Analyzing Apple Stock's Performance Ahead Of Q2 Report

Table of Contents

Recent Market Trends and their Impact on Apple Stock

The current global economic climate significantly influences Apple's sales and, consequently, its stock price. Understanding these trends is crucial for any Apple Stock performance analysis.

Global Economic Conditions

The global economy presents a mixed bag of challenges and opportunities for Apple.

- Rising Inflation: Increased inflation erodes consumer purchasing power, potentially impacting demand for Apple's premium products.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down economic growth and impacting Apple's sales.

- Supply Chain Disruptions: Ongoing supply chain issues could constrain Apple's production capacity and lead to delays in product releases.

- Consumer Spending Trends: Shifts in consumer spending patterns, towards essential goods rather than discretionary items like electronics, could affect Apple's sales figures.

These factors could negatively impact Apple's Q2 performance and stock price. However, Apple's strong brand loyalty and diverse product portfolio could mitigate some of these risks. A strong performance in services revenue, for example, could offset any decline in hardware sales.

Competitor Analysis

Apple faces stiff competition from several tech giants. A thorough competitor analysis is vital for any effective Apple stock performance analysis.

- Samsung: Samsung remains a major competitor, particularly in the smartphone market, offering comparable technology at often lower price points.

- Google: Google's Android operating system powers a vast majority of smartphones globally, posing a continuous challenge to Apple's iOS ecosystem.

- Microsoft: Microsoft's expansion into mobile devices and cloud services presents competition in various market segments.

The competitive landscape is dynamic. Innovative products and aggressive marketing strategies from competitors could impact Apple's market share and, subsequently, its stock performance. Apple's ability to innovate and maintain its brand premium will be key factors in determining its future success.

Analyzing Key Performance Indicators (KPIs) for Apple Stock

Analyzing key performance indicators provides critical insights into Apple's financial health and future prospects.

Revenue Projections

Analyst predictions for Apple's Q2 revenue vary, but generally, expectations remain high considering the company's historical performance. A detailed analysis of segment-wise revenue is crucial:

- iPhone Sales: This segment remains the core driver of Apple's revenue, and any significant fluctuations here drastically affect the overall performance.

- iPad Sales: While not as dominant as iPhone sales, iPad revenue contributes significantly and its performance reflects consumer spending trends.

- Mac Sales: The Mac segment, while experiencing growth, faces competition from other PC manufacturers.

- Wearables, Home, and Accessories: This segment reflects the growth of Apple's ecosystem and its penetration into diverse consumer needs.

- Services: The services segment, encompassing Apple Music, iCloud, and the App Store, demonstrates significant growth potential and revenue stability.

Any divergence from projected revenue could significantly impact Apple stock.

Earnings Per Share (EPS)

Earnings per share (EPS) is a crucial metric for investors. Comparing projected EPS with previous quarters and analyst consensus reveals insights into the company's profitability and growth trajectory.

- Comparison with Previous Quarters: Analyzing year-over-year and quarter-over-quarter growth in EPS helps understand the trends and stability of Apple's profitability.

