ABN Amro's Bonus Scheme: Potential Regulatory Action

Table of Contents

The ABN Amro bonus scheme has recently come under intense scrutiny, sparking concerns about potential regulatory action. This article will delve into the key aspects of this controversy, exploring the reasons for the regulatory interest and the potential consequences for the bank and its employees. We will examine the details of the bonus structure, the arguments for and against its fairness, and the possible outcomes of the ongoing investigation. We'll analyze the ABN Amro executive bonuses and their potential impact on the wider financial landscape.

<h2>Details of the ABN Amro Bonus Scheme</h2>

The ABN Amro bonus scheme, like many in the financial sector, is designed to reward employee performance and incentivize profitable behavior. However, the specifics of its structure, eligibility criteria, and payout mechanisms are currently under the microscope.

- Structure: The scheme likely involves a tiered system, with bonuses varying based on job role, team performance, and individual contributions. A percentage of an employee's base salary is typically allocated as a potential bonus.

- Eligibility Criteria: Specific performance metrics, such as exceeding sales targets, achieving specific financial goals, and demonstrating exemplary customer service, are likely used to determine eligibility.

- Payout Factors: Factors like overall company performance, risk management compliance, and individual contributions to profit will influence the final bonus amount. The weighting of each factor is crucial and is a point of contention in the current regulatory review.

- Historical Context: Analyzing past years’ bonus payouts and the evolution of the scheme over time is essential to understanding the current controversy. Have the criteria or payouts changed significantly? Have there been shifts in the focus of performance metrics?

- Bonus Pool Distribution: Understanding the total bonus pool and how it's distributed across different employee levels (from junior staff to senior executives) provides insight into potential fairness issues and potential regulatory concerns.

<h2>Reasons for Regulatory Scrutiny</h2>

The regulatory scrutiny surrounding the ABN Amro bonus scheme likely stems from several key concerns.

- Excessive Risk-Taking: Does the bonus scheme inadvertently encourage excessive risk-taking by employees to achieve short-term gains, potentially jeopardizing the long-term stability of the bank? This is a critical aspect of regulatory oversight, especially considering past banking crises.

- Compliance with Regulations: The scheme must comply with various EU banking regulations, including those relating to executive compensation and responsible business practices. Dutch-specific laws regarding financial institutions are also relevant.

- Specific Regulations Potentially Breached: This might include regulations on bonus caps, deferred bonuses, and clawback provisions. The specifics will depend on the details of the ABN Amro scheme and the interpretation of the relevant laws.

- Impact on Shareholder Value: A poorly designed bonus scheme can negatively impact shareholder value. Excessive payouts might reduce profitability, while a lack of transparency can erode investor confidence.

- Reputational Damage: Negative publicity surrounding the bonus scheme can significantly harm ABN Amro's reputation, impacting customer trust and its ability to attract and retain talent.

- Statements from ABN Amro and Regulatory Bodies: Public statements made by ABN Amro and the relevant regulatory authorities (such as De Nederlandsche Bank – DNB) will provide crucial context and insight into the ongoing investigation.

<h3>The Role of Executive Compensation</h3>

Executive compensation is always under close scrutiny. In the ABN Amro case, the focus will likely be on whether bonuses paid to top executives are disproportionately high compared to other employees' compensation.

- Comparison with Similar Banks: Analyzing executive bonus payouts at comparable banks is crucial to determining if the ABN Amro scheme is reasonable or excessive.

- Misaligned Incentives: The bonus scheme might inadvertently incentivize short-term gains at the expense of long-term sustainability. This misalignment of incentives is a major concern for regulators.

<h2>Potential Regulatory Actions and Consequences</h2>

The potential consequences for ABN Amro are significant if regulators find the bonus scheme non-compliant.

- Potential Actions: Regulatory bodies could impose substantial fines, demand clawbacks of already paid bonuses, or force ABN Amro to completely overhaul its bonus scheme.

- Legal and Financial Implications: These actions could have severe financial ramifications for ABN Amro, impacting its profitability and shareholder value.

- Impact on Employee Morale and Recruitment: Uncertainty surrounding the bonus scheme could negatively impact employee morale and make it difficult to attract and retain talent in a competitive job market.

- Broader Implications: The outcome of this situation could influence the regulatory landscape for other banks, leading to stricter regulations regarding executive compensation and bonus schemes across the European banking sector.

