Amundi Dow Jones Industrial Average UCITS ETF: How Net Asset Value (NAV) Impacts Your Investment

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Think of it as the intrinsic value of a single share in the ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation is directly tied to the performance of the 30 companies comprising the Dow Jones Industrial Average (DJIA).

- Components of NAV: The NAV calculation includes the market value of all the stocks held within the ETF, mirroring the DJIA's composition. It also subtracts any liabilities, such as management fees and expenses.

- Calculation Specificity: The Amundi Dow Jones Industrial Average UCITS ETF aims to replicate the DJIA's performance. Therefore, its NAV is calculated by weighting the market value of each constituent stock according to its representation in the DJIA index. This ensures a close tracking of the index.

- Frequency of Calculation: The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated and published daily, at the close of the market.

- Where to Find NAV Information: You can easily find the daily NAV on Amundi's official website, major financial news sources (like Bloomberg or Yahoo Finance), and through your brokerage account.

How NAV Fluctuations Affect Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding how NAV changes affect your investment is paramount. The NAV of the Amundi Dow Jones Industrial Average UCITS ETF directly reflects the overall performance of the DJIA.

- Impact of Market Changes: When the DJIA rises, the value of the underlying assets increases, leading to a higher NAV for the ETF. Conversely, a market downturn results in a lower NAV.

- Relationship Between NAV and ETF Share Price: Ideally, the ETF's trading price should closely track its NAV. However, a slight difference, known as tracking error, might exist due to market supply and demand. Significant discrepancies could indicate inefficiencies in the market.

- Understanding NAV for Buy and Sell Decisions: While not a perfect predictor, observing NAV trends can inform your investment strategy. Buying when the NAV is relatively low and selling when it’s high is a fundamental investment principle. However, remember that timing the market is inherently risky.

- Impact of Dividends and Expenses: Dividend payments from the underlying DJIA companies will generally increase the NAV, while management fees and other expenses will decrease it. These factors should be considered for long-term performance evaluation.

- Example Scenarios: If the DJIA increases by 5%, the Amundi Dow Jones Industrial Average UCITS ETF NAV should also increase by approximately 5% (minus any expenses). Conversely, a 2% drop in the DJIA will likely cause a similar drop in the ETF's NAV.

Factors Influencing Amundi Dow Jones Industrial Average UCITS ETF NAV Beyond Market Movements

Several factors beyond the simple rise and fall of the DJIA can influence the Amundi Dow Jones Industrial Average UCITS ETF NAV.

- Currency Fluctuations: If you're investing in the ETF in a currency different from the base currency of the ETF, fluctuations in exchange rates will impact your returns when converting back to your local currency.

- Management Fees and Expenses: The ETF's expense ratio directly affects the NAV over time. Higher expense ratios will gradually reduce the NAV, impacting your overall returns.

- Other Factors Affecting NAV: Corporate actions like stock splits, mergers, or acquisitions of companies within the DJIA can also influence the ETF's NAV, though often these are relatively short-lived effects.

Practical Strategies for Monitoring Amundi Dow Jones Industrial Average UCITS ETF NAV

Regularly monitoring the NAV is essential for informed investment management.

- Regular Monitoring: Aim to check the NAV at least once a week, or even daily if you're actively trading.

- Utilizing Online Resources: Use reputable financial websites and your brokerage platform to access real-time or end-of-day NAV data for the Amundi Dow Jones Industrial Average UCITS ETF.

- Setting Price Alerts: Many brokerage platforms allow you to set alerts that notify you when the NAV reaches specific thresholds, helping you to react to significant changes.

- Long-Term Perspective: While short-term NAV fluctuations can be tempting to react to, a long-term investment strategy focused on the overall growth of the DJIA is generally recommended.

Conclusion: Making Informed Investment Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Knowledge

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for successful investing. By consistently monitoring the NAV and considering the various factors influencing it, you can make more informed decisions about buying, selling, and managing your investment in this ETF. Remember to consider the impact of market changes, expenses, and currency fluctuations. Regularly review the ETF's fact sheet on Amundi's website and consider further research into ETF investing and NAV analysis to optimize your portfolio performance. Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV today to enhance your investment strategy!

Featured Posts

-

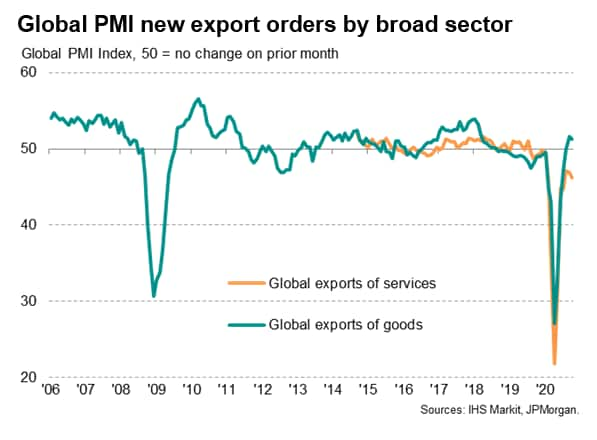

Pmi Beat Propels Dow Jones To Continued Measured Growth

May 24, 2025

Pmi Beat Propels Dow Jones To Continued Measured Growth

May 24, 2025 -

Gucci Under Demna Gvasalia A Look At The New Collections

May 24, 2025

Gucci Under Demna Gvasalia A Look At The New Collections

May 24, 2025 -

Joy Crookes Unveils I Know You D Kill A Deep Dive Into The New Track

May 24, 2025

Joy Crookes Unveils I Know You D Kill A Deep Dive Into The New Track

May 24, 2025 -

Analiz Svadeb Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 24, 2025

Analiz Svadeb Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 24, 2025 -

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025

Latest Posts

-

Camunda Con 2025 Amsterdam Orchestration For Maximum Ai And Automation Roi

May 24, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximum Ai And Automation Roi

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 24, 2025 -

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025 -

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025