Analysis: Baazar Style Retail - JM Financial's ₹400 Target Price

Table of Contents

JM Financial's Rationale Behind the ₹400 Target Price

JM Financial's optimistic ₹400 target price is underpinned by a comprehensive financial model incorporating several key assumptions. Their analysis projects robust growth for the target company within the Bazaar Style Retail segment, driven by a multitude of factors.

- Expected Revenue Growth: The model anticipates significant revenue expansion fueled by strategic expansion into new, untapped markets across India. This includes penetrating smaller cities and towns, where the reach of organized retail remains limited.

- Improved Operating Margins: JM Financial projects a steady improvement in operating margins through efficient inventory management, optimized supply chains, and strategic cost-cutting measures.

- Increased Market Share: The analysis suggests the company is well-positioned to capture a larger market share within the Bazaar Style Retail sector, leveraging its unique strengths and competitive advantages.

- Valuation Multiples: The target price is also justified by a comparative analysis of valuation multiples applied to similar companies in the retail sector, suggesting the current valuation is undervalued considering the company's growth potential.

Understanding the Bazaar Style Retail Sector

Bazaar Style Retail, also referred to as unorganized retail, comprises the vast network of independent small businesses, kirana stores, and local shops that form the backbone of India's retail infrastructure. These businesses offer a personalized, community-focused shopping experience, often catering to specific local needs and preferences. The sector's growth potential is immense, driven by several key factors:

- Large Addressable Market: A significant untapped market exists in smaller cities and towns across India, presenting enormous growth opportunities for businesses operating within the Bazaar Style Retail model.

- Growing Consumer Preference: Consumers are increasingly showing a preference for local businesses, valuing the personalized service and community connection these traditional retail outlets offer.

- Technological Advancements: The adoption of technology, such as digital payment systems and efficient inventory management tools, is enhancing operational efficiency and supply chain management within this sector.

- Government Support: Various government initiatives aimed at supporting small businesses and promoting retail growth are also contributing to the positive outlook for Bazaar Style Retail.

Key Factors Influencing Bazaar Style Retail Growth

Several macroeconomic factors significantly influence the growth trajectory of the Bazaar Style Retail sector. These include:

- Macroeconomic Conditions: Inflation, economic growth rates, and overall consumer spending patterns have a direct impact on the sector's performance. Periods of economic stability and rising disposable incomes typically benefit this sector.

- Competitive Landscape: The sector faces competition from organized retail giants and the ever-expanding reach of e-commerce platforms. Maintaining a competitive edge requires innovation, agility, and a strong understanding of local market dynamics.

Specific points to note include:

- Digitalization: The integration of digital tools and technologies presents both challenges and opportunities for adapting traditional retail models.

- Supply Chain Management: Efficient supply chain management is crucial, especially given the fragmented nature of the Bazaar Style Retail market.

- Regulatory Changes: Changes in regulations and policies can significantly impact operations and profitability.

- Strategic Partnerships: Collaborations with larger corporations can provide access to resources and expertise, enabling growth and expansion.

Risks and Challenges for Bazaar Style Retail

Despite the significant potential, Bazaar Style Retail also faces several challenges:

- Competition: Intense competition from organized retail chains and e-commerce giants poses a significant threat. Maintaining competitiveness requires differentiation and leveraging unique selling propositions.

- Consistency and Supply: Ensuring consistent product quality and maintaining a reliable supply chain are crucial for customer satisfaction and long-term success.

- Operational Efficiency: Optimizing operational efficiency in a fragmented market is a major challenge, requiring effective management and resource allocation.

- Access to Finance: Many Bazaar Style Retail businesses struggle to access formal financing, hindering their growth and expansion plans.

Investment Implications and Future Outlook

JM Financial's analysis presents a compelling case for the investment attractiveness of Bazaar Style Retail, particularly for the specific company they've targeted. However, it's crucial to acknowledge the inherent risks.

