Addressing Investor Anxiety: BofA's Take On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's recent reports paint a complex picture of the current economic landscape. Their market outlook incorporates several key factors influencing stock market valuations and contributing to investor anxiety. These factors include inflation rates, interest rate hikes by central banks like the Federal Reserve, potential recessionary risks, and significant geopolitical uncertainties.

-

BofA's prediction for future interest rate movements: BofA analysts typically provide forecasts for interest rate changes, influencing borrowing costs for businesses and consumers. Higher interest rates generally curb inflation but can also slow economic growth, impacting stock prices. Their predictions are carefully considered by investors to gauge potential market shifts.

-

BofA's assessment of inflation's impact on corporate earnings: High inflation erodes purchasing power and increases input costs for businesses, potentially squeezing profit margins and negatively affecting corporate earnings. BofA's analysis on this is crucial in evaluating the long-term health and profitability of companies.

-

BofA's view on the likelihood of a recession: BofA's economists closely monitor economic indicators to assess the probability of a recession. Their predictions, based on macroeconomic data, influence investor sentiment and risk appetite. The possibility of a recession significantly contributes to investor anxiety and impacts investment strategies.

-

Key geopolitical factors affecting BofA's market outlook: Geopolitical events, such as wars, trade disputes, and political instability, introduce considerable uncertainty into financial markets. BofA incorporates these risks into its market outlook, highlighting potential impacts on stock market valuations.

