Actor Michael Sheen Pays Off £1 Million In Debt

Table of Contents

The £1 Million Debt: Origins and Challenges

While the exact circumstances surrounding Michael Sheen's £1 million debt haven't been publicly detailed, it's likely a combination of factors common among high-earning individuals. The pressures of maintaining a certain lifestyle, coupled with potentially unsuccessful business ventures or investments, can quickly lead to significant debt. Unfortunately, specific information regarding the origin of his debt remains private.

- Potential sources of the debt: High-profile individuals often face unique financial pressures. This could include expensive lifestyle choices, investment losses, or perhaps even backing financially risky business ventures. The fluctuating nature of acting income also plays a part, with periods of high earnings interspersed with periods of lower work.

- The emotional and psychological toll of significant debt: The stress and anxiety associated with a £1 million debt are immense, regardless of one's professional success. This level of financial burden can significantly impact mental health and well-being.

- The impact of high-profile status on financial pressures: Sheen's public profile likely amplified the pressures he faced. Maintaining a certain lifestyle and image can be expensive, adding to the financial burden.

- Challenges faced in navigating complex financial situations: Managing complex finances, especially with substantial debt, requires expertise and careful planning. Navigating legal and financial complexities adds another layer of difficulty.

Sheen's Strategy for Debt Repayment

While the specifics of Sheen's debt repayment strategy remain undisclosed, we can speculate on the likely approaches a financially savvy individual would take. His success suggests a disciplined and comprehensive approach.

- Possible strategies employed: Sheen likely employed a multi-pronged approach involving strict budgeting, increased income generation through acting roles and endorsements, and potentially the sale of assets. Seeking professional financial advice from accountants and financial advisors would have been crucial.

- The importance of creating a comprehensive debt repayment plan: A detailed plan, outlining income, expenses, and a prioritized repayment schedule, is essential for tackling significant debt. This plan likely involved a focus on high-interest debts first.

- Prioritization of debts and interest rates: Focusing on high-interest debts first is a key strategy to minimize the total interest paid and accelerate debt reduction. This allows for more rapid progress towards becoming debt-free.

- The role of financial discipline and commitment: Repaying a £1 million debt requires unwavering commitment and discipline. Sticking to a budget, resisting impulsive spending, and maintaining focus are crucial.

Lessons Learned from Michael Sheen's Financial Journey

Michael Sheen's experience offers valuable lessons for everyone, regardless of their income level. His journey underscores the importance of proactive financial management.

- The importance of proactive financial planning: Creating a realistic budget, tracking expenses, and planning for the future are essential steps to avoid accumulating significant debt. Regular reviews of one's financial situation are crucial.

- Seeking professional financial advice: Financial advisors can provide expert guidance on budgeting, investments, and debt management. This is especially important when dealing with complex financial situations.

- Creating and sticking to a realistic budget: A budget is the cornerstone of responsible financial management. Tracking income and expenses helps identify areas for savings and spending adjustments.

- Recognizing the signs of financial distress and seeking help: Early intervention is key when facing financial difficulties. Don't hesitate to seek help from financial advisors or credit counselors.

- The power of consistent effort and discipline in achieving financial goals: Sheen's success highlights the importance of perseverance and commitment. Achieving financial freedom requires long-term dedication and consistent effort.

Avoiding a Similar Situation: Tips for Debt Management

Here's some practical advice to prevent and manage debt effectively:

- Budgeting and tracking expenses: Regularly monitor income and expenses using budgeting apps or spreadsheets.

- Creating an emergency fund: An emergency fund provides a safety net for unexpected expenses, preventing the need to borrow money.

- Understanding different types of debt and their interest rates: Knowing the interest rates on your debts helps prioritize repayment strategies.

- Utilizing debt consolidation strategies: Consolidating multiple debts into a single loan can simplify repayment and potentially lower interest rates.

- Seeking credit counseling if necessary: Credit counselors can help create a debt management plan and negotiate with creditors.

Conclusion

Michael Sheen's remarkable journey of paying off a £1 million debt serves as a testament to the power of financial discipline and planning. His success highlights the importance of proactive financial management, seeking professional advice when needed, and committing to a realistic budget. The inspiring nature of his achievement should motivate us all to take control of our finances. Don't let debt control your life; learn from Michael Sheen's experience and take steps toward your own financial freedom. Start building a stronger financial future today by creating a sound budget and tackling any outstanding debt. Take charge of your financial wellbeing.

Featured Posts

-

Pm Modi Flags Off First Train In Kashmir End Of An Era

May 01, 2025

Pm Modi Flags Off First Train In Kashmir End Of An Era

May 01, 2025 -

Mqbwdh Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Skht Nkth Chyny

May 01, 2025

Mqbwdh Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Skht Nkth Chyny

May 01, 2025 -

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025 -

Aj Ywm Ykjhty Kshmyr Hkwmt Awr Ewam Ky Janb Se Mkml Hmayt

May 01, 2025

Aj Ywm Ykjhty Kshmyr Hkwmt Awr Ewam Ky Janb Se Mkml Hmayt

May 01, 2025 -

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025

Latest Posts

-

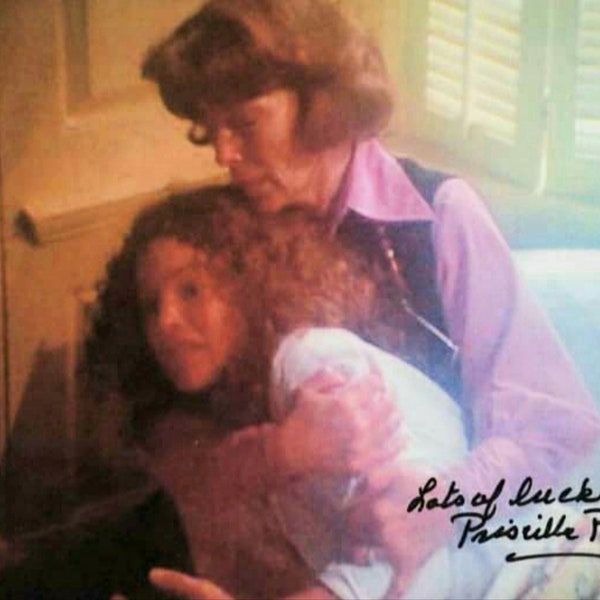

Priscilla Pointer Dead At 100 Remembering The Actress From Carrie

May 01, 2025

Priscilla Pointer Dead At 100 Remembering The Actress From Carrie

May 01, 2025 -

Priscilla Pointer Dead At 100 A Look Back At Her Career With Daughter In Carrie

May 01, 2025

Priscilla Pointer Dead At 100 A Look Back At Her Career With Daughter In Carrie

May 01, 2025 -

Remembering Priscilla Pointer A Century Of Life And Legacy In Film Carrie

May 01, 2025

Remembering Priscilla Pointer A Century Of Life And Legacy In Film Carrie

May 01, 2025 -

Priscilla Pointer 100 Dies Carrie Actress And Daughter Remembered

May 01, 2025

Priscilla Pointer 100 Dies Carrie Actress And Daughter Remembered

May 01, 2025 -

Priscilla Pointer Carrie Actress And Daughter Dead At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Daughter Dead At 100

May 01, 2025