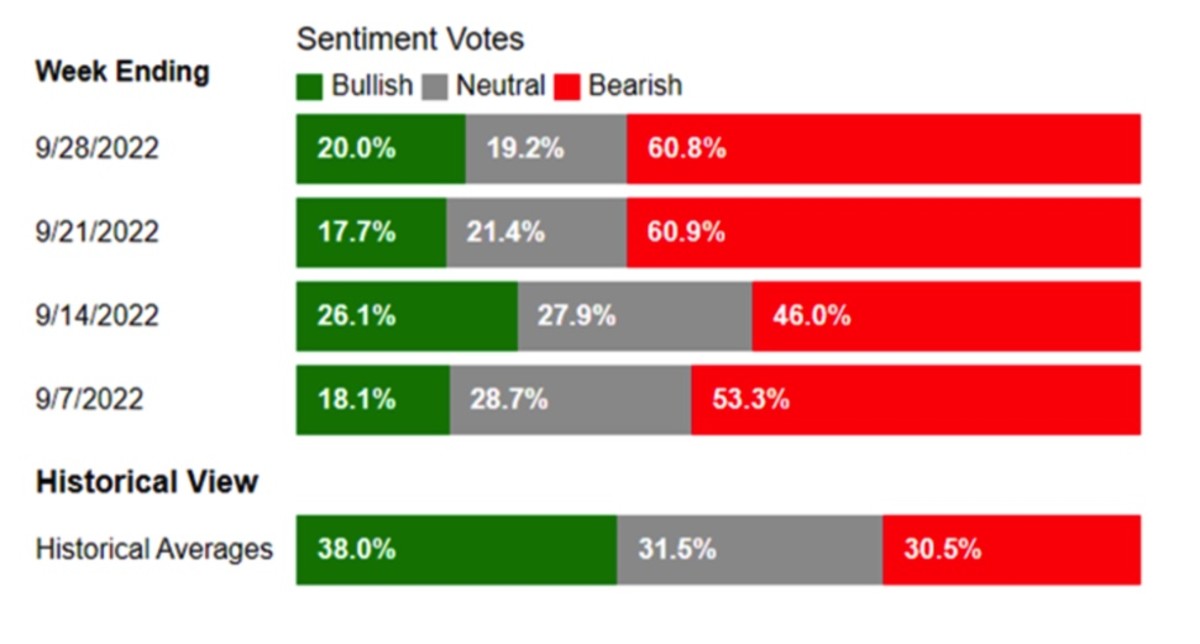

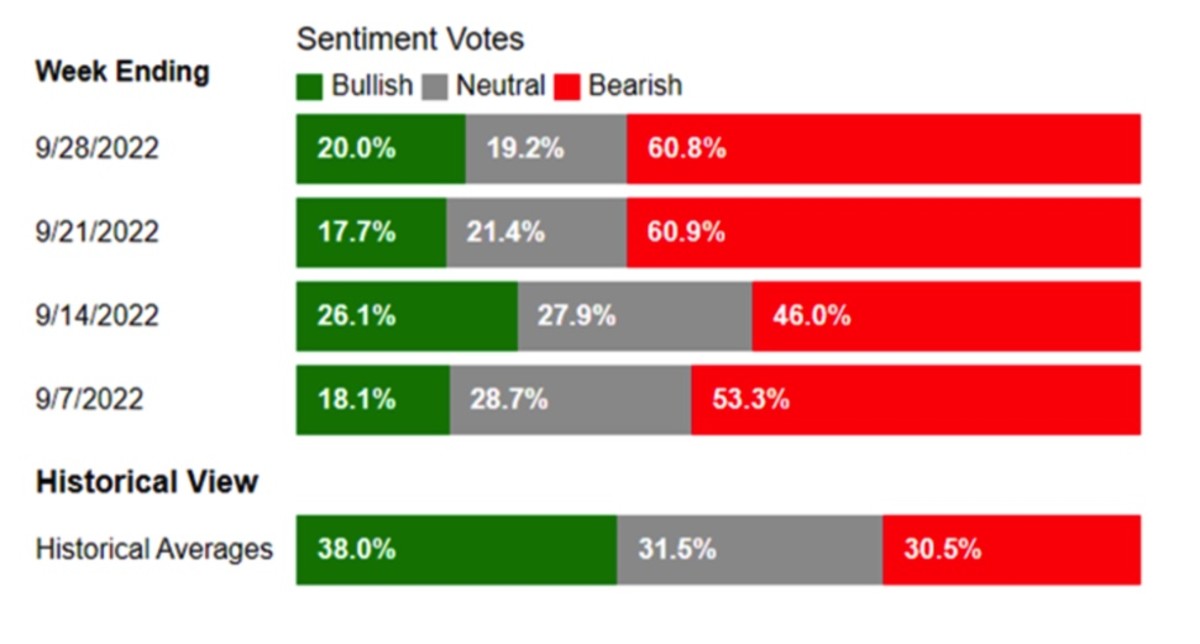

- Analyst Consensus: Comparing the projected EPS with the consensus forecast among financial analysts provides context and market sentiment.

