Analysis Of SSE's £3 Billion Spending Cut Amidst Economic Uncertainty

Table of Contents

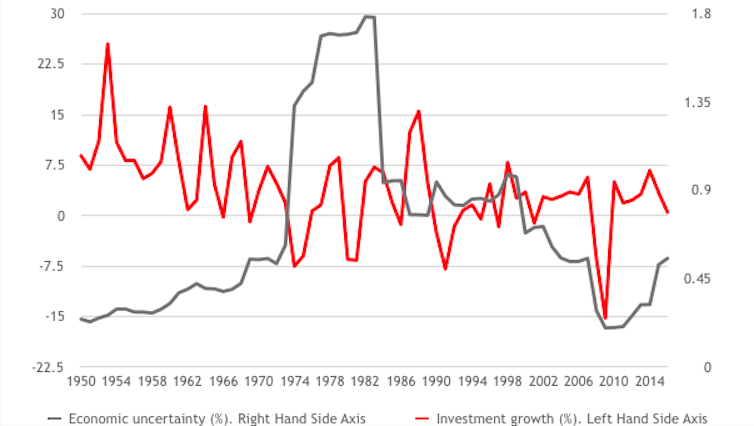

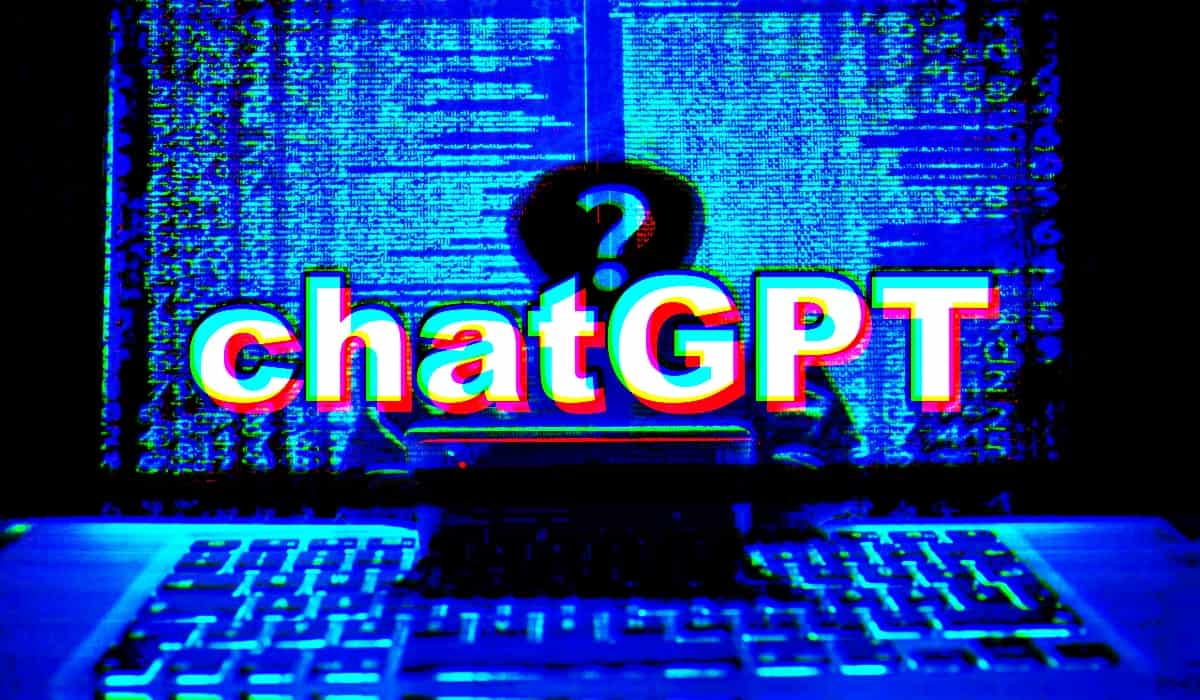

SSE's announcement of a £3 billion spending cut has sent shockwaves through the energy sector, highlighting the significant challenges posed by the current economic uncertainty. This article will delve into the reasons behind this drastic decision, analyze its implications for SSE, and explore the wider ramifications for the energy industry and the UK's energy transition. We will examine the impact on renewable energy investment, job security, and the long-term financial outlook for SSE, considering factors like inflation, government regulations, and shifting market dynamics.

