Amsterdam Stock Exchange Plunges: Three Consecutive Days Of Heavy Losses

Table of Contents

Underlying Causes of the Amsterdam Stock Exchange Plunge

The three-day decline of the AEX is a complex issue stemming from a confluence of factors, both global and domestic. Understanding these underlying causes is crucial for predicting future market behavior and mitigating potential risks.

Global Economic Uncertainty

Global economic headwinds have significantly impacted investor sentiment, contributing to the AEX's sharp drop. The interconnected nature of global markets means that events far beyond the Netherlands can dramatically affect the AEX index.

- Increased energy prices and supply chain disruptions: The ongoing war in Ukraine has led to soaring energy costs, impacting Dutch businesses reliant on affordable energy sources. Supply chain bottlenecks further exacerbate this, leading to reduced production and increased input costs. This uncertainty is a major factor impacting investor confidence.

- Weakening global economic growth forecasts: Major international organizations are revising their growth forecasts downward, fueled by inflation, rising interest rates, and geopolitical instability. This pessimism translates into reduced investment appetite globally, impacting even relatively stable markets like the Netherlands.

- Uncertainty surrounding future interest rate hikes by the European Central Bank (ECB): The ECB's efforts to combat inflation through interest rate hikes create uncertainty in the market. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits, thus impacting stock prices.

Sector-Specific Impacts

The downturn hasn't affected all sectors equally. Some sectors are experiencing disproportionately higher losses, indicating specific vulnerabilities within the Dutch economy.

- Analysis of performance of key AEX-listed companies in various sectors: Initial analysis reveals that technology and energy stocks have been particularly hard hit, reflecting global trends in these volatile sectors. Financial institutions also experienced significant losses, reflecting concerns about the broader economic outlook.

- Impact on specific companies and their stock prices: Several prominent AEX-listed companies have seen their share prices plummet, impacting investor portfolios and creating wider market uncertainty. This highlights the vulnerability of even established, large-cap companies to sudden market shifts.

- Potential for further sector-specific declines: The potential for further declines in specific sectors remains a significant concern. Further analysis is needed to identify and mitigate the risks to vulnerable industries within the Dutch economy.

Investor Sentiment and Market Psychology

Fear and panic selling played a significant role in exacerbating the AEX's decline. Negative news and market volatility can trigger a cascade effect, leading to amplified losses.

- Discussion of market volatility and its effect on trading volumes: The increased volatility resulted in significantly higher trading volumes, as investors rushed to react to the rapidly changing market conditions. This amplified the downward pressure on prices.

- Analysis of investor behavior and trends: Investor behavior analysis reveals a clear shift towards risk aversion, with investors pulling funds from the market to protect their capital. This behavior further accelerated the downturn.

- The impact of news coverage and media reporting on the market's reaction: Negative news coverage amplified the sense of panic and uncertainty, leading to a self-fulfilling prophecy where negative sentiment drove further declines.

Consequences of the Amsterdam Stock Exchange Decline

The AEX plunge has significant short-term and long-term consequences for the Dutch economy and its investors.

Impact on Dutch Economy

The decline of the AEX has significant implications for the broader Dutch economy.

- Potential impact on consumer confidence and spending: A falling stock market can negatively impact consumer confidence, leading to reduced spending and potentially slowing economic growth. This is a significant concern given the already existing economic challenges.

- Effect on foreign investment in the Netherlands: The market downturn could discourage foreign investment in the Netherlands, impacting economic growth and job creation. A less stable market is less attractive to international investors.

- Potential government responses to mitigate economic fallout: The Dutch government may need to implement measures to mitigate the economic fallout, potentially through fiscal stimulus or other policy interventions. The severity of the response will depend on the duration and depth of the downturn.

Investor Implications

The AEX decline significantly impacts investor portfolios, necessitating adjustments to investment strategies.

- Advice for investors on risk management and portfolio diversification: Investors are advised to review their risk tolerance and diversify their portfolios to minimize losses during periods of market volatility. A well-diversified portfolio can help cushion against significant losses in any single sector.

- Discussion of potential investment opportunities amidst the downturn: While risky, some investors may see opportunities to buy undervalued assets during the downturn, potentially benefiting from a market rebound. This requires careful research and a longer-term investment horizon.

- The importance of long-term investment strategies: Maintaining a long-term investment strategy is vital during market downturns. Short-term market fluctuations should not dictate long-term investment decisions.

Potential Future Scenarios for the Amsterdam Stock Exchange

The future trajectory of the AEX remains uncertain, depending on several interconnected factors.

Market Recovery

A market rebound is possible, but it depends on several factors.

- Potential for government intervention or policy changes: Government intervention, such as fiscal stimulus or supportive monetary policy, could help boost investor confidence and stimulate a market recovery.

- Analysis of the likelihood of a sustained recovery: The likelihood of a sustained recovery depends on the resolution of the underlying global economic issues and the restoration of investor confidence.

- Indicators to watch for signs of market stabilization: Investors should monitor key economic indicators, such as inflation rates, interest rates, and GDP growth, to gauge the potential for market stabilization.

Continued Decline

Unfortunately, the possibility of further losses remains.

