Amsterdam Stock Market: Three Days Of Decline, 11% Drop Since Wednesday

Table of Contents

Reasons Behind the Amsterdam Stock Market Decline

Several interconnected factors have contributed to the recent decline in the Amsterdam Stock Market. These can be broadly categorized into global economic uncertainties, specific Dutch economic pressures, and the resulting investor sentiment and market volatility.

Global Economic Uncertainty

The current global economic climate is rife with uncertainty, significantly impacting the AEX index performance. Rising inflation, aggressive interest rate hikes by central banks worldwide, and the ongoing geopolitical tensions – particularly the war in Ukraine and the resulting energy crisis – are casting a long shadow over global markets. The fear of a potential recession in major economies further exacerbates the situation, leading to risk aversion among investors.

- Examples of global events impacting the Amsterdam Stock Market: The ongoing war in Ukraine, impacting energy prices and supply chains; persistent inflation in the Eurozone; the aggressive interest rate hikes by the European Central Bank.

- Affected sectors: The energy sector has been particularly hard hit, with oil and gas prices remaining volatile. The technology sector, sensitive to interest rate changes and economic slowdown, is also experiencing significant pressure.

Specific Dutch Economic Factors

Beyond global pressures, several internal economic factors are contributing to the AEX index decline. High inflation in the Netherlands, driven partly by soaring energy costs and supply chain disruptions, is squeezing consumer spending and dampening economic growth. The Dutch housing market, traditionally a robust sector, is also showing signs of cooling, adding to the overall economic malaise.

- Key economic indicators showing negative trends: Decreasing consumer confidence, rising inflation exceeding the European average, a slowdown in the housing market, increasing energy costs for businesses.

- Company announcements: Recent negative announcements from several large Dutch companies regarding their earnings prospects have further fueled the decline.

Investor Sentiment and Market Volatility

The combination of global and domestic economic headwinds has severely impacted investor sentiment. Fear and uncertainty have led to significant market volatility and increased panic selling, amplifying the initial decline in the AEX index. This negative feedback loop further exacerbates the downturn.

- Examples of investor reactions: Increased selling pressure, reduced trading volumes in some sectors, a flight to safety into less volatile assets.

- Volatility indices: Measures of market volatility have spiked significantly, reflecting the increased uncertainty.

Impact on Key Sectors of the Amsterdam Stock Market

The three-day decline has differentially affected various sectors within the Amsterdam Stock Market.

Energy Sector

The energy sector, already grappling with volatile global prices, has been one of the hardest hit. Companies involved in oil and gas exploration and production have experienced significant share price drops. The transition to renewable energy sources, while a long-term positive trend, is currently adding to the sector's short-term volatility.

- Specific examples: [Insert examples of energy companies listed on the Amsterdam Stock Exchange and their share price performance].

Technology Sector

Technology companies, sensitive to interest rate changes and economic slowdowns, have also suffered significant losses. Concerns about reduced consumer spending and increased borrowing costs are weighing heavily on this sector.

- Specific examples: [Insert examples of technology companies listed on the Amsterdam Stock Exchange and their share price performance, citing any relevant news impacting them].

Financial Sector

Banks and other financial institutions have also been affected, although perhaps less severely than other sectors. Concerns about potential loan defaults and the impact of rising interest rates on profitability are impacting investor confidence.

- Specific examples: [Insert examples of financial institutions listed on the Amsterdam Stock Exchange and their share price movements].

Potential Future Outlook for the Amsterdam Stock Market

The future outlook for the Amsterdam Stock Market remains uncertain. A recovery is possible if global economic uncertainties ease, inflation begins to decline, and investor confidence is restored. However, a further decline cannot be ruled out if the current negative trends persist or worsen. Government interventions, such as fiscal stimulus or targeted support for specific sectors, could play a significant role in shaping the market's trajectory.

- Possible positive outcomes: Easing of global inflation, resolution of geopolitical tensions, renewed investor confidence.

