Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's stance on current stock market valuations is cautiously optimistic. While acknowledging the historically high valuations, they don't necessarily predict an imminent crash. Their assessment is nuanced, considering both the positive and negative factors driving current market conditions.

-

Key Metrics Used: BofA employed several key metrics to assess valuations, including the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and various sector-specific valuation ratios. These metrics provide a comprehensive picture of market valuation relative to historical trends and projected earnings.

-

Interest Rates' Role: BofA recognizes the significant impact of historically low interest rates on stock valuations. Low rates make borrowing cheaper for companies and encourage investors to seek higher returns in the stock market, thus driving up prices. Changes in interest rate policy are a key factor to watch for potential shifts in market valuations.

-

Sector-Specific Analysis: BofA's analysis likely highlighted specific sectors as either overvalued or undervalued. For example, certain technology sectors might be deemed overvalued due to high growth expectations, while others, like energy or financials, might appear comparatively undervalued depending on their growth projections and current market conditions. Understanding this sector-specific analysis is crucial for portfolio diversification.

Understanding the Drivers Behind Elevated Valuations

Several factors contribute to the current high stock market valuations:

-

Low Interest Rates: The prolonged period of low interest rates, a result of accommodative monetary policy by central banks, has pushed investors towards higher-yielding assets, including stocks. This increased demand has fueled price increases and contributed to elevated valuations.

-

Quantitative Easing (QE): QE programs, involving central banks purchasing government bonds and other assets, have injected significant liquidity into the market, further contributing to higher stock prices. This injection of capital increases the money supply, potentially driving up asset prices across the board.

-

Strong Corporate Earnings (and Expectations): While some sectors experienced a downturn, strong corporate earnings, particularly in certain technology sectors, have supported elevated valuations. Furthermore, positive expectations for future earnings growth also play a significant role in driving stock prices.

-

Investor Sentiment: Positive investor sentiment, fueled by factors like low interest rates and strong corporate earnings, can create a "fear of missing out" (FOMO) effect, leading to further price increases and potentially unsustainable valuations.

-

Technological Advancements: The continuous innovation and growth potential within the technology sector, along with the increasing adoption of new technologies across various industries, contributes to investor optimism and high valuations for many tech-related companies.

Risks Associated with High Stock Market Valuations

Investing in a market with elevated stock market valuations presents several risks:

-

Market Corrections/Crashes: High valuations increase the vulnerability of the market to corrections or even crashes. A sudden shift in investor sentiment or unexpected negative news could trigger a sharp decline in prices.

-

Lower Future Returns: Stocks purchased at historically high valuations are likely to generate lower returns in the future compared to those purchased at lower valuations. This is a key concern for long-term investors.

-

Rising Interest Rates: A rise in interest rates can negatively impact stock valuations. Higher rates increase borrowing costs for companies and make bonds a more attractive alternative for investors, potentially leading to a decline in stock prices.

-

Economic Downturns/Geopolitical Events: Elevated valuations make the market more vulnerable to economic downturns or geopolitical events. Uncertainties can trigger a sell-off, leading to significant losses.

Strategies for Navigating Elevated Stock Market Valuations

Based on BofA's assessment and the inherent risks associated with high stock market valuations, investors should consider the following strategies:

-

Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk. Don't put all your eggs in one basket.

-

Value Investing: Consider value investing approaches, focusing on companies trading below their intrinsic value. This strategy can potentially offer better long-term returns compared to investing in overvalued growth stocks.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon can help ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

-

Portfolio Re-allocation: Re-evaluate your portfolio allocation based on your risk tolerance. Consider shifting towards less risky assets if you are concerned about high valuations.

-

Professional Financial Advice: Seek advice from a qualified financial advisor who can help you develop a personalized investment strategy tailored to your individual circumstances and risk tolerance.

Conclusion

BofA's analysis of elevated stock market valuations highlights a cautiously optimistic outlook, acknowledging both the potential for continued growth and the significant risks involved. Understanding the factors driving these high valuations, along with the potential downsides, is crucial for informed investment decisions. By employing diversification strategies, considering value investing, maintaining a long-term horizon, and seeking professional advice, investors can better navigate the current market landscape and manage their portfolios effectively. Understanding and addressing concerns around elevated stock market valuations is crucial for long-term success. Stay informed about market trends and consult with financial professionals for personalized guidance.

Featured Posts

-

Richmond Man Sentenced For Hiding Gun Near 6 Year Old Nephew

Apr 30, 2025

Richmond Man Sentenced For Hiding Gun Near 6 Year Old Nephew

Apr 30, 2025 -

Yates And Dr Jessica Johnson A Powerful Black History Lesson

Apr 30, 2025

Yates And Dr Jessica Johnson A Powerful Black History Lesson

Apr 30, 2025 -

Ftcs Case Against Meta Latest Updates On Instagram And Whats App

Apr 30, 2025

Ftcs Case Against Meta Latest Updates On Instagram And Whats App

Apr 30, 2025 -

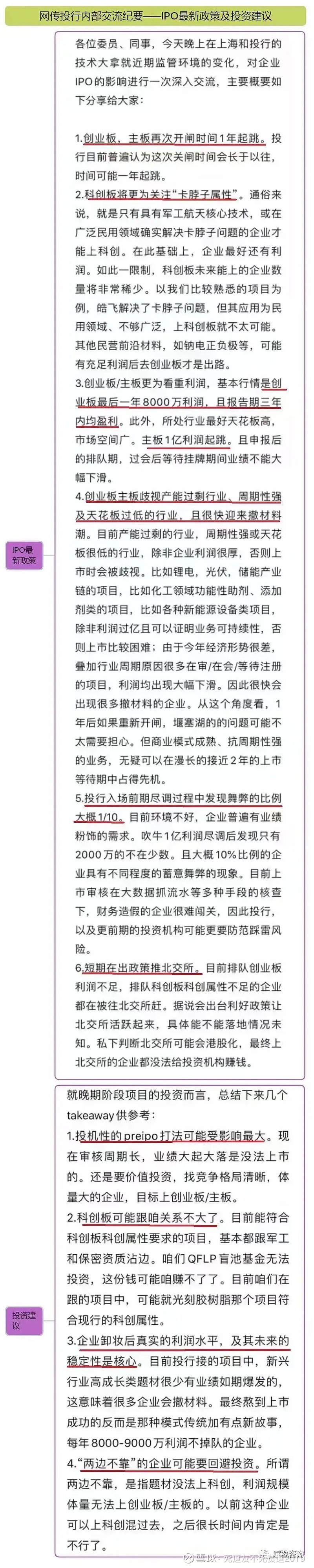

Ipo

Apr 30, 2025

Ipo

Apr 30, 2025 -

Rapport Amf Kering 2025 E1021784 Publication Du 24 Fevrier 2025

Apr 30, 2025

Rapport Amf Kering 2025 E1021784 Publication Du 24 Fevrier 2025

Apr 30, 2025

Latest Posts

-

Ithrottir I Bonus Deildinni Meistaradeildar Og Nba Leikadagskra

Apr 30, 2025

Ithrottir I Bonus Deildinni Meistaradeildar Og Nba Leikadagskra

Apr 30, 2025 -

M Buzelis Ir Jo Tylejimas Vilniaus Savu Vardu Turnyro Ivykiai

Apr 30, 2025

M Buzelis Ir Jo Tylejimas Vilniaus Savu Vardu Turnyro Ivykiai

Apr 30, 2025 -

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025 -

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025 -

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025