Understanding Elevated Stock Market Valuations

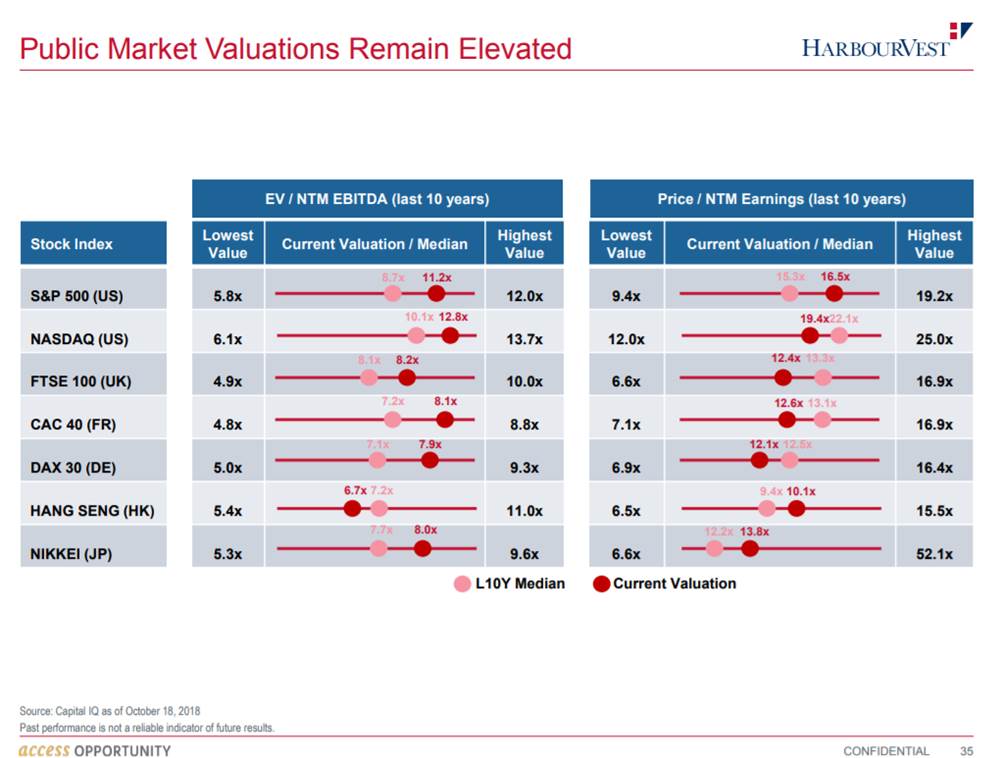

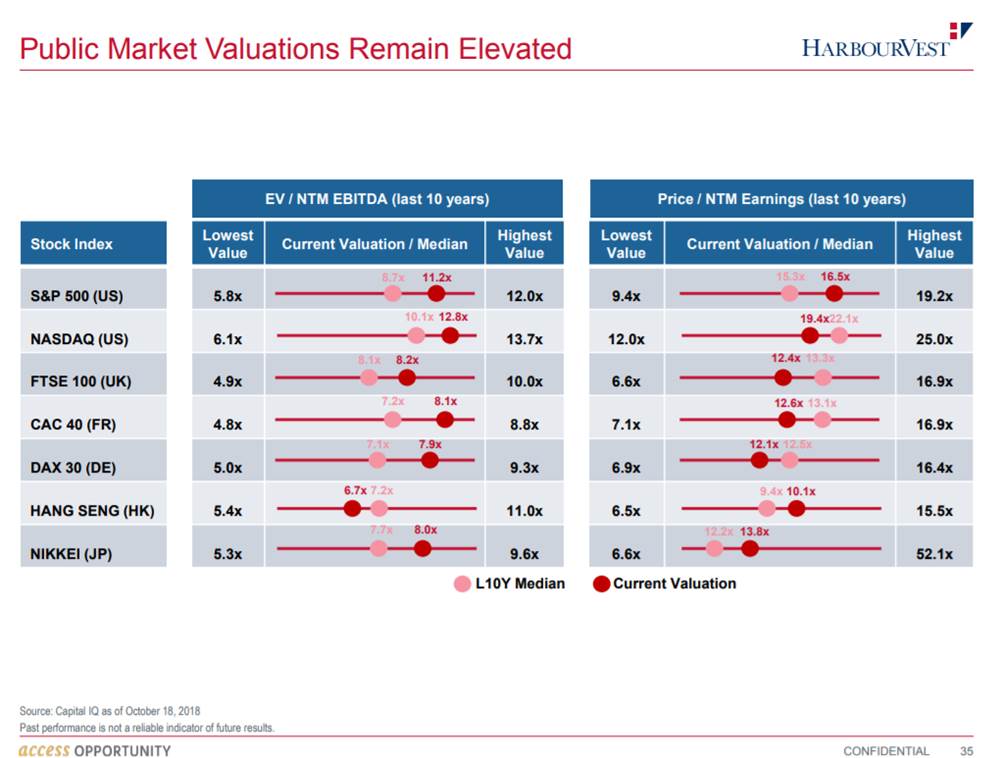

Understanding how to assess stock market valuations is critical during periods of heightened uncertainty. Metrics like the Price-to-Earnings ratio (P/E ratio), market capitalization, and discounted cash flow (DCF) analysis are crucial tools. BofA likely uses a combination of these to evaluate whether current valuations are justified or represent a potential bubble.

-

Explanation of commonly used stock valuation metrics: The P/E ratio, for example, compares a company's stock price to its earnings per share. A high P/E ratio can suggest that the market expects high future growth, but it can also indicate overvaluation. Other metrics like the PEG ratio (P/E ratio divided by the growth rate) provide further insights.

-

BofA's interpretation of current valuation multiples: BofA's analysts provide their interpretations of these valuation multiples, considering factors such as industry benchmarks, growth prospects, and macroeconomic conditions. Their insights help investors assess whether the market is accurately pricing assets.

-

Comparison of current valuations to historical averages: Comparing current market valuations to historical averages helps determine whether valuations are unusually high or low. This context is crucial in evaluating potential risks and opportunities.

-

Discussion of potential factors driving high valuations: Low interest rates, technological advancements, and strong corporate earnings can all contribute to high stock valuations. Understanding these drivers is crucial to judging whether current valuations are sustainable.

Strategies for Managing Investor Anxiety and Portfolio Risk

Based on BofA's analysis, investors can employ several strategies to manage their portfolios during periods of high market valuations and uncertainty. These strategies focus on risk mitigation and diversification to reduce potential losses and volatility.

-

Diversification across asset classes: Diversifying investments across various asset classes (stocks, bonds, real estate, commodities) helps reduce overall portfolio risk. This spread reduces the impact of any single asset's poor performance.

-

Strategies for reducing portfolio volatility: Techniques such as dollar-cost averaging (investing a fixed amount regularly) and hedging (using financial instruments to protect against losses) can help manage portfolio volatility and mitigate investor anxiety.

