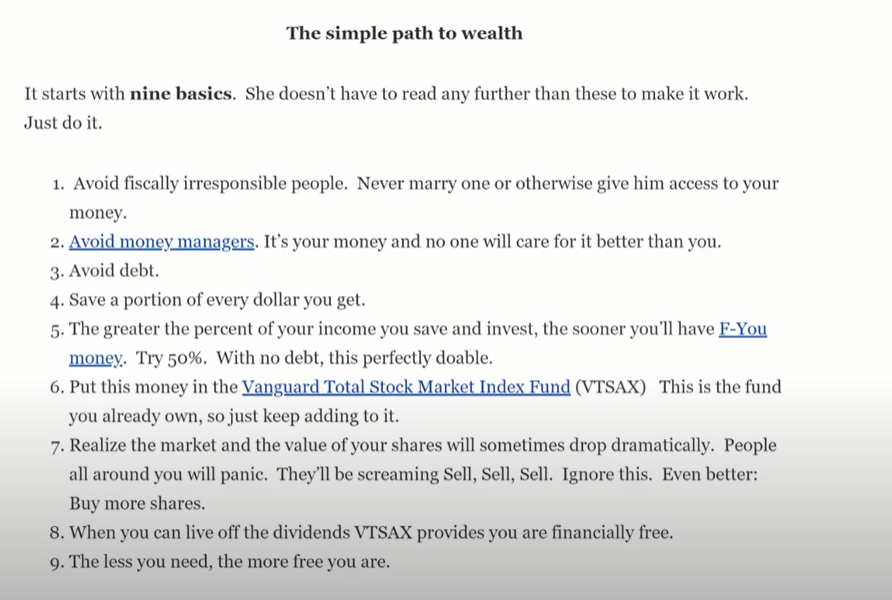

A Simple Path To Profitable Dividend Investing

Table of Contents

Understanding Dividend Investing Fundamentals

Before diving into building a profitable dividend portfolio, it’s crucial to understand the basics.

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. Imagine it as a share of the company's success being directly paid to you. These payments can be in the form of cash or additional shares of stock.

- Cash Dividends: The most common type, received directly into your brokerage account.

- Stock Dividends: Instead of cash, you receive additional shares of the company's stock. This increases your ownership stake but doesn't directly generate cash income.

Understanding key metrics is vital for identifying strong dividend stocks:

- Dividend Yield: This represents the annual dividend per share relative to the stock's price. A higher yield generally indicates a higher return on your investment, but it's crucial to analyze the underlying reasons for a high yield.

- Payout Ratio: This indicates the percentage of a company's earnings paid out as dividends. A sustainable payout ratio (generally below 60%) suggests a company's ability to continue making dividend payments without jeopardizing its growth.

It is also important to understand the tax implications:

- Dividend income is generally taxed as ordinary income. Consult a tax professional to understand the specific tax implications for your situation.

Identifying High-Yield Dividend Stocks

Finding reliable dividend stocks requires careful research and analysis.

- Screening Tools and Resources: Use online brokers (like Fidelity, Schwab, TD Ameritrade) and financial websites (like Yahoo Finance, Google Finance) that offer stock screening tools to filter for high-yield dividend stocks meeting your specific criteria.

- Fundamental Analysis: Don't just look at the dividend yield; examine the company's financial health. Analyze its balance sheet, income statement, and cash flow statements to assess its financial stability and future profitability.

- Due Diligence: Thoroughly research the company's history, business model, competition, and management team before investing. Look for consistent dividend growth history and strong financial fundamentals.

Building a Diversified Dividend Portfolio

Building a robust portfolio is vital for mitigating risk and maximizing returns in profitable dividend investing.

The Importance of Diversification

Diversification is a cornerstone of successful investing. It's about spreading your investments across various assets to reduce your risk. If one investment underperforms, others can potentially offset those losses.

- Diversify Across Sectors: Don't put all your eggs in one basket. Invest in companies from different industries (e.g., technology, healthcare, consumer goods) to minimize the impact of sector-specific downturns.

- Diversify Across Market Caps: Include a mix of large-cap (established companies), mid-cap (growing companies), and small-cap (young, high-growth companies) stocks to balance risk and growth potential.

- Geographic Diversification: Consider adding international stocks to further reduce your risk and gain exposure to different global economies.

Creating a Balanced Portfolio

Your portfolio's structure should reflect your risk tolerance and investment goals.

- Portfolio Allocation Strategies: A common approach is a 60/40 stock/bond allocation, with 60% in stocks (including dividend stocks) and 40% in bonds for stability. Adjust this ratio based on your risk appetite. Consider consulting a financial advisor to determine the best allocation for your individual needs.