- Factors Affecting EPS: Several factors, such as currency exchange rates, one-time charges, and changes in tax rates, can influence EPS.

A deviation from expected EPS can cause significant volatility in Apple stock prices.

Product Performance and Demand

Evaluating the performance and demand for key Apple products is crucial for an accurate Apple stock performance analysis.

- iPhone Sales: Analyzing iPhone sales provides critical insights into consumer demand and the success of new models and updates.

- Mac Sales: Assessing the performance of Mac sales reflects trends in the personal computer market.

- iPad Sales: Evaluating iPad sales helps understand the demand for tablets and the adoption of Apple's ecosystem in education and professional settings.

- Services Subscriptions: The growth in services subscriptions reflects the success of Apple's services ecosystem and its ability to generate recurring revenue.

Tracking these metrics helps predict future revenue streams and their impact on the Apple stock price.

Factors to Consider Before Investing in Apple Stock Post-Q2 Report

Before making any investment decisions, consider several factors beyond the Q2 report.

Risk Assessment

Investing in Apple stock, like any investment, involves inherent risks.

- Geopolitical Risks: Global political instability and trade tensions could disrupt Apple's supply chains and impact its international sales.

- Regulatory Changes: New regulations or antitrust actions could affect Apple's operations and profitability.

- Competition: Increased competition from other tech companies could erode Apple's market share and profitability.

- Economic Downturns: A significant economic downturn could drastically reduce consumer spending, impacting Apple's sales.

A thorough risk assessment is crucial for any informed investment strategy.

Valuation Metrics

Apple's valuation, relative to its peers and historical trends, is a key factor to consider.

- Price-to-Earnings Ratio (P/E): Comparing Apple's P/E ratio to industry peers helps determine if it's overvalued or undervalued.

- Price-to-Sales Ratio (P/S): Analyzing the P/S ratio provides another perspective on Apple's valuation relative to its revenue generation.

These metrics help determine whether the current Apple stock price reflects its underlying value and future growth potential.

Long-Term Growth Potential

Apple's long-term success depends on its ability to innovate and adapt to changing market conditions.

- New Product Development: Apple's ability to introduce innovative products and services will be key to maintaining its growth trajectory.

- Expansion into New Markets: Exploring new market segments and expanding its global reach will contribute to long-term growth.

- Technological Advancements: Staying at the forefront of technological innovation is essential for maintaining a competitive edge.

Analyzing Apple's long-term growth potential is essential for determining whether it's a worthwhile long-term investment.

Conclusion: Making Informed Decisions About Apple Stock

Analyzing Apple stock's performance involves considering numerous factors, including recent market trends, key performance indicators like revenue and EPS, and a comprehensive risk assessment. Understanding the competitive landscape, evaluating product demand, and analyzing valuation metrics are all crucial for making informed decisions. By carefully analyzing Apple stock's performance and considering the factors discussed above, you can make informed investment decisions about this influential tech giant. Continue your own comprehensive Apple stock performance analysis to ensure a well-informed strategy.

Featured Posts

-

Avrupa Borsalari Karisik Bir Guenuen Ardindan

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan

May 24, 2025 -

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025 -

Ftc Launches Probe Into Open Ai And Chat Gpt Data Privacy Concerns

May 24, 2025

Ftc Launches Probe Into Open Ai And Chat Gpt Data Privacy Concerns

May 24, 2025 -

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025 -

Apresentacao Oficial Ferrari 296 Speciale E Seus 880 Cv Hibridos

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seus 880 Cv Hibridos

May 24, 2025

Latest Posts

-

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025 -

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025 -

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025 -

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025 -

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025