Amsterdam AEX Index Falls Below Key Support Level

Table of Contents

Reasons for the Amsterdam AEX Index Decline

Several interconnected factors have contributed to the recent fall of the Amsterdam AEX Index below its key support level. Understanding these contributing elements is crucial for assessing the current market situation and anticipating potential future trends.

Global Economic Uncertainty

The global economic landscape is currently characterized by significant uncertainty. High inflation rates in many countries, coupled with aggressive interest rate hikes by central banks, are dampening economic growth and impacting investor sentiment. Geopolitical instability, including the ongoing war in Ukraine and escalating trade tensions, further exacerbates this uncertainty. These global headwinds inevitably impact the AEX, a market intrinsically linked to the global economy.

- Examples of specific global events impacting the AEX: The war in Ukraine, rising energy prices driven by global supply chain disruptions, increased interest rates from the European Central Bank, and persistent inflation across Europe.

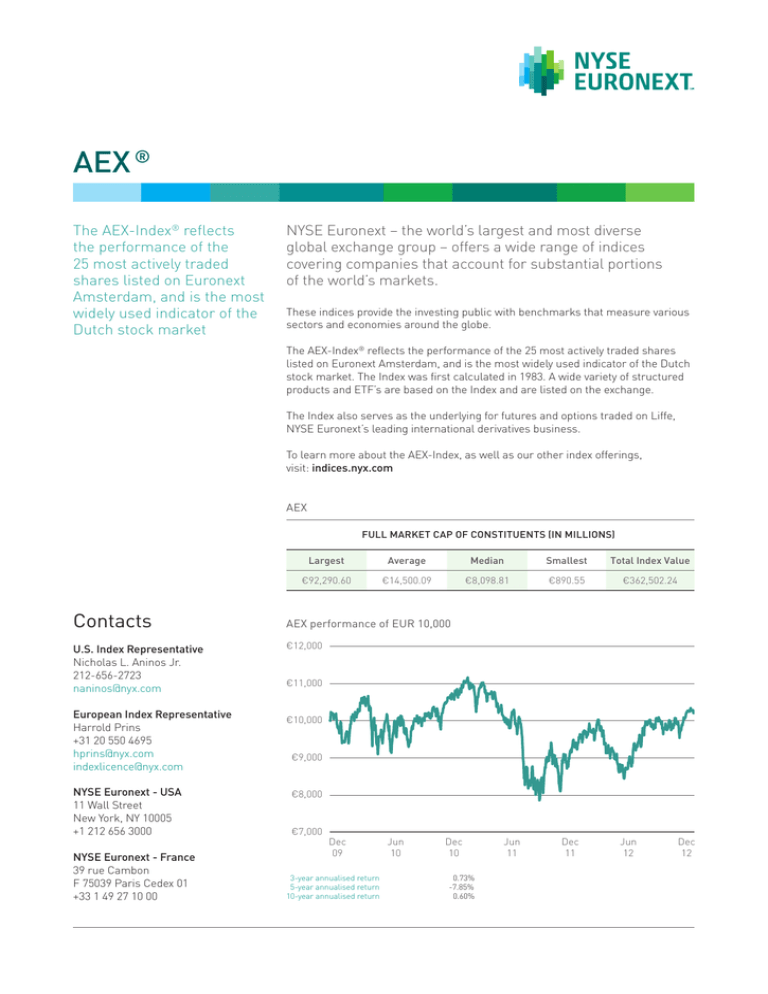

- Data points: For example, the energy sector within the AEX might have experienced a 15% drop in value due to the global energy crisis, while the technology sector may have seen a 10% decline reflecting broader global tech stock performance.

Sector-Specific Performance

The decline in the Amsterdam AEX Index isn't uniform across all sectors. Specific sectors are experiencing more significant pressure than others. A deeper analysis of individual sector performance reveals the nuances of this market downturn.

- Financials: Increased interest rates directly impact the profitability of financial institutions, potentially leading to reduced earnings and lower stock valuations.

- Energy: The energy sector's performance is highly volatile, influenced by global supply and demand dynamics and geopolitical events. Fluctuations in oil and gas prices directly affect the valuations of energy companies listed on the AEX.

- Technology: The tech sector, often sensitive to interest rate changes and overall economic sentiment, may experience decreased valuations as investors become more risk-averse.

