Analysis: Key Provisions Of The GOP's Comprehensive Bill

Table of Contents

Tax Reform Under the GOP Comprehensive Bill

The GOP comprehensive bill proposes sweeping changes to the nation's tax code, impacting both individual taxpayers and corporations. These changes are central to the bill's overall economic agenda, aiming to stimulate growth through targeted tax cuts and adjustments.

Individual Income Tax Changes

The proposed individual income tax changes include:

- Revised Tax Brackets: The bill suggests altering the current tax bracket system, potentially reducing the number of brackets and lowering the rates for certain income levels. This could lead to significant tax savings for some, while others might see minimal changes.

- Modified Deductions: Existing deductions, such as those for state and local taxes (SALT), might be limited or eliminated entirely. This could disproportionately impact higher-income taxpayers in high-tax states.

- Adjusted Tax Credits: Changes to existing tax credits, such as the child tax credit, are anticipated. These adjustments could either expand or limit the eligibility and amount of the credit, affecting families with children differently.

The economic consequences of these changes are complex and subject to ongoing debate. Proponents argue that lower taxes will stimulate economic growth, while critics express concerns about increased income inequality and the potential for reduced government revenue.

Corporate Tax Rate Reductions

A cornerstone of the GOP's tax reform plan is a significant reduction in the corporate tax rate. The bill proposes:

- Lower Corporate Tax Rate: A reduction in the corporate tax rate from the current level (e.g., 21%) to a lower percentage (e.g., 15%). This aims to make American businesses more competitive globally and attract foreign investment.

- Impact on Investment and Job Creation: Supporters believe this reduction will incentivize businesses to invest more in their operations, leading to increased job creation and economic growth. However, opponents argue that these benefits may not materialize, and that corporations might use the extra revenue for stock buybacks or executive compensation rather than investment.

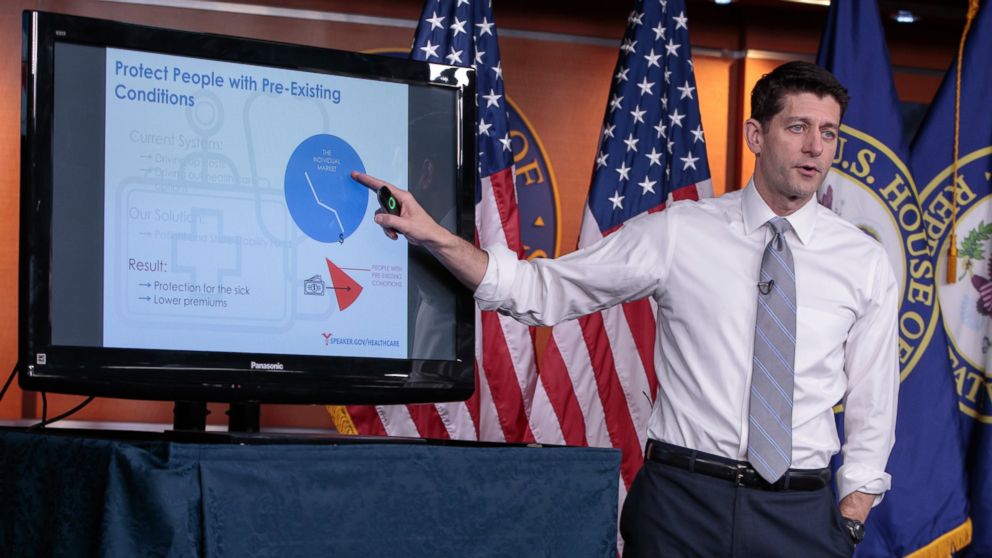

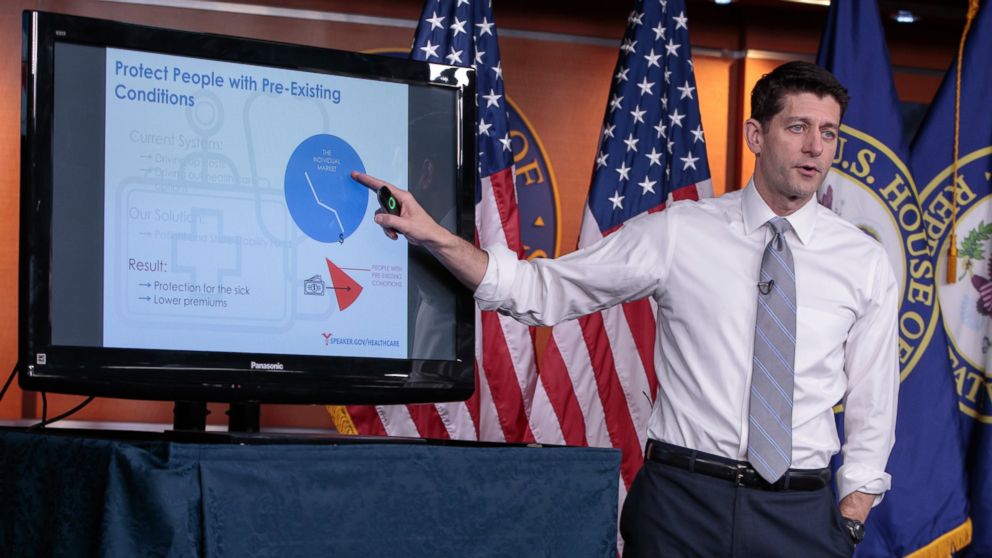

Healthcare Provisions in the GOP Comprehensive Bill

The GOP comprehensive bill includes significant proposals related to healthcare, focusing primarily on changes to the Affordable Care Act (ACA) and Medicaid.

