Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

Table of Contents

Factors Contributing to the Amsterdam Stock Exchange Losses

Several interconnected factors have contributed to the recent heavy losses on the Amsterdam Stock Exchange. These losses are not isolated but reflect broader global economic anxieties and geopolitical uncertainties.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, impacting investor sentiment worldwide. Rising inflation, aggressive interest rate hikes by central banks, and the ongoing war in Ukraine have created a perfect storm for market volatility.

- Decreased Consumer Confidence: High inflation is eroding purchasing power, leading to decreased consumer spending and impacting corporate earnings.

- Supply Chain Disruptions: The war in Ukraine and lingering effects of the pandemic continue to disrupt global supply chains, increasing production costs and limiting economic growth.

- Energy Price Volatility: Fluctuations in energy prices, exacerbated by the war in Ukraine, are impacting businesses across various sectors, adding further pressure to already strained margins.

- Data Point: The AEX index fell by 2.5% today, marking its lowest point in 18 months, indicating a significant loss of investor confidence.

Performance of Key Sectors

The decline in the AEX is not uniform across all sectors. Certain sectors are experiencing steeper losses than others, reflecting specific vulnerabilities.

- Energy Sector: The energy sector, highly sensitive to geopolitical events, has witnessed significant losses due to price volatility and supply chain disruptions. Companies like Shell and TotalEnergies, while global players, are still feeling the pinch.

- Technology Sector: The technology sector, which thrived during the pandemic, is now facing headwinds from rising interest rates, impacting valuations and investment appetite. Several tech startups listed on the AEX are experiencing significant drops in their share prices.

- Financials Sector: Banks and financial institutions are also facing headwinds from the rising interest rate environment, impacting their profitability and lending capabilities. Increased loan defaults are a growing concern.

Geopolitical Risks

Geopolitical instability significantly influences investor confidence. The ongoing war in Ukraine and its broader implications are key factors in the current market downturn.

- Ukraine Conflict: The war in Ukraine has created significant uncertainty, impacting energy prices, supply chains, and investor sentiment. The conflict's longevity is a major source of anxiety for markets.

- Energy Security: Europe's dependence on Russian energy has been exposed, leading to concerns about energy security and potentially impacting economic growth across the EU, which includes the Netherlands.

- Political Instability: While the Netherlands has a stable political system, any broader political instability within the EU could further negatively impact investor confidence.

Impact of the Losses on the Dutch Economy

The downturn on the Amsterdam Stock Exchange has significant implications for the Dutch economy.

Investor Sentiment and Confidence

The stock market decline is eroding investor confidence in the Dutch economy.

- Decreased Investment: The uncertainty is leading to decreased investment in businesses and infrastructure projects.

- Reduced Business Expansion: Companies are hesitant to expand their operations given the economic uncertainty.

- Job Creation Concerns: Reduced investment and business expansion could lead to reduced job creation and potentially increased unemployment.

- Pension Funds Impact: Pension funds, significantly invested in the AEX, will experience losses, impacting the retirement savings of millions of Dutch citizens.

Potential Government Response

The Dutch government is likely to consider various measures to mitigate the impact of the stock market decline.

- Fiscal Stimulus: The government might consider fiscal stimulus packages to boost economic activity and support businesses.

- Tax Breaks: Tax breaks or incentives could be offered to encourage investment and business expansion.

- Monetary Policy Adjustments: Coordination with the European Central Bank on monetary policy adjustments could be explored. However, such adjustments carry their own risks and need to be carefully considered.

Future Outlook and Predictions for the Amsterdam Stock Exchange

Predicting the future trajectory of the AEX is challenging, given the numerous interconnected factors at play.

Analyst Predictions and Forecasts

Financial analysts offer diverse opinions on the AEX's future, reflecting varying interpretations of current economic data and future scenarios.

- Pessimistic Views: Some analysts predict further declines in the AEX, citing persistent global economic uncertainty and geopolitical risks.

- Optimistic Views: Others remain cautiously optimistic, pointing to potential recovery driven by government interventions and structural reforms.

Potential Recovery Strategies

Several strategies could help recover from the losses and boost investor confidence.

- Structural Reforms: Implementing structural reforms to improve the business environment and attract foreign investment.

- Investment in Innovation: Investing in innovation and new technologies to enhance competitiveness.

- Economic Diversification: Diversifying the Dutch economy to reduce dependence on specific sectors vulnerable to global shocks.

Conclusion

The three consecutive days of heavy losses on the Amsterdam Stock Exchange are a result of a complex interplay of global economic uncertainty, underperformance of key sectors, and significant geopolitical risks. The impact on the Dutch economy is considerable, affecting investor confidence, investment levels, and potential job creation. The government's response will be crucial in mitigating the negative effects. While the future outlook remains uncertain, potential recovery strategies such as structural reforms, investment in innovation, and economic diversification offer pathways towards restoring investor confidence and achieving sustainable growth. Stay informed about the evolving situation on the Amsterdam Stock Exchange and its impact on your investments. Continue to monitor news and analysis regarding Amsterdam Stock Exchange losses to make informed decisions. Regularly check reputable financial sources for updates on the Amsterdam Stock Exchange’s performance.

