Addressing High Stock Market Valuations: A BofA Investor's Guide

Table of Contents

Understanding Current Market Conditions and High Valuations

What constitutes "high" valuations? It's not a simple yes or no answer. We typically look at metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE) to gauge market valuation. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially high valuations. The Shiller PE, which considers inflation-adjusted earnings over a longer period, provides a more nuanced perspective. Currently, elevated valuations are driven by a confluence of factors, including historically low interest rates, the impact of quantitative easing policies, and strong corporate earnings in certain sectors. However, these factors are not necessarily sustainable in the long term, adding to the complexity of the current market.

- Key Valuation Metrics:

- P/E Ratio: Price per share divided by earnings per share. A higher P/E ratio often suggests higher expectations for future growth.

- PEG Ratio: P/E ratio divided by the company's earnings growth rate. This helps account for growth potential.

- Price-to-Sales Ratio: Market capitalization divided by revenue. Useful for valuing companies with negative earnings.

- Interest Rates and Stock Valuations: Low interest rates often lead to higher stock valuations as investors seek higher returns in the equity market. Conversely, rising interest rates can put downward pressure on stock prices.

- Inflation's Impact: Inflation erodes purchasing power and can impact corporate earnings, influencing stock prices. High inflation can lead to increased interest rates, further impacting valuations.

- BofA Market Research: For detailed analysis and insights, refer to BofA's latest market research reports and commentary available through your BofA online portal.

Assessing Risk and Portfolio Diversification Strategies for High Valuations

High stock market valuations inherently increase the risk of market corrections or even crashes. The higher the price, the further it has to fall. Therefore, a diversified portfolio is crucial to mitigate this risk. Diversification involves spreading investments across various asset classes, sectors, and geographies.

- Benefits of Diversification: A diversified portfolio reduces the impact of any single investment performing poorly. In a high-valuation market, this protection is especially valuable.

- Adjusting Asset Allocation: Based on your risk tolerance and market outlook, you might consider shifting your asset allocation towards less volatile assets, such as bonds or alternative investments.

- Less Sensitive Sectors: Consider sectors less sensitive to overall market fluctuations, such as consumer staples or healthcare, for relative stability.

- Alternative Investments: Alternative investments, such as real estate or commodities, can offer diversification benefits and potentially less correlation with traditional stock markets.

Investing Strategies for High Stock Market Valuations

In a market with high valuations, a strategic approach is vital. Value investing, dividend investing, and focusing on high-quality companies are viable strategies.

- Value Investing: Identify companies trading below their intrinsic value. This requires thorough fundamental analysis to uncover undervalued opportunities.

- Dividend Investing: Companies with a history of consistent dividend payouts can provide a steady income stream, mitigating some of the risks associated with high valuations.

- High-Quality Companies: Focus on companies with strong fundamentals, robust balance sheets, and sustainable competitive advantages.

- BofA Research Resources: Utilize BofA's research platform and analyst reports to conduct in-depth due diligence and fundamental analysis.

The Role of Bonds and Fixed Income in a High-Valuation Environment

Bonds can serve as a ballast in a portfolio during periods of high stock valuations. They generally offer lower returns but provide stability and can help reduce overall portfolio volatility.

- Bond Types: Consider different bond types such as government bonds (lower risk) and corporate bonds (higher risk, higher potential yield).

- Bond Yields and Portfolio Returns: Bond yields contribute to overall portfolio returns and can offset losses in the equity market.

- Interest Rate Risk: Rising interest rates can negatively impact bond prices, so it's crucial to manage interest rate risk.

- Bond Investment Strategies: BofA offers various bond investment options; consult with a financial advisor to determine the best strategy for your portfolio.

Conclusion

Successfully navigating high stock market valuations requires a proactive and informed approach. By understanding the current market conditions, diversifying your portfolio, and employing appropriate investment strategies, BofA investors can effectively manage risk and potentially capitalize on opportunities even in a high-valuation environment. Remember to regularly review your investment strategy and consult with a financial advisor to address your specific needs and concerns regarding high stock market valuations. Learn more about managing your investments during periods of high stock market valuations by accessing additional BofA resources [link to BofA resources].

