Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV And Its Importance

Table of Contents

What is the Amundi MSCI All Country World UCITS ETF USD Acc?

The Amundi MSCI All Country World UCITS ETF USD Acc is an exchange-traded fund (ETF) that offers investors broad exposure to global equities. Its investment objective is to track the performance of the MSCI All Country World Index, a benchmark representing large, mid, and small-cap companies across developed and emerging markets worldwide. Being a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF means it adheres to strict European Union regulations, providing investors with a high level of regulatory oversight and investor protection.

- Globally diversified investment strategy: Provides access to a wide range of companies across numerous countries and sectors, reducing overall portfolio risk through diversification.

- Exposure to developed and emerging markets: Offers investors participation in the growth potential of both established and rapidly developing economies.

- USD-denominated for currency transparency: Simplifies currency risk management for investors whose base currency is USD or those who prefer currency clarity.

- Suitable for long-term investment goals: Designed for investors seeking long-term growth and diversification as part of a well-diversified portfolio.

Understanding Daily NAV

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, the daily NAV is calculated at the close of each trading day by Amundi, reflecting the market value of the underlying assets held within the ETF. This value per share acts as a key indicator of the ETF's performance.

- Daily NAV reflects the ETF's asset value per share: It provides a snapshot of the ETF's worth on a daily basis.

- Calculated at the end of each trading day: The NAV calculation considers the closing prices of all the assets within the ETF's portfolio.

- Influenced by global market performance and currency fluctuations: Changes in the prices of the underlying securities and fluctuations in exchange rates directly affect the daily NAV.

- Provides a benchmark for evaluating ETF performance: By tracking the daily NAV over time, investors can assess the ETF's performance against its benchmark index.

Monitoring Daily NAV for Investment Decisions

Tracking the Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV allows investors to make more informed decisions. While short-term fluctuations are normal, focusing on long-term trends is crucial. By comparing the daily NAV with the ETF's market price, investors can (although unlikely with a major ETF like this) potentially identify minor arbitrage opportunities.

- Identify potential entry and exit points: Monitoring NAV trends can help investors determine opportune moments to buy or sell the ETF.

- Assess the impact of market events on the investment: Significant global events can affect the NAV, and monitoring provides insight into the ETF's resilience.

- Track portfolio performance and adjust strategy if needed: Regular NAV checks allow for timely portfolio adjustments based on performance and risk tolerance.

Risk Management and Daily NAV

Monitoring the daily NAV is integral to effective risk management. Significant drops in the NAV can signal potential market downturns or specific risks related to the ETF's holdings. This information allows investors to adjust their portfolios according to their risk tolerance and investment goals.

- Early warning system for potential market downturns: Sharp declines in NAV can indicate broader market weakness.

- Helps assess portfolio volatility and risk exposure: Analyzing NAV fluctuations helps investors understand the risk profile of their investment.

- Facilitates informed decisions based on risk appetite: Investors can adjust their positions based on their risk tolerance and the observed NAV trends.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV

Reliable sources for accessing the Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV include:

- Amundi Website: The official source for the most accurate and up-to-date information.

- Major financial data providers (Bloomberg, Refinitiv): These platforms offer comprehensive financial data, including ETF NAVs.

- Your brokerage account: Most brokerage platforms display the daily NAV of your held ETFs.

Always verify information from multiple sources to ensure accuracy.

Conclusion

Regularly monitoring the Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV is crucial for informed investment decisions and effective risk management. Understanding the factors influencing daily NAV fluctuations allows investors to make strategic choices aligned with their long-term goals. Staying informed about the Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV and its performance is key to maximizing your global investment strategy. Learn more about the ETF and its performance by regularly checking its daily NAV and consulting with a financial advisor.

