Amsterdam Stock Market: Trade War Anxiety Causes 7% Opening Plunge

Table of Contents

The Impact of Trade War Uncertainty on the Amsterdam Stock Market

The global economy is intricately interwoven, and trade disputes have far-reaching consequences. The Amsterdam Stock Market, while seemingly geographically distant from the epicenter of many trade conflicts, is significantly impacted by global trade war uncertainty. The AEX's performance reflects the broader global economic sentiment, making it highly sensitive to shifts in international trade relations. Several sectors within the Amsterdam Stock Exchange are particularly vulnerable to trade wars.

Export-oriented industries, a significant component of the Dutch economy, face increased challenges with tariffs and trade barriers. Technology companies, reliant on global supply chains and international markets, are also highly susceptible to trade disruptions. The impact manifests in several key ways:

- Increased import/export costs: Tariffs and trade restrictions directly increase the cost of goods, impacting both businesses and consumers.

- Supply chain disruptions: Trade wars can lead to delays and disruptions in global supply chains, hindering production and delivery timelines.

- Reduced consumer confidence: Uncertainty surrounding trade policies can negatively impact consumer confidence, leading to decreased spending and economic slowdown.

- Investor flight to safer assets: Investors often seek refuge in less volatile assets during times of economic uncertainty, leading to capital outflow from riskier markets like the Amsterdam Stock Market.

Analysis of the 7% Opening Plunge: A Deeper Dive

The 7% drop in the AEX index was a sharp and significant event. The plunge occurred within the first hour of trading on [Insert Date], lasting approximately [Insert Duration]. This immediate and dramatic decline showcased the market's extreme sensitivity to trade war anxieties. The trading volume during this period was exceptionally high, further emphasizing the magnitude of the market reaction.

(Insert Chart/Graph visualizing the AEX index decline during the specified period)

A detailed look at the numbers reveals the severity of the plunge:

- AEX Index before the plunge: [Insert Number]

- AEX Index during the plunge (lowest point): [Insert Number]

- AEX Index after the initial plunge (recovery, if any): [Insert Number]

- Key companies experiencing significant losses: [List specific companies and percentage losses].

- Trading volume spike: [Quantify the increase in trading volume compared to a normal trading day].

Investor Sentiment and Reactions to the Trade War Anxiety

The trade war news triggered a significant shift in investor sentiment, characterized by heightened fear and uncertainty. Investors reacted swiftly, attempting to mitigate potential losses through various strategies. Many adopted more conservative investment approaches, focusing on diversification and hedging against further market declines.

- Increased volatility: The market exhibited increased volatility in the days following the plunge, reflecting investor uncertainty.

- Shift towards conservative strategies: Investors moved away from riskier assets, favoring more stable investments.

- Analyst comments: [Include quotes from financial analysts commenting on the situation and investor sentiment – source the quotes appropriately].

Potential Long-Term Effects on the Amsterdam Stock Market and the Dutch Economy

The prolonged uncertainty surrounding trade wars poses significant long-term risks for the Amsterdam Stock Market and the Dutch economy. The ripple effects could be substantial, impacting various sectors and leading to potentially negative economic consequences.

- Impact on GDP growth: Sustained trade tensions could lead to a slowdown in GDP growth for the Netherlands.

- Job losses: Industries heavily reliant on international trade might experience job losses due to decreased demand and production disruptions.

- Government interventions: The Dutch government might implement policy changes or interventions to mitigate the economic impact of trade wars.

Conclusion: Navigating the Amsterdam Stock Market in Times of Trade War Uncertainty

The 7% opening plunge in the Amsterdam Stock Market vividly illustrates the significant impact of trade war anxiety on even seemingly insulated markets. The interconnected nature of the global economy means that trade disputes have far-reaching consequences, affecting investor sentiment, market volatility, and potentially long-term economic growth. The factors contributing to this downturn – increased import/export costs, supply chain disruptions, reduced consumer confidence, and investor flight to safer assets – highlight the vulnerability of the AEX to global trade uncertainties.

To navigate the complexities of the Amsterdam Stock Market during these uncertain times, staying informed about global trade developments is crucial. Monitor trade war developments to protect your investments, learn how to navigate the Amsterdam Stock Market's volatility, and consider diversifying your portfolio to mitigate risk. Further research into global trade policies and their potential impact on specific sectors within the AEX will be essential for making informed investment decisions. Stay informed about the Amsterdam Stock Market and its response to evolving global trade dynamics.

