Analysis: Dollar Depreciation And Asian Currency Instability

Table of Contents

Factors Contributing to Dollar Depreciation

Several interconnected factors contribute to the ongoing depreciation of the US dollar, creating uncertainty in global financial markets and significantly influencing Asian currency stability.

Inflationary Pressures in the US

Rising inflation in the United States is a primary driver of dollar depreciation. High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors seeking stable returns. This reduced demand directly impacts the dollar's value, pushing it downward against other major currencies.

- Impact of Federal Reserve policy: The Federal Reserve's monetary policy actions, such as interest rate hikes aimed at curbing inflation, can have both positive and negative impacts on the dollar's value. While higher rates might attract foreign investment, they can also slow economic growth, potentially weakening the dollar in the long run.

- Rising energy prices: Soaring energy prices, often influenced by geopolitical factors, contribute significantly to inflationary pressures, further diminishing the dollar's appeal.

- Supply chain disruptions: Ongoing global supply chain disruptions, exacerbated by geopolitical events and the pandemic's lingering effects, fuel inflation and add to the downward pressure on the dollar.

Increased US Debt

A burgeoning US national debt weakens investor confidence in the long-term health of the US economy. This diminished confidence can trigger capital flight, as investors seek safer havens for their assets, leading to a decline in the dollar's value.

- Impact of government spending: Large government spending programs, without corresponding revenue increases, can exacerbate the national debt and negatively impact the dollar's strength.

- Interest rate hikes: While interest rate hikes might temporarily strengthen the dollar by attracting foreign investment, excessive increases can stifle economic growth and ultimately weaken the currency.

- International credit ratings: Downgrades in US credit ratings by international agencies signal increased risk to investors, further diminishing the dollar's attractiveness.

Global Economic Uncertainty

Geopolitical instability and global economic slowdowns significantly contribute to dollar depreciation. During times of uncertainty, investors often seek safe-haven assets, reducing demand for riskier currencies like the dollar.

- Impact of the war in Ukraine: The ongoing war in Ukraine has created significant global economic uncertainty, driving investors towards safe-haven assets and weakening the dollar.

- Global recession fears: Growing fears of a global recession increase demand for stable currencies and reduce investor confidence in the dollar.

- Energy crisis: The ongoing global energy crisis further exacerbates economic uncertainty, contributing to the weakening of the dollar.

Impact on Asian Currencies

The depreciation of the US dollar has profound consequences for Asian currencies, creating increased volatility and impacting trade, investment, and overall economic stability.

Increased Volatility

A weakening dollar introduces significant uncertainty into foreign exchange markets, resulting in increased volatility for Asian currencies. This volatility complicates business planning, investment decisions, and risk management for companies operating within the region.

- Examples of specific Asian currencies experiencing volatility: The Japanese Yen, Chinese Yuan, South Korean Won, and Indian Rupee have all experienced periods of significant volatility in recent times due to the weakening dollar.

Impact on Trade and Investment

Fluctuations in exchange rates directly affect the price of imports and exports, significantly impacting trade balances across Asia. A weaker dollar can make US goods cheaper for Asian consumers but can simultaneously increase import costs for Asian countries.

- Impact on trade surpluses/deficits: Changes in exchange rates can alter trade balances, potentially shifting surpluses to deficits or vice versa for Asian nations.

- Foreign direct investment flows: Currency volatility can deter foreign direct investment, as investors become hesitant to commit capital in uncertain market conditions.

- Tourism: Exchange rate fluctuations significantly influence tourism, affecting both inbound and outbound travel from Asian countries.

Potential for Economic Instability

Significant currency fluctuations can destabilize Asian economies, particularly those with large external debts or significant reliance on exports. This can lead to inflationary pressures, higher unemployment rates, and slower economic growth.

- Examples of vulnerable Asian economies: Countries with high levels of dollar-denominated debt or economies heavily reliant on exports are particularly vulnerable to the effects of dollar depreciation.

- Potential for currency crises: In extreme cases, significant currency volatility can trigger currency crises, with potentially devastating consequences for national economies.