- Risks and uncertainties that could prolong the downturn: Persistent global economic uncertainty, geopolitical instability, and further interest rate hikes could prolong the downturn.

- Worst-case scenarios and their potential impact: In a worst-case scenario, the decline could deepen, impacting businesses, employment, and overall economic growth in the Netherlands.

- Strategies for mitigating potential losses: Investors should carefully manage their portfolios, diversify their investments, and consider hedging strategies to mitigate potential losses.

Conclusion

The three-day plunge of the Amsterdam Stock Exchange represents a significant event with far-reaching consequences for the Dutch economy and global markets. Understanding the underlying causes—from global economic uncertainty to investor sentiment—is crucial for navigating this period of volatility. While the future remains uncertain, investors need to carefully monitor developments and adapt their strategies accordingly. Staying informed about the Amsterdam Stock Exchange and its fluctuations is vital for making informed decisions. Continue to follow our coverage for the latest updates on the Amsterdam Stock Exchange and its impact. Understanding the intricacies of the Amsterdam Stock Exchange is crucial for successful investment.

Featured Posts

-

Svadebniy Den Na Kharkovschine 40 Par Sozdali Semi Foto

May 24, 2025

Svadebniy Den Na Kharkovschine 40 Par Sozdali Semi Foto

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Frank Sinatra And His Four Wives Love Loss And Legacy

May 24, 2025

Frank Sinatra And His Four Wives Love Loss And Legacy

May 24, 2025 -

Frankfurt Stock Exchange Opens Dax Remains Stable Post Record

May 24, 2025

Frankfurt Stock Exchange Opens Dax Remains Stable Post Record

May 24, 2025 -

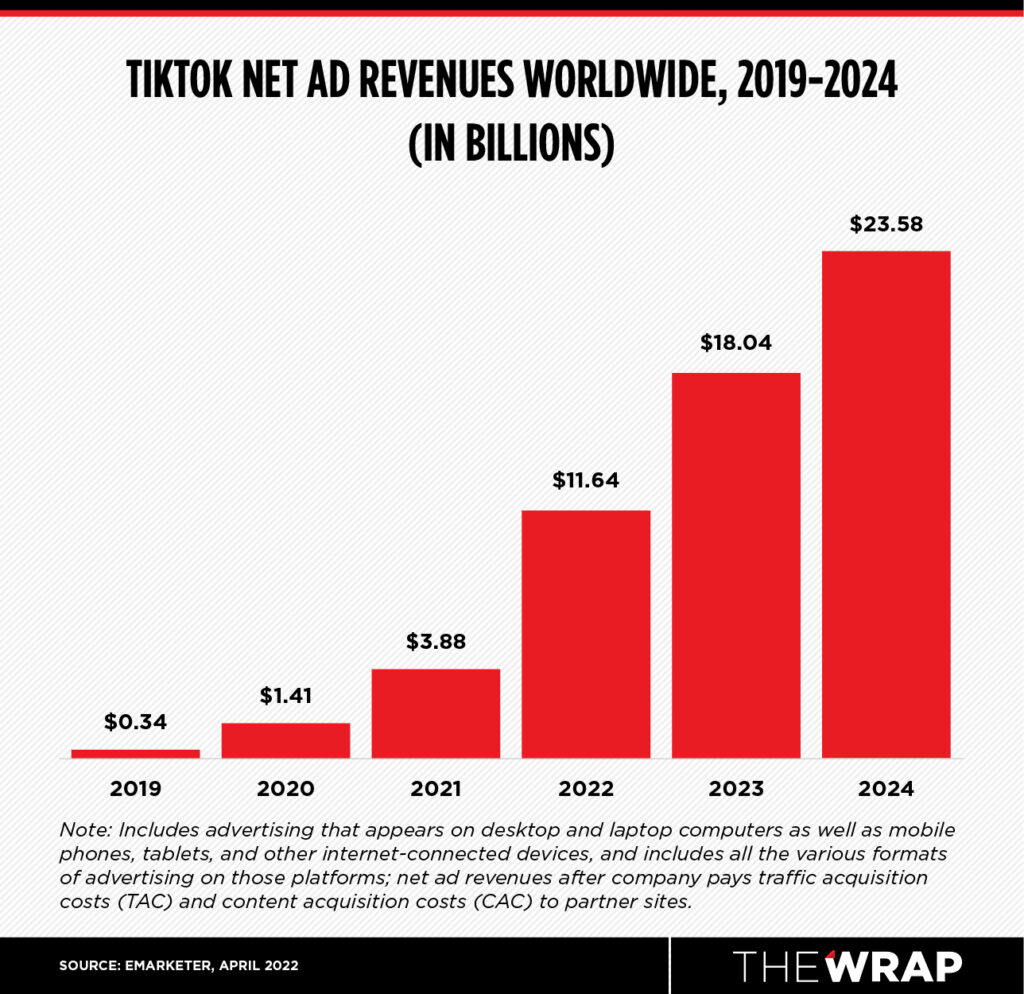

Legal Battle Amsterdam Residents Vs City Hall Tik Toks Impact On Local Business

May 24, 2025

Legal Battle Amsterdam Residents Vs City Hall Tik Toks Impact On Local Business

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025