- Possible negative outcomes: Deepening recession in major economies, persistent high inflation, further escalation of geopolitical tensions.

Conclusion:

The recent 11% three-day decline in the Amsterdam Stock Market represents a significant event with far-reaching implications for the Dutch economy. A combination of global economic uncertainties, domestic economic pressures, and volatile investor sentiment has fueled this downturn, disproportionately affecting sectors like energy and technology. While the future remains uncertain, close monitoring of the AEX index and diversification of investment portfolios are crucial strategies for navigating this challenging period. Further research into the Amsterdam Stock Market and its future performance is vital for making informed investment decisions. Stay informed about the evolving situation in the Amsterdam Stock Market to mitigate risks.

Featured Posts

-

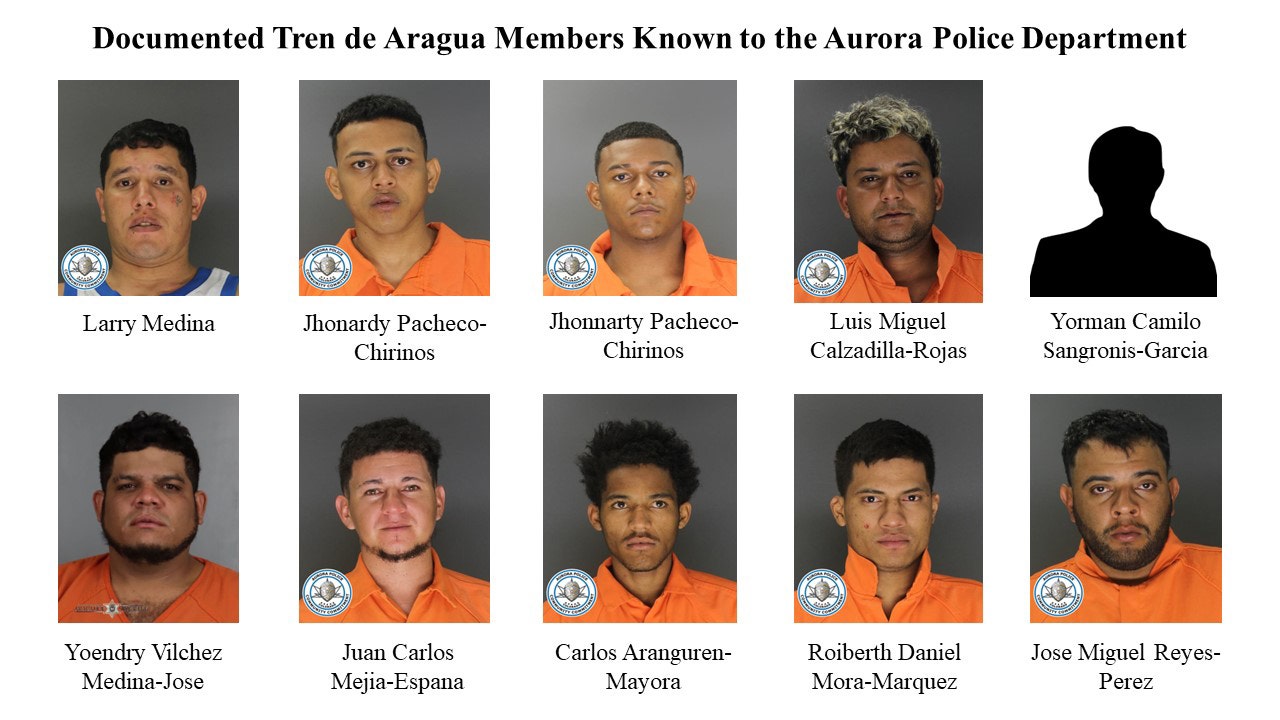

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Memorial Day 2025 Air Travel Smart Tips And Dates To Avoid Crowds

May 24, 2025

Memorial Day 2025 Air Travel Smart Tips And Dates To Avoid Crowds

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street

May 24, 2025 -

Understanding The Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value

May 24, 2025

Understanding The Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025