Addressing Investor Concerns: BofA On Stretched Stock Market Valuations

Table of Contents

BofA's Key Findings on Stretched Valuations

BofA's report highlights significantly elevated stock market valuations, exceeding historical averages in many sectors. They utilize key stock valuation metrics, such as the price-to-earnings ratio (P/E) and the price-to-sales ratio (P/S), to assess market overvaluation. These metrics compare a company's stock price to its earnings and sales, respectively, providing insight into how expensively a company is valued relative to its performance.

-

BofA's assessment of current P/E ratios across various sectors: The report reveals that P/E ratios across numerous sectors are considerably higher than their long-term averages, suggesting potential overvaluation. Certain growth sectors, in particular, exhibit exceptionally high P/E ratios, raising concerns about their sustainability.

-

Comparison of current valuations to historical averages and previous market peaks: BofA's analysis compares current market capitalization and valuation multiples to historical data, including periods preceding previous market corrections. This comparison reveals a significant divergence from historical norms, signifying a heightened risk of a market downturn.

-

Specific examples of overvalued sectors or individual stocks identified by BofA: While BofA hasn't explicitly named specific stocks, their report indicates certain technology and growth-focused sectors are showing particularly elevated valuations, making them potentially vulnerable in a market correction.

Underlying Factors Contributing to Stretched Valuations

Several economic and market factors have contributed to the current stretched valuations. Understanding these factors is critical for assessing the sustainability of current market levels.

-

The impact of low interest rates on investor behavior and stock prices: Prolonged periods of low interest rates incentivize investors to seek higher returns in riskier assets, such as stocks, driving up demand and prices. This has pushed valuations to historically high levels.

-

The role of quantitative easing and monetary policy in driving asset prices: Central banks' policies, like quantitative easing (QE), have injected vast amounts of liquidity into the market, further inflating asset prices and contributing to elevated valuations.

-

The influence of inflation expectations on market valuations: Rising inflation expectations can impact stock valuations. While some inflation can be beneficial for corporate profits, high or unexpected inflation can erode investor confidence and potentially lead to market corrections.

-

The effect of positive economic growth forecasts (or lack thereof) on investor sentiment: Positive economic growth forecasts generally support higher stock valuations, while negative forecasts or economic uncertainty can lead to lower valuations and increased market volatility.

The Impact of Geopolitical Uncertainty

Geopolitical uncertainty significantly impacts investor sentiment and market valuations. The current global landscape is characterized by heightened uncertainty, which contributes to market volatility.

-

Examples of recent geopolitical events affecting markets: Recent events such as the war in Ukraine, rising tensions between major global powers, and supply chain disruptions have introduced significant uncertainty into the market.

-

The impact of these events on investor confidence and risk appetite: These events can erode investor confidence, causing a flight to safety and potentially leading to market declines. Risk appetite decreases, impacting investor willingness to hold riskier assets.

-

The potential for increased market volatility due to these factors: Geopolitical instability inherently increases market volatility, creating a more challenging environment for investors.

Strategies for Navigating Stretched Valuations

Given BofA's concerns, investors need to adopt robust risk management strategies to protect their portfolios.

-

The importance of diversification across asset classes: Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk. This reduces the impact of any single asset's underperformance.

-

Strategies for identifying undervalued stocks or sectors (value investing): Value investing focuses on identifying companies trading below their intrinsic value. This strategy can help investors find opportunities even in an overvalued market.

-

Approaches to reducing exposure to potentially overvalued assets: Investors should consider reducing their exposure to sectors or individual stocks exhibiting exceptionally high valuations, shifting towards more conservatively valued assets.

-

Considering a more defensive investment approach: A defensive investment strategy focuses on preserving capital and minimizing losses during market downturns. This may involve shifting to lower-risk investments like high-quality bonds.

-

Importance of a well-defined asset allocation strategy: A well-defined asset allocation strategy is crucial. It should align with your risk tolerance, investment goals, and time horizon, allowing for adjustments based on market conditions.

Conclusion

BofA's warning about stretched stock market valuations underscores the need for careful risk management. Several factors, including low interest rates, quantitative easing, inflation expectations, and geopolitical uncertainty, have contributed to elevated valuations. Investors should consider diversifying their portfolios, adopting a more defensive approach if needed, and focusing on identifying undervalued assets. Don't ignore the warning signs. Develop a robust investment strategy to navigate these stretched stock market valuations and seek professional financial advice to tailor your approach to your specific circumstances.

Featured Posts

-

Goldman Sachs Offers Exclusive Guidance On Tariffs A Trump Administration Strategy

Apr 29, 2025

Goldman Sachs Offers Exclusive Guidance On Tariffs A Trump Administration Strategy

Apr 29, 2025 -

Perplexity Vs Google A Ceos Perspective On The Future Of Ai Browsers

Apr 29, 2025

Perplexity Vs Google A Ceos Perspective On The Future Of Ai Browsers

Apr 29, 2025 -

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025 -

Elite Universities Unite A Private Collective Challenges The Trump Administration

Apr 29, 2025

Elite Universities Unite A Private Collective Challenges The Trump Administration

