Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Importance

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's essentially the total value of all the securities (stocks, bonds, etc.) held within the ETF, minus any liabilities, divided by the number of outstanding shares. The daily NAV calculation is crucial for determining the ETF's value and is typically calculated at the end of each trading day. This daily pricing mechanism reflects the market value of the ETF's holdings.

- NAV reflects the market value of all assets held within the ETF. This provides a clear picture of the fund's performance based on the performance of its underlying assets.

- Daily NAV fluctuations show the ETF's performance against market movements. By tracking changes in the NAV, investors can gauge the ETF's sensitivity to market volatility and overall market trends.

- Comparing the daily NAV to the ETF's trading price helps identify potential arbitrage opportunities. While usually minimal, discrepancies can sometimes arise, allowing savvy investors to profit.

- Understanding NAV is crucial for calculating returns and assessing investment strategy effectiveness. It forms the basis for calculating your gains or losses and helps you evaluate your overall investment performance against your goals.

Understanding the Daily NAV of Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist’s daily NAV is directly influenced by the performance of the MSCI World Index, which it aims to track. The "Dist" designation signifies that the ETF distributes dividends to its shareholders. This distribution has a direct impact on the daily NAV.

- How the ETF's holdings in the MSCI World Index impact the daily NAV: As the underlying index performs (rises or falls), the value of the holdings within the Amundi MSCI World II UCITS ETF Dist will change proportionally, directly affecting the NAV.

- The effect of dividend payouts on the daily NAV (decrease after distribution): On the ex-dividend date, the NAV typically decreases by the amount of the dividend distributed per share. This is because the assets of the fund are reduced by the dividend payment.

- Where to find the daily NAV: You can usually find the daily NAV on the Amundi website, major financial news sources, and through your brokerage account.

- The difference between the NAV and the market price of the ETF: While ideally, the NAV and the market price should be very close, minor discrepancies might exist due to trading volume and market liquidity.

The Role of Dividends in the Daily NAV

Understanding dividend distributions is essential for interpreting the daily NAV of the Amundi MSCI World II UCITS ETF Dist.

- The NAV typically drops on the ex-dividend date reflecting the distributed amount. This is a normal occurrence and does not indicate poor performance.

- Understanding the dividend yield helps in evaluating the ETF's long-term investment potential. A higher dividend yield, all things being equal, can contribute significantly to the overall return of your investment.

- Impact of reinvestment of dividends on the overall NAV growth: If dividends are reinvested, this can lead to compounding growth and a higher overall NAV over time. This should be considered when evaluating the long-term return.

Utilizing Daily NAV for Informed Investment Decisions

Tracking the daily NAV of the Amundi MSCI World II UCITS ETF Dist empowers investors to make informed decisions.

- Monitoring NAV helps identify trends and potential investment opportunities. Consistent monitoring can reveal emerging patterns that signal potential buy or sell opportunities.

- Regular NAV checks are beneficial for portfolio rebalancing and risk management. By monitoring the NAV, you can adjust your portfolio to maintain your desired asset allocation and manage risk effectively.

- Comparing NAV with historical data helps assess performance against benchmarks. This allows investors to evaluate the ETF's performance relative to its benchmark index and the overall market.

- Combining NAV analysis with other fundamental and technical analyses for a comprehensive approach. Using NAV data in conjunction with other market indicators enhances investment decision-making.

Conclusion

Understanding the daily NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for effective investment management. By consistently monitoring the NAV, considering its fluctuations in relation to the MSCI World Index, and factoring in the impact of dividend distributions, investors can make more informed buy and sell decisions, optimize their portfolios, and ultimately achieve their investment goals. Regularly checking the Amundi website for the latest NAV data, alongside relevant market news and analysis, is key to staying informed and making sound investment choices. Learn more about optimizing your investment strategy by closely monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist and similar ETFs.