- Potential Returns and Risks: Investing in this sector offers the potential for substantial returns, but also carries considerable risk due to market volatility and the challenges faced by small businesses.

- Comparative Analysis: A thorough comparison with other investment opportunities in the retail sector is essential before making any investment decisions.

- Long-Term Growth: The long-term growth prospects for the Bazaar Style Retail sector are positive, driven by India's burgeoning middle class and the expanding reach of retail infrastructure.

- Investor Recommendations: Investment decisions should be made based on individual risk tolerance, investment goals, and a comprehensive understanding of the market dynamics.

Conclusion: Is JM Financial's ₹400 Target Price Achievable for Bazaar Style Retail?

JM Financial's ₹400 target price for the selected Bazaar Style Retail company reflects a bullish outlook driven by strong growth projections and favorable market conditions. While the sector faces considerable challenges, the immense potential of the untapped market and the increasing consumer preference for local businesses make it an attractive investment prospect. The achievability of the ₹400 target hinges on the company's ability to navigate the competitive landscape, manage operational efficiencies, and adapt to evolving market dynamics. However, the long-term growth potential of Bazaar Style Retail remains compelling. Learn more about investing in Bazaar Style Retail today! Conduct your own thorough research and assess the risks and rewards before making any investment decisions. Dive deeper into the world of Bazaar Style Retail and discover its potential for growth and profitability.

Featured Posts

-

Anthony Edwards And His Baby Mama Custody Battle Details Emerge

May 15, 2025

Anthony Edwards And His Baby Mama Custody Battle Details Emerge

May 15, 2025 -

Positive Monsoon Forecast To Boost Indian Agriculture And Consumption

May 15, 2025

Positive Monsoon Forecast To Boost Indian Agriculture And Consumption

May 15, 2025 -

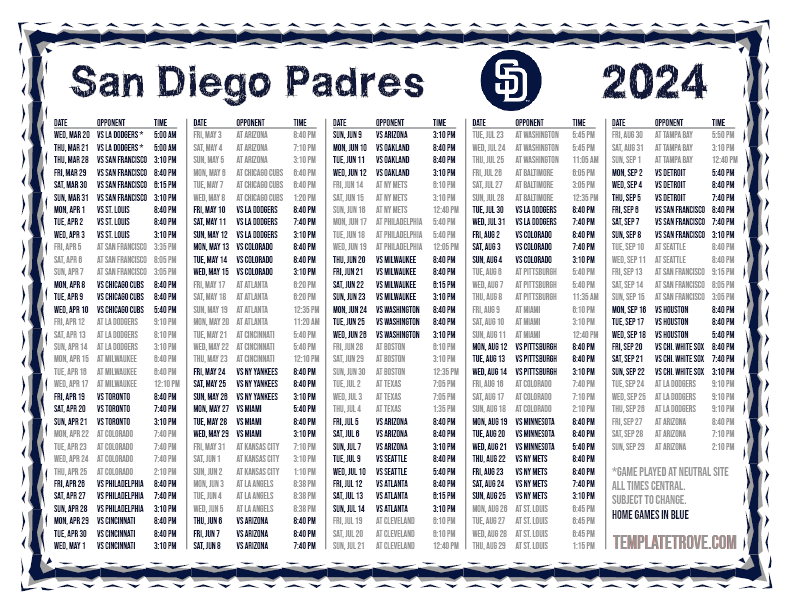

San Diego Padres Streaking Into Wrigley For The 2025 Home Opener

May 15, 2025

San Diego Padres Streaking Into Wrigley For The 2025 Home Opener

May 15, 2025 -

De Npo En Het Vertrouwen Acties Van Het College Van Omroepen

May 15, 2025

De Npo En Het Vertrouwen Acties Van Het College Van Omroepen

May 15, 2025 -

Major Cabinet Reshuffle Ai Ministry New Energy And Housing Leaders

May 15, 2025

Major Cabinet Reshuffle Ai Ministry New Energy And Housing Leaders

May 15, 2025