<h2>Main Points: Deconstructing SSE's £3 Billion Reduction</h2>

<h3>2.1 Reasons Behind SSE's £3 Billion Spending Reduction</h3>

<h4>H3: Inflation and Rising Interest Rates</h4>

Soaring inflation and sharply increased interest rates are major culprits behind SSE's decision. The cost of borrowing has skyrocketed, making large-scale infrastructure projects significantly more expensive. Simultaneously, the cost of materials and labor has increased dramatically, squeezing profit margins.

- Increased material costs: The price of steel, copper, and other essential materials used in energy infrastructure projects has risen exponentially, impacting project budgets.

- Higher labor expenses: Wage inflation and increased competition for skilled labor have driven up labor costs, adding further pressure on project feasibility.

- Difficulty securing financing: The higher interest rate environment makes it harder and more expensive for companies like SSE to secure the necessary financing for large-scale investments. This impacts not only new projects but also the refinancing of existing debt. For example, the planned expansion of the Shetland wind farm might be delayed due to higher financing costs.

<h4>H3: Government Regulations and Energy Policy</h4>

Government policies and regulations play a crucial role in shaping the energy landscape and influencing investment decisions. Changes in renewable energy subsidies, stricter environmental regulations, and potential new energy taxes all contribute to the complexity of the investment climate.

- Changes in renewable energy subsidies: Reductions or changes in government support for renewable energy projects can significantly affect their viability.

- Stricter environmental regulations: Meeting increasingly stringent environmental standards adds to the cost and complexity of projects, potentially making some unfeasible.

- Potential impact of new energy taxes: The introduction of new taxes or levies on energy production could further reduce profitability and discourage investment. The potential impact of a carbon tax, for example, is a significant consideration for SSE's long-term planning.

<h4>H3: Shifting Market Dynamics and Consumer Behavior</h4>

The energy market is dynamic, and consumer behavior plays a significant role. Decreased energy demand due to economic downturn, increased competition, and pressure on profit margins all contribute to the need for strategic cost-cutting measures.

- Decreased energy demand: Economic slowdown can lead to lower energy consumption, impacting revenue streams and making large capital expenditures less attractive.

- Increased competition: The competitive landscape in the energy sector is intense, forcing companies to carefully manage costs to remain profitable.

- Impact on profit margins: The combination of rising costs and potentially lower demand directly impacts profitability, making cost-cutting measures crucial for survival. Data showing a decrease in household energy consumption during the past year further underscores this point.

<h4>H3: Focus on Core Business and Profitability</h4>

The spending cut reflects SSE's strategic focus on improving profitability and strengthening its financial position. This involves prioritizing core projects, streamlining operations, and implementing rigorous cost optimization strategies.

- Prioritization of key projects: SSE is likely focusing its resources on projects with the highest potential returns and strategic importance.

- Streamlining operations: Internal efficiency improvements are being implemented to reduce operational costs.

- Cost optimization strategies: A comprehensive review of all spending is being conducted, identifying areas for potential cost savings without compromising safety or quality. Financial reports released by SSE will detail these strategies in the coming months.

<h3>2.2 Implications of the Spending Cut for SSE</h3>

<h4>H3: Impact on Renewable Energy Investments</h4>

The spending cut will inevitably impact SSE's renewable energy portfolio and its long-term sustainability goals. Some projects may be delayed or cancelled entirely, potentially slowing the transition to cleaner energy sources.

- Delayed or cancelled projects: Projects deemed less strategically important or less financially viable may be postponed or abandoned altogether.

- Reduced investment in renewable energy infrastructure: The overall level of investment in renewable energy infrastructure will likely be lower than previously planned.

- Potential impact on carbon emission targets: The reduction in renewable energy investment could hinder SSE's ability to meet its carbon emission reduction targets.

<h4>H3: Effect on Job Security and Employment</h4>

The £3 billion cut could lead to job losses, restructuring initiatives, and potentially impact employee morale. SSE will likely implement measures to minimize redundancies, but some job losses are possible.

- Potential job losses: While SSE aims to minimize job losses, some redundancies are anticipated as part of the restructuring process.

- Restructuring initiatives: The company will likely undertake significant restructuring efforts to improve efficiency and reduce costs.

- Employee morale: Uncertainty surrounding job security and potential restructuring could negatively affect employee morale.

<h4>H3: Long-Term Financial Outlook for SSE</h4>

The long-term financial consequences of the spending cut are complex and depend on various factors. The immediate impact might be a dip in share price, but the long-term effects will depend on the success of SSE's cost-cutting and strategic refocusing.