Changes to the Affordable Care Act (ACA)

The bill proposes significant alterations to the ACA, including:

- Changes to Insurance Coverage: Potential modifications to the individual mandate, requiring individuals to have health insurance or face a penalty, might be included. Changes to the essential health benefits package could also be considered.

- Pre-existing Conditions: The bill might address provisions related to coverage for individuals with pre-existing conditions, a key provision of the ACA. Potential alterations could impact access to affordable healthcare for millions of Americans.

- Subsidies and Tax Credits: Subsidies and tax credits designed to help individuals afford health insurance could be changed, potentially affecting the affordability of insurance for low- and middle-income families.

These changes could drastically alter the healthcare landscape, potentially increasing the number of uninsured Americans and impacting the availability and affordability of healthcare services.

Medicaid Reforms

The GOP comprehensive bill is expected to propose significant reforms to the Medicaid program, potentially including:

- Funding Changes: Reductions in federal funding for Medicaid could significantly strain state budgets and necessitate cuts to services. Block grants, which allocate a fixed amount of funding to states, are a possibility.

- Eligibility Requirements: Changes to eligibility requirements could result in millions losing Medicaid coverage, impacting access to vital healthcare services for vulnerable populations.

These potential changes could have profound effects on state healthcare systems and the millions of Americans who rely on Medicaid.

Environmental Regulations and the GOP Comprehensive Bill

The GOP comprehensive bill is anticipated to include significant changes to environmental regulations and energy policies.

Proposed Rollbacks of Environmental Protections

The bill may propose weakening or eliminating various environmental regulations, including:

- Clean Air Act and Clean Water Act: Proposed changes could relax emission standards and water quality regulations, potentially impacting air and water quality.

- Endangered Species Act: Potential alterations to the Endangered Species Act could weaken protections for threatened and endangered species.

These rollbacks could have significant negative consequences for environmental protection and public health.

Energy Policy Changes

The bill might include:

- Fossil Fuel Subsidies: Continued or increased subsidies for fossil fuels could hinder the transition to renewable energy sources.

- Renewable Energy Incentives: Reductions or eliminations of incentives for renewable energy development could stifle growth in this sector.

These changes could have significant impacts on both the environment and the economy, potentially exacerbating climate change and slowing the growth of the renewable energy sector.

Other Key Provisions of the GOP Comprehensive Bill

Beyond tax reform, healthcare, and environmental policy, the GOP comprehensive bill is likely to address other critical areas.

Government Spending and Budget Allocations

The bill might propose changes to government spending, potentially involving:

- Defense Spending: Increases in defense spending are a possibility, while other areas might experience budget cuts.

- Infrastructure Spending: Proposed investments in infrastructure could stimulate economic growth but might also lead to increased national debt.

These changes could dramatically reshape the federal budget and the priorities of the government.

Social Security and Retirement Programs

Potential reforms to Social Security and other retirement programs are likely to be included, potentially affecting:

- Retirement Age: Increases in the retirement age could impact millions of Americans nearing retirement.

- Benefit Reductions: Reductions in Social Security benefits could leave retirees with less income during their retirement years.

These changes could have a profound and long-lasting impact on the financial security of millions of Americans.

Conclusion

The GOP comprehensive bill encompasses a wide range of policy proposals with potentially significant implications for the American economy, healthcare system, environment, and social welfare programs. The proposed tax reforms, healthcare changes, environmental rollbacks, and adjustments to government spending and social security represent a comprehensive effort to reshape national policy. Understanding the intricacies of the GOP comprehensive bill is crucial for informed civic engagement. Continue your research and participate in the ongoing dialogue surrounding this landmark legislation.

Featured Posts

-

Cobalt Market Volatility The Aftermath Of Congos Export Ban

May 15, 2025

Cobalt Market Volatility The Aftermath Of Congos Export Ban

May 15, 2025 -

Skema Kerja Sama Pemerintah Dan Swasta Dalam Proyek Giant Sea Wall

May 15, 2025

Skema Kerja Sama Pemerintah Dan Swasta Dalam Proyek Giant Sea Wall

May 15, 2025 -

The Nhl Draft Lottery A Breakdown Of The Rules And Fan Reaction

May 15, 2025

The Nhl Draft Lottery A Breakdown Of The Rules And Fan Reaction

May 15, 2025 -

Discussie Over Leeflang Bruins Moet Met Npo Toezichthouder In Gesprek

May 15, 2025

Discussie Over Leeflang Bruins Moet Met Npo Toezichthouder In Gesprek

May 15, 2025 -

Experiencias Con Euforias Deleznables Relatos Y Reflexiones

May 15, 2025

Experiencias Con Euforias Deleznables Relatos Y Reflexiones

May 15, 2025