Addressing Investor Concerns: BofA's Take On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall view on current high stock market valuations is nuanced. While acknowledging the elevated levels, they haven't necessarily declared an imminent market crash. Instead, their reports suggest a cautious optimism, highlighting potential risks while also pointing to factors that could support continued, albeit potentially slower, growth. The sustainability of these valuations, however, remains a key point of discussion.

-

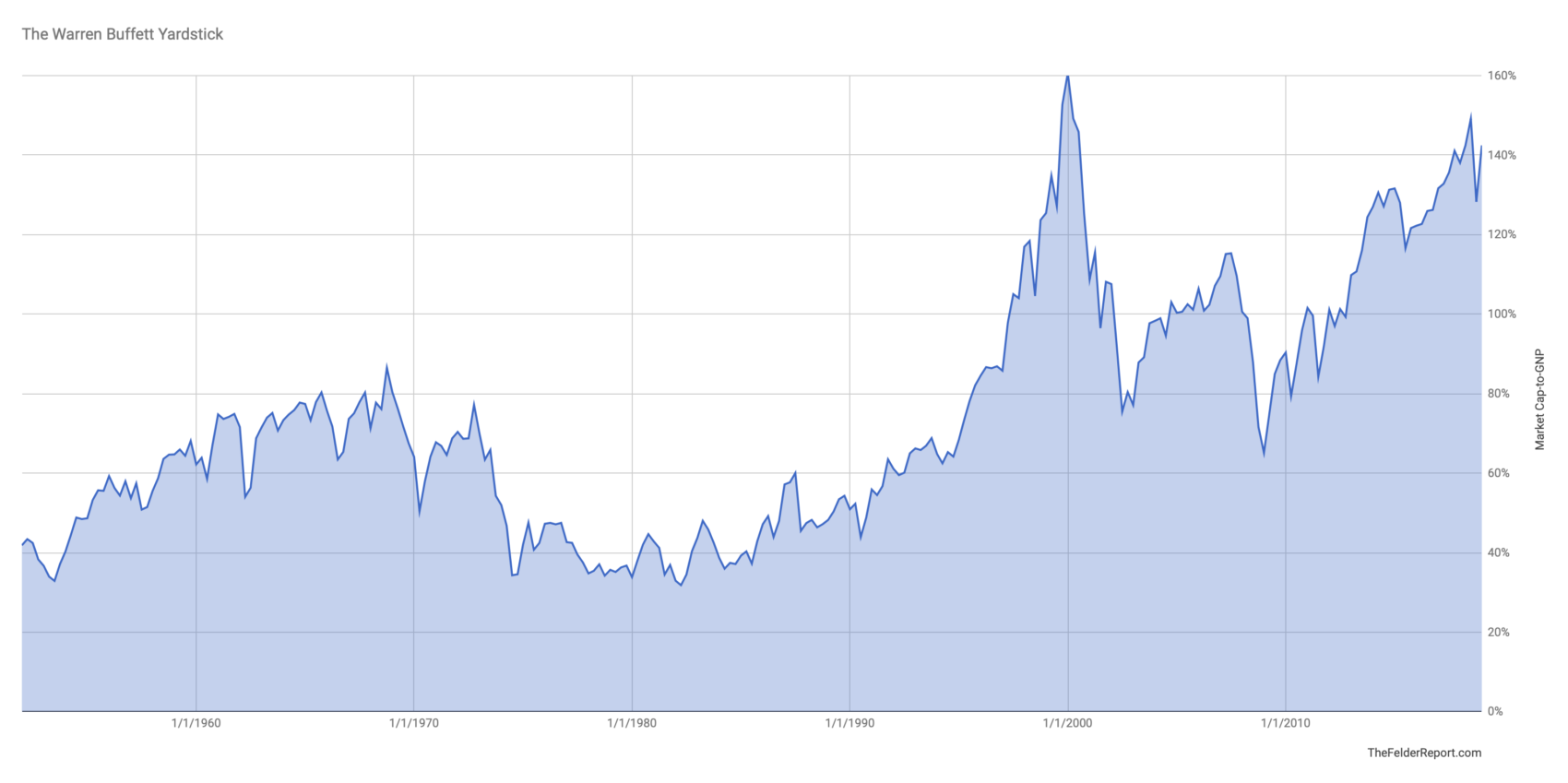

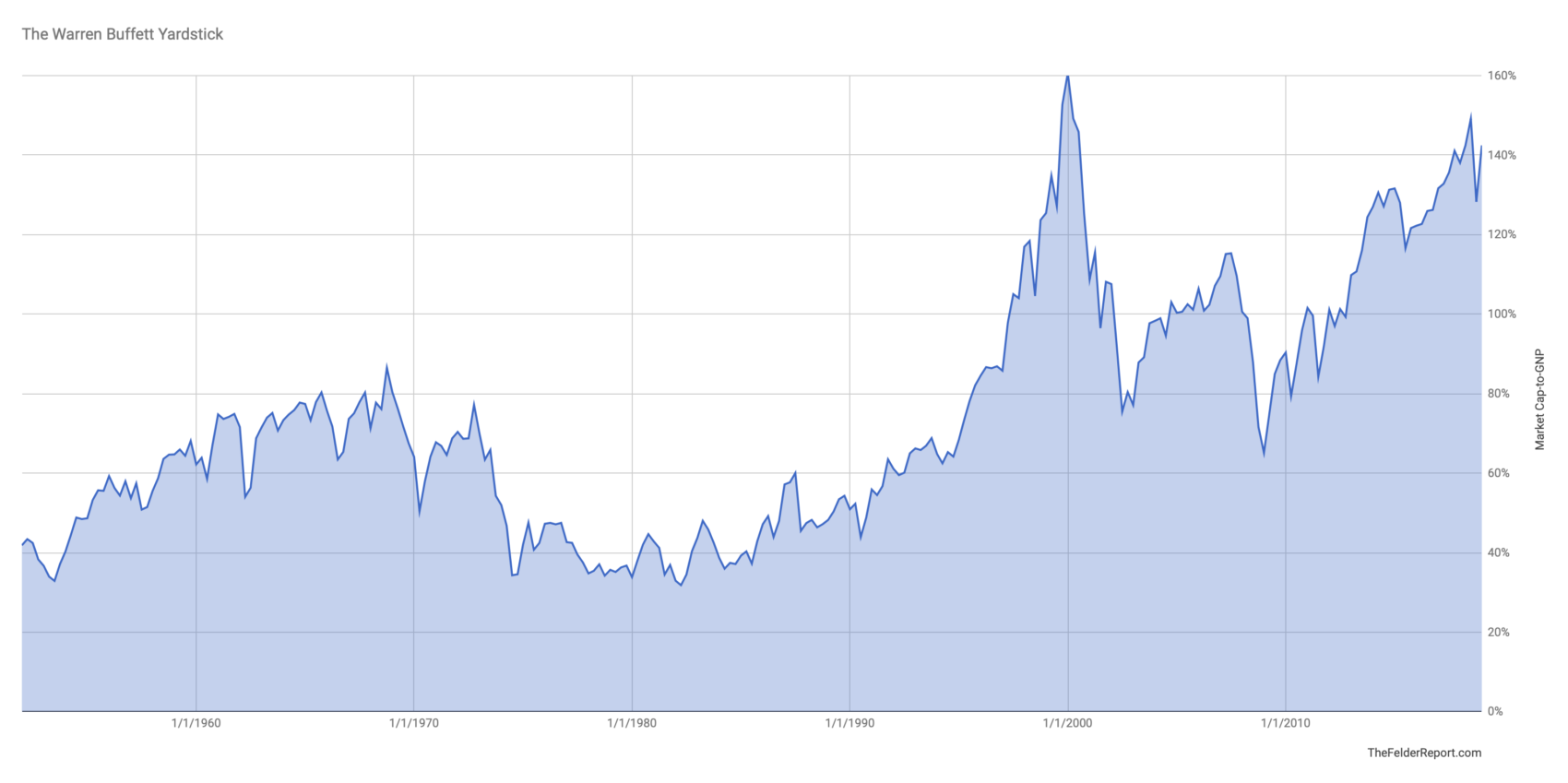

Specific BofA Reports: BofA's research reports, often available to clients and summarized in public-facing materials, frequently address market valuations. These reports often analyze factors like price-to-earnings ratios (P/E ratios), cyclically adjusted price-to-earnings ratios (CAPE ratios), and other valuation metrics to assess market health. Look for reports focusing on "market outlook" or "investment strategy" for detailed analyses.

-

Key Economic Indicators: BofA's analysis incorporates various key economic indicators. These include inflation rates (CPI and PCE), interest rate movements (Federal Funds Rate, bond yields), and earnings growth across different sectors. High inflation, for instance, can impact future earnings expectations and thus, valuations. Rising interest rates generally increase borrowing costs for companies and can cool down market exuberance. Strong earnings growth, conversely, can justify higher valuations.

