: Transaction costs are significantly lower compared to other cryptocurrencies.

- Scalability: The Ripple network is designed to handle a large volume of transactions.

- Use Cases: Beyond payments, XRP is being explored for various applications, including supply chain management and micropayments.

Ripple's Ecosystem and Partnerships

Ripple's success is significantly tied to its partnerships with numerous financial institutions globally. These collaborations boost XRP's adoption and legitimacy within the traditional financial sector. Strategic alliances enhance the network's capabilities and expand its reach. This institutional backing contributes to XRP's overall value proposition.

- Key Partnerships: Ripple has partnered with major banks like Santander, SBI Holdings, and many others, demonstrating its growing influence in the global financial system. These partnerships help validate the technology and increase the potential for widespread adoption.

- Impact on Adoption: These partnerships provide a significant pathway for broader XRP adoption, driving demand and potentially influencing its price.

Analyzing XRP's Market Performance and Trends

Analyzing XRP's historical price performance is crucial for understanding its volatility and potential for future growth. While XRP has experienced periods of significant growth, it's also susceptible to market fluctuations. Studying past trends can offer valuable insights for informed investment decisions. Technical analysis, considering indicators like moving averages and trading volume, can provide additional signals.

- Price Volatility: XRP, like most cryptocurrencies, is highly volatile. Its price can experience sharp increases and decreases in short periods.

- Market Influences: Regulatory changes, adoption rates, and overall market sentiment significantly impact XRP's price.

- Technical Analysis: Employing technical indicators, alongside fundamental analysis, can help assess potential entry and exit points for XRP trading. Chart patterns can offer valuable insights into market trends.

Investing in XRP: Strategies and Platforms

Choosing a Reliable Cryptocurrency Exchange

Selecting a secure and reliable cryptocurrency exchange is paramount for successful XRP investment. Factors to consider include security measures (like two-factor authentication), trading fees, liquidity (the ease of buying and selling XRP), and the exchange's overall reputation.

- Security: Prioritize exchanges with robust security protocols to protect your funds.

- Fees: Compare trading fees across different platforms to minimize costs.

- Liquidity: Choose exchanges with high trading volume to ensure smooth transactions.

- Reputable Exchanges: Research and select established exchanges with a proven track record.

Different Investment Approaches

There are various investment strategies you can employ when investing in XRP. Understanding your risk tolerance is crucial for selecting the appropriate approach.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market high.

- Lump Sum Investment: Investing a significant amount of capital at once, often based on market timing predictions. This approach carries higher risk but offers potentially greater returns.

- Risk Tolerance: Your comfort level with potential losses significantly impacts your chosen strategy. A conservative investor might prefer DCA, while a more aggressive investor might favor lump sum investments.

Securely Storing Your XRP

Protecting your XRP investment is crucial. Using secure wallets is essential to prevent unauthorized access and potential losses.

- Hardware Wallets: These offline devices offer the highest level of security. Examples include Ledger and Trezor.

- Software Wallets: These digital wallets offer convenience but require extra caution to maintain security. Always choose reputable providers.

- Private Key Security: Never share your private key with anyone. Losing your private key means losing access to your XRP.

Managing Risk When Investing in XRP

Understanding Volatility and Market Fluctuations

The cryptocurrency market, and XRP specifically, is inherently volatile. Price swings can be dramatic due to various factors.

- Regulatory News: Government regulations and announcements can significantly impact XRP's price.

- Market Sentiment: Overall investor confidence and speculation can cause significant price fluctuations.

- Past Volatility: Reviewing XRP's past price movements helps understand its volatility and potential risks.

Diversifying Your Portfolio

Diversification is key to managing risk in any investment portfolio. Don't put all your eggs in one basket.

- Asset Classes: Diversify across different asset classes, including stocks, bonds, real estate, and other cryptocurrencies.

- Risk Mitigation: Diversification helps reduce the impact of losses in any single asset.

Setting Stop-Loss Orders and Risk Management Techniques

Implementing risk management strategies is critical for protecting your investment.

- Stop-Loss Orders: These automatically sell your XRP if the price drops to a predetermined level, limiting potential losses.

- Position Sizing: Investing only a portion of your capital in XRP helps prevent significant losses.

- Taking Profits: Establish profit targets and sell a portion of your XRP when those targets are reached.

Conclusion

Investing in XRP (Ripple) presents a unique opportunity, but it's crucial to approach it with a well-defined strategy and robust risk management plan. By understanding XRP's technology, carefully selecting your investment approach, and employing effective risk management techniques, you can navigate the complexities of the cryptocurrency market and potentially maximize your returns while minimizing losses. Remember to conduct thorough research and always consider your personal risk tolerance before investing in XRP or any other cryptocurrency. Start your journey to understanding and investing in XRP wisely today!

