Analysis Of Thames Water Executive Bonuses: Fair Or Unfair?

Table of Contents

2.1. Examining Thames Water's Financial Performance: Profitability vs. Investment

Thames Water's financial performance is central to evaluating the fairness of its executive bonuses. A thorough examination reveals a complex picture where profitability doesn't necessarily translate to efficient service delivery or responsible investment in infrastructure.

- Profitability and Debt: While Thames Water has reported profits, analyzing their financial reports reveals significant levels of debt. This debt burden raises questions about the allocation of resources – is profit being prioritized over crucial upgrades to aging infrastructure? Detailed scrutiny of their balance sheets and income statements is needed to understand the true financial health of the company.

- Bonus Structure and Metrics: The specific metrics used to determine executive bonuses are crucial. Were these KPIs focused solely on shareholder returns and short-term profits, neglecting the long-term needs of the water system and the well-being of customers? Transparency regarding these metrics is essential for public accountability. If these details weren't publicly available, it undermines the fairness of the process.

- Industry Benchmarks: Comparing Thames Water's performance against competitors in the UK water industry is vital. Do other water companies with similar financial situations compensate executives at a similar rate? Such a comparison will highlight whether Thames Water's bonus structure is an outlier or reflects industry standards. A lack of transparency from other companies doesn't excuse Thames Water's actions.

Bullet Points:

- Key Financial Indicators: Revenue, Operating Profit, Net Profit, Return on Equity, Debt-to-Equity Ratio.

- Discrepancies: A comparison between reported profits and investment in infrastructure maintenance and upgrades is crucial for evaluating the fairness of bonuses.

- External Audits: Any external audits or regulatory investigations should be considered, as these can shed light on potential accounting irregularities or mismanagement.

2.2. The Role of Ofwat in Regulating Thames Water and Executive Compensation

Ofwat, the water services regulator for England and Wales, plays a critical role in overseeing water companies like Thames Water. Their involvement in regulating executive compensation is key to understanding the context of the bonus controversy.

- Regulatory Framework: Ofwat's regulatory framework regarding executive pay in the water industry needs thorough examination. Are there clear guidelines and limitations on bonus payouts, tied to performance metrics that prioritize customer service and infrastructure investment?

- Ofwat's Response: Ofwat's response to the Thames Water bonus controversy is crucial. Did they launch an investigation? Did they impose any penalties or sanctions? Their actions (or lack thereof) directly reflect the effectiveness of the current regulatory framework.

- Effectiveness of Regulation: The current regulatory framework needs to be assessed. Does it adequately prevent excessive executive compensation at the expense of customers and necessary infrastructure improvements? The recent controversy suggests potential weaknesses that need addressing.

Bullet Points:

- Relevant Ofwat Regulations: Specific regulations related to executive pay and performance-related bonuses should be cited.

- Fines and Penalties: A list of any fines or penalties imposed on Thames Water in recent years is important for assessing their compliance record.

- Regulatory Effectiveness: A critical evaluation of Ofwat's role in preventing excessive executive compensation is crucial.

2.3. Public Perception and the Ethics of Executive Bonuses amidst Service Failures

Public perception of the Thames Water executive bonuses is overwhelmingly negative. This negative sentiment raises important ethical questions about corporate responsibility and fairness.

- Public Reaction: News articles, social media posts, and public opinion polls reveal widespread anger and frustration towards Thames Water's executive compensation practices. The public's perception is directly tied to the contrast between lavish bonuses and the poor quality of service experienced by many customers.

- Ethical Implications: Awarding substantial bonuses while customers face high bills and substandard service raises serious ethical concerns. It underscores a disconnect between the company's priorities and the needs of its customers. The contrast raises questions about corporate social responsibility in the water industry.

- Impact on Reputation: The negative publicity surrounding the bonuses will undoubtedly impact Thames Water's reputation and its ability to attract investors and maintain public trust.

Bullet Points:

- Quotes from Stakeholders: Include quotes from affected customers, politicians, and consumer groups to illustrate public sentiment.

- Corporate Social Responsibility: Discuss the lack of corporate social responsibility shown by Thames Water.

- Legal Challenges: Mention any potential legal challenges or shareholder activism related to the bonuses.

3. Conclusion: Fairness and Future of Thames Water Executive Compensation

The analysis of Thames Water executive bonuses reveals a complex interplay between financial performance, regulatory oversight, and public perception. While the company may have reported profits, the high levels of debt and the apparent lack of investment in crucial infrastructure raise serious concerns. Furthermore, the lack of transparency surrounding the bonus metrics and the inadequate response from Ofwat cast significant doubt on the fairness of these payouts. The ethical implications are undeniable, especially considering the poor service provided to many customers. The bonuses were largely unjustified based on the evidence presented.

The debate over Thames Water executive bonuses highlights the need for greater transparency and accountability in the water industry. Continue the conversation and demand fairer practices by contacting your local MP and urging them to address the concerns raised about Thames Water executive compensation. Further research into the regulatory framework governing water companies is also crucial to ensuring that such controversies are avoided in the future.

Featured Posts

-

The Mystery Of The Red Lights Over France A Deep Dive

May 22, 2025

The Mystery Of The Red Lights Over France A Deep Dive

May 22, 2025 -

Arrest Made In Killing Of Embassy Workers Lischinsky And Milgram

May 22, 2025

Arrest Made In Killing Of Embassy Workers Lischinsky And Milgram

May 22, 2025 -

Concert De Novelistes Avant Le Hellfest A L Espace Julien

May 22, 2025

Concert De Novelistes Avant Le Hellfest A L Espace Julien

May 22, 2025 -

Aaron Rodgers To Steelers Insider Squashes Pat Mc Afee Show Speculation

May 22, 2025

Aaron Rodgers To Steelers Insider Squashes Pat Mc Afee Show Speculation

May 22, 2025 -

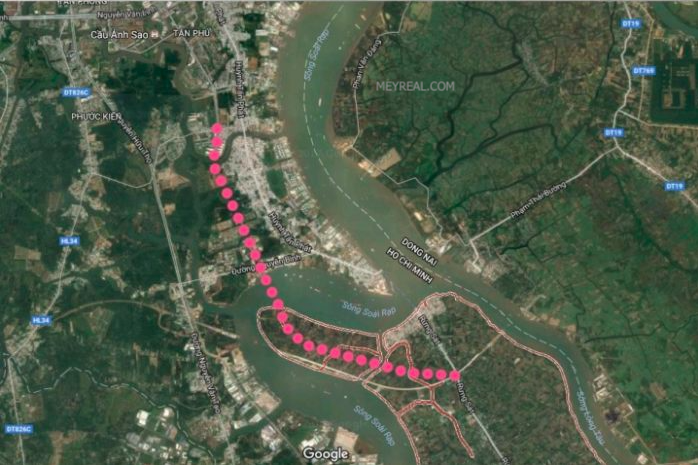

Thong Tin Du An Cau Ma Da Khoi Cong Thang 6 Ket Noi Dong Nai Binh Phuoc

May 22, 2025

Thong Tin Du An Cau Ma Da Khoi Cong Thang 6 Ket Noi Dong Nai Binh Phuoc

May 22, 2025