Conclusion

The depreciation of the US dollar and the consequent instability in Asian currencies present a complex challenge with far-reaching implications. Understanding the contributing factors and their impact is crucial for investors, businesses, and policymakers. The increased volatility necessitates careful monitoring of market trends and proactive strategies to mitigate risks. Further research and analysis into the long-term effects of dollar depreciation and Asian currency instability are vital. Stay informed about shifts in the global financial markets and consider consulting financial experts for personalized guidance in managing your investments during this period of Asian currency fluctuations and a weakening dollar.

Featured Posts

-

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025 -

Cole Escola From Clatskanie To Broadway

May 06, 2025

Cole Escola From Clatskanie To Broadway

May 06, 2025 -

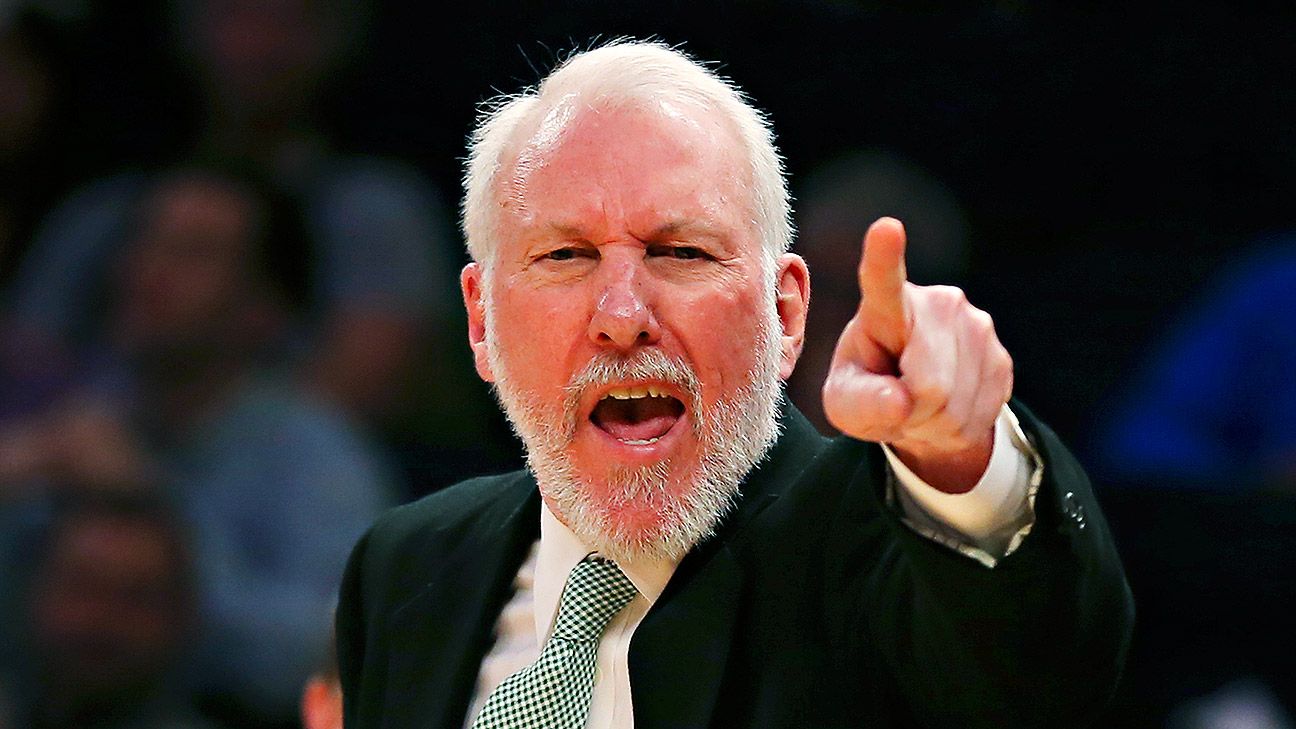

Popovich To Miami Analyzing The Heats Potential New Coach

May 06, 2025

Popovich To Miami Analyzing The Heats Potential New Coach

May 06, 2025 -

Budget Friendly Shopping Finding The Best Deals

May 06, 2025

Budget Friendly Shopping Finding The Best Deals

May 06, 2025 -

Ayo Edebiris First Love A Look Back

May 06, 2025

Ayo Edebiris First Love A Look Back

May 06, 2025