Featured Posts

-

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025 -

Paris Facing Financial Strain Amid Luxury Sector Slowdown

May 25, 2025

Paris Facing Financial Strain Amid Luxury Sector Slowdown

May 25, 2025 -

M62 Roadworks Westbound Closure Impacts Manchester To Warrington Drivers

May 25, 2025

M62 Roadworks Westbound Closure Impacts Manchester To Warrington Drivers

May 25, 2025 -

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025 -

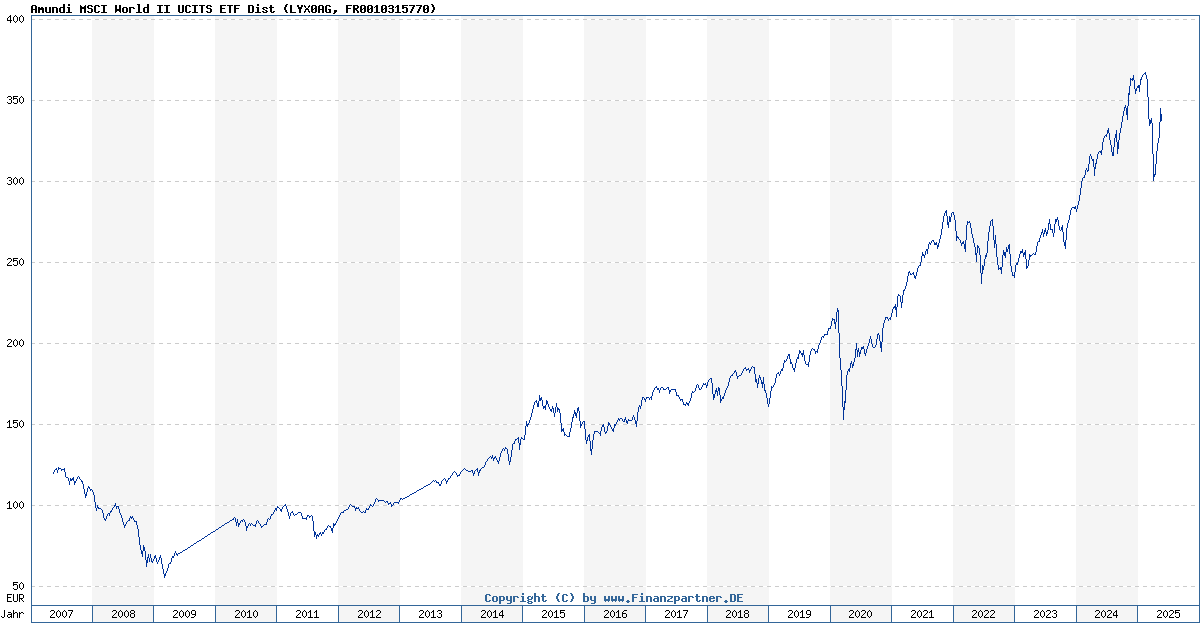

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Latest Posts

-

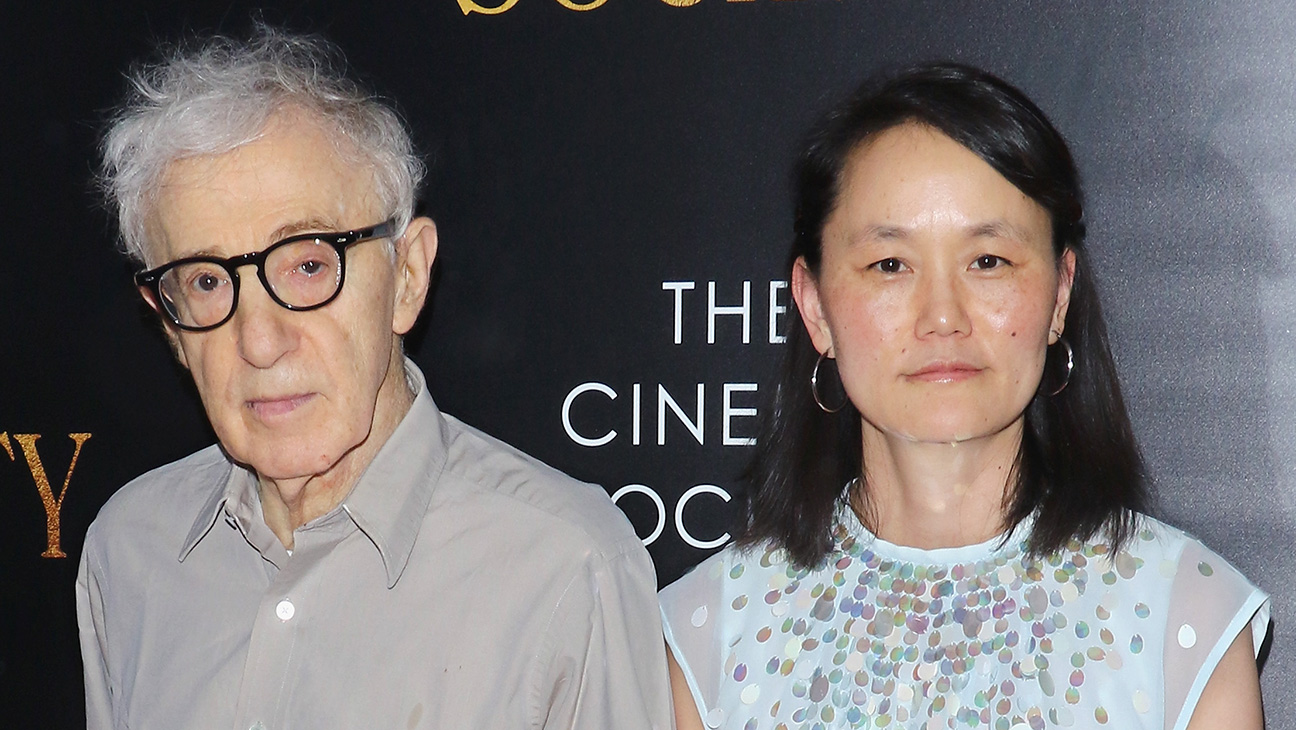

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

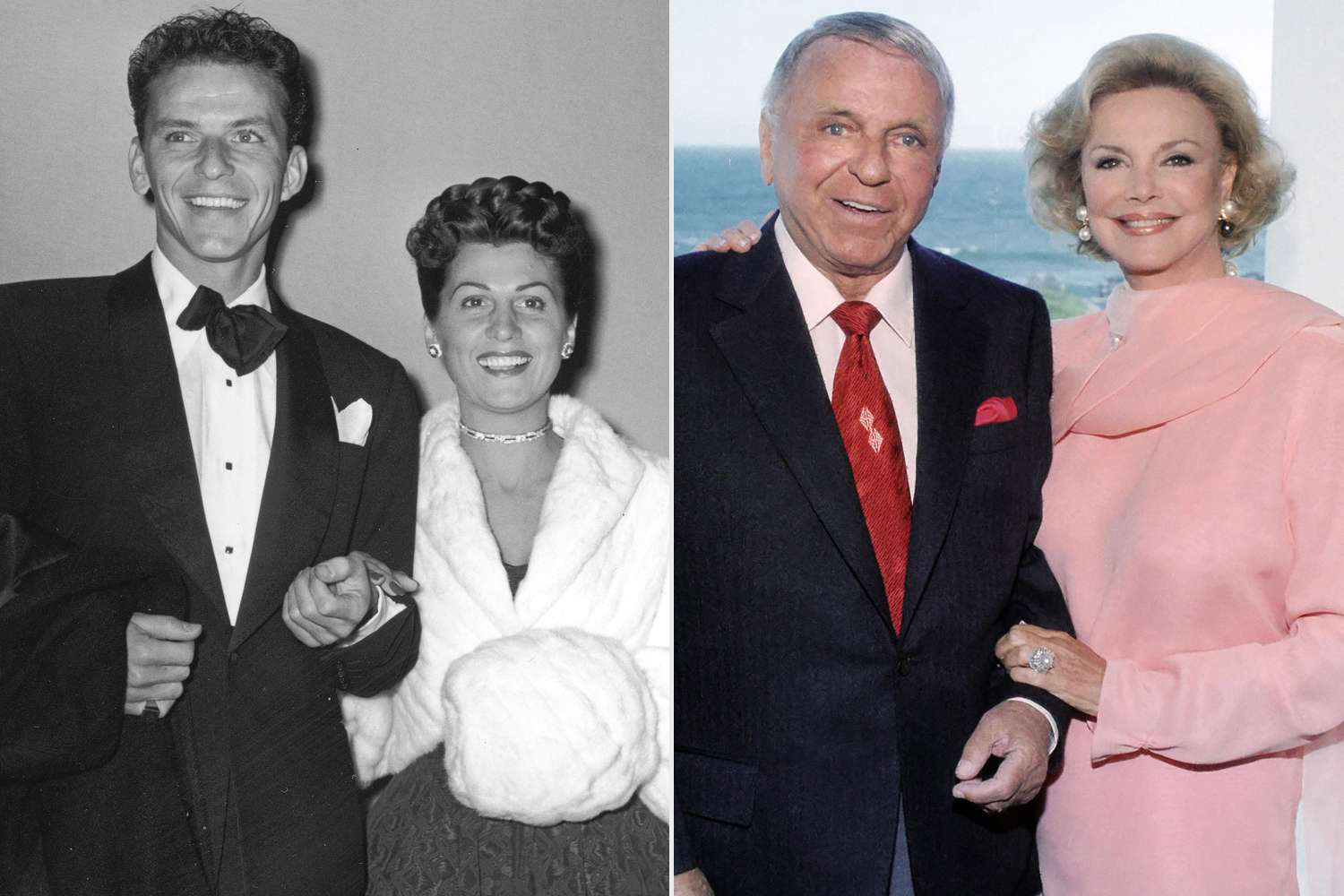

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025