Airline Industry Reels Under Pressure From Soaring Oil Prices

Table of Contents

The Direct Impact of High Oil Prices on Airline Operations

Increased Fuel Costs as a Major Expense

Fuel costs constitute a substantial portion of an airline's operating budget, often exceeding 20%. Recent data shows a staggering increase in aviation fuel prices – upwards of 50% year-on-year in some regions – placing immense pressure on airline profitability.

- Percentage Increase: Specific examples vary by region and airline, but increases of 30-60% are not uncommon.

- Budget Impact: Fuel is typically the second-largest expense after labor for most airlines. This massive increase directly impacts bottom lines.

- Airline Examples: Airlines like Ryanair and Delta have publicly acknowledged the significant impact of rising fuel costs on their financial performance, impacting their quarterly reports. Smaller airlines, with less financial resilience, are particularly vulnerable.

Strategic Route Adjustments and Flight Frequency Reductions

Faced with escalating fuel costs, airlines are forced to make difficult decisions regarding their route networks and flight schedules. Less profitable routes are being cut, and flight frequencies on others are being reduced.

- Route Cuts: Airlines are prioritizing high-demand, high-revenue routes, resulting in the elimination of less lucrative services.

- Reduced Frequency: To reduce fuel consumption, airlines may choose to fly fewer planes on popular routes, impacting passenger convenience and potentially causing flight delays.

- Airline Examples: Several airlines have announced route reductions and consolidated their flight schedules in response to soaring fuel costs.

Impact on Cargo Operations

The surge in aviation fuel prices significantly impacts air freight, increasing shipping costs and affecting global supply chains. Businesses relying on air cargo for timely delivery face increased expenses and potential delays.

- Increased Costs: Higher fuel costs translate directly into increased shipping charges for businesses using air freight, impacting their profitability and competitiveness.

- Delays and Shortages: Reduced flight frequencies and route cancellations can lead to delays and shortages of goods transported by air, disrupting supply chains globally.

- Global Supply Chain Impacts: Industries heavily reliant on air freight, such as pharmaceuticals and technology, are particularly vulnerable to disruptions caused by rising fuel costs.

The Ripple Effect: Consequences for Passengers and the Wider Economy

Rising Air Ticket Prices

The increased operating costs, primarily driven by fuel prices, are inevitably passed on to passengers in the form of higher air ticket prices. This impacts both leisure and business travel.

- Increased Airfares: Passengers can expect to pay significantly more for air travel, impacting travel plans and budgets.

- Impact on Leisure Travel: Higher fares might deter some leisure travelers, particularly budget-conscious individuals, reducing demand.

- Impact on Business Travel: Companies may reduce business travel to cut costs, affecting business relationships and productivity.

Economic Implications Beyond the Airline Industry

The ripple effect of soaring oil prices extends beyond the airline industry, affecting tourism, hospitality, and related sectors.

- Tourism Impact: Reduced air travel due to higher prices can negatively impact tourism destinations, leading to reduced revenue for hotels, restaurants, and other businesses.

- Job Losses: The airline industry, and the businesses supporting it, may face job losses as airlines downsize operations and cut costs.

- Broader Economic Consequences: Reduced air travel can negatively affect global economic activity, reducing trade and investment.

The Search for Sustainable Aviation Fuel (SAF)

The high reliance on traditional jet fuel makes the airline industry vulnerable to price volatility. Sustainable Aviation Fuel (SAF) offers a potential long-term solution.

- SAF Role: SAF, derived from sustainable sources like used cooking oil and agricultural waste, can reduce dependence on fossil fuels and mitigate future fuel price shocks.

- Challenges and Opportunities: The production and adoption of SAF face challenges, including scalability, cost, and infrastructure development.

- Government Initiatives and Industry Collaboration: Governments and industry players are actively promoting SAF development and adoption through investment, subsidies, and research initiatives.

Strategies for Airlines to Navigate the Crisis

Fuel Hedging Strategies

Airlines employ fuel hedging strategies to mitigate the risk of volatile fuel prices. These strategies involve purchasing fuel contracts at fixed prices.

- Hedging Techniques: Various techniques exist, including futures contracts, options, and swaps.

- Pros and Cons: Hedging can protect against price increases but also limits potential benefits if prices decline.

- Examples: Successful hedging strategies can significantly reduce the impact of price fluctuations, while unsuccessful ones can amplify losses.

Operational Efficiency Improvements

Airlines are exploring various ways to improve operational efficiency to reduce fuel consumption and manage costs.

- Route Optimization: Careful planning of flight routes and altitudes can significantly reduce fuel consumption.

- Aircraft Maintenance: Well-maintained aircraft are more fuel-efficient.