Featured Posts

-

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025 -

Nrw Eis Trend Diese Sorte Ist Der Ueberraschungssieger In Essen

May 24, 2025

Nrw Eis Trend Diese Sorte Ist Der Ueberraschungssieger In Essen

May 24, 2025 -

France New Proposals For Punishing Underage Criminals

May 24, 2025

France New Proposals For Punishing Underage Criminals

May 24, 2025 -

Esc 2025 Conchita Wurst And Jjs Joint Eurovision Village Concert

May 24, 2025

Esc 2025 Conchita Wurst And Jjs Joint Eurovision Village Concert

May 24, 2025 -

National Rallys Le Pen Sundays Demonstration And Its Implications

May 24, 2025

National Rallys Le Pen Sundays Demonstration And Its Implications

May 24, 2025

Latest Posts

-

Pope Leos Former Parishioner Goes Viral On Tik Tok

May 24, 2025

Pope Leos Former Parishioner Goes Viral On Tik Tok

May 24, 2025 -

A Tik Tokers Viral Story Remembering Pope Leos Time As Bishop

May 24, 2025

A Tik Tokers Viral Story Remembering Pope Leos Time As Bishop

May 24, 2025 -

Unexpected Viral Success Tik Tokers Story About Pope Leo

May 24, 2025

Unexpected Viral Success Tik Tokers Story About Pope Leo

May 24, 2025 -

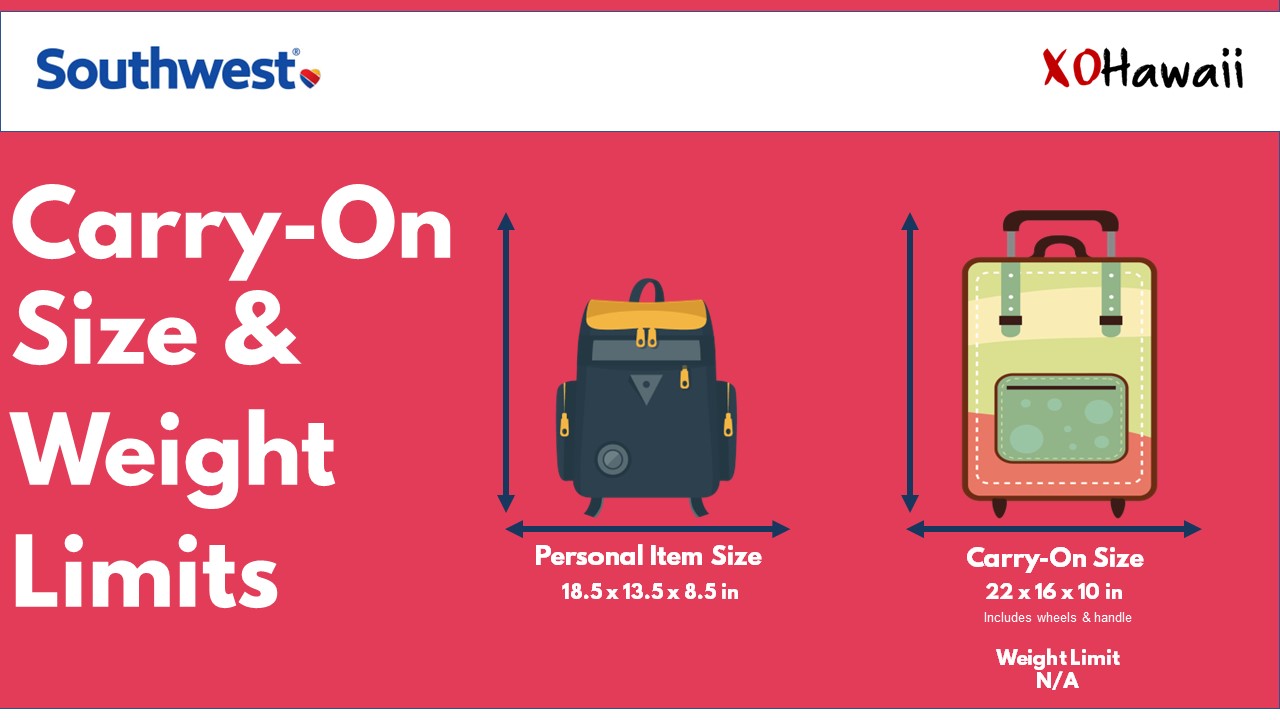

Carry On Changes Southwest Airlines Restricts Portable Chargers

May 24, 2025

Carry On Changes Southwest Airlines Restricts Portable Chargers

May 24, 2025 -

Air Traffic Controllers Sound Alarm Newark Airport Issues Stem From Trumps First Term Plan

May 24, 2025

Air Traffic Controllers Sound Alarm Newark Airport Issues Stem From Trumps First Term Plan

May 24, 2025