- Asset Allocation: Asset allocation refers to the distribution of your investments across different asset classes (stocks, bonds, real estate, etc.). Carefully consider your investment horizon and risk tolerance when determining your asset allocation strategy.

Managing Your Dividend Investments for Long-Term Growth

Long-term success in profitable dividend investing requires ongoing management and adjustments.

Reinvesting Dividends for Compounding Growth

One of the most powerful strategies is reinvesting your dividends to buy more shares.

- Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, allowing you to automatically reinvest your dividends, purchasing additional shares without brokerage fees.

- Accelerated Wealth Building: Reinvesting dividends creates a compounding effect, accelerating your wealth building over time. The more shares you own, the more dividends you receive, and the more shares you can buy.

- Potential Tax Advantages: In some cases, reinvesting dividends through a DRIP may offer tax advantages. Consult a tax professional for details.

Regular Monitoring and Portfolio Adjustments

Your portfolio is not a "set it and forget it" investment.

- Market Conditions and Company Performance: Regularly review your portfolio's performance, adjusting your holdings based on market conditions, company performance, and your evolving financial goals. Rebalance your portfolio periodically to maintain your desired asset allocation.

- Staying Informed: Stay up-to-date on news affecting your investments and the broader economy. Read financial news, follow company announcements, and consider consulting with a financial advisor.

Unlocking the Potential of Profitable Dividend Investing

Profitable dividend investing hinges on understanding dividend fundamentals, building a diversified portfolio, and actively managing your investments for long-term growth. By carefully selecting high-yield dividend stocks, diversifying your holdings, and reinvesting dividends, you can generate passive income, build wealth, and significantly reduce your investment risk. Remember the importance of thorough due diligence, regular monitoring, and adapting your strategy to changing market conditions.

Start building your profitable dividend portfolio today! Research high-yield dividend stocks and begin your path to financial freedom. Remember to consult a financial advisor before making any significant investment decisions.

Featured Posts

-

Payton Pritchards Sixth Man Of The Year Candidacy Factors Behind His Improvement

May 12, 2025

Payton Pritchards Sixth Man Of The Year Candidacy Factors Behind His Improvement

May 12, 2025 -

2025 Indy 500 One Driver Out

May 12, 2025

2025 Indy 500 One Driver Out

May 12, 2025 -

Did Appearing On Teen Mom Ruin Farrah Abrahams Life

May 12, 2025

Did Appearing On Teen Mom Ruin Farrah Abrahams Life

May 12, 2025 -

Pritchard Wins Nba Sixth Man Of The Year Award

May 12, 2025

Pritchard Wins Nba Sixth Man Of The Year Award

May 12, 2025 -

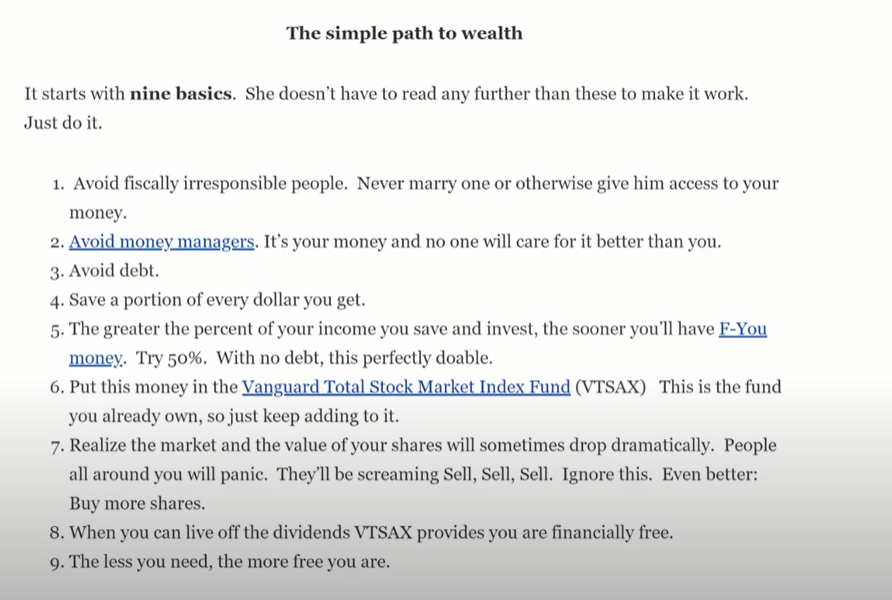

El Inusual Regalo De Uruguay A China Y Su Impacto En Las Exportaciones Ganaderas

May 12, 2025

El Inusual Regalo De Uruguay A China Y Su Impacto En Las Exportaciones Ganaderas

May 12, 2025

Latest Posts

-

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025 -

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025 -

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025 -

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025