Featured Posts

-

Frankfurt Stock Exchange Dax Climbs Towards New Record At Opening

May 25, 2025

Frankfurt Stock Exchange Dax Climbs Towards New Record At Opening

May 25, 2025 -

When To Fly For The Cheapest Memorial Day Flights In 2025

May 25, 2025

When To Fly For The Cheapest Memorial Day Flights In 2025

May 25, 2025 -

Yevrobachennya 2025 Khto Peremozhe Za Prognozom Konchiti Vurst

May 25, 2025

Yevrobachennya 2025 Khto Peremozhe Za Prognozom Konchiti Vurst

May 25, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025 -

The Practicalities Of An Escape To The Country What You Need To Know

May 25, 2025

The Practicalities Of An Escape To The Country What You Need To Know

May 25, 2025

Latest Posts

-

Dazi Trump Sul Settore Moda Un Analisi Degli Effetti Su Nike Lululemon E Altri

May 25, 2025

Dazi Trump Sul Settore Moda Un Analisi Degli Effetti Su Nike Lululemon E Altri

May 25, 2025 -

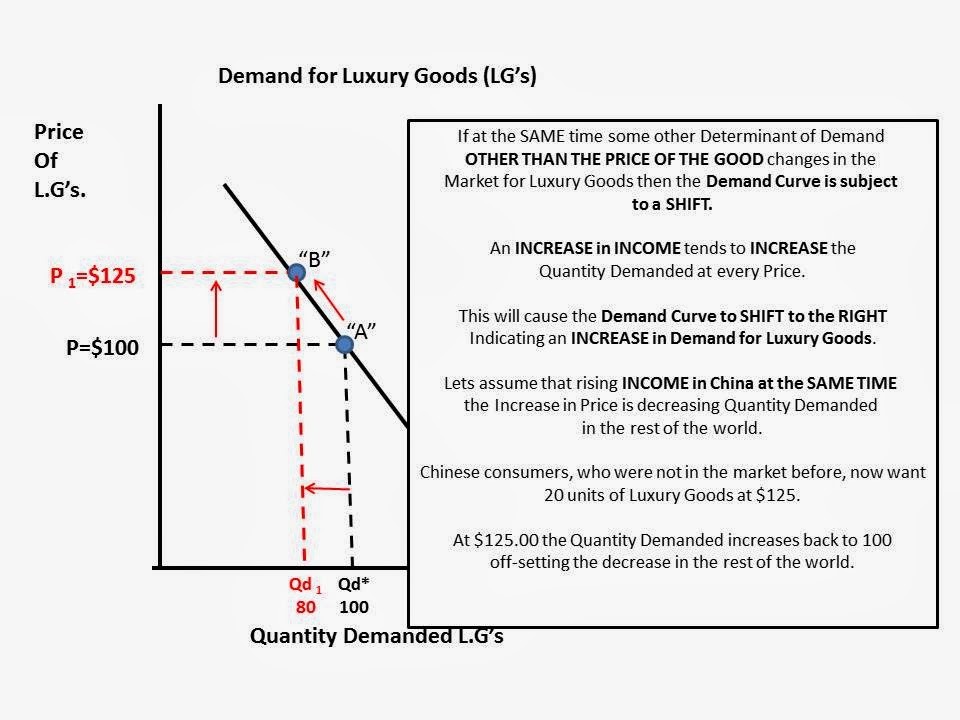

Pariss Economy Suffers From Luxury Goods Market Decline

May 25, 2025

Pariss Economy Suffers From Luxury Goods Market Decline

May 25, 2025 -

Analysis Massimo Vians Exit As Guccis Chief Industrial And Supply Chain Officer

May 25, 2025

Analysis Massimo Vians Exit As Guccis Chief Industrial And Supply Chain Officer

May 25, 2025 -

Crisi Moda Le Conseguenze Dei Dazi Del 20 Imposti Da Trump

May 25, 2025

Crisi Moda Le Conseguenze Dei Dazi Del 20 Imposti Da Trump

May 25, 2025 -

Economic Slowdown In Luxury Sector Hits Paris Hard

May 25, 2025

Economic Slowdown In Luxury Sector Hits Paris Hard

May 25, 2025