Amsterdam Stock Exchange: 7% Fall At Open Reflects Global Trade Tensions

Table of Contents

Global Trade War Escalation and its Impact on the AEX

Rising Tariffs and Retaliatory Measures

The ongoing global trade war, particularly the US-China trade dispute, has significantly impacted the AEX. Rising tariffs and retaliatory measures imposed by various countries create uncertainty and directly affect Dutch businesses heavily reliant on international trade. This "global trade uncertainty" translates into decreased investor confidence and increased volatility in the Amsterdam Stock Exchange.

- Specific Examples: Companies in the technology and agricultural sectors, significant exporters for the Netherlands, have been particularly hard hit. For example, companies like ASML Holding (ASML.AS), a leading semiconductor equipment manufacturer, face challenges due to US-China trade restrictions. Similarly, Dutch agricultural exports face tariffs impacting their profitability and market share.

- Export Dependence: Data reveals that a substantial portion of the Dutch economy relies on exports. This high level of export dependence makes the Netherlands particularly vulnerable to the ripple effects of global trade disputes. A significant portion of Dutch GDP is tied to exporting goods and services, making the AEX highly susceptible to external trade shocks.

- Keyword Integration: The impact of the global trade war on the Amsterdam Stock Exchange is undeniable, leading to increased "AEX volatility" and a noticeable shift in "trade war impact on Amsterdam Stock Exchange."

Investor Sentiment and Market Volatility

The escalating trade tensions have severely undermined investor confidence, leading to significant "AEX market volatility." Investors, facing increased uncertainty, are exhibiting a "flight to safety," shifting their investments away from riskier assets like stocks listed on the AEX.

- Sell-off Trends: This has resulted in widespread sell-off trends, as investors seek to reduce their exposure to the risks associated with global trade disputes. Statistics showing significant investment outflows from the AEX further underscore this trend.

- Reduced Investment: The uncertainty surrounding future trade policies discourages new investment, further exacerbating the downward pressure on the AEX. Companies are delaying expansion plans, and overall investment in the Dutch market is slowing down.

- Keyword Integration: The decline in "investor confidence Amsterdam Stock Exchange" is directly linked to "risk aversion" in the current global economic climate.

Specific Companies Heavily Affected by the Drop

Analysis of Key AEX Performers

Several major companies listed on the AEX experienced significant percentage drops following the market opening. This section analyzes the performance of these key players, highlighting their vulnerability to trade tensions.

- Significant Percentage Drops: For example, [Company Name 1] ([Ticker Symbol]), a company heavily reliant on exports to China, saw a [Percentage]% drop. Similarly, [Company Name 2] ([Ticker Symbol]), operating in the technology sector, experienced a [Percentage]% decline, reflecting the sector's susceptibility to trade restrictions.

- Vulnerability to Trade Tensions: These declines illustrate the direct correlation between global trade uncertainty and the performance of individual AEX-listed companies. The vulnerability of specific companies varies depending on their export markets and reliance on global supply chains.

- Keyword Integration: Analyzing "AEX stock performance" and specifically the "Dutch company stock prices" provides critical insights into the market's response to escalating trade conflicts.

Sectoral Analysis

The decline wasn't uniform across all sectors. Some sectors suffered more significant losses than others, reflecting their varying degrees of susceptibility to global trade fluctuations.

- Technology and Financials: The technology and financial sectors experienced significant drops, reflecting their sensitivity to investor sentiment and global economic uncertainty.

- Energy and Agriculture: The energy and agricultural sectors also faced challenges, highlighting the impact of trade wars on commodity prices and international supply chains. This “AEX sector performance” highlights the interconnectedness of the global economy.

- Keyword Integration: Understanding the "impact of trade wars on specific sectors" provides a crucial context for comprehending the overall AEX decline.

Potential Short-Term and Long-Term Implications for the Amsterdam Stock Exchange

Short-Term Outlook

The short-term outlook for the AEX remains uncertain, contingent on the evolution of global trade tensions and the potential for further market corrections.

- Potential for Further Drops: The possibility of further drops cannot be ruled out, depending on how trade negotiations progress and the resulting investor sentiment.

- Short-Term Recovery Scenarios: However, if trade tensions ease, a short-term recovery is possible, albeit dependent on investor confidence returning.

- Keyword Integration: Accurately forecasting "AEX short-term forecast" requires close monitoring of global trade developments and investor behavior. An "Amsterdam Stock Exchange prediction" requires deep analysis of numerous factors.

Long-Term Implications

The long-term implications of these trade tensions on the Dutch economy and the AEX are significant and warrant careful consideration.

- Economic Slowdown: Prolonged trade disputes could lead to an economic slowdown in the Netherlands, potentially impacting long-term growth prospects.

- Impact on Foreign Investment: Increased uncertainty discourages foreign investment, further hindering economic growth and the performance of the AEX.

- Keyword Integration: Analyzing the "long-term outlook AEX" requires evaluating the potential for "impact on Dutch economy" and exploring strategies for "sustainable growth Amsterdam Stock Exchange."