Featured Posts

-

Naujausias Porsche Elektromobiliu Ikrovimo Centras Europoje Vietos Ir Galimybes

May 24, 2025

Naujausias Porsche Elektromobiliu Ikrovimo Centras Europoje Vietos Ir Galimybes

May 24, 2025 -

Der Beliebteste Eisgeschmack In Essen Und Nrw Das Ergebnis Ueberrascht

May 24, 2025

Der Beliebteste Eisgeschmack In Essen Und Nrw Das Ergebnis Ueberrascht

May 24, 2025 -

Sexist Chants Aimed At Female Referee Spark Investigation

May 24, 2025

Sexist Chants Aimed At Female Referee Spark Investigation

May 24, 2025 -

Annie Kilners Social Media Activity After Kyle Walkers Night Out

May 24, 2025

Annie Kilners Social Media Activity After Kyle Walkers Night Out

May 24, 2025 -

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Latest Posts

-

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025 -

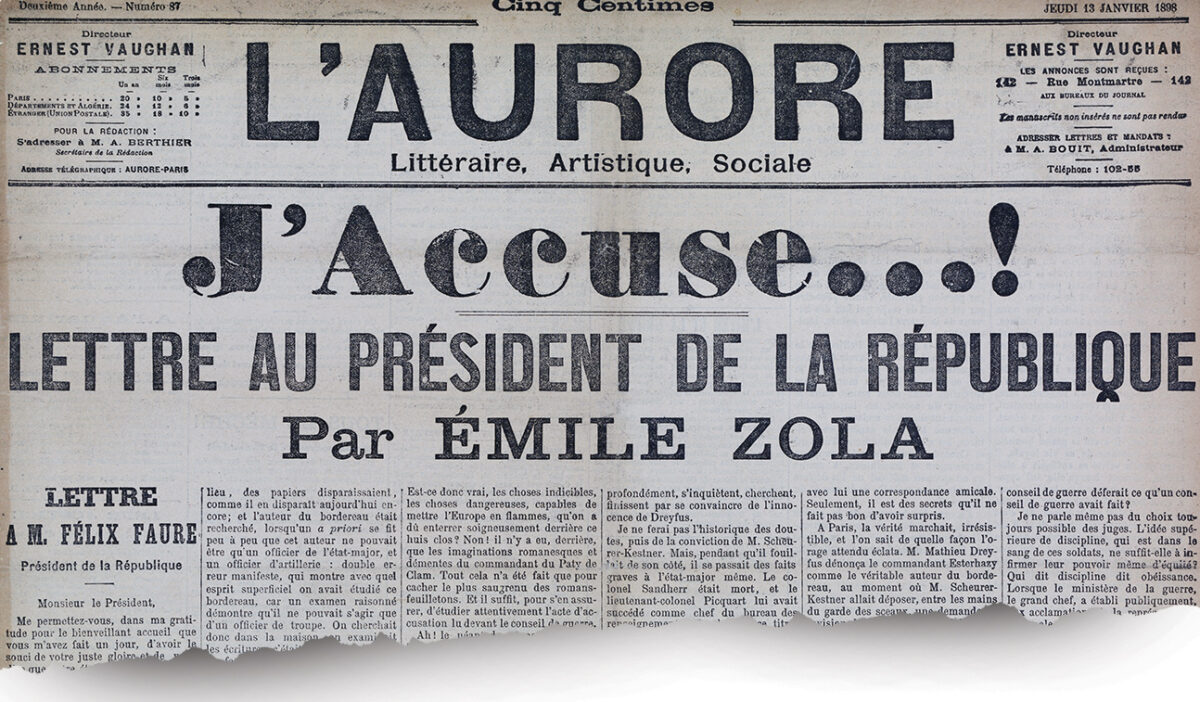

France To Recognize Dreyfus Innocence Parliament Debates Posthumous Promotion

May 24, 2025

France To Recognize Dreyfus Innocence Parliament Debates Posthumous Promotion

May 24, 2025 -

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025 -

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025