Analysis: Copper Prices And The China-US Trade Dynamic

Table of Contents

China's Role as a Dominant Copper Consumer

China's voracious appetite for copper is a major driver of global prices. This demand stems from two primary sources: massive infrastructure projects and a booming manufacturing sector.

Massive Infrastructure Projects and Copper Demand

China's relentless pursuit of infrastructure development fuels enormous copper consumption. The country's ambitious plans for high-speed rail expansion, renewable energy projects (solar farms, wind turbines), and smart city initiatives require vast quantities of copper wiring, cabling, and components.

- High-Speed Rail: Estimates suggest that constructing one kilometer of high-speed rail line requires approximately 100-150 tons of copper. With thousands of kilometers planned and under construction, the demand is substantial. Government initiatives like the Belt and Road Initiative further amplify this demand.

- Renewable Energy: The transition to renewable energy sources is a significant driver of copper consumption. Solar panels, wind turbines, and electric vehicle charging stations all rely heavily on copper for their electrical components. China's ambitious renewable energy targets necessitate massive copper usage.

- Smart City Initiatives: The development of smart cities, encompassing advanced infrastructure and technology, significantly increases the demand for copper in various applications, including data centers and communication networks.

Keywords: Chinese infrastructure, copper consumption, renewable energy, high-speed rail, smart cities, Belt and Road Initiative

Manufacturing Sector and Copper Usage

China's position as the world's manufacturing powerhouse contributes significantly to global copper demand. Various sectors rely heavily on copper:

- Electronics Manufacturing: The production of electronics, from smartphones and computers to advanced electronics, requires substantial amounts of copper for wiring, circuit boards, and other components. The ongoing growth of the electronics industry in China continues to drive demand.

- Construction Materials: Copper is a vital component in building construction, used in electrical wiring, plumbing systems, and roofing. The continued urbanization and construction boom in China fuel this demand.

- Automotive Industry: The automotive industry, particularly the electric vehicle (EV) sector, consumes significant quantities of copper for electric motors, batteries, and wiring. China's booming EV market translates directly into higher copper demand.

Keywords: Chinese manufacturing, electronics manufacturing, construction materials, automotive industry, copper demand, electric vehicles

The Impact of US-China Trade Policies on Copper Prices

The complex relationship between the US and China significantly impacts copper prices. Trade policies, geopolitical tensions, and resulting market uncertainty play a crucial role.

Tariffs and Trade Wars

Trade wars and tariffs imposed by the US and China have created significant disruptions in global copper supply chains, leading to price volatility.

- Tariffs on copper imports and exports between the two countries have increased costs and hampered trade flows. This impacts both the price and availability of copper globally.

- The uncertainty surrounding trade policies makes it difficult for businesses to plan and invest, leading to hesitancy and potentially reduced demand.

- As a result of trade tensions, companies have sought alternative suppliers, potentially affecting prices in different markets.

Keywords: US-China trade war, tariffs, copper import, copper export, supply chain disruption, market volatility, alternative suppliers