-

Sector-Specific Analysis: BofA's research often highlights specific sectors that appear overvalued or undervalued based on their analysis. This might involve identifying technology stocks trading at significantly high multiples compared to historical averages or certain cyclical sectors looking undervalued given their future earnings potential.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations, many of which are interconnected. BofA's analysis likely emphasizes the following:

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and encouraged investors to seek higher returns in the stock market, pushing up prices. This low-cost capital fuels growth and can inflate asset prices.

-

Strong Corporate Earnings (or Potential): Strong corporate earnings or the anticipation of strong future earnings can justify higher stock prices. Companies exceeding expectations boost investor confidence and drive demand for their shares.

-

Increased Market Liquidity: Abundant liquidity in the market, often a result of central bank policies, can inflate asset prices by increasing the buying power of investors.

-

Technological Advancements: The rapid pace of technological innovation fuels growth in certain sectors, leading to higher valuations for companies at the forefront of these advancements. The potential for disruptive technologies to reshape industries often translates to higher risk premiums and valuations.

-

Geopolitical Factors: Global events and geopolitical uncertainty can also influence market valuations. Investors often seek safety in assets perceived as less risky during periods of uncertainty, potentially pushing up valuations in certain sectors while depressing others.

BofA's Recommended Strategies for Investors

Given the current high stock market valuations, BofA likely advises a balanced and cautious approach. Their recommended strategies might include:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the overall portfolio risk. This diversification strategy is crucial in a market with elevated valuations where the potential for a correction is higher.

-

Value vs. Growth Investing: Depending on their analysis of specific sectors, BofA might favor a value investing approach (focusing on undervalued companies) or a more cautious growth approach (selecting companies with strong future growth potential but at more reasonable valuations).

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market volatility and benefit from the long-term growth potential of the market.

-

Tactical Asset Allocation: BofA may suggest tactical asset allocation adjustments, meaning shifting investment allocations between different asset classes based on market conditions and the firm's outlook.

-

Alternative Investments: Exploring alternative investments like private equity or infrastructure could offer diversification benefits and potentially higher returns, although often with less liquidity.

Managing Risk in a High-Valuation Market

Effectively managing risk is paramount in a market characterized by high stock market valuations. BofA's advice will likely emphasize:

-

Regular Portfolio Rebalancing: Regularly rebalancing the portfolio to maintain the desired asset allocation helps to control risk and capitalize on market fluctuations.

-

Individual Stock Valuation: Careful analysis of individual stock valuations, beyond just market indices, is essential to identify potentially overvalued or undervalued companies.

-

Inflation's Impact: Understanding the impact of inflation on investment returns is critical. Inflation erodes purchasing power and can affect the real returns of investments.

-

Professional Financial Advice: Seeking professional financial advice from a qualified advisor is crucial for tailoring an investment strategy that aligns with individual risk tolerance and financial goals.

Conclusion

Bank of America's analysis of high stock market valuations provides valuable insights for investors. Understanding the factors contributing to these valuations, along with BofA's recommended strategies, is crucial for navigating the current market. By carefully considering diversification, risk management, and long-term investment horizons, investors can better position themselves for success even in a market characterized by high stock market valuations. Remember to consult with a financial advisor to create a personalized investment plan that addresses your specific needs and risk tolerance when dealing with these high stock market valuations. Don't underestimate the importance of understanding the complexities of high stock market valuations and the strategies to mitigate associated risks.

