Airlines Face Headwinds: Navigating The Impact Of Oil Supply Disruptions

Table of Contents

Soaring Fuel Costs and Their Impact on Airline Profitability

The relationship between oil prices and airline operating costs is undeniable. A sharp increase in crude oil prices translates almost directly into higher fuel costs for airlines. This has a cascading effect across the industry, impacting everything from ticket prices and profit margins to route adjustments and long-term planning. The current instability in global oil markets, exacerbated by oil supply disruptions, makes accurate forecasting incredibly difficult, adding another layer of complexity for airline executives.

- Increased fuel surcharges passed onto consumers: Airlines often pass increased fuel costs onto consumers through higher ticket prices, impacting consumer demand, especially for price-sensitive travelers.

- Reduced profit margins impacting shareholder returns: Higher fuel costs directly eat into an airline's profit margins, reducing returns for shareholders and potentially impacting investment in future growth.

- Potential for route cancellations or reductions in less profitable routes: Airlines may be forced to cancel or reduce less profitable routes to offset increased fuel expenses, impacting connectivity and passenger convenience.

- Impact on smaller airlines with less financial resilience: Smaller airlines, with less financial cushion, are disproportionately affected by volatile fuel prices, facing a greater risk of insolvency compared to their larger counterparts.

Hedging Strategies and Risk Management in Uncertain Times

Fuel hedging is a crucial risk management tool used by airlines to mitigate the impact of fluctuating oil prices. This involves using financial instruments, such as futures contracts and options, to lock in future fuel prices at a predetermined rate. However, even the most sophisticated hedging strategies have limitations, particularly during periods of extreme oil supply disruptions where unforeseen events drastically alter market dynamics.

- Advantages and disadvantages of different hedging techniques: Futures contracts offer price certainty but require significant upfront capital, while options provide flexibility but come with premium costs. The optimal strategy depends on an airline's risk tolerance and financial resources.

- The role of financial risk management teams: Dedicated teams analyze market trends, develop hedging strategies, and constantly monitor market developments to minimize exposure to price volatility.

- Limitations of hedging during extreme price volatility: Extreme events, like unforeseen geopolitical instability leading to significant oil supply disruptions, can render even the most carefully crafted hedging strategies ineffective.

Operational Efficiency and Fuel Conservation Measures

Airlines are actively pursuing various strategies to improve operational efficiency and reduce fuel consumption. This involves a multifaceted approach, encompassing technological advancements, optimized operational procedures, and strategic partnerships. These efforts not only improve the bottom line but also contribute to environmental sustainability.

- Investing in newer, more fuel-efficient aircraft: Modern aircraft are significantly more fuel-efficient than older models, representing a substantial long-term investment in cost reduction.

- Implementing advanced flight planning and air traffic management techniques: Optimizing flight routes, reducing unnecessary holding patterns, and utilizing advanced air traffic control systems can significantly reduce fuel burn.

- Crew training programs focused on fuel-efficient flying: Training pilots and cabin crew on fuel-saving techniques contributes to overall operational efficiency.

- Ground operations optimization to minimize fuel burn during taxiing and ground handling: Efficient ground operations, including reduced taxiing times and optimized ground handling procedures, can lead to measurable fuel savings.

Government Intervention and Support Measures

Governments play a crucial role in supporting the airline industry during times of crisis. Direct financial aid, tax breaks, and regulatory measures can help alleviate the burden of volatile fuel prices, ensuring the sector's continued stability. International cooperation is also vital in addressing global fuel price volatility.

- Tax relief on aviation fuel: Reducing taxes on aviation fuel can directly lower operating costs for airlines.

- Direct financial aid packages for struggling airlines: Government bailouts or loan guarantees can provide crucial financial support to airlines facing severe financial distress.

- Government regulations to encourage fuel efficiency: Incentivizing the adoption of fuel-efficient technologies and operational practices can drive industry-wide improvements.

- International agreements on fuel pricing transparency: Increased transparency in global fuel markets can help stabilize prices and reduce uncertainty.

Navigating the Turbulence – A Future for Airlines Amidst Oil Supply Disruptions

Airlines face significant challenges due to oil supply disruptions and their impact on fuel costs. However, proactive strategies like effective hedging, focused improvements in operational efficiency, and supportive government policies are crucial for navigating this turbulent environment. The airline industry has consistently demonstrated resilience and adaptability, and with continued innovation and strategic planning, it can successfully navigate these challenges. The future of air travel remains bright, but addressing the impact of future oil supply disruptions requires ongoing research, discussion, and collaboration. We encourage you to share your thoughts and insights on how airlines can best navigate these challenges and build a more resilient and sustainable aviation sector. Let's continue the conversation on mitigating the impact of future oil supply disruptions on the aviation industry.