Geopolitical Uncertainty and Investment

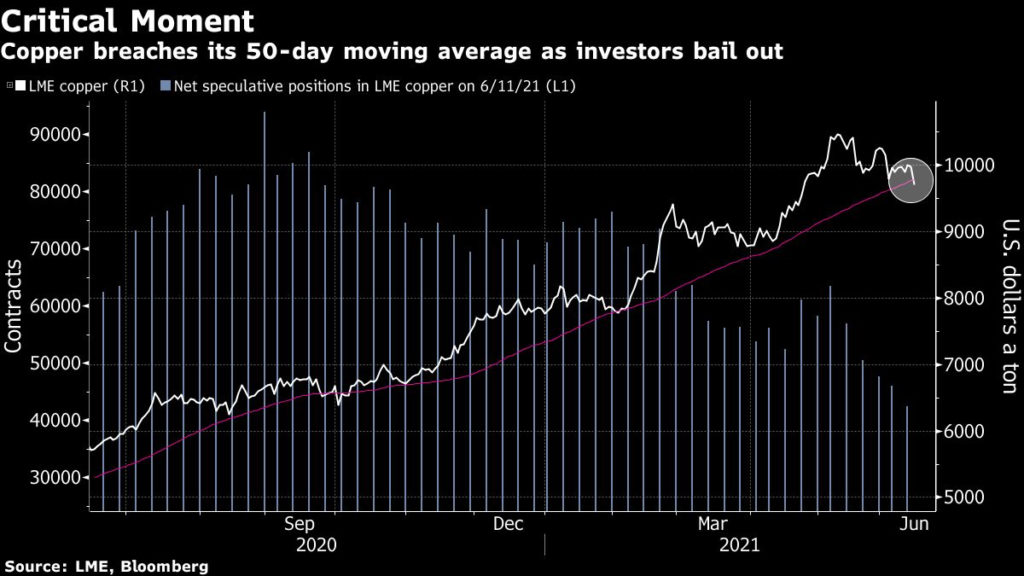

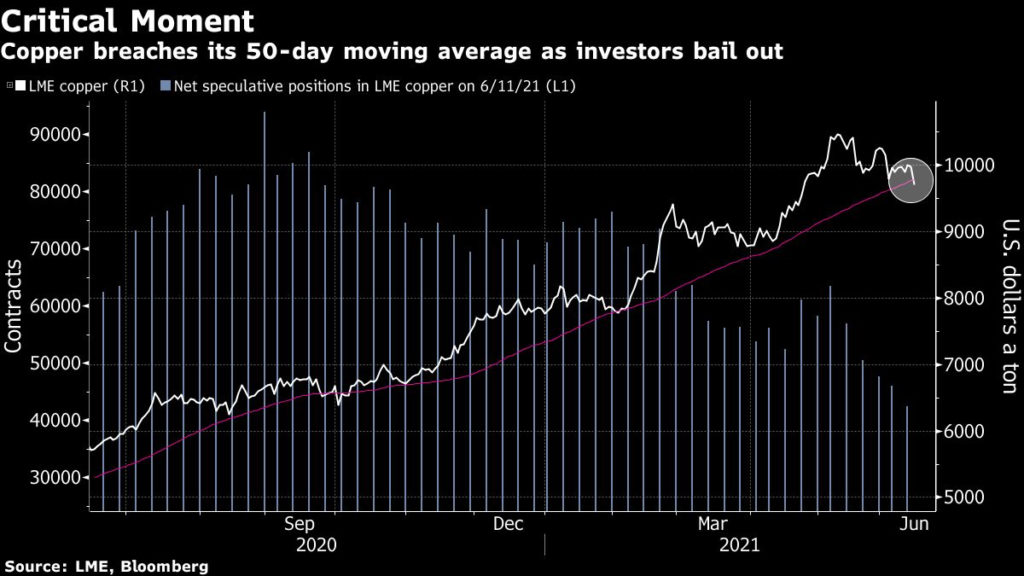

The uncertainty surrounding the US-China trade relationship significantly influences investor sentiment and copper futures prices.

- Geopolitical risk directly impacts investor confidence. Negative news about the trade relationship can lead to investors selling off copper futures contracts, driving prices down.

- Hedging strategies, employed by businesses to mitigate risk, increase market activity and can affect price volatility.

- Long-term copper investment decisions are heavily influenced by the perceived stability of the US-China relationship. Uncertainty tends to discourage long-term investment.

Keywords: Geopolitical risk, investor sentiment, copper futures, hedging strategies, commodity investment

Alternative Copper Sources and Supply Chain Resilience

To mitigate risks associated with reliance on China or the US, countries are diversifying their copper sourcing and improving production efficiency.

Diversification of Copper Sources

Several countries are key players in the global copper market, offering alternatives to relying solely on China or the US.

- Chile and Peru are major copper producers, consistently supplying significant portions of the global market. Their political stability and mining practices are key factors impacting supply.

- Other significant copper-producing countries, such as the Democratic Republic of Congo and Zambia, play a growing role in the global supply chain.

- Diversification strategies aim to reduce dependence on any single nation, providing greater stability and resilience to the global copper market.

Keywords: Copper mining, copper production, Chile copper, Peru copper, supply chain diversification, global copper supply

Technological Advancements in Copper Production

Technological advancements are improving copper production efficiency and sustainability.

- New technologies in copper extraction and processing are aimed at increasing efficiency and reducing costs. This can impact the overall supply and price of copper.

- Sustainable mining practices are becoming increasingly important, focusing on minimizing environmental impact and ensuring responsible resource management. This could affect the long-term supply and the cost of production.

- Improvements in recycling techniques are increasing the recovery rate of copper from scrap materials, contributing to a more sustainable supply.

Keywords: Copper mining technology, sustainable copper mining, copper production efficiency, technological advancements, copper recycling

Conclusion

The complex interplay between copper prices and the China-US trade dynamic highlights the interconnectedness of the global economy. Understanding the significant role of China as a copper consumer and the impact of trade policies on supply chains is crucial for navigating this volatile market. Investors and businesses need to closely monitor the evolving relationship between these two economic giants to anticipate future fluctuations in copper prices and adjust their strategies accordingly. For a deeper understanding of copper prices and the China-US trade dynamic, continue researching the latest market trends and geopolitical developments.

Featured Posts

-

Albrnamj Alsewdy Ltnmyt Wiemar Alymn Yueqd Ajtmaea Jdyda Lmjmwet Alshrkae

May 06, 2025

Albrnamj Alsewdy Ltnmyt Wiemar Alymn Yueqd Ajtmaea Jdyda Lmjmwet Alshrkae

May 06, 2025 -

Warner Bros Discovery Faces 1 1 Billion Advertising Loss Without Nba Deal

May 06, 2025

Warner Bros Discovery Faces 1 1 Billion Advertising Loss Without Nba Deal

May 06, 2025 -

Understanding Trump How To Approach Meetings For Optimal Outcomes

May 06, 2025

Understanding Trump How To Approach Meetings For Optimal Outcomes

May 06, 2025 -

Budget Shopping Quality Without The High Price

May 06, 2025

Budget Shopping Quality Without The High Price

May 06, 2025 -

The Best Affordable Items Quality And Value Combined

May 06, 2025

The Best Affordable Items Quality And Value Combined

May 06, 2025