Analyzing BBVA's Long-Term Investment Banking Strategy

Table of Contents

BBVA's Historical Performance in Investment Banking

BBVA, a global financial services group, holds a significant position in the international investment banking arena. Understanding its historical performance provides valuable context for evaluating its current strategy. BBVA's investment banking journey has been marked by periods of both considerable success and challenges. Early expansion and strategic acquisitions played a pivotal role in shaping its global footprint. However, like many financial institutions, BBVA faced headwinds during the 2008 financial crisis and subsequent economic downturns. Analyzing this historical context is vital to understanding the evolution of BBVA's current investment banking strategy.

- Key acquisitions and mergers: The acquisition of Compass Banking Corporation in the US and significant expansion in Latin America were key milestones, though not without their own challenges in integration and market adaptation.

- Significant market share changes: BBVA's market share has fluctuated over time, reflecting broader market trends and the competitive landscape of the investment banking sector. Periods of growth were often followed by periods of consolidation and strategic repositioning.

- Performance metrics (e.g., revenue, profitability): Tracking key performance indicators such as revenue generated from investment banking activities and profitability margins provides a quantitative assessment of its success. These metrics provide a critical benchmark for evaluating the effectiveness of its strategic decisions.

- Comparison to competitors (e.g., Santander, JPMorgan Chase): Benchmarking BBVA's performance against key competitors like Santander and JPMorgan Chase highlights its relative strengths and weaknesses within the sector. A comparative analysis can reveal areas for potential improvement and strategic adjustments.

Current Strategic Focus and Key Initiatives

BBVA's current investment banking strategy centers on several key initiatives designed to drive growth and enhance its competitive position. This includes a strong focus on specific industry sectors and geographic expansion, leveraging technology, and integrating ESG considerations.

- Focus on specific industry sectors (e.g., renewable energy, technology): BBVA has identified high-growth sectors like renewable energy and technology as key target markets, aligning its investment banking services with long-term economic trends and societal needs.

- Geographic expansion strategies (e.g., Latin America, Asia): BBVA continues to actively pursue geographic expansion, particularly in Latin America and Asia, seeking to tap into emerging market opportunities and diversify its revenue streams.

- Key partnerships and alliances: Strategic collaborations and alliances with fintech companies and other financial institutions are vital for enhancing its service offerings and expanding its reach.

- Investment in new technologies (e.g., fintech, AI): Significant investment in fintech and artificial intelligence is crucial for improving operational efficiency, enhancing customer experience, and developing innovative financial products.

- Emphasis on sustainable finance and ESG (Environmental, Social, and Governance) factors: BBVA is actively promoting sustainable finance initiatives, integrating ESG considerations into its investment banking operations, reflecting a growing global focus on environmental and social responsibility.

Strengths and Weaknesses of BBVA's Investment Banking Strategy

A SWOT analysis provides a structured framework for evaluating BBVA's investment banking strategy:

Strengths:

- Experienced personnel with deep market knowledge and expertise.

- Strong brand reputation and established client relationships.

- Significant presence in key global markets, particularly in Europe and Latin America.

- Commitment to technological innovation and digital transformation.

Weaknesses:

- Relatively smaller market share compared to some global giants in certain regions.

- Potential challenges in integrating acquired entities and managing operational complexities.

- Dependence on specific geographic markets and economic conditions.

Opportunities:

- Growth potential in emerging markets with expanding financial sectors.

- Increasing demand for sustainable finance solutions and ESG-aligned investments.

- Potential for strategic partnerships and alliances to expand market reach and service offerings.

Threats:

- Intense competition from established global investment banks and new fintech entrants.

- Economic downturns and geopolitical instability impacting investment activity.

- Regulatory changes and evolving compliance requirements impacting operations.

Potential Future Challenges and Opportunities for BBVA

BBVA's future success hinges on its ability to navigate potential challenges and capitalize on emerging opportunities.

- Impact of fintech and digital transformation: The rapid advancement of fintech and digital technologies presents both challenges and opportunities. Adapting to this evolving landscape is crucial for maintaining competitiveness.

- Adapting to evolving regulatory landscapes: Staying compliant with ever-changing regulations and maintaining a strong risk management framework is critical for long-term sustainability.

- Managing risks associated with global uncertainty: Geopolitical instability and economic volatility require robust risk management strategies to mitigate potential negative impacts.

- Leveraging data analytics and AI for better decision-making: Utilizing advanced data analytics and AI capabilities for improved decision-making and enhanced customer service is essential for future growth.

Conclusion: Analyzing BBVA's Long-Term Investment Banking Strategy – Key Takeaways and Future Outlook

Analyzing BBVA's long-term investment banking strategy reveals a complex picture of strengths, weaknesses, opportunities, and threats. While BBVA possesses significant assets, including a strong brand and experienced personnel, it faces competitive pressure and the need for continuous adaptation in a rapidly changing global landscape. Its strategic focus on specific sectors, geographic expansion, and technological innovation holds promise for future growth, but effectively managing risks and navigating regulatory challenges will be crucial. To gain a deeper understanding of BBVA's future trajectory, it's essential to stay informed about its strategic moves and announcements. Follow BBVA's investor relations section and news releases to keep abreast of developments related to BBVA's long-term investment banking strategy and its ongoing evolution.