-

Defensive investment options to consider: During times of uncertainty, investors may consider shifting towards more defensive investments, such as high-quality bonds or dividend-paying stocks, known for their relative stability.

-

Importance of a long-term investment strategy: Maintaining a long-term investment strategy is essential; short-term market fluctuations should not dictate long-term financial goals. This perspective helps mitigate investor anxiety caused by short-term market volatility.

-

The role of professional financial advice: Seeking guidance from a qualified financial advisor can be extremely beneficial. They can provide personalized advice based on your specific risk tolerance, financial goals, and the current market conditions, helping alleviate investor anxiety.

Conclusion

BofA's analysis highlights the significant impact of elevated stock market valuations and the resulting investor anxiety. The current economic environment demands a cautious yet proactive approach. By understanding BofA's assessment of market conditions and employing appropriate diversification and risk management strategies, investors can navigate this period of uncertainty more effectively. Don't let investor anxiety control your decisions. Use BofA's insights to address your concerns and develop a robust investment strategy to manage elevated stock market valuations effectively. Consider seeking professional financial advice to tailor a strategy that aligns with your individual financial goals and risk tolerance.

Featured Posts

-

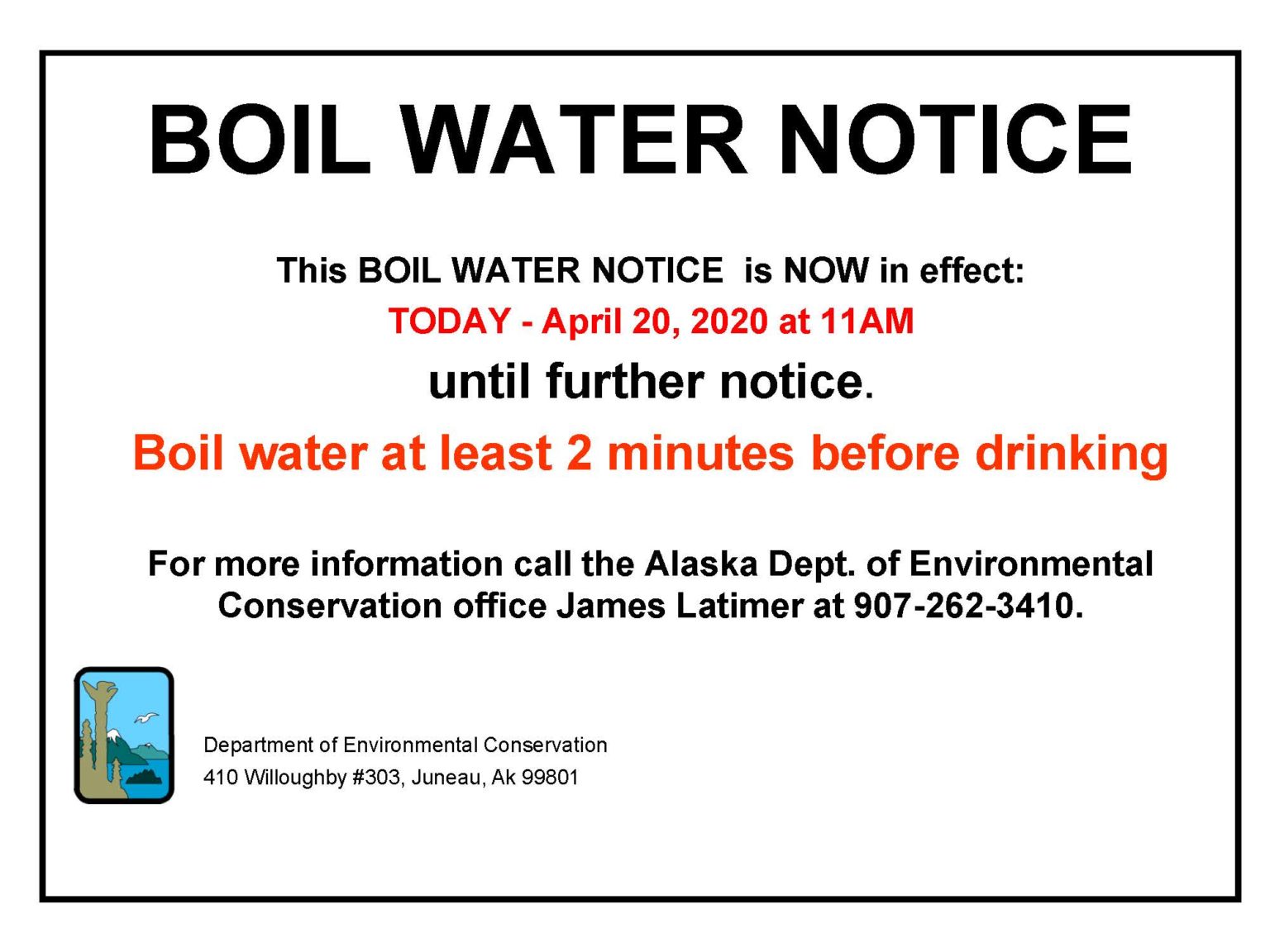

Pulaski County Boil Water Order In Effect Until Saturday

May 16, 2025

Pulaski County Boil Water Order In Effect Until Saturday

May 16, 2025 -

Mlb Dfs Lineup Advice May 8th Sleeper Picks And Hitter Projections

May 16, 2025

Mlb Dfs Lineup Advice May 8th Sleeper Picks And Hitter Projections

May 16, 2025 -

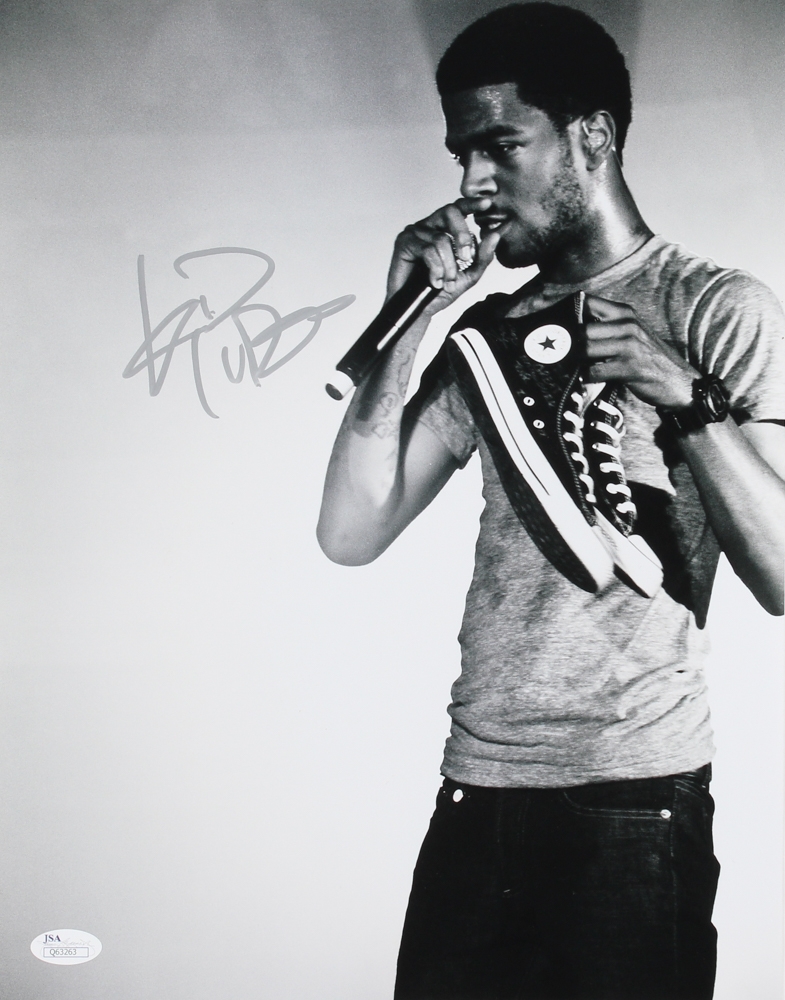

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 16, 2025

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 16, 2025 -

Georgia Southwestern State University Campus Incident Resolved All Clear

May 16, 2025

Georgia Southwestern State University Campus Incident Resolved All Clear

May 16, 2025 -

The Biden Warren Exchange A Look At The Debate Over Mental Fitness

May 16, 2025

The Biden Warren Exchange A Look At The Debate Over Mental Fitness

May 16, 2025