- Crew Scheduling: Optimized crew scheduling can reduce idle time and fuel burn.

- Technology’s Role: Advanced technologies, such as predictive maintenance and flight optimization software, are crucial for efficient operations and fuel savings.

Government Support and Policy Interventions

Governments worldwide are considering measures to support the airline industry during this challenging period.

- Tax Breaks: Tax breaks or reductions in aviation fuel taxes can provide relief to airlines.

- Subsidies: Direct financial assistance to airlines can help them overcome the immediate impact of high fuel prices.

- Intervention Effectiveness: The effectiveness of government interventions varies depending on the specific measures implemented and the economic context.

Conclusion

The soaring oil prices present a severe challenge to the airline industry, impacting operational costs, ticket prices, and the wider economy. Airlines are responding with route adjustments, increased fares, and a renewed focus on operational efficiency and sustainable fuel sources. However, the long-term effects of this crisis remain uncertain.

Call to Action: Understanding the impact of soaring oil prices on the airline industry is crucial for both passengers and industry stakeholders. Stay informed about the latest developments and consider the long-term implications for air travel and the global economy. Continue reading to learn more about the airline industry’s struggle with oil prices and the potential solutions being explored.

Featured Posts

-

Epic Games And Fortnite Another Lawsuit Over In App Purchases

May 03, 2025

Epic Games And Fortnite Another Lawsuit Over In App Purchases

May 03, 2025 -

Tensions Rise Tory Chairmans Clash With Reform Uk Over Populism

May 03, 2025

Tensions Rise Tory Chairmans Clash With Reform Uk Over Populism

May 03, 2025 -

Mental Health Courses By Government Ignou Tiss Nimhans And More

May 03, 2025

Mental Health Courses By Government Ignou Tiss Nimhans And More

May 03, 2025 -

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 03, 2025

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 03, 2025 -

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025

Latest Posts

-

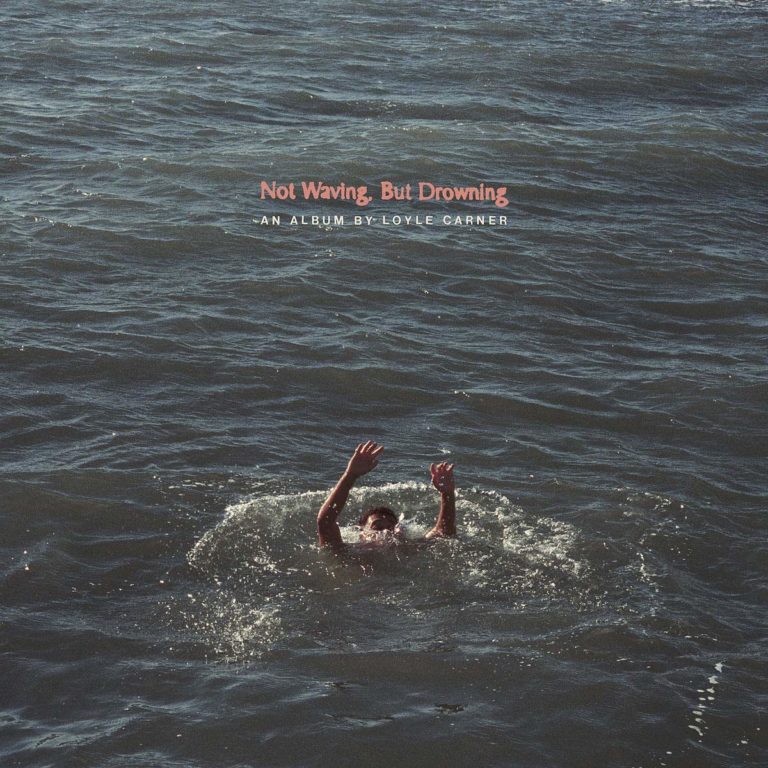

3 Arena Loyle Carner Live In Dublin

May 03, 2025

3 Arena Loyle Carner Live In Dublin

May 03, 2025 -

Loyle Carner Fatherhood Influences New Music And Glastonbury Set

May 03, 2025

Loyle Carner Fatherhood Influences New Music And Glastonbury Set

May 03, 2025 -

Loyle Carners Glastonbury Performance And New Music A Fathers Perspective

May 03, 2025

Loyle Carners Glastonbury Performance And New Music A Fathers Perspective

May 03, 2025 -

A Grieving Familys Tribute To Poppy A Beloved Manchester United Fan

May 03, 2025

A Grieving Familys Tribute To Poppy A Beloved Manchester United Fan

May 03, 2025 -

Loyle Carner Fatherhood New Album And Glastonbury

May 03, 2025

Loyle Carner Fatherhood New Album And Glastonbury

May 03, 2025