Featured Posts

-

The Osimhen Transfer Saga Manchester Uniteds Financial Constraints

Apr 26, 2025

The Osimhen Transfer Saga Manchester Uniteds Financial Constraints

Apr 26, 2025 -

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025 -

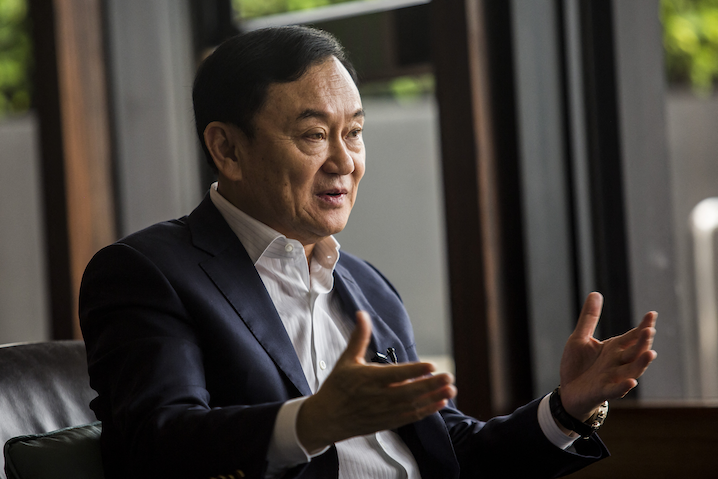

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025 -

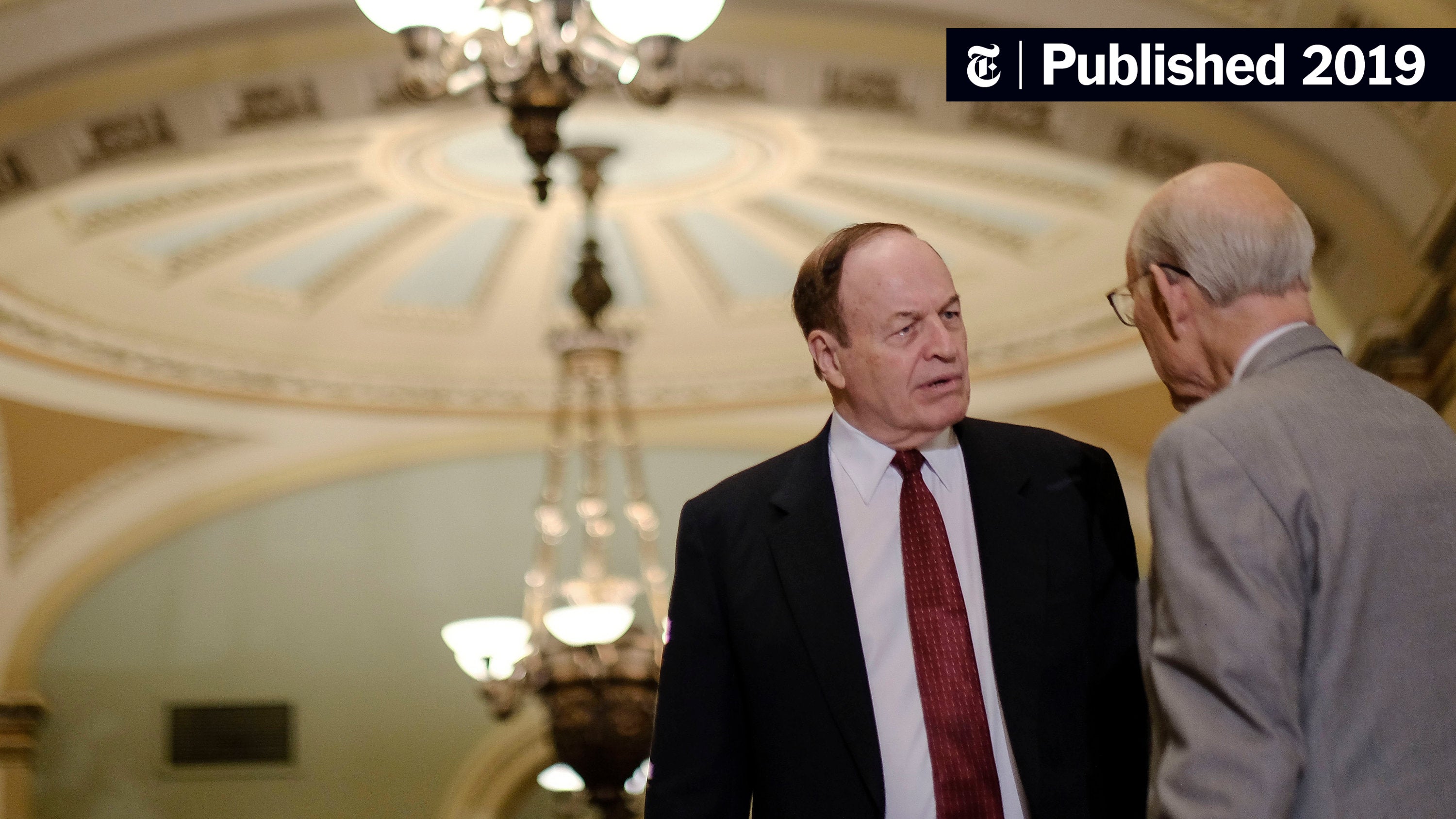

Changes To Federal Disaster Relief Qualification Under Trump

Apr 26, 2025

Changes To Federal Disaster Relief Qualification Under Trump

Apr 26, 2025 -

Town Hall Tensions Voters Grill Representatives From Both Parties

Apr 26, 2025

Town Hall Tensions Voters Grill Representatives From Both Parties

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025