ABN Amro: Dutch Central Bank Investigates Bonus Payments

Table of Contents

The Scope of the DNB Investigation

The DNB plays a critical role in overseeing and regulating the banking sector in the Netherlands, ensuring financial stability and adherence to national and international regulations. Their investigation into ABN Amro's bonus structure stems from concerns about potential non-compliance with these regulations. Specifically, the investigation focuses on whether bonuses were awarded despite poor performance, risky behavior, or a failure to comply with EU or national regulations regarding bonus caps. This ABN Amro bonus scandal, as some are calling it, could have far-reaching implications.

- Timeframe: The investigation covers bonus payments made during the period of [Insert specific timeframe, if available. Otherwise, use a general timeframe like "the past three years"].

- Amount: The potential amount of bonuses under scrutiny is estimated to be in the range of [Insert estimated amount, if available. If unavailable, use phrasing like "a significant sum"].

- Targets: While the DNB hasn't publicly named specific individuals or departments, the investigation is likely focused on senior executives and potentially those in departments directly related to risk management and performance evaluation.

- Preliminary Findings: [Insert any available information about preliminary findings. If no findings are public, state that the investigation is ongoing and no conclusions have been released yet.]

Potential Implications for ABN Amro

The consequences of the ABN Amro bonus investigation could be severe. The bank faces several potential outcomes, each with significant implications for its future.

-

Financial Penalties: The DNB has the power to impose substantial financial penalties on ABN Amro if it finds evidence of regulatory breaches concerning the bonus payments. These penalties could significantly impact the bank's profitability.

-

Reputational Damage: Negative publicity surrounding the investigation could severely damage ABN Amro's reputation, impacting customer trust and potentially leading to a loss of business. The reputational damage from an ABN Amro bonus scandal could be long-lasting.

-

Changes to Executive Compensation Policies: The investigation may force ABN Amro to overhaul its executive compensation policies, potentially leading to stricter guidelines and tighter controls on bonus payments.

-

Impact on Shareholder Confidence: News of the investigation could negatively affect shareholder confidence, leading to a decline in ABN Amro's stock price and making it more difficult to attract future investments.

-

Stock Price Impact: The ABN Amro stock price has already shown [Insert information on stock price fluctuations, if available. Otherwise, use a phrase like "some volatility" or "potential for future volatility"] since the news of the investigation broke.

-

Legal Ramifications: Beyond the DNB's investigation, ABN Amro and its executives could face legal action from investors or regulatory bodies if the investigation reveals serious misconduct.

-

Internal Risk Management: The investigation is likely to prompt a thorough review and potential overhaul of ABN Amro's internal risk management systems and processes related to executive compensation.

The Broader Context of Banking Bonuses in the Netherlands

The regulatory environment surrounding executive compensation in the Dutch banking sector is relatively stringent, reflecting international efforts to curb excessive risk-taking in the financial industry. The ABN Amro bonus investigation highlights the ongoing debate surrounding the appropriate level of executive pay and the need for robust regulatory oversight.

- Relevant Legislation: [Mention specific Dutch legislation affecting executive pay in the financial sector. Examples might include laws related to bonus caps or responsible banking practices].

- Recent Reforms: [Discuss any recent changes or proposed reforms to bonus regulations in the Netherlands. Highlight any relevant initiatives to improve corporate governance within the banking sector].

- Public Opinion: Public opinion on banking bonuses in the Netherlands is generally [Describe public sentiment. If statistics are available, include them here, citing the source]. Surveys often reveal a significant level of skepticism about the fairness and proportionality of executive compensation in the banking industry.

Comparison with International Practices

Compared to other countries like the UK and the US, the Netherlands has [Describe the differences in regulatory approaches to banking bonuses. Are Dutch regulations stricter or more lenient? Are there notable differences in public opinion?]. International best practices regarding executive compensation emphasize the importance of aligning pay with long-term performance, minimizing excessive risk-taking, and promoting transparency and accountability.

Conclusion

The DNB's investigation into ABN Amro's bonus payments highlights the ongoing challenges in regulating executive compensation within the banking sector. The potential financial, reputational, and legal ramifications for ABN Amro are significant, and the outcome of this investigation will undoubtedly shape future bonus practices within the bank and across the Dutch financial landscape. The ABN Amro bonus investigation serves as a stark reminder of the need for robust regulation and ethical conduct within the financial industry.

Call to Action: Stay informed about the latest developments in the ABN Amro bonus investigation and the evolving regulatory environment for banking executive compensation in the Netherlands. Continue to monitor news related to the ABN Amro bonus investigation and related keywords such as "ABN Amro bonus scandal" and "DNB banking regulations" for further updates.

Featured Posts

-

Dropout Kings Frontman Adam Ramey Dead At Age

May 22, 2025

Dropout Kings Frontman Adam Ramey Dead At Age

May 22, 2025 -

Abn Amro Bonus System Under Investigation By Dutch Regulator

May 22, 2025

Abn Amro Bonus System Under Investigation By Dutch Regulator

May 22, 2025 -

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025 -

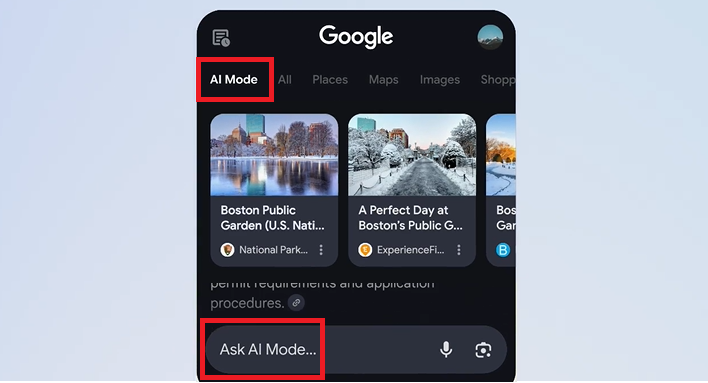

Ai Mode The Future Of Google Search

May 22, 2025

Ai Mode The Future Of Google Search

May 22, 2025 -

Cau Ma Da Du An Trong Diem Thuc Day Phat Trien Kinh Te Dong Nai

May 22, 2025

Cau Ma Da Du An Trong Diem Thuc Day Phat Trien Kinh Te Dong Nai

May 22, 2025