Featured Posts

-

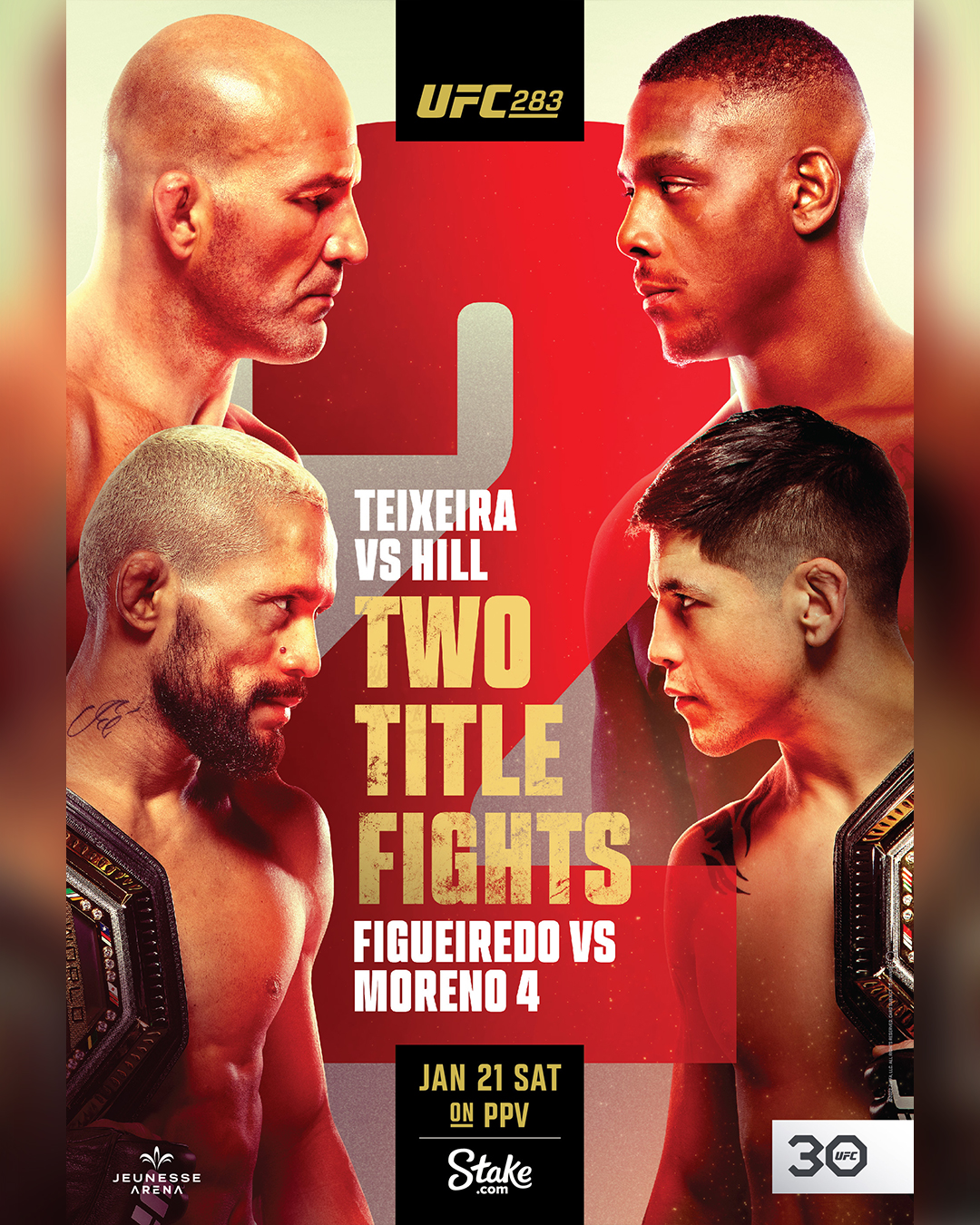

Ufc Fight Night Expert Predictions For Sandhagen Vs Figueiredo Fight

May 04, 2025

Ufc Fight Night Expert Predictions For Sandhagen Vs Figueiredo Fight

May 04, 2025 -

Israel Et L Aide Humanitaire A Gaza La Mise En Garde Ferme De Macron

May 04, 2025

Israel Et L Aide Humanitaire A Gaza La Mise En Garde Ferme De Macron

May 04, 2025 -

Ufc 314 Main Card And Prelims Complete Fight Order Announcement

May 04, 2025

Ufc 314 Main Card And Prelims Complete Fight Order Announcement

May 04, 2025 -

2025 16000

May 04, 2025

2025 16000

May 04, 2025 -

Robertson Vs Rodriguez Ufc Des Moines Finish Prediction

May 04, 2025

Robertson Vs Rodriguez Ufc Des Moines Finish Prediction

May 04, 2025