Amundi Dow Jones Industrial Average UCITS ETF (Dist): A NAV Deep Dive

Table of Contents

Understanding Net Asset Value (NAV) in the Context of ETFs

What is NAV?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For ETFs, this is calculated by taking the total market value of all the underlying securities held in the ETF's portfolio, adding any cash holdings, and subtracting all liabilities (including management fees and expenses). This figure is then divided by the total number of outstanding ETF shares.

- NAV vs. Market Price: The NAV is distinct from the market price, which fluctuates throughout the trading day based on supply and demand. Ideally, the market price should closely track the NAV, though discrepancies can occur, particularly in less liquid ETFs.

- Importance of NAV in ETF Performance Evaluation: The NAV provides a crucial benchmark for assessing an ETF's true underlying value. Monitoring NAV changes over time helps investors gauge the ETF's performance relative to its benchmark index.

Factors Affecting the Amundi DJIA ETF's NAV

Several factors influence the daily NAV of the Amundi DJIA ETF:

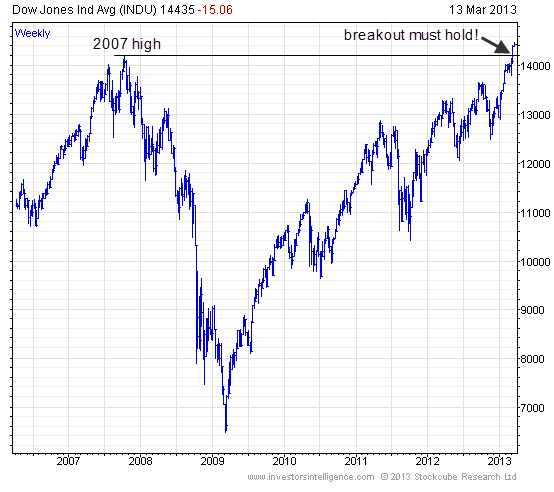

- Underlying Asset Performance: The primary driver of the Amundi DJIA ETF's NAV is the performance of the Dow Jones Industrial Average (DJIA) components. Positive movements in the DJIA generally lead to NAV increases, while negative movements cause decreases.

- Currency Fluctuations: If the ETF holds assets denominated in currencies other than the ETF's base currency, exchange rate fluctuations can affect the NAV.

- Management Fees and Expenses: The ETF's management fees and operating expenses reduce the overall assets, impacting the NAV.

- Dividend Distributions: Dividend payments from the underlying DJIA companies are usually passed on to ETF investors. These distributions reduce the NAV on the ex-dividend date.

- Impact of Inflows and Outflows: Significant inflows (new investment) or outflows (redemptions) of ETF shares can influence the NAV, although this effect is typically less pronounced than the performance of the underlying assets.

How to Access and Interpret the Amundi DJIA ETF's NAV

The daily NAV for the Amundi DJIA ETF is readily available from several sources:

- Amundi Website: The official Amundi website usually provides up-to-date NAV information for all their ETFs.

- Financial Data Providers: Major financial data providers like Bloomberg, Refinitiv, and Yahoo Finance also publish daily NAV data for ETFs.

Understanding NAV charts is essential. These charts visually represent NAV changes over time, allowing investors to identify trends and assess long-term performance. For advanced investors, comparing the NAV to the market price can reveal potential arbitrage opportunities. However, this requires a high level of market understanding and is generally not recommended for beginners.

Amundi Dow Jones Industrial Average UCITS ETF (Dist): Specific NAV Considerations

Dividend Distribution and its Effect on NAV

The Amundi DJIA ETF (Dist) distributes dividends to its shareholders. The dividend policy is clearly outlined in the ETF's prospectus.

- Pre- and Post-Dividend NAV: The NAV will decrease on the ex-dividend date, reflecting the distribution of dividends to investors.

- Tax Implications: Investors should be aware of any tax implications associated with receiving dividend distributions. This depends on their individual tax jurisdictions.

The Role of UCITS Structure on NAV Transparency

The UCITS (Undertakings for Collective Investment in Transferable Securities) structure ensures a high degree of regulatory compliance and transparency. This means the NAV calculation is subject to strict regulations, guaranteeing a clear and accurate reflection of the ETF’s value.

- Comparison to Non-UCITS Structures: Compared to non-UCITS structures, the UCITS framework offers investors greater protection and confidence in the accuracy of the reported NAV.

Comparing NAV to Other Dow Jones Industrial Average ETFs

Investors might find it beneficial to compare the NAV performance of the Amundi DJIA ETF to other similar ETFs tracking the DJIA. This allows for a relative performance assessment. (Note: This section would ideally include links to competing ETFs.)

Utilizing NAV for Investment Decisions in the Amundi DJIA ETF

NAV as an Indicator of Long-Term Value

Consistent NAV growth over time indicates strong performance of the underlying DJIA. While short-term fluctuations are normal, long-term trends provide a more reliable picture of the ETF's value.

NAV and Investment Timing Strategies

Some investors might use NAV in conjunction with other technical or fundamental analysis indicators to inform their investment timing strategies. However, it is crucial to remember that no single metric guarantees investment success, and timing the market is inherently risky.

Risks Associated with Investing Based Solely on NAV

While NAV is a vital metric, investors shouldn't base their decisions solely on it. Market conditions, overall economic outlook, and personal risk tolerance should all be considered before investing.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is essential for informed investment choices. By analyzing factors influencing its NAV and utilizing this data alongside other market indicators, investors can better assess the ETF’s performance and suitability within their portfolio. Regularly monitoring the NAV, combined with a thorough understanding of your risk tolerance and investment goals, will help you make the most of this exposure to the Dow Jones Industrial Average. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF (Dist) and its NAV by visiting [link to relevant Amundi resource]. Start your journey towards informed investing with a deeper understanding of the Amundi DJIA ETF's NAV today!

Featured Posts

-

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025 -

Erfolgsgeschichte Golz Und Brumme Als Essener Leistungstraeger

May 24, 2025

Erfolgsgeschichte Golz Und Brumme Als Essener Leistungstraeger

May 24, 2025 -

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025 -

Yevrobachennya Kudi Podilisya Peremozhtsi Ostannikh 10 Rokiv

May 24, 2025

Yevrobachennya Kudi Podilisya Peremozhtsi Ostannikh 10 Rokiv

May 24, 2025 -

Escape To The Country Everything You Need To Know Before You Go

May 24, 2025

Escape To The Country Everything You Need To Know Before You Go

May 24, 2025

Latest Posts

-

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations A Ne Pas Manquer

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations A Ne Pas Manquer

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies Du Futur En Europe

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies Du Futur En Europe

May 24, 2025 -

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques A Decouvrir

May 24, 2025

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques A Decouvrir

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Le Francais Contemporain Selon Mathieu Avanzi Un Regard Neuf

May 24, 2025

Le Francais Contemporain Selon Mathieu Avanzi Un Regard Neuf

May 24, 2025