Featured Posts

-

Canada Post Strike Looms Potential Service Disruptions This Month

May 08, 2025

Canada Post Strike Looms Potential Service Disruptions This Month

May 08, 2025 -

Xrp Price Prediction After A 400 Increase Whats Next

May 08, 2025

Xrp Price Prediction After A 400 Increase Whats Next

May 08, 2025 -

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025 -

Is Stephen Kings The Long Walk Finally Coming To The Big Screen

May 08, 2025

Is Stephen Kings The Long Walk Finally Coming To The Big Screen

May 08, 2025 -

Is Rogue The Right Leader For The X Men

May 08, 2025

Is Rogue The Right Leader For The X Men

May 08, 2025

Latest Posts

-

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

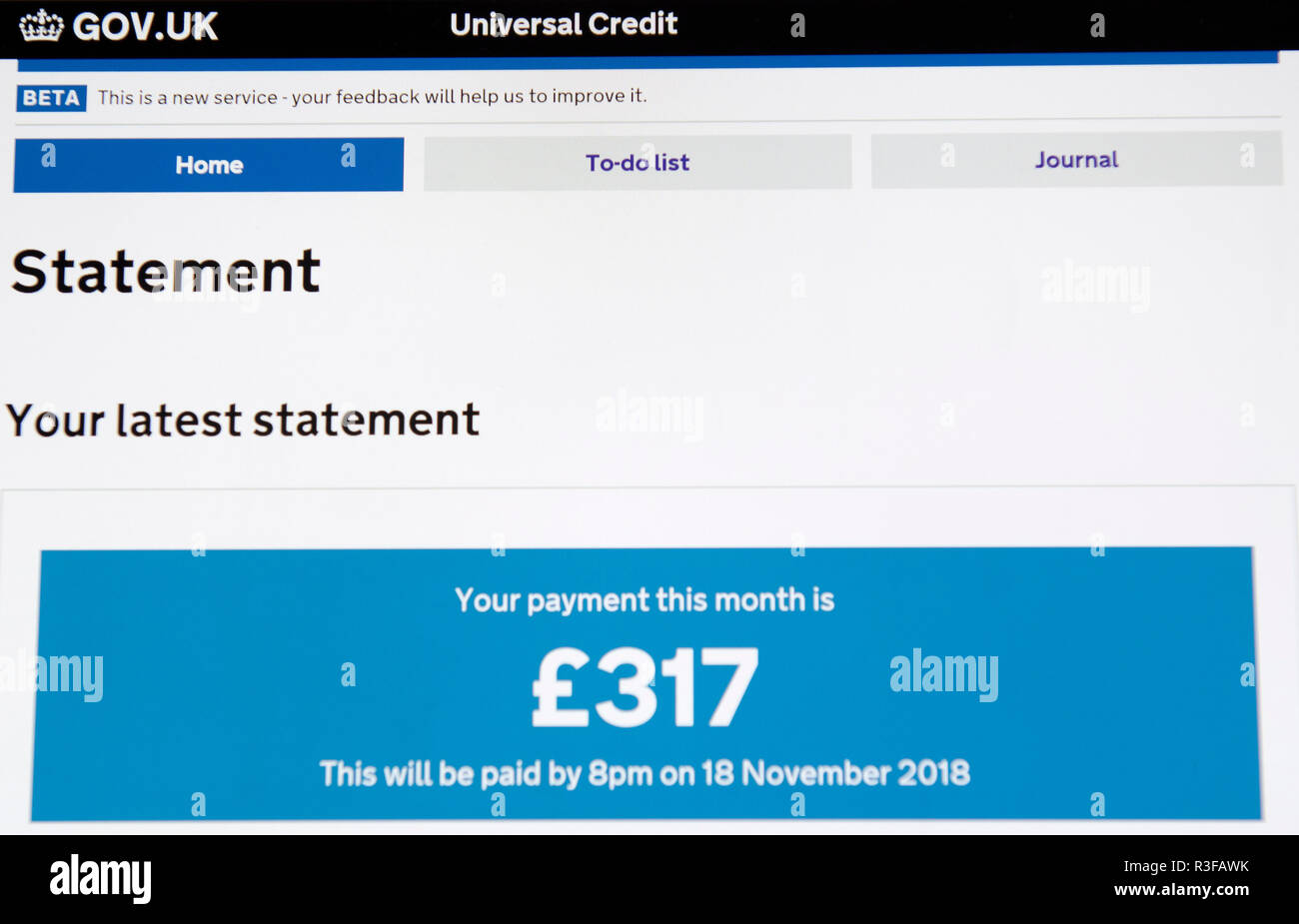

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025 -

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025