Conclusion: Navigating the Volatility of the Amsterdam Stock Exchange

The 7% plunge in the Amsterdam Stock Exchange underscores the significant impact of escalating global trade tensions on even robust economies. The key factors contributing to this decline include rising tariffs, decreased investor confidence, and the vulnerability of specific Dutch companies and sectors to international trade disputes. The short-term outlook remains uncertain, but prolonged trade wars could lead to a significant economic slowdown and long-term damage to the Dutch economy and the AEX. To make informed investment decisions, it is crucial to monitor the Amsterdam Stock Exchange closely, staying updated on AEX performance and understanding the impact of global trade on its trajectory. Stay informed about the Amsterdam Stock Exchange and global trade relations to navigate this volatile market effectively.

Featured Posts

-

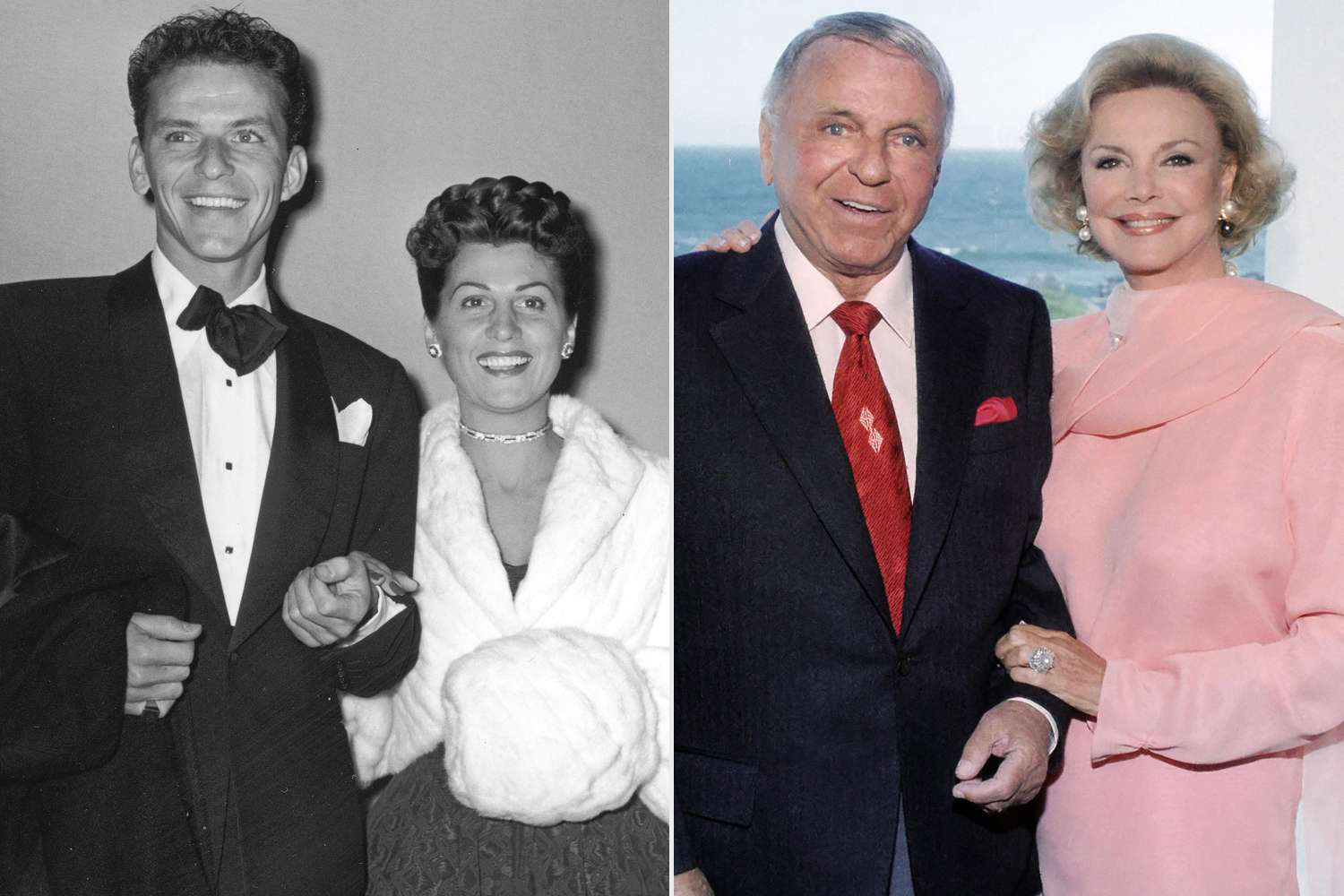

Frank Sinatras Marital History Wives Relationships And Legacy

May 25, 2025

Frank Sinatras Marital History Wives Relationships And Legacy

May 25, 2025 -

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 25, 2025

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 25, 2025 -

Konchita Vurst Dnes Neynata Evolyutsiya Sled Spechelvaneto Na Evroviziya

May 25, 2025

Konchita Vurst Dnes Neynata Evolyutsiya Sled Spechelvaneto Na Evroviziya

May 25, 2025 -

Apple Stock Under Pressure Ahead Of Q2 Results

May 25, 2025

Apple Stock Under Pressure Ahead Of Q2 Results

May 25, 2025 -

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 25, 2025

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 25, 2025

Latest Posts

-

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025