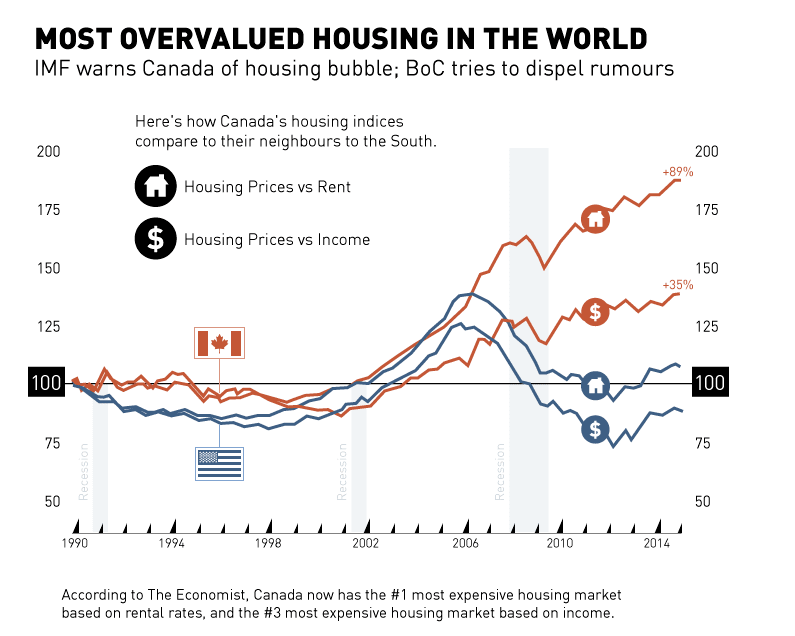

Affordable Housing In Canada: The Down Payment Dilemma

Table of Contents

Understanding the Down Payment Requirements in Canada

The down payment required for a mortgage in Canada depends heavily on the purchase price of the home. These percentages are regulated and designed to mitigate risk for lenders.

-

Homes priced under $500,000: Require a minimum down payment of 5% on the first $500,000. However, this means a larger percentage of the purchase price is needed as a down payment the closer to $500,000 the home's value is. This lower down payment option can also increase your monthly mortgage payment significantly.

-

Homes priced over $500,000: Require a minimum down payment of 5% on the first $500,000 and 10% on the portion exceeding $500,000. For example, a $700,000 home would require a $50,000 down payment (5% of $500,000) plus $20,000 (10% of $200,000), totaling $70,000.

CMHC Insurance: The Canada Mortgage and Housing Corporation (CMHC) insures mortgages with down payments below 20%. This insurance protects lenders against potential losses if the borrower defaults. While CMHC insurance allows for smaller down payments, it increases the overall cost of the mortgage through added premiums.

- Higher down payments lead to lower mortgage insurance premiums. The more you put down, the less risk the lender perceives, resulting in lower premiums.

- Lower down payments require CMHC insurance, increasing overall costs. These costs are factored into your monthly mortgage payments.

- Different lenders may have varying down payment requirements. While CMHC sets minimum standards, individual lenders might have stricter policies.

Strategies to Save for a Down Payment on Affordable Housing

Saving for a down payment requires discipline and a strategic approach. Several avenues can help you accelerate your savings journey.

High-yield savings accounts offer competitive interest rates, helping your money grow faster. Tax-Free Savings Accounts (TFSAs) allow you to save tax-free, while Registered Retirement Savings Plans (RRSPs) offer tax deductions on contributions, though there are specific rules on withdrawing these funds for a down payment.

The Home Buyers' Plan (HBP) is a government program that allows first-time homebuyers to withdraw up to $35,000 from their RRSPs tax-free to help with a down payment. Remember to repay the withdrawal within 15 years.

- Create a realistic budget and track expenses: Identify areas where you can cut back.

- Automate savings through regular contributions: Set up automatic transfers from your chequing to your savings account.

- Explore alternative income streams (part-time jobs, side hustles): Supplement your income to boost your savings rate.

- Reduce unnecessary expenses to accelerate savings: Minimize eating out, entertainment costs, or subscriptions to speed up the process.

Government Programs and Initiatives for Affordable Housing

Several federal and provincial programs assist first-time homebuyers in Canada. These programs often focus on affordability and aim to make homeownership more accessible.

The First-Time Home Buyers' Incentive is a federal program offering shared equity mortgages, reducing the amount you need for a down payment. Provincial governments also offer various programs, including grants, tax rebates, and land transfer tax exemptions. It’s crucial to check your province's specific initiatives.

- Eligibility criteria for each program: Income limits, residency requirements, and other conditions vary depending on the program.

- Application process and required documentation: Each program has a unique application procedure and needs different supporting documentation.

- Potential limitations and restrictions: Understand any restrictions on the type of property you can purchase or the location.

- Links to relevant government websites: Research the specific programs available in your province via the relevant government websites.

Exploring Alternative Housing Options

If securing a down payment for a detached home in a major city proves challenging, consider alternative options that can make homeownership more affordable.

Smaller cities or rural areas often have significantly lower property prices, allowing you to buy a larger home for the same down payment. Condos and townhouses typically have lower purchase prices than detached homes, although condo fees need to be factored into your budget.

Co-ownership or shared equity programs allow you to buy a property with others, sharing the down payment and mortgage responsibilities.

- Lower purchase prices in less competitive markets: Explore areas outside major city centers.

- Trade-offs between location and property size: Weigh the pros and cons of location versus space.

- Community aspects of different housing types: Consider condo living versus the privacy of a detached home.

- Financial implications of various ownership structures: Understand the legal and financial implications of co-ownership or shared equity.

Conclusion

Securing affordable housing in Canada requires careful planning and a realistic understanding of down payment requirements. By exploring various savings strategies, leveraging government programs, and considering alternative housing options, you can significantly increase your chances of achieving your homeownership goals. Remember to research thoroughly and seek professional financial advice to make informed decisions. Start planning your path towards affordable housing in Canada today!

Featured Posts

-

Nhl 2025 Post Trade Deadline Playoff Contenders And Predictions

May 09, 2025

Nhl 2025 Post Trade Deadline Playoff Contenders And Predictions

May 09, 2025 -

Solve The Nyt Spelling Bee April 9 2025 Hints And Answers

May 09, 2025

Solve The Nyt Spelling Bee April 9 2025 Hints And Answers

May 09, 2025 -

Fentanyl Crisis Record Seizure Highlights Ongoing Struggle

May 09, 2025

Fentanyl Crisis Record Seizure Highlights Ongoing Struggle

May 09, 2025 -

Gambling On Catastrophe Analyzing The La Wildfires Betting Market

May 09, 2025

Gambling On Catastrophe Analyzing The La Wildfires Betting Market

May 09, 2025 -

Alpine Bosss Stern Warning To Doohan F1 News

May 09, 2025

Alpine Bosss Stern Warning To Doohan F1 News

May 09, 2025