- Specific companies and their contribution: For instance, a significant drop in the share price of a major Dutch bank or energy company can disproportionately affect the overall AEX index. (Charts and graphs illustrating sector-specific performance would be included here in a published article).

Investor Sentiment and Market Volatility

Negative investor sentiment and increased market volatility are key drivers of the AEX's decline. News and events negatively impacting investor confidence can trigger sell-offs, amplifying downward pressure on the index.

- Recent news affecting investor sentiment: Negative earnings reports from key AEX companies, announcements of decreased economic growth forecasts for the Netherlands, and general global market uncertainty have all contributed to declining investor confidence.

- Data on trading volume and market fluctuations: Increased trading volume during periods of market decline indicates heightened investor activity and anxiety.

Implications of the Amsterdam AEX Index Falling Below Support

The AEX's fall below a key support level has significant implications, both in the short term and the long term. Understanding these potential consequences is essential for effective investment decision-making.

Short-Term Outlook

The short-term outlook suggests potential for further price drops and increased market volatility. Technical analysis indicators might signal further declines.

- Potential technical indicators suggesting further declines: Breaking below key support levels often triggers further selling pressure. Negative momentum indicators and bearish chart patterns might reinforce this outlook.

- Expert opinions: Financial analysts and market experts may provide short-term forecasts, although predictions are inherently uncertain.

Long-Term Implications

The long-term implications depend on various factors, including the speed and effectiveness of economic recovery, government policy responses, and global market stability.

- Potential recovery scenarios: A swift resolution to geopolitical tensions, a decline in inflation, and sustained economic growth could lead to a recovery in the AEX.

- Factors influencing long-term growth: Government investment in infrastructure, technological innovation, and reforms to improve business competitiveness will be crucial for the long-term recovery and growth of the Dutch economy and, by extension, the AEX.

Strategies for Investors Amidst the Amsterdam AEX Index Decline

Navigating the current market challenges requires a proactive approach to risk management and diversification. Investors should carefully consider their investment strategies.

Risk Management and Diversification

Diversification across asset classes, geographies, and sectors is essential to mitigate risk. Reducing exposure to overly volatile assets and increasing holdings in more stable assets is a prudent strategy.

- Diversification strategies: Consider diversifying into international markets, bonds, real estate, or other asset classes less correlated with the AEX.

- Hedging strategies: Investors may consider using hedging techniques, such as options or futures contracts, to protect against further market declines.

Monitoring Key Indicators

Regularly monitoring key economic indicators and market trends is crucial for informed investment decisions. Tracking these indicators helps anticipate market shifts and adapt investment strategies accordingly.

- Key indicators to track: Inflation rates, interest rates, GDP growth, unemployment figures, consumer confidence, and AEX sector-specific performance indicators.

- Resources for tracking indicators: Utilize reliable financial news sources, economic data websites, and investment research platforms.

Conclusion

The recent fall of the Amsterdam AEX Index below its key support level is a significant event driven by a combination of global economic uncertainty, sector-specific challenges, and negative investor sentiment. The short-term outlook suggests potential for further volatility, while the long-term implications depend on various factors influencing economic recovery. Investors should prioritize risk management, diversification, and closely monitoring key economic indicators to navigate this uncertain market. Stay informed about the fluctuations of the Amsterdam AEX Index and adjust your investment strategy accordingly. Continue monitoring the Amsterdam AEX Index for significant changes and adapt your investment approach based on the evolving market conditions. Regularly review your portfolio and consider consulting a financial advisor for personalized guidance on navigating the current market situation surrounding the Amsterdam AEX Index.

Featured Posts

-

Demnas Gucci Designs Kering Reports Lower Sales Figures For Year

May 24, 2025

Demnas Gucci Designs Kering Reports Lower Sales Figures For Year

May 24, 2025 -

Ritka Porsche 911 80 Millio Forintos Extrak Kueloenlegessege

May 24, 2025

Ritka Porsche 911 80 Millio Forintos Extrak Kueloenlegessege

May 24, 2025 -

Nyt Mini Crossword March 12 2025 Solutions And Hints

May 24, 2025

Nyt Mini Crossword March 12 2025 Solutions And Hints

May 24, 2025 -

Recenzja Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025

Recenzja Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025 -

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025