- Impact on share price: The announcement of the spending cut is likely to have caused a temporary drop in SSE's share price.

- Credit rating: Credit rating agencies will be closely monitoring SSE's financial performance following the spending cuts.

- Investor confidence: The long-term impact on investor confidence will depend on how effectively SSE manages the challenges and demonstrates a path to sustainable profitability. Analyst reports will provide further insights into the long-term financial prospects.

<h3>2.3 Wider Implications for the Energy Sector</h3>

<h4>H3: Industry-wide Trend</h4>

SSE's decision may signal a wider trend within the energy sector, as other companies grapple with similar challenges. Many energy companies are likely undertaking their own cost-cutting measures in response to the current economic climate.

- Similar cost-cutting measures by other energy companies: We can anticipate similar announcements from other major energy players as they navigate the current economic headwinds.

- Impact on overall investment in the energy sector: The reduced investment across the sector could hinder progress in the energy transition and impact future energy security. This will significantly affect the speed of the green energy transformation.

<h4>H3: Impact on Energy Transition</h4>

Reduced investment in the energy sector, particularly in renewable energy, could slow down the transition to a low-carbon energy system. This will have considerable consequences for achieving climate change goals.

- Slowed progress towards renewable energy targets: The decrease in investment may delay or even jeopardize the achievement of national and international renewable energy targets.

- Potential impact on climate change goals: A slower transition to renewable energy sources will likely increase carbon emissions and hinder efforts to combat climate change.

<h2>Conclusion: The Future of SSE and the Impact of Spending Cuts</h2>

SSE's £3 billion spending cut reflects the significant challenges facing the energy sector amidst persistent economic uncertainty. The decision, driven by inflation, rising interest rates, government regulations, and shifting market dynamics, will have profound implications for SSE's renewable energy investments, job security, and long-term financial outlook. Furthermore, it signals a potential industry-wide trend that could impact the pace of the energy transition and efforts to mitigate climate change. While the immediate consequences might be negative, the long-term success will depend on SSE's ability to effectively manage its resources, implement cost-cutting strategies, and adapt to the evolving energy landscape. Keep up-to-date with further analysis of SSE's financial performance and the evolving landscape of the energy market amidst continued economic uncertainty.

Featured Posts

-

Fascisms Threat A Delaware Governors Perspective On The Post Biden Administration

May 26, 2025

Fascisms Threat A Delaware Governors Perspective On The Post Biden Administration

May 26, 2025 -

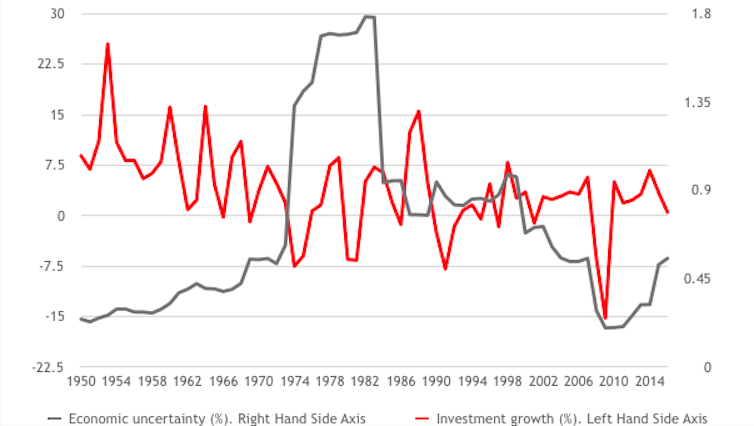

Flash Flood Emergency Preparedness A Step By Step Guide

May 26, 2025

Flash Flood Emergency Preparedness A Step By Step Guide

May 26, 2025 -

Ralph Fiennes In Talks To Play Coriolanus Snow In The Hunger Games Fans Favor Kiefer Sutherland

May 26, 2025

Ralph Fiennes In Talks To Play Coriolanus Snow In The Hunger Games Fans Favor Kiefer Sutherland

May 26, 2025 -

Tour Of Flanders The Ultimate Duel Between Pogacar And Van Der Poel

May 26, 2025

Tour Of Flanders The Ultimate Duel Between Pogacar And Van Der Poel

May 26, 2025 -

Chat Gpt Developer Open Ai Facing Ftc Investigation

May 26, 2025

Chat Gpt Developer Open Ai Facing Ftc Investigation

May 26, 2025