Apr 29, 2025 -

Willie Nelson New Album Release And Family Controversy

Apr 29, 2025

Willie Nelson New Album Release And Family Controversy

Apr 29, 2025

Latest Posts

-

New Music From Willie Nelson The Oh What A Beautiful World Album

Apr 29, 2025

New Music From Willie Nelson The Oh What A Beautiful World Album

Apr 29, 2025 -

Willie Nelson Announces Oh What A Beautiful World Album Release

Apr 29, 2025

Willie Nelson Announces Oh What A Beautiful World Album Release

Apr 29, 2025 -

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

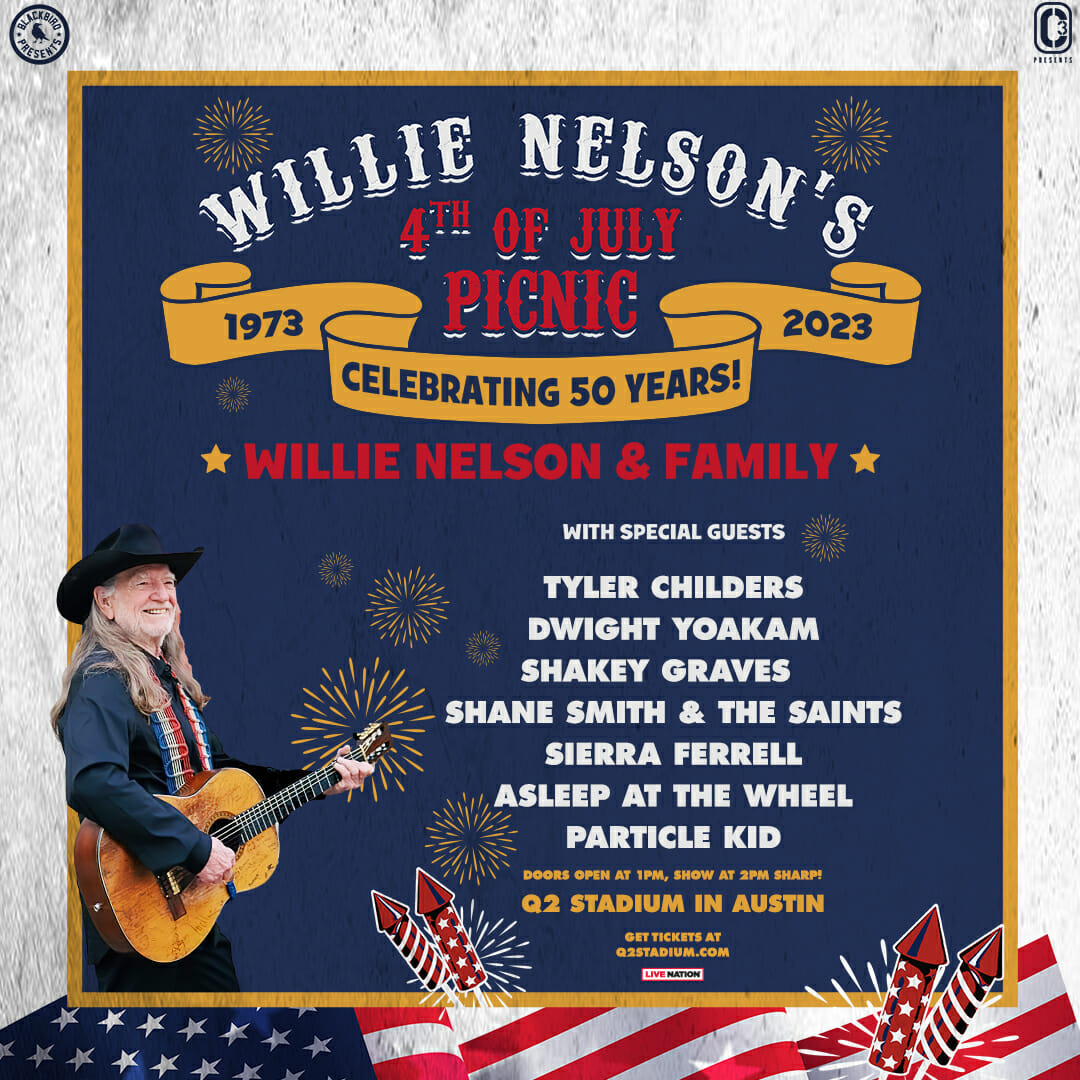

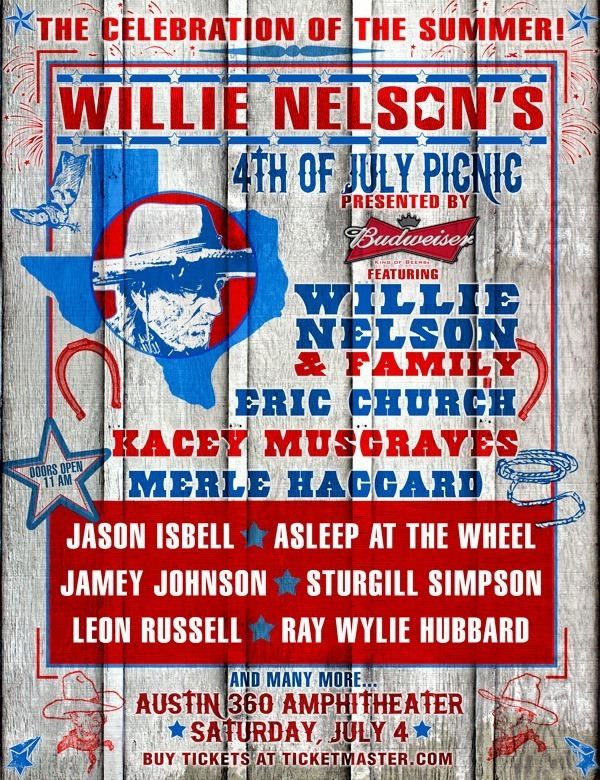

Get Ready Texas Willie Nelsons 4th Of July Picnic Is Back

Apr 29, 2025

Get Ready Texas Willie Nelsons 4th Of July Picnic Is Back

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025