Featured Posts

-

2025 4 22

Apr 25, 2025

2025 4 22

Apr 25, 2025 -

United Kingdoms Eurovision 2025 Act All About Remember Monday

Apr 25, 2025

United Kingdoms Eurovision 2025 Act All About Remember Monday

Apr 25, 2025 -

Hyundai Profit Surges Past Forecasts Boosted By North American And Hybrid Vehicle Sales

Apr 25, 2025

Hyundai Profit Surges Past Forecasts Boosted By North American And Hybrid Vehicle Sales

Apr 25, 2025 -

Sherwood Ridge Primary School Accommodates Students Beliefs Regarding Anzac Day Observances

Apr 25, 2025

Sherwood Ridge Primary School Accommodates Students Beliefs Regarding Anzac Day Observances

Apr 25, 2025 -

Manalapans Rise From Quiet Town To Millionaires Playground

Apr 25, 2025

Manalapans Rise From Quiet Town To Millionaires Playground

Apr 25, 2025

Latest Posts

-

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025 -

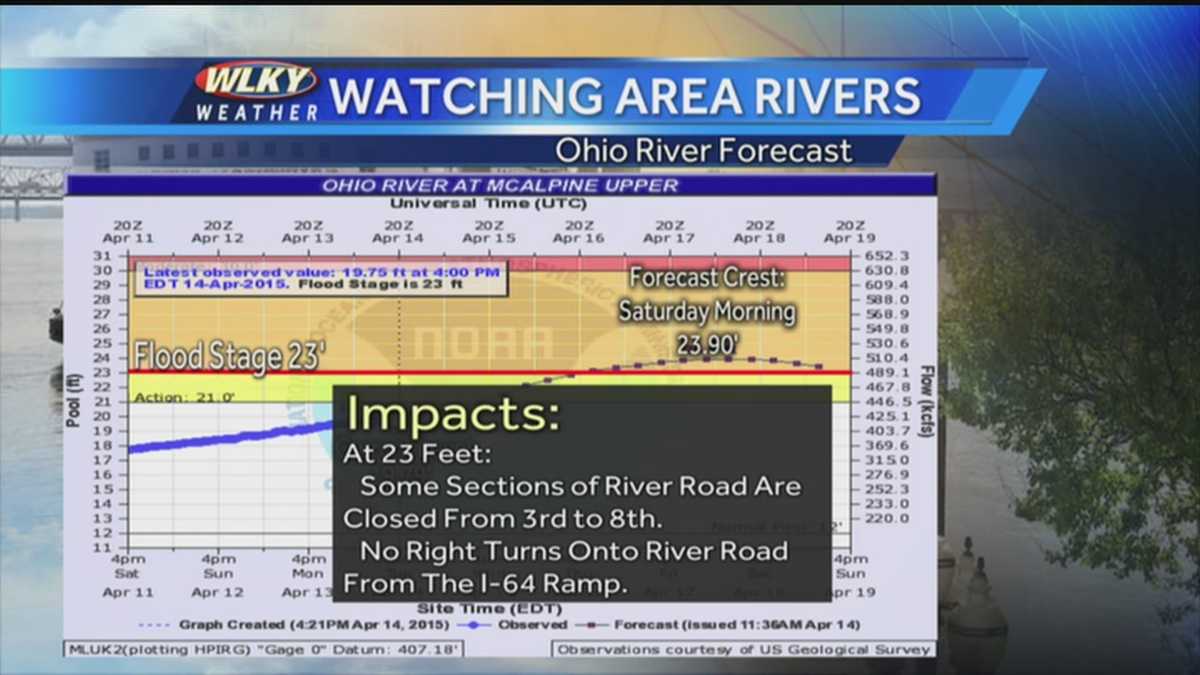

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025 -

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025