Featured Posts

-

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025 -

Watch Stagecoach 2025 Online The Ultimate Livestream Guide

Apr 25, 2025

Watch Stagecoach 2025 Online The Ultimate Livestream Guide

Apr 25, 2025 -

The Above The Law Morning Docket April 2nd 2025 Edition

Apr 25, 2025

The Above The Law Morning Docket April 2nd 2025 Edition

Apr 25, 2025 -

Arsenal Transfer News Journalist Updates On Two Bundesliga Targets

Apr 25, 2025

Arsenal Transfer News Journalist Updates On Two Bundesliga Targets

Apr 25, 2025 -

Taylors Of Harrogate Awarded Gold In Harrogate Competition

Apr 25, 2025

Taylors Of Harrogate Awarded Gold In Harrogate Competition

Apr 25, 2025

Latest Posts

-

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025 -

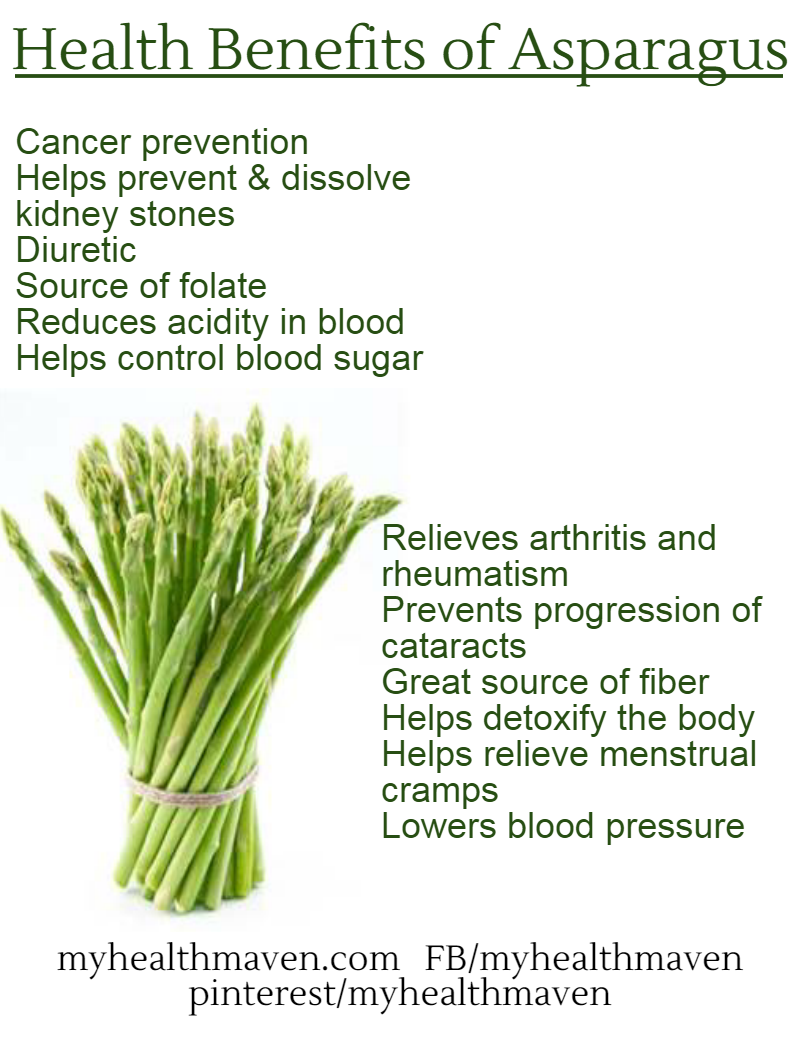

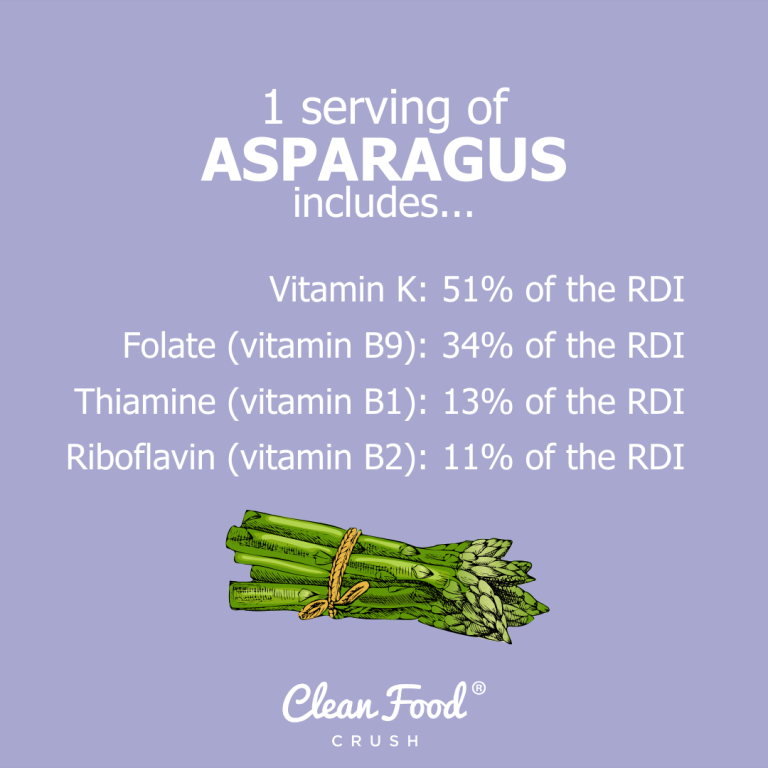

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025 -

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025 -

The Complete Guide To Asparagus And Its Health Benefits

Apr 30, 2025

The Complete Guide To Asparagus And Its Health Benefits

Apr 30, 2025 -

Asparagus And Health Exploring The Positive Impacts

Apr 30, 2025

Asparagus And Health Exploring The Positive Impacts

Apr 30, 2025