<h2>Public and Media Reaction to the ABN Amro Bonus Scheme</h2>

Public and media reaction to the ABN Amro bonus scheme has been varied. Some may express outrage over what they perceive as excessive payouts, especially in light of past financial scandals.

- News Articles, Expert Opinions, Public Statements: Analyzing news articles, expert opinions, and public statements will reveal the breadth of public sentiment and the arguments for and against the scheme.

- Impact on Brand Image and Customer Confidence: Negative publicity can significantly damage ABN Amro's brand reputation and erode customer confidence, impacting its business performance and long-term sustainability.

<h2>Conclusion</h2>

The ABN Amro bonus scheme controversy highlights the ongoing debate surrounding executive compensation and its potential implications for risk-taking within the financial sector. The potential regulatory actions underscore the increasing scrutiny applied to corporate governance and the need for transparent and responsible compensation practices. The outcome of this situation will have significant consequences for ABN Amro and the wider financial industry, shaping future bonus structures and influencing the regulatory landscape. Staying informed about the developments in this case is crucial for understanding the evolving regulations surrounding ABN Amro bonus schemes and similar compensation structures. Keep checking back for updates on this evolving situation regarding the ABN Amro bonus scheme and its implications.

Featured Posts

-

Unpacking The Blake Lively Allegedly Story What We Know Bored Panda

May 22, 2025

Unpacking The Blake Lively Allegedly Story What We Know Bored Panda

May 22, 2025 -

The Goldbergs The Humor Heart And History Of A Beloved Show

May 22, 2025

The Goldbergs The Humor Heart And History Of A Beloved Show

May 22, 2025 -

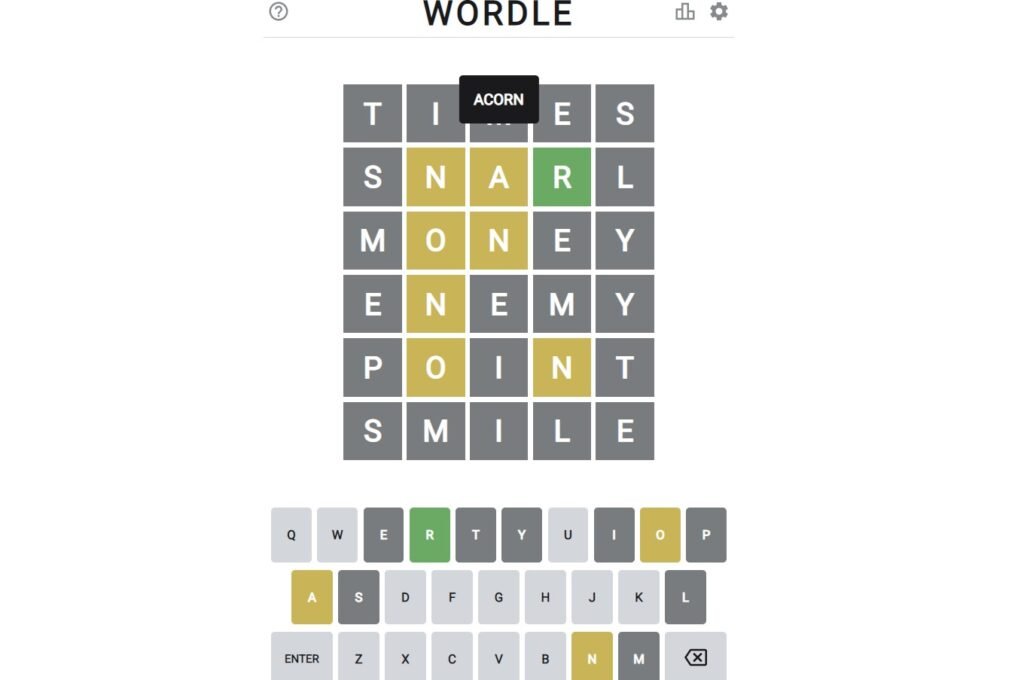

Wordle 1358 March 8th Clues And Answer For Todays Game

May 22, 2025

Wordle 1358 March 8th Clues And Answer For Todays Game

May 22, 2025 -

Virginia Gasoline Prices Week Over Week Decline Gas Buddy

May 22, 2025

Virginia Gasoline Prices Week Over Week Decline Gas Buddy

May 22, 2025 -

Israeli Embassy Identifies Victims Of Dc Shooting

May 22, 2025

Israeli Embassy Identifies Victims Of Dc Shooting

May 22, 2025